Energy Storage Market Outlook:

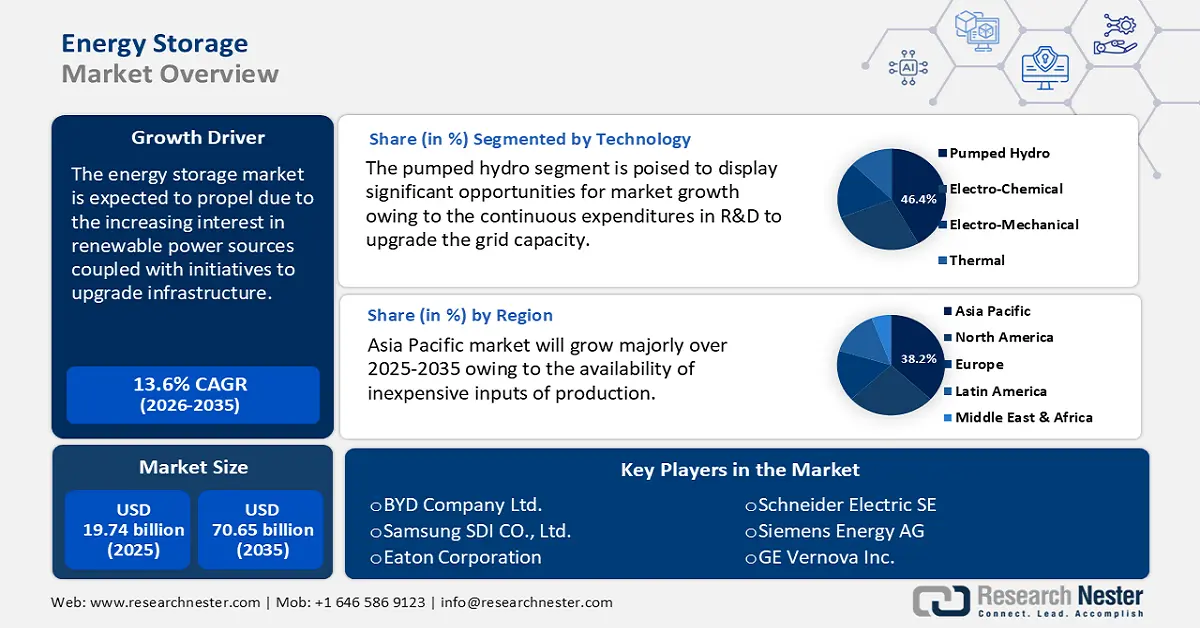

Energy Storage Market size was over USD 19.74 billion in 2025 and is poised to exceed USD 70.65 billion by 2035, growing at over 13.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of energy storage is estimated at USD 22.16 billion.

The global energy storage market is anticipated to boom as a result of the increasing interest in renewable energy technologies such as solar and wind coupled with the initiatives to upgrade power infrastructure. Recently, the World Resources Institute revealed that some nations have made considerable progress in modernizing and building new infrastructure. For instance, China has spent billions on ultra-high-voltage powerlines that can effectively transport electricity from distant power plants (such as coal, wind, and solar) to cities that require a lot of energy. Currently, 100% renewable power is transmitted by several of these lines. In areas with robust intergovernmental institutions, such as the EU and portions of the U.S., where separate organizations manage shared grids across several states or nations, efforts to enhance infrastructure planning and power sharing are making the most headway.

Furthermore, grid-scale battery storage is considerably driving growth in the energy storage market by enabling greater integration of renewable energy sources, enhancing grid reliability, and supporting decarbonization efforts. As renewable energy generation increases, grid-scale batteries help manage the intermittent nature of solar and wind power by storing excess energy and discharging it when demand is high. The International Energy Agency (IEA) reported that between 2022 and 2030, deployed grid-scale battery storage capacity increased 35-fold to around 970 GW in the Net Zero Scenario. The capacity increased from 11 GW in 2022 to almost 170 GW in 2030 alone.

Key Energy Storage Market Insights Summary:

Regional Highlights:

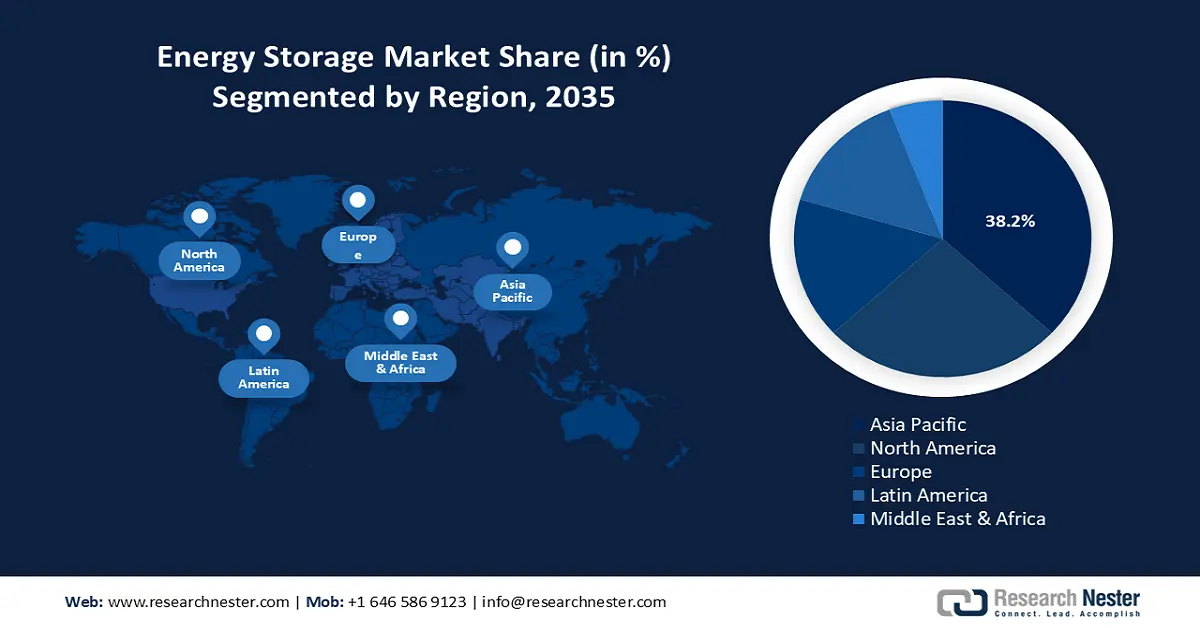

- Asia Pacific commands a 38.2% share in the Energy Storage Market, propelled by increasing industrialization, urbanization, and supportive government policies, driving strong growth through 2035.

- North America’s energy storage market is projected to achieve significant growth by 2035, driven by rising renewable energy integration and grid modernization needs.

Segment Insights:

- The Pumped Hydro segment is anticipated to capture over 46.4% share by 2035, influenced by the growing use of pumped hydro technology and grid upgrades.

Key Growth Trends:

- Increasing deployment of localized energy storage

- Innovations in battery chemistries

Major Challenges:

- High initial investments

- Lack of standard to determine battery pack health

- Key Players: BYD Company Ltd., Samsung SDI Co., Ltd., Eaton Corporation, Schneider Electric SE, Siemens Energy AG, GE Vernova Inc., Tesla, Inc., ABB Ltd., EVAPCO, Inc., UCAP Power, Inc..

Global Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.74 billion

- 2026 Market Size: USD 22.16 billion

- Projected Market Size: USD 70.65 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 12 August, 2025

Energy Storage Market Growth Drivers and Challenges:

Growth Drivers

- Increasing deployment of localized energy storage: Municipalities now play a crucial role in accomplishing national carbon neutrality goals as a result of the global trend towards decentralized energy systems. Municipalities are in charge of decarbonizing the local energy system by integrating renewable energy sources extensively into current systems, as they are the primary participants in the local energy transition. Because energy storage plays a crucial role in grid management, its use has seen a large global adoption. Localized energy storage systems allow consumers to store excess energy from renewable sources such as solar and wind for use during peak demand or grid outages.

By decentralizing energy storage, localized solutions help reduce stress on central grids, lower electricity costs, and improve reliability, particularly in areas prone to power disruptions. Additionally, with advancements in battery technology and smart energy management, localized storage is becoming more efficient and cost-effective, encouraging wider adoption. As governments and businesses focus on energy decentralization and sustainability, localized energy storage systems are expected to play a vital role in shaping the future of the energy sector. - Innovations in battery chemistries: The global imperative to address contemporary energy challenges and meet daily demands—among which rechargeable batteries play a crucial role—has catalyzed the continuous advancement of electrochemical energy storage systems and technologies. Given the widespread availability of sodium, sodium-ion batteries present a promising alternative to lithium-based batteries. Additionally, numerous international start-ups are actively developing aluminum-based batteries for applications in electric vehicles. For various applications, a hybrid system that integrates an ultra-capacitor with either lithium-ion or lead-acid batteries may also prove to be practical.

Batteries are vital to the green energy movement; however, for battery technology to achieve widespread success, it must remain economically viable. In comparison to lithium-ion batteries, iron-air batteries are substantially more cost-effective—up to ten times less expensive—while also capable of storing energy for durations of up to 100 hours. Similarly, the performance range and storage capacity of electric vehicles may be enhanced through the use of lithium-sulfur batteries, which are believed to be more efficient than their lithium-ion counterparts. Given the abundance and affordability of sulfur, this can lead to decreased overall costs. Furthermore, production facilities for lithium-sulfur batteries can be utilized for manufacturing due to their similarities in manufacturing processes with lithium-ion batteries. Therefore, advancements in battery technologies such as solid-state, sodium-ion, and lead-acid batteries are increasing efficiency, lifespan, and safety while reducing costs. These advancements make energy storage more viable for large-scale and long-duration applications.

Challenges

- High initial investments: Installing battery energy storage systems can be difficult in rural areas because grid electricity is scarce or unpredictable. Setting up a dependable power source is crucial for initial setup and continuing maintenance, perhaps using solar panels or other alternative sources. Due to a lack of local service providers and replacement components, routine maintenance and repairs for battery energy storage devices may be challenging in distant locations. Extreme heat, high humidity, or corrosive environments common in remote areas are examples of harsh environmental conditions that might affect battery systems' performance and longevity, requiring extra durability and safety precautions. With their higher energy density and better performance, battery energy storage systems such as lead-acid, flow, and lithium-ion batteries need a large initial investment. Lithium-ion batteries provide benefits including low self-discharge rates, high energy density, and less maintenance needs, despite their initial higher cost. Therefore, a higher initial cost is impeding the energy storage market.

- Lack of standard to determine battery pack health: Another issue facing the energy storage market is the absence of a standard to assess the condition of lithium-ion battery packs. To assess the condition of the battery packs in the field, techniques including electrochemical impedance spectroscopy, voltage and temperature profiling, and impedance spectroscopy are used. Nevertheless, there is no widely recognized criterion for evaluating the battery packs' condition.

Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 19.74 billion |

|

Forecast Year Market Size (2035) |

USD 70.65 billion |

|

Regional Scope |

|

Energy Storage Market Segmentation:

Technology (Pumped Hydro, Electro-Chemical, Electro-Mechanical, Thermal)

Pumped hydro segment is set to capture over 46.4% energy storage market share by 2035. The segment is expanding due to the growing use of pumped hydro technology worldwide. Moreover, it is anticipated that continuous expenditures in R&D to upgrade the grid capacity and infrastructure in regions such as Asia Pacific and North America are escalating the growth of the segment. The IEA reported that in 2021, the total installed capacity of pumped-storage hydropower was approximately 160 GW. In 2020, the global capacity was approximately 8,500 GWh, which accounted for more than 90% of the world's total power storage. The U.S. has the biggest capacity in the world. Daily balancing is provided by the vast majority of facilities currently in operation.

Application (Transportation, Grid Management)

The grid management segment in energy storage market is expected to garner a significant share during the assessed period. Large-scale energy storage is accomplished through the use of grid storage technologies. The industrial sector has a significant energy requirement, which fuels the segment's expansion. Large-scale energy storage also makes it possible for a reliable and effective power supply. In the Net Zero Emissions by 2050 Scenario, grid-scale storage is crucial for several system functions, including short-term balancing and operating reserves, ancillary services for grid stability and postponing the purchase of new transmission and distribution lines, long-term energy storage, and grid operation restoration after a blackout.

Also, according to the IEA, by the end of 2022, the total installed grid-scale battery storage capacity was about 28 GW, the majority of which had been added during the preceding 6 years. Due to the addition of over 11 GW of storage capacity, installations increased by more than 75% in 2022 compared to 2021. With gigawatt-scale increases, the U.S. and China were the market leaders.

Our in-depth analysis of the global energy storage market includes the following segments:

|

Technology |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy Storage Market Regional Analysis:

APAC Market Statistics

Asia Pacific in energy storage market is predicted to hold more than 38.2% revenue share by 2035. Increased investments in the region's industrialization and urbanization, along with supportive government policies, have stimulated market expansion. Additionally, the region is drawing foreign direct investments due to the availability of inexpensive inputs for production. China and other nations are the global center of manufacturing. The region's economy is expanding at an exponential rate, which is driving up demand for a reliable and efficient energy source. The primary factors propelling the growth of the energy storage systems market in the Asia Pacific region are the growing investments in rural electrification, the increased government investments in the adoption of sustainable energy sources, and the increased government initiatives to encourage the corporate sector to adopt renewable energy sources.

Through encouraging laws and programs, the Government of China is playing a significant role in propelling the expansion of the energy storage market. The goals of these regulations are to increase grid stability and incorporate more renewable energy sources. To encourage the development of innovative energy storage technologies and infrastructure, for example, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) have released guidelines. Additionally, several massive energy storage projects are being developed in China. For instance, in June 2024, In Shandong, China, Sineng Electric reported that a 100MW/200MWh energy storage project had been successfully put into service. It offers major economic, environmental, and social advantages and is a major step forward in the grid's integration of renewable energy.

The goals of these initiatives are to improve energy security, encourage the integration of renewable energy sources, and stabilize the system. Large battery storage systems, pumped hydro storage facilities, and hybrid systems—which integrate many storage technologies—are a few examples. Moreover, the rapid increase in industrial and commercial energy storage installations in the nation is consequently driving the energy storage market by improving grid stability, reducing operational costs, and supporting the clean energy transition ambition.

Furthermore, the Ministry of New and Renewable Energy indicated that India has committed to lowering the emission intensity of its GDP by 45% by 2030, compared to 2005 levels, and has set a goal to attain 50% of its installed capacity from non-fossil fuel-based energy sources by that time. It is difficult to maintain grid stability and a steady supply of electricity when a sizable portion of variable and intermittent renewable energy is incorporated into the energy mix.

The problem with renewable energy sources is that they change depending on the season, climate, time of year, and location. The available energy from renewable sources can be stored using Energy Storage Systems (ESS), which can then be used at the day's busiest times. Also, according to the Central Electricity Authority's (CEA) National Electricity Plan (NEP) 2023, the energy storage capacity needed in 2026–2027 is expected to be 82.37 GWh (47.65 GWh from PSP and 34.72 GWh from BESS). Therefore, this surging demand for energy storage systems is accelerating the market growth.

North America Market Analysis

North America energy storage market is expected to grow at a significant rate during the projected period. As a result of its improved electrical grid systems, propensity for using renewable energy, and rising investments in energy storage technologies, North America is anticipated to have the greatest share of the worldwide energy storage market. Owing to federal and state incentives for sustainable energy and microgrid development, the United States leads the world in BESS deployment. Additionally, the region has good legislation, such as tax incentives for energy storage systems, and strong government support.

Moreover, to reduce intermittency and maintain grid stability, the U.S. is experiencing an increase in demand for energy storage systems due to the rising integration of renewable energy sources, such as wind and solar power. Continuous developments in energy storage technologies, such as flow and lithium-ion batteries, are increasing system cost-effectiveness, efficiency, and dependability, which is propelling energy storage market uptake in the nation. Energy storage system adoption is largely driven by the need for grid modernization and resilience against extreme weather events and grid disruptions, especially for peak demand management and grid stabilization.

Additionally, the government’s supportive policies, such as tax incentives and renewable energy targets, are escalating the deployment of utility-scale energy storage systems, leading to lower capital costs and driving further investments in the sector.

Below is a table showing the U.S. utility-scale energy storage systems for electricity generation in 2022:

|

Storage system |

Number of plants and generators |

Power capacity (MW) |

Energy capacity (MWh) |

Gross generation (MWh) |

Net generation (MWh) |

|

Pumped-storage hydro |

40-152 |

22,008 |

NA |

22,459,700 |

6,033,905 |

|

Batteries |

403-429 |

8,842 |

11,105 |

2,913,805 |

539,294 |

|

Solar-thermal |

2-3 |

405 |

NA |

NA |

NA |

|

Compressed-air |

1-2 |

110 |

110h |

NA |

57 |

|

Flywheels |

4-5 |

47 |

17 |

NA |

0 |

Similarly, energy storage is growing in popularity as a result of federal and provincial policies that encourage the integration of renewable energy sources as Canada moves away from centralized power generation and toward more dispersed networks. The IEA revealed that from 2024 to 2034, the Canadian government offered a 15% investment tax credit for transmission equipment, power storage systems, mitigated natural gas-fired electricity generation, and non-emitting electricity-generating systems.

Key Energy Storage Market Players:

- BYD Company Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung SDI Co., Ltd.

- Eaton Corporation

- Schneider Electric SE

- Siemens Energy AG

- GE Vernova Inc.

- Tesla, Inc.

- ABB Ltd.

- EVAPCO, Inc.

- UCAP Power, Inc.

To expand their product lines, major energy storage market players are investing heavily in research and development, which will support further growth in the energy storage Market. To expand their global presence, market players are also implementing a variety of strategic measures, including the introduction of new products, contracts, higher investments, mergers and acquisitions, and cooperation with other businesses. To grow and thrive in a market that is becoming highly competitive, competitors in the energy storage sector must provide affordable products.

Recent Developments

- In November 2024, Eaton, an intelligent power management business, unveiled the xStorageTM battery energy storage system (BESS) to help speed decarbonization projects and maximize the impact of onsite renewables. The technology, which allows communities and businesses to strategically deploy stored energy and function independently of the electric grid, can help them decrease energy costs, lower carbon emissions, and sustain power during utility disruptions.

- In April 2024, Schneider Electric, a global leader in digital transformation of energy management and automation, released its newest Battery Energy Storage System (BESS), which is built and constructed to be part of a flexible and scalable architecture. BESS is the cornerstone for a fully integrated microgrid system powered by Schneider Electric's controls, optimization, electrical distribution, and world-class digital and field services.

- Report ID: 7297

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.