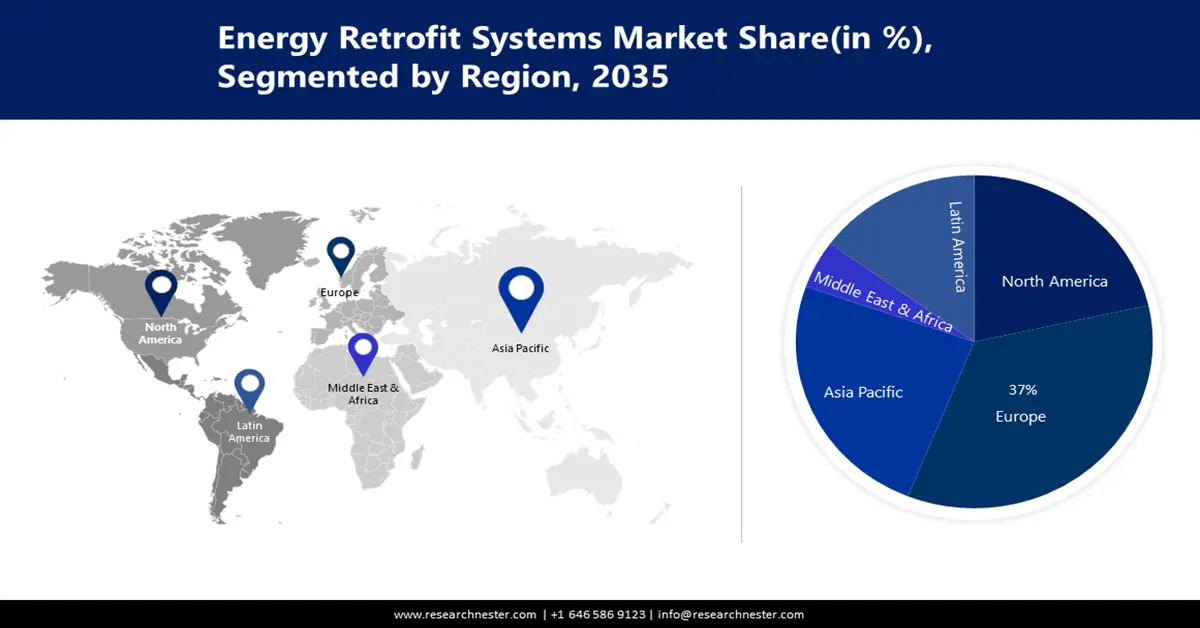

Energy Retrofit Systems Market Regional Analysis:

Europe Market Insights

Europe energy retrofit systems market is expected to hold the largest share of 37% by the end of 2035. The expansion can be attributed to the region's rising environmental concerns. For instance, the European Commission introduced the Renovation Wave initiative, which aims to decrease energy poverty, improve quality of life, and cut emissions by expediting house renovations across the EU. Moreover, the remodeling wave plan would enhance the health and well-being of residents because energy-efficient buildings make people more susceptible to cold snaps and heat waves. In the next 10 years, the strategy wants to double the rate of energy renovation, which will result in greatly increased energy and resource efficiency. By 2030, 35 million structures, according to the commission is anticipated to be renovated.

Energy retrofit systems market in Germany is driven by government reforms like the Building Energy Act, which was enacted in 2020 and later amended in 2023 and again in 2024. The act specifies building energy requirements, particularly insulation standards and thermal technologies for new and retrofitted ones. The Federal Funding for Efficient Buildings (BEG) is Germany’s prominent retrofit support program that sets even higher efficiency achievements with government financial support. The 2023 Energy Efficiency Law has a goal to limit energy consumption by the end of 2030 and instate obligatory exemplary roles for public authorities to play by 2045. Retrofitting old infrastructure is estimated to play a pivotal part in achieving the set targets.

North America Market Insights

North America energy retrofit systems market’s predominant driving factor is the U.S. government’s tax credits to transition sustainable renovated apartments. The IRA tax credits have been available to the residents of New York since 2023 and in June 2024, income-eligible New Yorkers are rendered IRA rebate access to avail upfront concessions on home energy updates. Rebates and IRA tax credits and rebates help homeowners save money, limit energy use, and contribute to sustainability efforts. The Appliance Upgrade and EmPower+ programs provided the initial funding to income-eligible citizens, while additional IRA rebates for multifamily buildings are likely to be rolled out in 2025. EmPower+ incentives are determined based on household income and the details are as follows.

- Low-income, single-family households: Capped at USD 10,000 per project.

- Moderate-income single-family households: Capped at USD 5,000 per project.

Home Electrification Appliance Rebate (HEAR) under the IRA umbrella has expanded the compensations that income-eligible New York residents can avail of via EmPower+ program in addition amounts listed above.

- Air sealing, ventilation, and insulation: USD 1,600

- Electrical service upgrade (panel box): USD 4,000

- Heat pumps: USD 8,000

- Heat pump water heaters: USD 1,750

- Electrical wiring upgrade: USD 2,500

The U.S. energy retrofit systems market landscape is shaped by prohibitions such as the IRA and NYS offerings. The eligibility is based on federal income tax liability, household income, product specifications, etc. Furthermore, the International Energy Conservation Code (IECC) has standardized insulation and air sealing systems and materials in January 2023. Systems installed in 2025 will be eligible for a maximum credit of USD 1,200 when abiding by the IECC policies.

U.S. Tax Credits for Energy Retrofit System

|

Equipment type |

Tax Credit for 2022 Tax Year |

Updated Tax Credit for 2023-2032 Tax Years |

Home Clean Electricity Products

|

Solar (electricity) |

30% of cost |

|

|

Fuel Cells |

||

|

Wind Turbine |

||

|

Battery Storage |

N/A |

30% of cost |

Heating, Cooling, and Water Heating

|

Heat pumps |

USD 300 |

30% of cost, up to USD 2,000 per year |

|

Heat pump water heaters |

||

|

Biomass Stoves |

|

|

|

Solar (water heating) |

|

|

|

Geothermal heat pumps |

30% of cost |

|

|

Efficient heating equipment |

USD 300 |

30% of cost, up to USD 600 |

|

Efficient air conditioners |

||

|

Efficient water heating equipment |

USD 150

|

30% of cost, up to USD 600 |

Other Energy Efficiency Upgrades

|

Electric panel/ circuit upgrades for new electric equipment |

N/A |

30% of cost, up to USD 600 |

|

Insulation materials |

10% of cost |

30% of cost |

|

Windows, including skylights |

10% of cost |

30% of cost, up to USD 600 |

|

Exterior doors |

10% of cost |

30% of cost, up to USD 600 for doors |

|

Home Energy Audits |

N/A |

30% of cost, up to USD 500 for doors (up to USD 250 each) |

|

Home Electric Vehicle Charger |

30% of cost, up to USD 1,000 |

30% of cost, up to USD 1,000 |

Source: U.S. DOE