Enterprise Payments Platform Market - Regional Analysis

APAC Market Insights

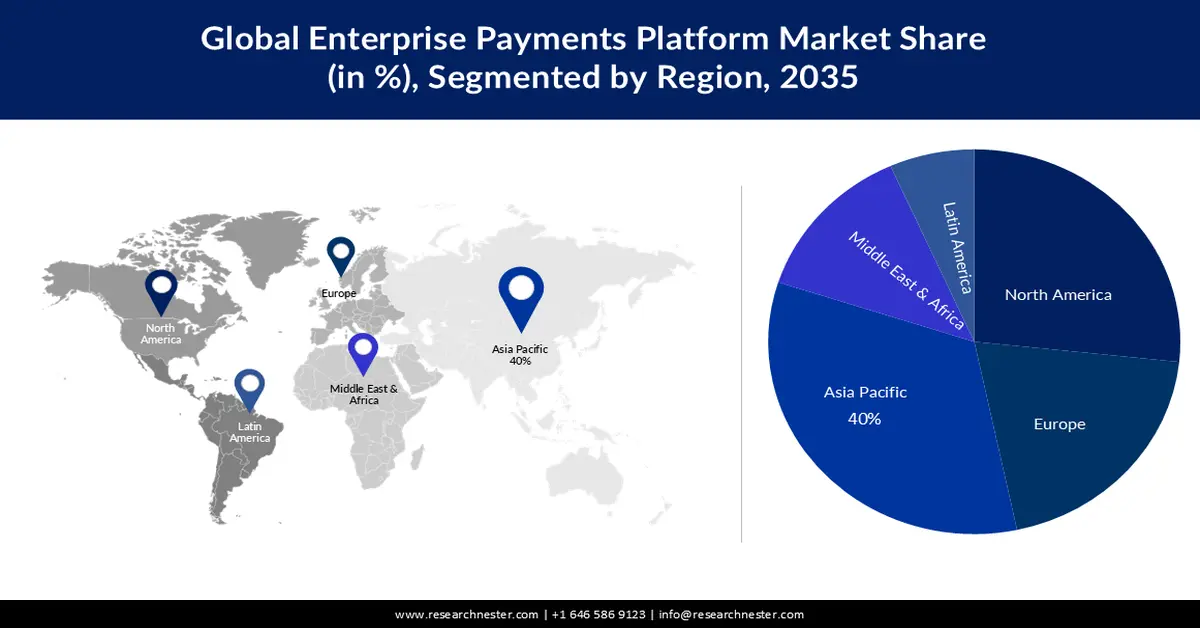

Asia Pacific industry is predicted to dominate majority revenue share of 40% by 2035. The Asia Pacific region is recognizing the potential of data analytics and business insights to drive growth. Enterprise Payments Platforms are increasingly incorporating advanced analytics and reporting features to help businesses gain insights from payment data. These insights empower businesses to make informed decisions, optimize their payment processes, detect fraud, and identify cost-saving opportunities. Asia Pacific region is a hotbed of growth in the Enterprise Payments Platform market, driven by a confluence of factors. The burgeoning e-commerce landscape, financial inclusion initiatives, mobile-first payment preferences, regulatory reforms, cross-border trade, and data-driven insights are steering the demand for sophisticated payment solutions. As businesses across the region embrace digital transformation and adapt to evolving customer expectations, the role of Enterprise Payments Platforms in shaping the financial landscape is more significant than ever.

North American Market Insights

The enterprise payments platform market in the North American region is projected to hold the second-largest share during the forecast period. One of the primary growth drivers in North America is the rapid pace of digital transformation and the surge in e-commerce. According to, e-commerce sales in the United States alone are projected to reach USD 908 billion in the year 2023. This trend is reshaping consumer behavior and redefining payment preferences. As businesses transition to digital storefronts and online marketplaces, Enterprise Payments Platforms play a pivotal role in enabling secure and seamless online transactions. They are equipped to handle a variety of payment methods, including credit cards, mobile wallets, and other digital options, aligning with the evolving landscape of digital commerce. North America is a leading force in the Enterprise Payments Platform market, driven by an array of factors. The digital transformation of commerce, fintech innovation, regulatory adherence, global trade, financial inclusion, and data analytics are steering the demand for advanced payment solutions. As businesses in North America continue to embrace technology and adapt to changing customer preferences, Enterprise payment platforms play a pivotal role in shaping the financial landscape and driving economic growth in the region.