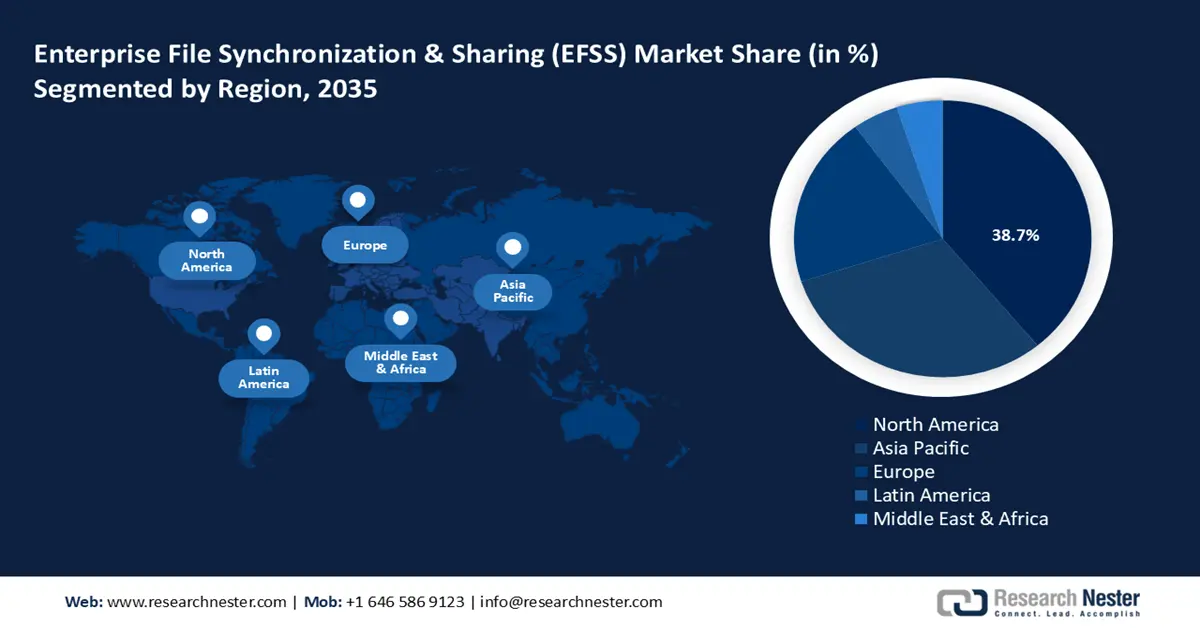

Enterprise File Synchronization & Sharing Platform Market - Regional Analysis

North America Market Insights

The North America EFSS platform market held a 38.7% revenue share by the end of 2035. The market’s expansion is attributed to a well-established cloud infrastructure. Additionally, the region has stringent data protection laws, such as Canada’s PIPEDA and CCPA (California Consumer Privacy Act), requiring improvements in file-sharing solutions. The U.S. federal funding for cybersecurity and infrastructure is allocated more than USD 2 billion in FY25, which directly benefits the deployment of EFSS platforms across multiple sectors, ranging from BFSI to healthcare. With the complexity of cybersecurity increasing, the regional market is poised to maintain a leading demand for EFSS solutions throughout the forecast timeline.

The U.S. enterprise file synchronization & sharing (EFSS) platform market benefits from the proactive integration of digital solutions across multiple enterprises, creating a sustained demand for EFSS solutions. Additionally, the supportive government regulations in the U.S. boost the market growth. Two such regulatory practices are the Digital Government Strategy, the Federal Cloud Computing Strategy (FedRAMP), and the modernization mandates pushed by Executive Order 14028 in May 2021. In addition, the majority of enterprises in the country are moving critical workload to the cloud, and the demand for EFSS solutions is expected to further proliferate across workspaces.

APAC Market Insights

The APAC EFSS platform market is poised to register the fastest revenue share of 24.4% throughout the forecast period. A major driver of the regional market is poised to be a surging demand from SMEs. Two major initiatives within the region are the Digital India initiative and the Cloud Computing Development Plan of China, which have bolstered the deployment of EFSS platforms. Also, more than half of enterprises in India have implemented cloud-based document sharing platforms between 2022 and 2024. Lastly, the region has some of the highest densities of mobile users, creating a high demand for secure file-sharing solutions.

The China enterprise file synchronization & sharing (EFSS) platform market is slated to exhibit sustained growth during the anticipated timeline. Two recent laws in China impact the sector’s growth curve, i.e., the Data Security Law of 2021 and the Personal Information Protection Law (PIPL) in 2022. These laws mandate companies to adopt local, secure EFSS solutions. Additionally, as per the Cyberspace Administration of China, the demand for localized EFSS vendors is increasing due to the compliance requirement with cross-border data transfer laws. The market is also poised to benefit from the 14th 5-year plan (2021-2025) that supports data collaboration between the burgeoning tech and manufacturing sectors.

Europe Market Insights

The Europe enterprise file synchronization & sharing (EFSS) platform market is projected to capture a significant share throughout the study period. The stringent regulatory compliance requirements and rising cybersecurity concerns are fuelling the sales of enterprise file synchronization & sharing platforms. The region’s push for digital workplace transformation is also contributing to the EFSS solution sales growth. The General Data Protection Regulation (GDPR) is estimated to remain the primary driver, compelling organizations to adopt EFSS platforms with advanced encryption, audit trails, and data residency options.

Germany leads the sales of EFSS platforms, supported by its robust manufacturing base and highly regulated industries. The strong national data protection policies also contribute to the increasing adoption of enterprise file synchronization & sharing solutions. At least 37% of the 45,000 exchange servers in the country are vulnerable to cyber threats, per the Federal Office for Information Security (BSI). Also, the Industrie 4.0 initiatives, backed by the Federal Ministry for Economic Affairs and Climate Action (BMWK), are driving EFSS adoption in manufacturing and engineering sectors. Overall, investing in Germany is poised to offer lucrative returns in the years ahead.