Enterprise VSAT Market Outlook:

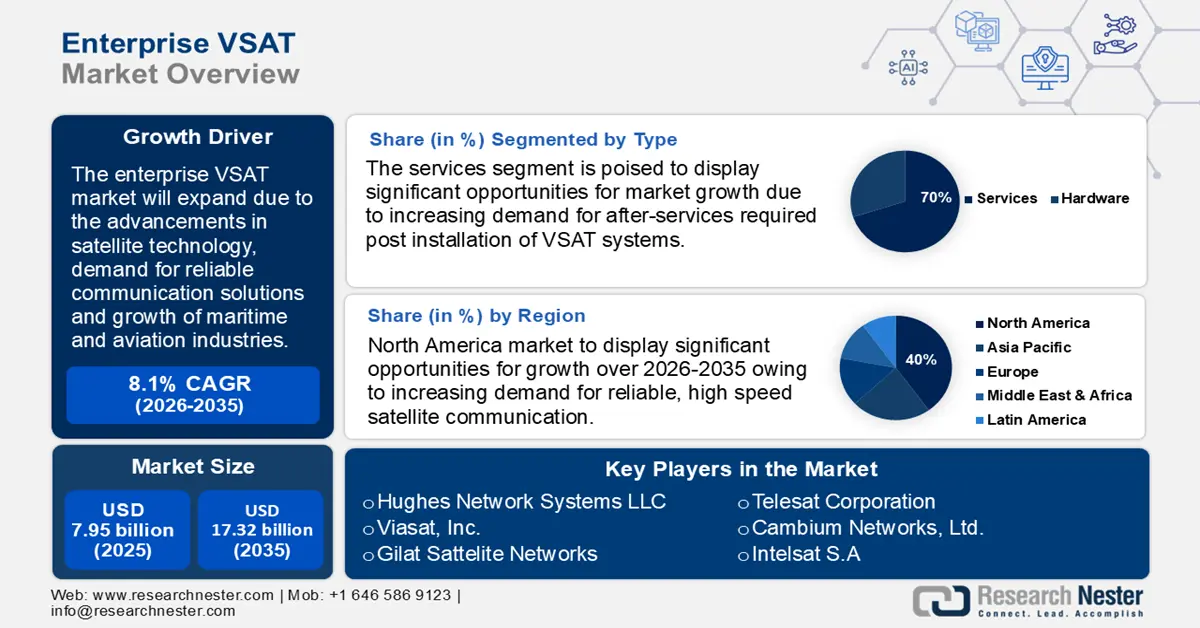

Enterprise VSAT Market size was valued at USD 7.95 billion in 2025 and is set to exceed USD 17.32 billion by 2035, registering over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of enterprise VSAT is estimated at USD 8.53 billion.

The global enterprise VSAT market is experiencing significant growth attributed to increasing demand for reliable communication solutions in remote and underserved areas. VSAT systems provide high-speed internet access, voice services, and data transmission for businesses particularly where traditional terrestrial networks are limited or unavailable. Industries such as oil and gas, maritime, mining operations, and rural branches of banks rely on VSAT for uninterrupted communication. To cater to the rising demand, in June 2024, Viasat, a global leader in satellite communications launched its energy services division, Viasat Energy Services to manage communication services for remote oil and gas customers. The new solution has been expanded to seamlessly incorporate low earth orbit (LEO) satellite capacity alongside Viasat Energy Services’ existing multi-orbit and terrestrial capacity designed to deliver highly flexible abilities that can serve energy customer needs through a single, integrated, and well-managed service.

Key Enterprise VSAT Market Insights Summary:

Regional Highlights:

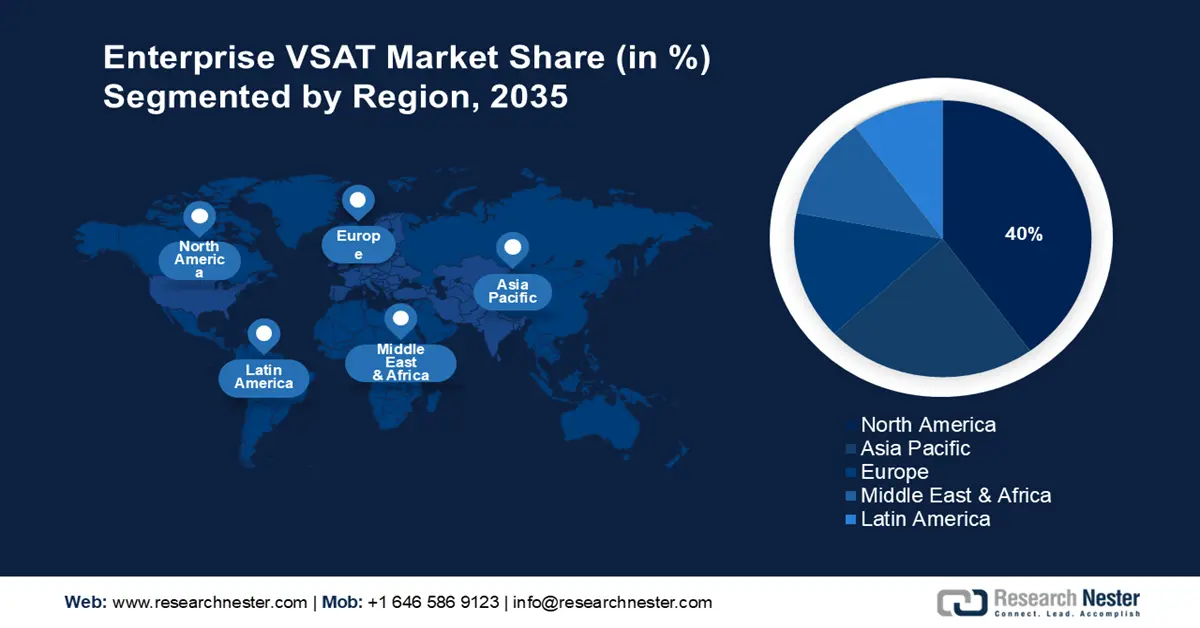

- North America enterprise very small aperture terminal (VSAT) market will account for 40% share by 2035, attributed to increasing demand for reliable high-speed satellite communication in various sectors.

- Asia Pacific market will register substantial growth during the forecast period 2026-2035, driven by rapid industrialization and digitalization increasing connectivity needs.

Segment Insights:

- The services segment in the enterprise vsat market is projected to hold a 70% share by 2035, attributed to the increasing demand for after services, including monitoring, troubleshooting, and upgrades, to ensure continuous, reliable operation of VSAT systems.

- The services segment in the enterprise vsat market is projected to hold a 70% share by 2035, attributed to the increasing demand for after services, including monitoring, troubleshooting, and upgrades, to ensure continuous, reliable operation of VSAT systems.

Key Growth Trends:

- Side effects and patient compliance

- Growth of maritime and aviation industries

Major Challenges:

- High initial costs

- Regulatory constraints

Key Players: Hughes Network Systems LLC, Viasat, Inc., Gilat Satellite Networks, Comtech Telecommunications Corp., Cambium Networks, Ltd, Airtel India, Nelco, SES S.A., Intelsat S.A., Telesat Corporation.

Global Enterprise VSAT Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.95 billion

- 2026 Market Size: USD 8.53 billion

- Projected Market Size: USD 17.32 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Indonesia, Malaysia, Thailand

Last updated on : 18 September, 2025

Enterprise VSAT Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in satellite technology: Advancements in satellite technology play an important role in fueling enterprise very small aperture terminal (VSAT) market growth. Technological innovations such as High Throughput Satellites (HTS) and Low Earth Orbit (LEO) satellite systems have significantly enhanced bandwidth availability, data speed, and latency improvements, broadening the applications of VSAT systems. These technological breakthroughs enable providers to offer more tailored services to enterprises, including increased capacity for data-intensive applications. Additionally, developments in ground equipment have reduced costs and improved service reliability, attracting a wider range of industries to adopt VSAT solutions for their communication needs, which encourages market growth and diversity. For instance, in April 2024, SES announced a second-generation software-enabled satellite system O3b mPOWER to provide high-performance connectivity services around the globe. It will deliver reliable connectivity services ranging from tens of Mbps to multiple gigabits per second.

- Growth of maritime and aviation industries: Shipping companies are adopting VSAT systems to offer internet access for crew welfare and operational efficiency. Moreover, the rising demand for in-flight connectivity is driving the adoption of VSAT solutions in the aviation sector. For instance, in January 2025, Inmarsat Maritime, a Viasat company in collaboration with Maritime London initiated a new working group called SEA-CARE to enhance maritime safety. It has established a sea-care working group to enhance data sharing which can improve safety at sea. This working group aims to provide deeper insight into key maritime safety issues by sharing and combining the data that can help improve industry-wide standards.

Challenges

-

High initial costs: The initial cost of installation and setup of VSAT systems including satellite terminals and antennas involves significant upfront costs, which can be a barrier for small and medium enterprises. Additionally, ongoing maintenance and operation costs of VSAT systems especially in remote locations add to the total cost of ownership. Further, the need for specialized technical expertise to manage and maintain these systems adds further expenditure, making it challenging for companies to justify the investment in a competitive enterprise VSAT market. Also, the emergence of new communication technologies may offer alternative solutions impacting the growth of the VSAT market.

- Regulatory constraints: VSAT operations require frequency licensing which varies across regions and can delay deployment. Varying regulations across regions can pose challenges for the deployment and operations of VSAT systems. Moreover, regional licensing and frequency allocation can slow down adoption.

Enterprise VSAT Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 7.95 billion |

|

Forecast Year Market Size (2035) |

USD 17.32 billion |

|

Regional Scope |

|

Enterprise VSAT Market Segmentation:

By Type Segment Analysis

Services segment is expected to hold over 70% enterprise VSAT market share by the end of 2035, attributed to the after services required after installation of VSAT systems. Service providers ensure everything works without interruption by offering regular monitoring, troubleshooting, and upgrades. With more businesses looking for cost-effective and efficient options, managed service models are becoming popular. Once the VSAT network is deployed and installed, it is necessary to provide ongoing maintenance and support to ensure continuous reliable, and efficient operation. This includes regular maintenance tasks such as cleaning the antenna and checking equipment for damage or wear. It also includes providing technical support and troubleshooting assistance to address any issues that may arise.

By Organization Size Segment Analysis

By the end of 2035, small and medium enterprises segment is set to hold over 65% enterprise VSAT market share. VSAT systems are an affordable option for smaller businesses, helping them to connect in areas with low network coverage. These systems are flexible, and scalable and allow SMEs to avoid spending on expensive infrastructure. They also support IoT applications making them valuable for SMEs in developing areas with limited internet access.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Organization |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise VSAT Market Regional Analysis:

North America Market Insights

North America in enterprise VSAT market is expected to capture around 40% revenue share by the end of 2035, due to increasing demand for reliable, high-speed satellite communication. The presence of key industry players and the growing demand for satellite-based communication solutions in sectors such as defense, transportation, oil & gas, maritime and emergency push the demand for robust connectivity solutions. Further, advancements in satellite technology such as HTS are enhancing capacity and affordability. Major players focus on providing customizable services to meet diverse business needs.

The U.S. is the largest enterprise VSAT market for VSAT services in North America, with a robust number of enterprises relying on VSATs for their communication needs. Industries such as oil and gas, agriculture, and government use VSAT for critical operations and connectivity. The adoption of advanced satellite technologies such as HTS and LEO constellations is driving improved performance and cost efficiency. Key VSAT service providers are focusing on tailored solutions to support business. For instance, Intelsat is a leading satellite operator that provides VSAT services to enterprises in North America, offering a range of solutions for data, voice, and video communications.

The enterprise VSAT market in Canada is a growing sector, driven by the increasing demand for reliable and secure satellite-based communications services, expansion of cellular networks, and growing need for disaster recovery and business continuity solutions. For instance, Xplornet Inc. is Canada’s leading provider of broadband services offering VSAT services to enterprises and consumers in rural and remote areas. According to the Canadian Commission for Complaints for Telecom-television Services (CCTS) 2023-24 Annual report released on 16 January 2025, Xplore emerged as a top performer in delivering a positive customer experience. It further announced over USD 1.6 billion of new funding committed to provide a fully financed expansion plan for Xplore’s continued fiber-to-the-home network roll-out. This will ensure multi-gigabit speeds to more than 400,000 homes in rural Canada by 2027. The funding will also enable Xplore to utilize its 1.6 billion MHZ-POP spectrum portfolio to offer next-generation 5G fixed wireless services to over 1.5 million homes across Canada.

Asia Pacific Market Insights

Asia Pacific region is anticipated to observe substantial growth through 2035, due to rapid expansion due to the growing industrialization and digitalization in China, India, and Japan and increasing demand for connectivity in remote areas. Key industries such as mining, maritime, and banking rely on VSAT for secure and reliable communications. The rise of digital transformation and government initiatives for rural connectivity are boosting adoption. Advances in satellite technology including HTS and LEO satellites further enhance market growth.

The enterprise VSAT market in China is expanding due to the focus on improving connectivity. Key industries such as energy, logistics, and agriculture leverage VSAT for reliable communication in challenging environments. Government initiatives, including Digital China strategy and investments in satellite technology, drive adoption. Advancements in high-capacity satellites and domestic manufacturing are enhancing affordability and accessibility. For instance, China Satcom is a leading provider of VSAT services in China, offering a range of solutions for enterprises, including broadband internet services, VPNs, and disaster recovery services.

The enterprise VSAT market in India is predicted to be the fastest-growing market during the forecast period. It is witnessing strong growth driven by increasing connectivity needs in remote and rural areas. The emergence of banking, telecom and energy sectors rely on VSAT for secure, and reliable communication. The government initiatives such as digital India and satellite backed broadband expansion are boosting adoption. The rise of cost-effective satellite technologies such as HTS an LEO are also enhancing enterprise VSAT market penetration. In India, businesses and government agencies are calling for faster and more dependable internet connections, particularly in rural areas with inadequate terrestrial infrastructure.

Enterprise VSAT Market Players:

- Hughes Network Systems, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Viasat, Inc.

- Gilat Satellite Networks

- Comtech Telecommunications Corp.

- Cambium Networks, Ltd.

- Airtel India

- Nelco

- SES S.A.

- Intelsat S.A.

- Telesat Corporation

- ORBCOMM Inc.

- Kymeta Corporation

- AeroVironment, Inc.

- L3Harris Technologies, Inc

The enterprise VSAT market is led by key players offering advanced satellite communication solutions across industries. Companies such as Hughes Network Systems and Viasat Inc. dominate with their innovative satellite technology and extensive networks. Intelsat and SES are major providers, leveraging high throughput satellites for high-capacity services. Telesat focuses on LEO satellite deployments to enhance global connectivity. These companies drive the market by addressing diverse industry needs from remote operations to IoT-based applications. Here is a list of key players operating in the global enterprise very small aperture terminal (VSAT) market:

Recent Developments

- In January 2025, Viasat, a leading satellite communications company was chosen by NASA to support its direct-to-earth (DTE) communication through the Near Space Network (NSN). This is a part of a five-year contract worth USD 4.82 billion with an option to extend for another five years. Viasat is one of the four companies selected to provide ground support services for NASA missions, with plans to expand its role in the future.

- In January 2025, Eutelsat Group, a leading satellite communications company partnered with Nigerian Communications Satellite Limited (NIGCOMSAT) to bring low earth orbit satellite services to Nigeria. This collaboration is a multi-million dollar project aimed at improving satellite connectivity in the region.

- In January 2025, Gilat Satellite Networks Ltd., a worldwide leader in satellite networking technology, solutions, and services, awarded USD 5 million in defense contracts to support critical connectivity of its owned US-based subsidiary, Gilat DataPath.

- Report ID: 7137

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Enterprise VSAT Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.