Energy Retrofit Systems Market Outlook:

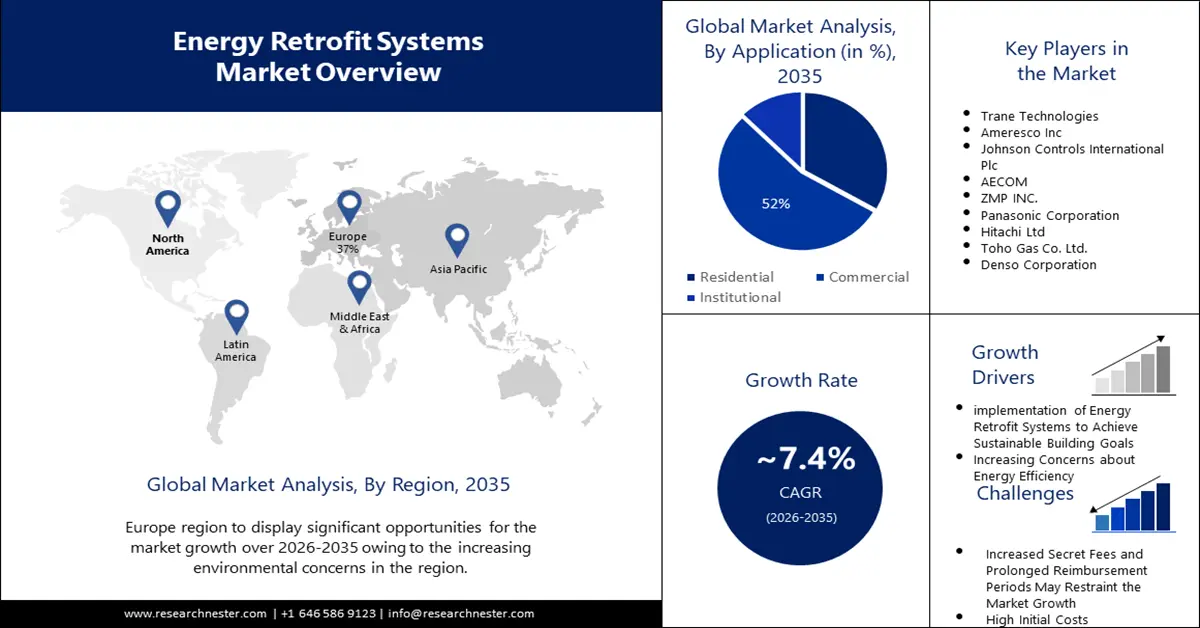

Energy Retrofit Systems Market size was over USD 211.84 Billion in 2025 and is projected to reach USD 432.56 Billion by 2035, witnessing around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of energy retrofit systems is evaluated at USD 225.95 Billion.

The developments in commercial and residential real estate sectors shape the energy retrofit systems market landscape. Beyond saving energy utilization, retrofitting older buildings reduces staff sickness by 20%, enhances employee productivity by up to USD 7,500 per person annually, and creates 3.2 million new employment opportunities per year. Furthermore, the asset value of such buildings is appreciated by 15%, according to the World Economic Forum. The final consumption of energy by retrofitting old buildings was 31% of the cumulative energy consumed by all verticals in 2022.

Commercial and public companies account for 75% of U.S. GDP. Further, buildings consume 75% of the electricity and 40% of the total energy used in the United States. As such, buildings play a pivotal role in achieving the country's economic and energy sector goals. Of this, 21% was by retrofitted residential vertical, 9% by commercial, and 1% by other buildings. Typically, retrofitted intervention comprises of digitalization of building management systems, upgradation of roof, walls, and windows, installation of HAVC equipment, heat electrification, and LED lighting. Retrofitting is a disaggregated intervention, which mostly includes CapEx-led energy efficient installations and building materials. In developed and EMDE economies LED bulbs reduced upfront costs per bulb. According to India’s UJALA program, per unit LED bulb was decreased to USD 0.8 and this drove the steadfast uptake of 1.15 billion LED light bulbs by 2020. This resulted in a yearly savings of USD 2.5 billion and 47 kWh.

DOE leads the building of energy models in the U.S. for researchers, builders, technology developers, and architects, including ComStock and ResStock. As per the U.S. DOE, the onsite combustion of the residential sector is anticipated to cross 266 quads and the commercial energy will reach 149.6 quads by 2050 in a business-as-usual (BAU) scenario. In the case high electric scenario, the site energy in residential will be roughly 71.73 quads, and commercial will be 56.5 quads by 2050. Commercial and residential buildings are among the largest carbon dioxide sources and other GHG emissions in the U.S., representing one-third of the overall GHG emissions in the country. Presently, approximately 130 million homes require some form of retrofitting, 40 million are new houses, and 60 billion square feet of commercial floor space is projected to be built by 2050. The existing infrastructure consumes enormous energy and is responsible for considerable climate pollution. Current buildings are ascribed to 74% of U.S. electricity for heating and cooling systems, and resident energy costs sum up to about USD 370 billion annually.

Buildings can be retrofitted to facilitate the use of a fraction of the energy they would otherwise require, meaning residents are less susceptible to volatile energy prices. Investments in demand-side solutions, especially high-performance envelope elements such as walls and windows for low-carbon heating and smart home control systems drastically limit the need to construct new power grids. Clean energy sources can save billions of dollars while offsetting a major portion of the grid decarbonization costs. However, the progress toward achieving net zero needs to be ramped up by 10x to meet its goals.

DOE’s data from the last decade says that just 500,000 of the 100 million homes that do not presently use a heat pump are estimated to make this conversion each year. At this rate, it will take 200 years to transition the residential heating stock to heat pumps. However, present market trends reflect a positive growth trajectory as in 2023 alone 4 million heat pumps were purchased by U.S. citizens, thereby, eclipsing the sales of gas furnaces for the very first time. Furthermore, IRA’s heat pump incentives are projected to galvanize further market adoption. The heat pump production capacity as of 2023 was 161.58GW and to cater to the expected demand in the Net Zero Emissions (NZE) scenario the capacity demand is likely to reach 460.26GW by 2030.

Comparative Timeline Analysis of Heat Pump Adoption

|

|

Current pace (2024)

|

Need a 10x increase in pace by 2030 (including homes that will require envelope upgrades) |

|

Homes without heat pumps |

100 million |

100 million |

|

Conversions per year |

500,000 |

5 million |

|

For full conversions |

200 years |

20 years |

Source: U.S. DOE

Recent advancements in air-source heat pump technology have made them a viable alternative heating solution in areas with subfreezing temperatures. The U.S. DOE published that air-source pumps installed in the Mid-Atlantic and Northeast areas have annual savings of 3,000 kWh (USD 459 at USD 0.153/kWh) as opposed to electric resistance heating, and 6,200 kWh (USD 948 at USD 0.153/kWh) benchmarking against to oil systems. Typically, the higher the heating efficiency (HSPF) and cooling efficiency (SEER), the greater the cost per unit. Despite this, the ROI on energy savings is higher than the initial investment to replace outdated units. In January 2023, strict HSPF2 and SEER2 regulations were enacted to improve the retail footprint of air-source heat pumps.