ENT Disorder Treatment Market Outlook:

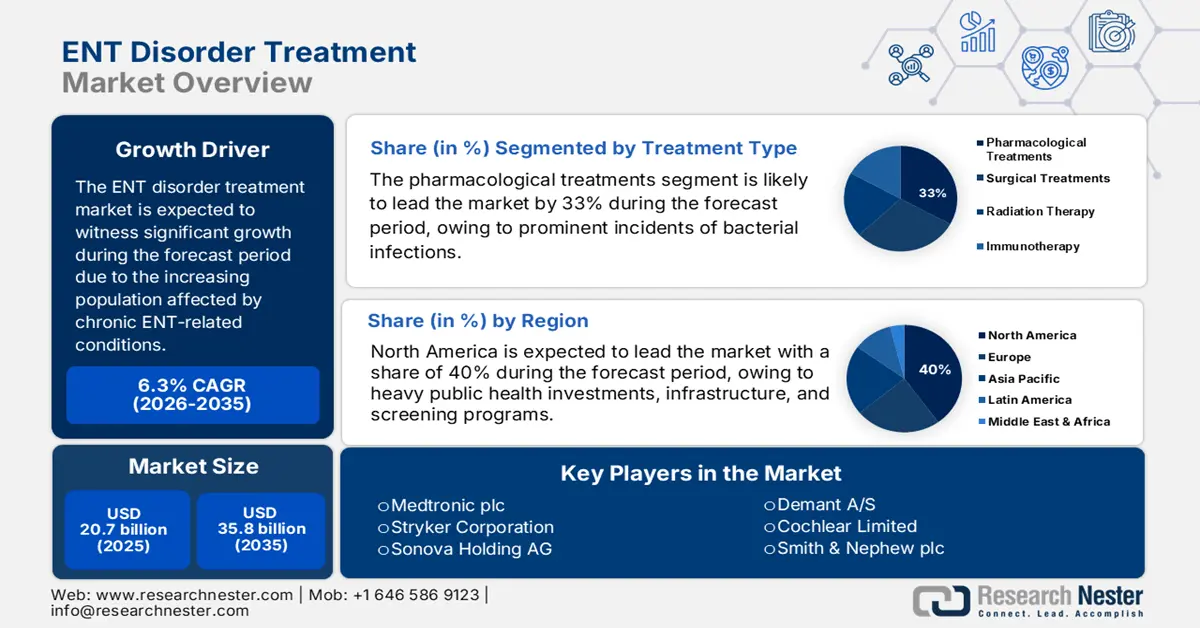

ENT Disorder Treatment Market size is valued at USD 20.7 billion in 2025 and is projected to reach USD 35.8 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of ENT disorder treatment is estimated at USD 22 billion.

The international market is primarily driven by the increasing population affected by chronic ENT-related conditions, such as sinusitis, rhinitis, and hearing loss that affect millions worldwide. The increasing population of seniors also significantly contributes to growth as ENT disorders come with aging and gain prominence. As per a report by NIH in September 2024, among adults aged above 52 with moderate or severe hearing loss, about 28% have difficulty living daily. To compare, among adults in the same age bracket yet with no hearing loss, 7.3% have difficulty living daily. Progression in technology, for instance, minimally invasive surgery and artificial intelligence-based diagnostics, is making treatment and patient outcomes more effective.

Moreover, trade activities related to the ENT disorder treatment market involve the export and import of raw and finished products, which enables global accessibility to such treatments. ENT medical device production lines are necessary to enable the supply of the demand for these products, which facilitates effective production processes. General trade processes such as tariffs and regulations, influence the availability and cost of ENT treatments in different regions of the world. According to a report by the World Health Organization in February 2025, less than USD 1.4 per capita per year is needed in incremental investment to increase ear and hearing care services globally, and it points out that extending access is affordable. It requires international cooperation to bridge gaps and move the treatment of the global ENT forward.

Key ENT Disorder Treatment Market Insights Summary:

Regional Insights:

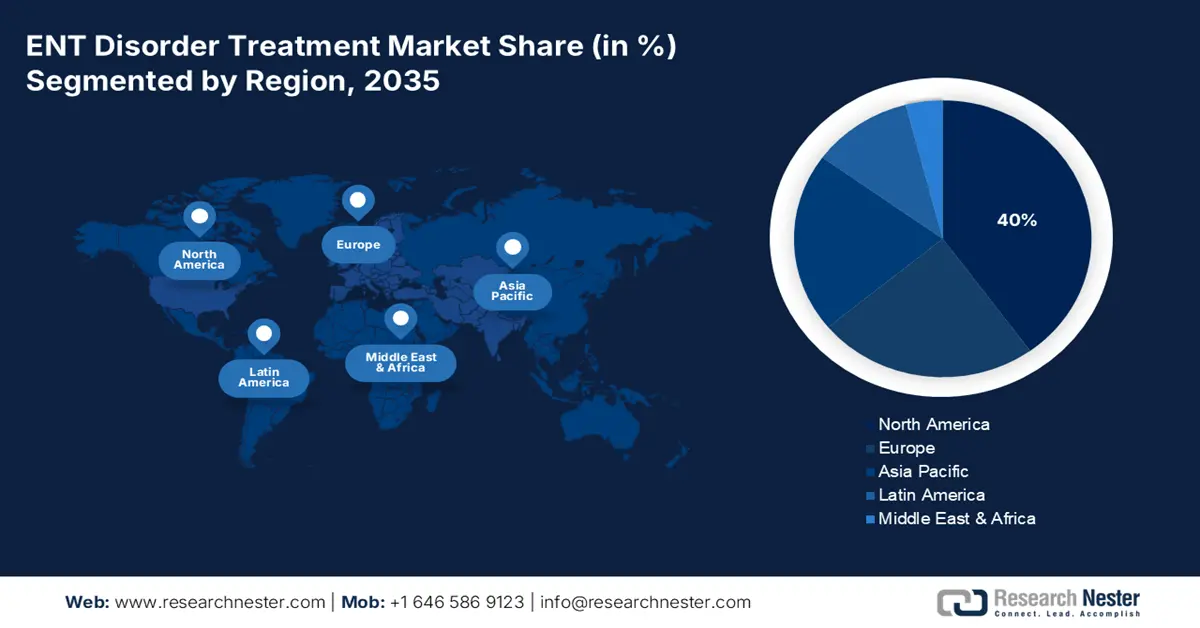

- North America is projected to command the largest 40% share of the ENT Disorder Treatment Market by 2035, supported by strong public health investments, early screening programs, and government-backed initiatives ensuring timely diagnosis and care.

- The Asia Pacific region is anticipated to witness the fastest growth during 2026–2035, propelled by a high patient population base, increasing healthcare expenditure, and supportive government policies advancing ENT treatment infrastructure.

Segment Insights:

- In the ENT Disorder Treatment Market, the pharmacological treatments (antibiotics) segment is estimated to capture a 33% share by 2035, propelled by the rising incidence of bacterial infections such as otitis media and sinusitis and advancements in targeted antibiotic formulations.

- The surgical interventions segment is set to dominate the treatment procedure landscape by 2035, driven by shorter recovery periods, minimal scarring, and the increasing integration of robotic and real-time imaging technologies enhancing surgical precision.

Key Growth Trends:

- Rising adoption of cochlear implants

- Regulatory approvals and innovation accelerate ENT market growth

Major Challenges:

- Regulatory hurdles and high development costs

Key Players: Medtronic plc, Stryker Corporation, Sonova Holding AG, Demant A/S, Cochlear Limited, Smith & Nephew plc, Olympus Corporation, Karl Storz SE & Co. KG, Starkey Hearing Technologies, GN Hearing (ReSound), Oticon (William Demant Holding A/S), Interacoustics A/S, Hoya Corporation, Meril Life Sciences Pvt. Ltd., Ambu A/S.

Global ENT Disorder Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.7 billion

- 2026 Market Size: USD 22 billion

- Projected Market Size: USD 35.8 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 25 September, 2025

ENT Disorder Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of cochlear implants: The rising adoption of hearing solutions such as cochlear implants is a major growth driver for the market. As per a report by NIH in September 2024, more than 1 million cochlear implants were inserted worldwide in 2022, showing an increasing acceptance and technological evolution in hearing restoration. In the U.S. alone, roughly 118,100 implants were performed in adults and 65,000 in children, thereby pointing to an ever-expanding patient pool that can avail itself of these provisions. Previouslythe growing demand for cochlear implants drove increased in the ENT treatment sector that fueled its expansion.

- Regulatory approvals and innovation accelerate ENT market growth: Recent FDA regulatory action shows robust growth of innovation in the ENT disorder treatment market. As per a comprehensive study done by NLM in January 2024, in 2022, the FDA approved a couple of drugs and devices, identified 37 new otolaryngology-related devices, and 2 new drugs for ENT applications, after soliciting expert panel reviews. The flood of approvals confirms continuing efforts made by manufacturers in developing newer treatment modalities, thus expanding available choices for treatment, and fostering market growth.

- Advancements in minimally invasive surgical techniques: The growth of the market is greatly supported by the growth and acceptance of minimally invasive surgical techniques in ENT treatment. Such procedures allow reduced recovery periods, minimized complications, and improved outcomes for the patients. As the healthcare providers attach more importance to patient comfort and speedy procedures, the need for engineering advanced surgical tools and technologies keeps on growing, thereby motivating manufacturers to look towards further innovations in this field to expand their product range in the arena of ENT treatment.

GABHS (Group A Beta-Hemolytic Streptococcus) Testing Across ENT Infections: Distribution and Positivity Trends

Clinical Trial Comparison of GABHS Testing among Individuals with Different ENT Infections (2022)

|

Reported ENT Infection |

GABHS Tested |

Positive Test of the Tested Individuals’ Group |

Percentage of Positive in All 784 Tested |

Percentage of Positive from All +ve (%) |

|

Tonsillitis (N = 11 624) |

485 (4.2%) |

16 (3.3%) |

61.9% |

31% |

|

Quinsy (N = 1867) |

91 (4.9%) |

17 (18.7%) |

11.6% |

33% |

|

AOM (N = 2375) |

157 (6.6%) |

9 (5.7%) |

20% |

17% |

|

Periorbital cellulitis (N = 547) |

34 (6.2%) |

5 (14.7%) |

43.4% |

10% |

|

Supraglottitis (N = 278) |

4 (1.4%) |

0 (0%) |

0.5% |

0% |

|

Deep neck space (N = 140) |

5 (3.6%) |

3 (60%) |

0.6% |

6% |

|

Acute mastoiditis (N = 52) |

8 (15.4%) |

2 (25%) |

1% |

4% |

|

Total (N = 16 883) |

784 |

52 |

Source: NLM, September 2022

Challenge

- Regulatory hurdles and high development costs: The ENT disorder treatment market is hindered by regulatory hurdles and the huge costs of developing new drugs or medical devices. Furthermore, the lengthy approval process often postpones product launches and increases expenses i.e., hindering innovation being brought to patients. Further to this, it gets difficult for manufacturers to comply with varying regulations across different regions as they try to establish a market entry strategy for global expansion, and hence, a deterrent to growth.

ENT Disorder Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 20.7 billion |

|

Forecast Year Market Size (2035) |

USD 35.8 billion |

|

Regional Scope |

|

ENT Disorder Treatment Market Segmentation:

Treatment Type Segment Analysis

The pharmacological treatments (antibiotics) in the treatment type segment are expected to hold the largest market share of 33% during the forecast period in the ENT disorder treatment market, due to the prominent incidents of bacterial infections, such as acute otitis media and sinusitis, which most often mandate antibiotic treatment. The adoption is further boosted by some respectable developments in targeted antibiotic formulations that have enhanced efficiency with reduced side effects. However, according to the CDC, bacterial infections, which are among the greatest causes of ENT complications, are continuously driving the demand for antibiotics. With rising awareness of the hazards associated with untreated infections, timely intervention through antibiotics has, therefore, greatly increased.

Treatment Procedure Segment Analysis

The surgical interventions are expected to hold the largest market share in the treatment procedure segment during the forecast period in the ENT disorder treatment market, due to reduced recovery periods, minimal scarring, and lesser chances of complications posed by the open surgical technique. The addition of advanced technology, including robotic assistance and real-time imaging, has made these interventions more precise and safer. According to a report by Stats N Data published in August 2025, the minimally invasive surgery market is expected to reach near USD 50 billion in the next five years, highlighting an increasing growth trend. This trend is expected to be helpful in the market share of minimally invasive techniques in ENT surgeries.

Product Type Segment Analysis

The medical devices are expected to hold the largest market share in the product type segment during the forecast period in the ENT disorder treatment market, due to an increased prevalence of hearing loss mainly among the ageing global population. Technological advances have facilitated the evolution of sleeker hearing aids equipped with features such as artificial intelligence and rechargeable batteries that make for a better user experience and satisfaction. According to the report by NIH in September 2024, in the U.S., 15% of adults aged 18 and over reportedly face some hearing troubles, which is increasing the demand for hearing aid solutions. These developments are going to further cement the place of hearing aids as the leading product type in markets.

Our in-depth analysis of the ENT disorder treatment market includes the following segments:

|

Segment |

Sub-segments |

|

Treatment Type |

|

|

Treatment Procedure |

|

|

Product Type |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ENT Disorder Treatment Market - Regional Analysis

North America Market Insight

The global ENT disorder treatment market in North America is expected to hold the highest market share of 40% within the forecast period due to heavy public health investments, infrastructure, and screening programs. Federal support ensures timely diagnosis and care of conditions such as Early Hearing Detection and Intervention (EHDI). According to a report by CDC in August 2024, 1 to 2 per 1,000 infants in the U.S. are born deaf or hard-of-hearing, which highlights the importance of early detection systems. This patient pool enhances the access and capacity of ENT devices and treatment, reinforcing North America's dominant regional position.

The global ENT disorder treatment market in the U.S. is growing significantly, with increased federal research funding and regulatory support that foster innovation and accessibility. The NIH's National Institute on Deafness and Other Communication Disorders (NIDCD) continues to support translational research and develop new clinical programs to address hearing and balance disorders. As per a report by NIH, March 2024, the NIDCD President's budget of USD 535.9 million covers a diversity mentoring program and a new contract to enhance clinical trial oversight and analysis. Both targeted activities serve as catalysts for faster development of novel diagnostics and therapies.

Asia Pacific Market Insight

The global ENT disorder treatment market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to a high population burden and supportive government policies. As per a report by NIH in January 2025, NIH estimates that by 2060, there would be approximately 242 million individuals in China suffering from moderate-to-total hearing loss, reflecting a sizeable patient pool. This increasing demand, combined with increasing public health expenditure and infrastructure development, fuels the Asia Pacific market as a leading region in ENT disorder treatment expansion.

The global ENT disorder treatment market in China is growing significantly due to targeted government initiatives and increased funding towards improved healthcare infrastructure and access. The government of China has implemented various policies to tackle this looming problem, including the implementation of national centralized drug procurement programs aimed at reducing pharmaceutical prices and curbing drug circulation. As per a report by NLM August 2023, the prices of 234 medicines have been decreased under national centralized procurement, with a greater than 53% average rate of decline, and the overall saving in drug costs has exceeded 260 billion yuan (USD 35.6 billion) in 2022.

Europe Market Insight

The global ENT disorder treatment market in Europe is expected to grow steadily within the forecast period due to population aging in the region, which is increasing the occurrence of hearing and balance disorders. Advances in medical technology and augmented adoption of minimally invasive surgical procedures are driving up the quality of treatment. Developed healthcare systems also ensure broad availability for treatment and diagnosis. Increased investment in research and clinical trials also leads to innovation. These are the forces that lead to growth in the region's market and improve patient care. Government support and increased public awareness regarding ENT health also play important roles in the growth of the market.

The global ENT disorder treatment market in the UK is growing significantly due to strict government policies and increasing healthcare expenditure. As per a June 2025 report by the UK Government, it is providing a £29 billion (USD 36.2 billion) real terms increase in a-year NHS day-to-day spending from 2023 to 2024 to 2028 to 2029, taking spending to £226 billion (USD 282.5 billion) in 2028 to 2029, with a 3.0% average annual real terms rate of growth over the SR period. This injection of funds assists in achieving NHS targets to reduce waiting times so that 92% of patients, such as those requiring ENT treatment, will begin consultant-led treatment for non-emergency conditions within 18 weeks of referral by the end of Parliament. This quicker access will be expected to fuel demand for treatments for ENT disorders, with the market opening up widely.

The Healthcare Expenditure of Countries of Europe (2022)

|

Country |

Expenditure (€ million) |

|

Germany |

488,677 |

|

France |

313,574 |

|

Italy |

175,719 |

|

Spain |

131,114 |

|

Netherlands |

96,820 |

|

Austria |

49,897 |

|

Sweden |

59,110 |

|

Belgium |

59,626 |

Source: Eurostat, November 2024

Key ENT Disorder Treatment Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Sonova Holding AG

- Demant A/S

- Cochlear Limited

- Smith & Nephew plc

- Olympus Corporation

- Karl Storz SE & Co. KG

- Starkey Hearing Technologies

- GN Hearing (ReSound)

- Oticon (William Demant Holding A/S)

- Interacoustics A/S

- Hoya Corporation

- Meril Life Sciences Pvt. Ltd.

- Ambu A/S

The ENT disorder treatment market is highly competitive among manufacturers. Companies are now into product innovation, forming strategic alliances, and internationalizing their market to increase shares. Medtronic and Johnson & Johnson are investing heavily in the research and development of newer surgical instruments and hearing solutions. Similarly, Cochlear Limited and Sonova Holding AG are acquiring regional players to further their regional strength through regional distributor networks. The strategic moves are directed toward catering to the increased demand for more effective ENT treatments and better patient outcomes.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2025, Somnair Inc. announced to develop the first non-invasive neurostimulation treatment for obstructive sleep apnea (OSA), led by J2 Ventures with participation from Nexus Neurotech Ventures, Rice Alliance, and Wolfpoint Capital. Somnair secured USD 4.3 million in seed funding to advance its technology.

- In May 2023, Enterin Inc. announced that its investigator-sponsored Investigational New Drug (IND) application (166532) was accepted by the FDA. It is going to treat patients with prodromal multisystem atrophy (MSA) with ENT-01.

- Report ID: 7834

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ENT Disorder Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.