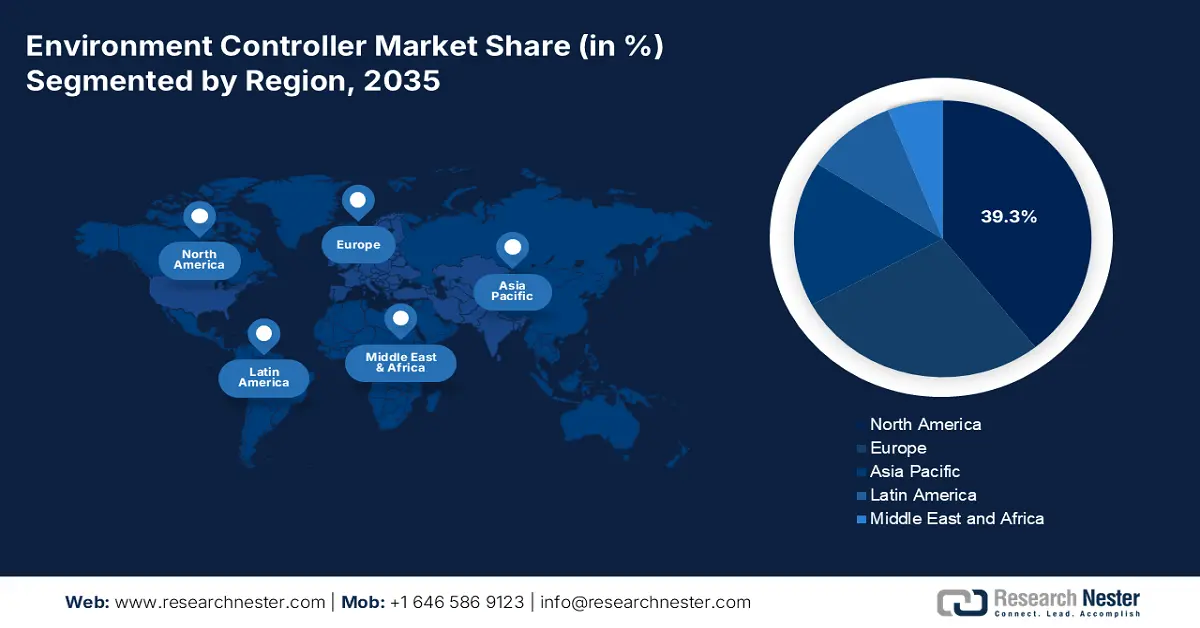

Environment Controller Industry - Regional Synopsis

North America Market Insights

North America is dominating the environment controllers market and is expected to hold the revenue share of 39.3% by 2035. The market is driven by the robust energy codes and modernization of the existing building stock. The key drivers of the market are the U.S. Department of Energy’s building efficiency standards and Canada’s Greening Government Strategy, mandating net-zero carbon federal buildings. The trend is shifting from hardware to integrated cloud-based Building Management Systems that enable predictive maintenance and grid interactivity. Investments are focused on retrofitting commercial real estate and improving the grid resilience with significant spending on IoT-enabled controls to meet the federal and corporate sustainability targets, ensuring a steady market growth.

The U.S. environment controllers market is primarily driven by the regulatory mandates and the strategic shift towards Grid-Interactive Efficient Buildings. In this regard, the U.S Department of Energy funds technologies that enable buildings to dynamically manage energy utilization. Further, in June 2023, the U.S. Energy Information Administration estimates that the total energy consumption in commercial buildings was nearly 6,787 trillion British thermal units, highlighting a massive savings potential via advanced controls. This driver, together with tax incentives from the Inflation Reduction Act, is fueling sustained demand for smart interoperable control systems that can assure verifiable energy savings along with grid services. Being increasingly crucial for managing the growing load due to building electrification, these systems are giving prime importance to the development of controllers with strong demand response capability and seamless integration with utility programs in order to tap into this growing market segment.

Major Fuel Consumption by the End use in the U.S. Commercial Building

|

End use |

Percentage |

|

Space Heating |

32 |

|

Other |

16 |

|

Ventilation |

11 |

|

Lighting |

10 |

|

Cooling |

9 |

|

Cooking |

7 |

|

Refrigeration |

5 |

|

Water Heating |

5 |

|

Computing |

4 |

|

Office Equipment |

1 |

Source: EIA June 2023

The Canada environment controllers market is characterized by its focus on deep decarbonization and resilience in a harsh climate. The federal government’s Greening Government Strategy, which targets net-zero carbon federal buildings, is a key driver pushing the adoption of all-electric systems and advanced building management systems. This policy direction is aided by the tangible investment. For example, the Government of Canada data in January 2025 depicts that in 2022, the Federal Budget committed USD 150 million to the Canada Green Buildings Strategy to spur the market transformation. This building, alongside robust provincial building codes, creates a stable policy-driven market for high-performance environment controllers capable of managing the complex heat pump and HVAC systems for both efficiency and extreme weather adaptation.

APAC Market Insights

Asia Pacific is the fastest growing environment controllers market and is projected to grow at a CAGR of 9.2% during the forecast period 2026 to 2035. The market is driven by the massive urban construction, the stringent new government energy policy, and rapid industrial automation. China’s push for the Dual Carbon goals is mandating smarter building controls, while India’s ambitious green building certification system, GRIHA, and its Smart Cities Mission are creating sustained demand. The key trend is the leapfrogging to cloud-based and IoT solutions, mainly in India and China, where developers are integrating smart controls directly into the new commercial and residential projects. For example, the funding allocated for the urban infrastructure upgrades includes intelligent environment control systems. The market is highly competitive, with strong local players emerging alongside global giants, all vying for a share in this unprecedented infrastructure boom.

The China is leading the environment controllers market in APAC and is driven by the national Dual Carbon policy mandating peak carbon emissions by 2030. This has led to the swift implementation of stricter building energy codes across all provinces, pushing the use of advanced building management systems in new constructions and major retrofits. The scale of this initiative is vast. According to the People’s Daily Online data report released in December 2023, the value of the construction work completed in 2023 was more than 31 trillion Yuan, highlighting the immense policy-driven demand for energy-efficient environment control technologies to manage this massive stock and meet the national climate goals. This policy framework compels provincial and municipal governments to actively enforce these standards, creating a consistent, top-down regulatory driver for the entire building supply chain to adopt intelligent environment control solutions.

The Japan environment controllers market is defined by a focus on technologically advanced and resilience driven by the need to modernize an aging building stock and improve energy security. The primary trend is the integration of environment control systems with disaster preparedness and response features such as automated ventilation control during the seismic events or power outages this is aided by the government policy for example, the Ministry of Economy Trade and Industry data in April 2024 states that it has allocated ¥72.5 billion in this 2023 budget for projects related to the building energy efficiency and smart community development directly funding the adoption of next gen resilient controllers.

Europe Market Insights

The Europe environment controllers market is defined by the robust regulatory drivers, most notably the EU’s Energy Performance of Buildings Directive and Renovation Wave Strategy, which mandates a climate-neutral building stock by 2050. This creates a powerful non-discretionary demand for retrofitting existing buildings with advanced HVAC and building management systems. The market is transitioning towards holistic building automation, integrating energy efficiency with indoor environmental quality monitoring for health and productivity. A prime trend is the rise of the digital building logbooks and smart readiness indicators as promoted by the European Commission, which values buildings based on their technological capacity. For instance, the European Union’s Recovery and Resilience Facility has allocated a significant amount in loans and grants, a portion of which is directed towards green building renovations, directly fueling the market for modern environmental controls.

Germany’s environment controllers market is the largest in Europe and is driven by the ambitious Energiewende policy and the robust Building Energy Act. The dominant trend is the integration of the lighting controls with on-site renewables and storage to create nearly self-sufficient buildings. This is heavily aided by the government subsidies. For example, the state-owned KfW Bank Group, via its energy-efficient construction and refurbishment program, committed €21.6 billion in promissory lending in 2022 alone to support building modernization, as per the SEC data in December 2023, financing directly on the adoption of advanced connected environment control systems that are mandatory to qualify for this public funding.

France market is uniquely shaped by its pioneering Reglementation Environnementale RE2020, which regulates a building’s full lifecycle carbon footprint, aiming beyond mere operational energy. This has created a strong demand for controllers that optimize complex hybrid systems, including low-carbon heating and dynamic shading. Public investment is the key driver, with the national agency ADEME playing a central role. In its performance plan for the 2023 to 2027 ADEME was allocated a significant budget for 2023 to surge the ecological transition funding, innovation, and deployment of the very building control technologies required for RE2020 compliance. This regulatory pressure ensures that advanced, data-driven environment controllers are no longer optional but a fundamental component of all new construction projects across the country.