Environment Controllers Market Outlook:

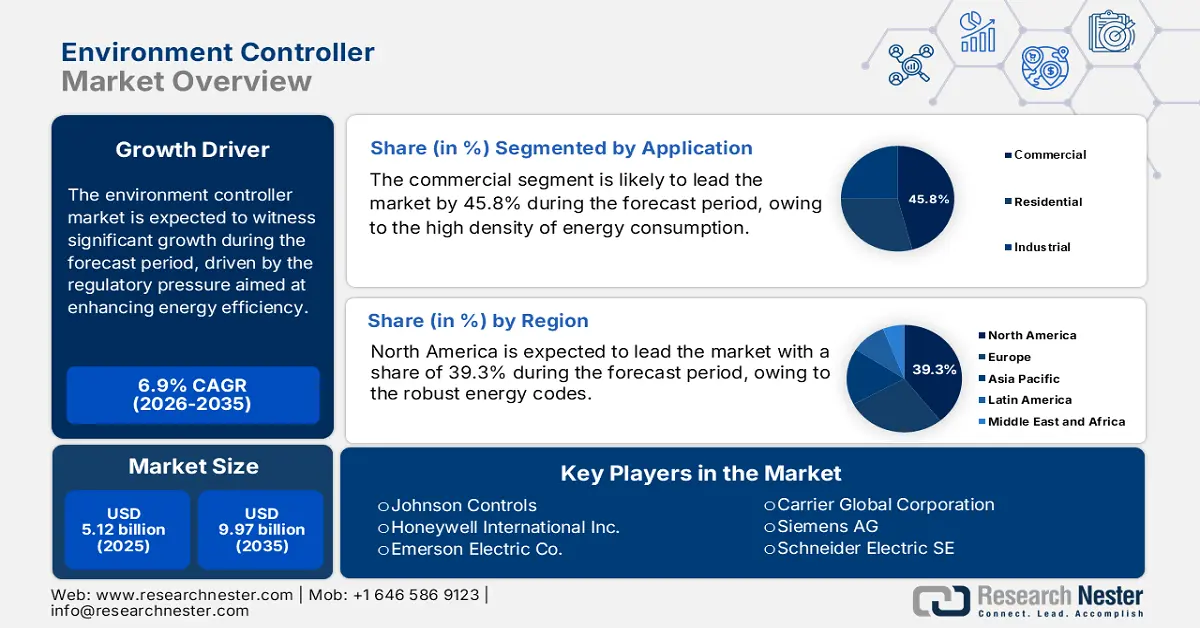

Environment Controllers Market size was valued at USD 5.12 billion in 2025 and is projected to reach USD 9.97 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the environment controllers is estimated at USD 5.47 billion.

The primary growth driver for the environment controllers market is regulatory pressure aimed at enhancing energy efficiency and reducing greenhouse gas emissions from the built environment. Government mandates are creating a non-discretionary demand for the advanced building management and control systems. The U.S. Department of Energy report in August 2023 notes that buildings account for approximately 74% of the nation’s electricity use and 35% of its total primary energy use. In response, federal and state energy codes are becoming increasingly robust, compelling building owners and operators to invest in advanced control systems for HVAC, lighting, and overall building automation to comply. This regulatory push is amplified by initiatives such as the Federal Building Management Plan, which mandates the performance improvement for federal facilities, creating a substantial policy-driven market for environmental control in federal facilities, resulting a verifiable energy savings.

The market’s supply chain is vulnerable to fluctuations in raw material costs, particularly for semiconductors, metals, and specialized components. The U.S. imported USD 591,677 million of electronic products in 2023 from China, Mexico, Taiwan, Vietnam, and other countries, as per the data from USITC 2023. In response, there is a strategic trend toward nearshoring and expanding domestic manufacturing capacity to reduce the supply chain risks. This reliance increases the exposure to trade disruptions, pricing volatility, and logistics delays. Federal initiatives supporting semiconductor and electronics manufacturing are further reinforcing this transition by encouraging localized component fabrication, assembly operations, and strategic inventory management. Further, these measures aim to reduce the supply chain risks while boosting the long-term production resilience and operational continuity.

Electronic Products: U.S. General Imports by Selected Trading Partners

|

Year |

Imports Value |

|

2019 |

483,429 |

|

2020 |

482,606 |

|

2021 |

570,630 |

|

2022 |

629,432 |

|

2023 |

591,677 |

Source: USITC 2023