Energy Retrofit Systems Market Outlook:

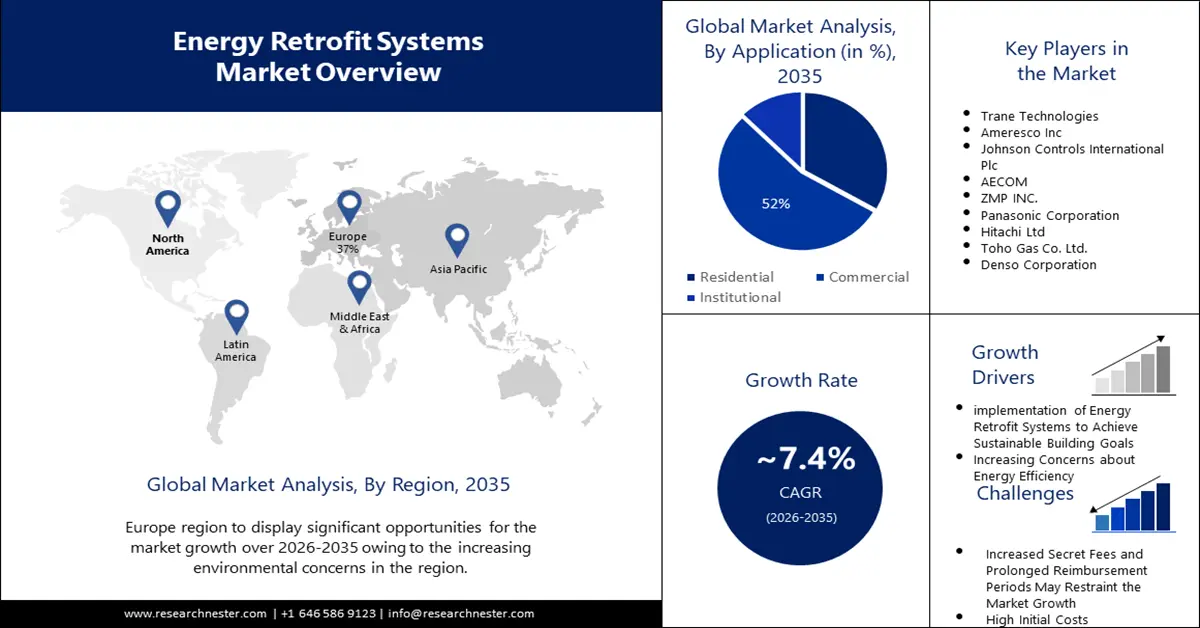

Energy Retrofit Systems Market size was over USD 211.84 Billion in 2025 and is projected to reach USD 432.56 Billion by 2035, witnessing around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of energy retrofit systems is evaluated at USD 225.95 Billion.

The developments in commercial and residential real estate sectors shape the energy retrofit systems market landscape. Beyond saving energy utilization, retrofitting older buildings reduces staff sickness by 20%, enhances employee productivity by up to USD 7,500 per person annually, and creates 3.2 million new employment opportunities per year. Furthermore, the asset value of such buildings is appreciated by 15%, according to the World Economic Forum. The final consumption of energy by retrofitting old buildings was 31% of the cumulative energy consumed by all verticals in 2022.

Commercial and public companies account for 75% of U.S. GDP. Further, buildings consume 75% of the electricity and 40% of the total energy used in the United States. As such, buildings play a pivotal role in achieving the country's economic and energy sector goals. Of this, 21% was by retrofitted residential vertical, 9% by commercial, and 1% by other buildings. Typically, retrofitted intervention comprises of digitalization of building management systems, upgradation of roof, walls, and windows, installation of HAVC equipment, heat electrification, and LED lighting. Retrofitting is a disaggregated intervention, which mostly includes CapEx-led energy efficient installations and building materials. In developed and EMDE economies LED bulbs reduced upfront costs per bulb. According to India’s UJALA program, per unit LED bulb was decreased to USD 0.8 and this drove the steadfast uptake of 1.15 billion LED light bulbs by 2020. This resulted in a yearly savings of USD 2.5 billion and 47 kWh.

DOE leads the building of energy models in the U.S. for researchers, builders, technology developers, and architects, including ComStock and ResStock. As per the U.S. DOE, the onsite combustion of the residential sector is anticipated to cross 266 quads and the commercial energy will reach 149.6 quads by 2050 in a business-as-usual (BAU) scenario. In the case high electric scenario, the site energy in residential will be roughly 71.73 quads, and commercial will be 56.5 quads by 2050. Commercial and residential buildings are among the largest carbon dioxide sources and other GHG emissions in the U.S., representing one-third of the overall GHG emissions in the country. Presently, approximately 130 million homes require some form of retrofitting, 40 million are new houses, and 60 billion square feet of commercial floor space is projected to be built by 2050. The existing infrastructure consumes enormous energy and is responsible for considerable climate pollution. Current buildings are ascribed to 74% of U.S. electricity for heating and cooling systems, and resident energy costs sum up to about USD 370 billion annually.

Buildings can be retrofitted to facilitate the use of a fraction of the energy they would otherwise require, meaning residents are less susceptible to volatile energy prices. Investments in demand-side solutions, especially high-performance envelope elements such as walls and windows for low-carbon heating and smart home control systems drastically limit the need to construct new power grids. Clean energy sources can save billions of dollars while offsetting a major portion of the grid decarbonization costs. However, the progress toward achieving net zero needs to be ramped up by 10x to meet its goals.

DOE’s data from the last decade says that just 500,000 of the 100 million homes that do not presently use a heat pump are estimated to make this conversion each year. At this rate, it will take 200 years to transition the residential heating stock to heat pumps. However, present market trends reflect a positive growth trajectory as in 2023 alone 4 million heat pumps were purchased by U.S. citizens, thereby, eclipsing the sales of gas furnaces for the very first time. Furthermore, IRA’s heat pump incentives are projected to galvanize further market adoption. The heat pump production capacity as of 2023 was 161.58GW and to cater to the expected demand in the Net Zero Emissions (NZE) scenario the capacity demand is likely to reach 460.26GW by 2030.

Comparative Timeline Analysis of Heat Pump Adoption

|

|

Current pace (2024)

|

Need a 10x increase in pace by 2030 (including homes that will require envelope upgrades) |

|

Homes without heat pumps |

100 million |

100 million |

|

Conversions per year |

500,000 |

5 million |

|

For full conversions |

200 years |

20 years |

Source: U.S. DOE

Recent advancements in air-source heat pump technology have made them a viable alternative heating solution in areas with subfreezing temperatures. The U.S. DOE published that air-source pumps installed in the Mid-Atlantic and Northeast areas have annual savings of 3,000 kWh (USD 459 at USD 0.153/kWh) as opposed to electric resistance heating, and 6,200 kWh (USD 948 at USD 0.153/kWh) benchmarking against to oil systems. Typically, the higher the heating efficiency (HSPF) and cooling efficiency (SEER), the greater the cost per unit. Despite this, the ROI on energy savings is higher than the initial investment to replace outdated units. In January 2023, strict HSPF2 and SEER2 regulations were enacted to improve the retail footprint of air-source heat pumps.

Key Energy Retrofit Systems Market Insights Summary:

Regional Highlights:

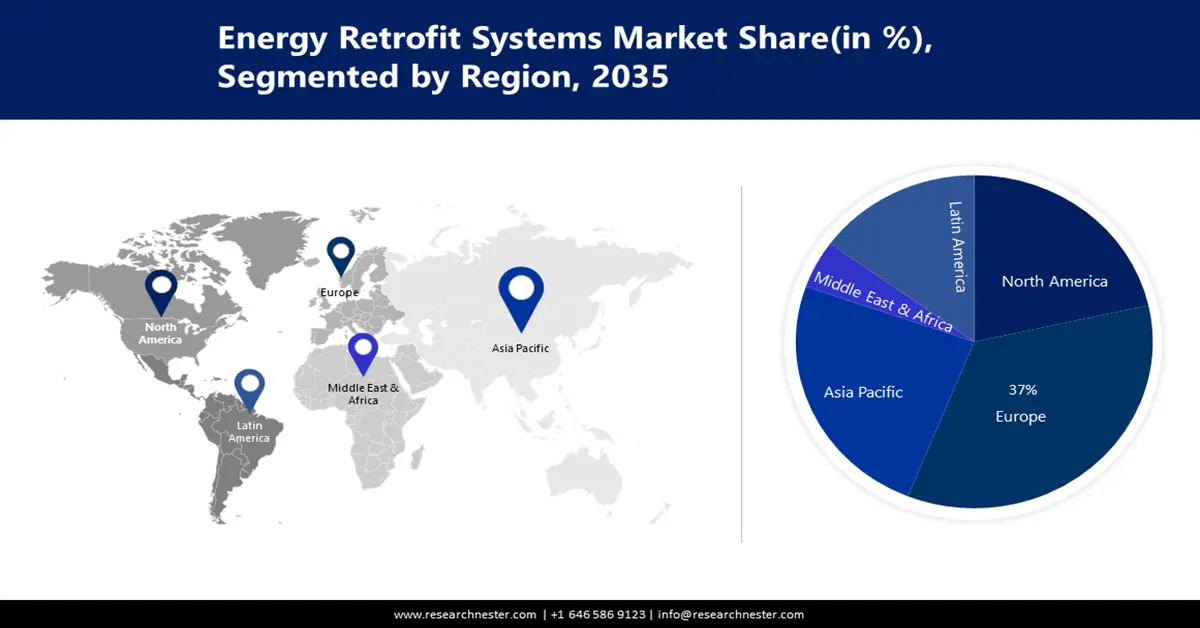

- Europe energy retrofit systems market is anticipated to achieve a 37% share by 2035, driven by rising environmental concerns and initiatives like the Renovation Wave to decrease energy poverty and improve quality of life.

Segment Insights:

- The commercial segment segment in the energy retrofit systems market is expected to capture a 52% share by 2035, driven by demand for efficient facility management and labor mobility in commercial buildings.

- The envelope segment in the energy retrofit systems market is projected to achieve a 42% share by 2035, influenced by retrofitting building envelopes to reduce energy consumption and carbon footprints.

Key Growth Trends:

- Employment opportunities in clean energy

- Initiatives promoting a strong economy and competitiveness

Major Challenges:

- Lack of infrastructure and Information

Key Players: Orion Energy Systems Inc, Trane Technologies, Ameresco Inc, Johnson Controls International Plc, AECOM, ZMP INC.

Global Energy Retrofit Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 211.84 Billion

- 2026 Market Size: USD 225.95 Billion

- Projected Market Size: USD 432.56 Billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Energy Retrofit Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Employment opportunities in clean energy: In 2023, jobs in clean energy expanded twice the rate of the overall U.S. labor market, owing to record-high federal investments in developing energy supply chains. Clean energy job CAGR was 4.9%, doubling down on the rest of the economic growth of 2.0%, thereby, creating 149,000 jobs. Energy sector employment surged to 8.35 million in 2023 from 8.10 million in 2022, representing a rise of 250,000 new opportunities. Globally, by 2030 8 million jobs in the clean energy sector are likely to be added, finds the IEA. Solar energy is being increasingly integrated into new constructions and upgrading older buildings. A 2024 USEER report suggests that electric power generation based on solar energy jobs was 364,544 in 2023.

Electric power generation (EPG) sector is massive in size and the employment rate grew the fastest in 2023 than any other technology segment. EPG added 36,458 jobs, while lost 870 jobs, ascribing to a net addition of 35,588 jobs. Cumulatively, U.S. EPG had more than 900,000 jobs in 2023.

Concentration of Solar Electric Power Generation Employment by Technology and Industry

|

Utilities |

Construction (including retrofitting) |

Manufacturing |

Wholesale Trade |

Professional and Business Services |

Other Services |

|

4% |

50% |

13% |

8% |

16% |

10% |

Source: USEER

In August 2022, as part of the IRA, investments worth USD 370 billion were made in clean energy and climate for the following decade. Besides a broad portfolio of tax credits that incentivize thousands of clean energy projects generation and deployment across the country, IRA funded USD 9.0 billion to states for rendering home retrofits and energy efficacy consumer rebates, USD 5.8 billion to limit industrial emissions, and USD 27 billion as GHG Reduction Fund, and USD 40 billion as loans to promote clean energy projects.

China is home to about 30% of the global energy workforce with clean energy employment rising by 2 million. Meanwhile, fossil fuel-related jobs fell by 600, 000 during 2019-2022, particularly in coal. Currently, China’s 60% of the energy labor force works in clean sectors, wherein clean energy manufacturing employs approximately 3 million people. China amounts to 80% of EV battery and solar PV and manufacturing jobs worldwide. As per the government’s 14th Five-Year Plan, 0.35 billion square meters of building area is projected to be retrofitted by the end of 2025.

-

Initiatives promoting a strong economy and competitiveness: DOE works with organizations through the Better Buildings initiative, to improve building infrastructure and manufacturing plant upgradations. The cumulative result of this work is reported below and demonstrates the remarkable energy and water efficiency while minimizing GHG byproducts and waste. In its second year of reporting, Better Climate Challenge’s over 225 partners successfully implemented sustainable practices in the U.S.

Overall Results to Date as of 2024

|

Energy saved |

3.6 quadrillion Btu |

|

Costs reduced |

USD 22 billion |

|

CO2e emissions avoided |

224 million metric tons |

|

Funding extended by financial allies |

USD 37 billion |

|

Water saved |

22 billion gallons |

|

Industrial facilities reported |

3,700 |

|

Partner solution published |

3,400 |

Better Climate Challenge Results

|

GHG emissions reduction from base year reported |

24% (average) |

|

Building space reported |

1.8 billion sq. ft. |

|

Industrial facilities reported |

1,900 |

Source: U.S. DOE

In 2024, the Better Buildings Initiative integrated building owners and designers to provide thermal heating design guidance and drive energy retrofit system development strategies. This has aided the installation of heat pumps and solar panels in new and retrofit constructions. The second part of the guideline is expected to be rolled out in 2025 by the Better Buildings Initiative to further decarbonize existing energy systems in close collaboration with ASHRAE and program allies.

Challenges

-

Lack of infrastructure and Information: The current energy efficiency gap is a result of the irrational behavioral habits of residential consumers. Numerous studies have looked into how the energy efficiency gap between investment prospects and actual implementation slows the market growth for energy retrofit systems. Structure changes present further difficulties for the energy retrofit systems market. Energy retrofit systems could damage historical and archaeological resources because they use untested techniques, tools, or technologies.

Energy Retrofit Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 211.84 Billion |

|

Forecast Year Market Size (2035) |

USD 432.56 Billion |

|

Regional Scope |

|

Energy Retrofit Systems Market Segmentation:

Product

The envelope segment in energy retrofit systems market is expected to hold the largest share of 42% during the forecast period. Retrofitting the building envelope promotes thermal comfort and minimizes drafts through the addition of insulation and an air barrier to the walls. Less heat is lost as a result, which reduces energy consumption and lowers carbon footprints for both owners and tenants. Additionally, research found that envelope retrofitting has the ability to help the benchmark home's energy use drop by about 30%.

Application

The commercial segment is set to capture a 52% share of the global energy retrofit systems market by 2035. The market is growing due to a growing demand for easy facility management, process efficiency, and effective labor mobility. Office buildings generate the most revenue among non-residential sector. In 2020, the market for commercial real estate was projected to be close to USD 33 trillion, with over USD 10 trillion anticipated for each of the areas of EMEA, Asia Pacific, and North America. In 2022, Whole Foods expanded its retail presence, to grow responsibly by reducing emissions in its operations, stores, and facilities. 45 Whole Foods stores now utilize low-GWP refrigerant systems, while 65 stores have been retrofitted to refrigerant R-448A. The latter has 68% lower GWP than legacy HFCs. Moreover, New York’s Whole Foods store has 100% HFC-free refrigeration operation.

Our in-depth analysis of the global energy retrofit systems market includes the following segments:

|

Product |

|

|

Appliances |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy Retrofit Systems Market Regional Analysis:

Europe Market Insights

Europe energy retrofit systems market is expected to hold the largest share of 37% by the end of 2035. The expansion can be attributed to the region's rising environmental concerns. For instance, the European Commission introduced the Renovation Wave initiative, which aims to decrease energy poverty, improve quality of life, and cut emissions by expediting house renovations across the EU. Moreover, the remodeling wave plan would enhance the health and well-being of residents because energy-efficient buildings make people more susceptible to cold snaps and heat waves. In the next 10 years, the strategy wants to double the rate of energy renovation, which will result in greatly increased energy and resource efficiency. By 2030, 35 million structures, according to the commission is anticipated to be renovated.

Energy retrofit systems market in Germany is driven by government reforms like the Building Energy Act, which was enacted in 2020 and later amended in 2023 and again in 2024. The act specifies building energy requirements, particularly insulation standards and thermal technologies for new and retrofitted ones. The Federal Funding for Efficient Buildings (BEG) is Germany’s prominent retrofit support program that sets even higher efficiency achievements with government financial support. The 2023 Energy Efficiency Law has a goal to limit energy consumption by the end of 2030 and instate obligatory exemplary roles for public authorities to play by 2045. Retrofitting old infrastructure is estimated to play a pivotal part in achieving the set targets.

North America Market Insights

North America energy retrofit systems market’s predominant driving factor is the U.S. government’s tax credits to transition sustainable renovated apartments. The IRA tax credits have been available to the residents of New York since 2023 and in June 2024, income-eligible New Yorkers are rendered IRA rebate access to avail upfront concessions on home energy updates. Rebates and IRA tax credits and rebates help homeowners save money, limit energy use, and contribute to sustainability efforts. The Appliance Upgrade and EmPower+ programs provided the initial funding to income-eligible citizens, while additional IRA rebates for multifamily buildings are likely to be rolled out in 2025. EmPower+ incentives are determined based on household income and the details are as follows.

- Low-income, single-family households: Capped at USD 10,000 per project.

- Moderate-income single-family households: Capped at USD 5,000 per project.

Home Electrification Appliance Rebate (HEAR) under the IRA umbrella has expanded the compensations that income-eligible New York residents can avail of via EmPower+ program in addition amounts listed above.

- Air sealing, ventilation, and insulation: USD 1,600

- Electrical service upgrade (panel box): USD 4,000

- Heat pumps: USD 8,000

- Heat pump water heaters: USD 1,750

- Electrical wiring upgrade: USD 2,500

The U.S. energy retrofit systems market landscape is shaped by prohibitions such as the IRA and NYS offerings. The eligibility is based on federal income tax liability, household income, product specifications, etc. Furthermore, the International Energy Conservation Code (IECC) has standardized insulation and air sealing systems and materials in January 2023. Systems installed in 2025 will be eligible for a maximum credit of USD 1,200 when abiding by the IECC policies.

U.S. Tax Credits for Energy Retrofit System

|

Equipment type |

Tax Credit for 2022 Tax Year |

Updated Tax Credit for 2023-2032 Tax Years |

Home Clean Electricity Products

|

Solar (electricity) |

30% of cost |

|

|

Fuel Cells |

||

|

Wind Turbine |

||

|

Battery Storage |

N/A |

30% of cost |

Heating, Cooling, and Water Heating

|

Heat pumps |

USD 300 |

30% of cost, up to USD 2,000 per year |

|

Heat pump water heaters |

||

|

Biomass Stoves |

|

|

|

Solar (water heating) |

|

|

|

Geothermal heat pumps |

30% of cost |

|

|

Efficient heating equipment |

USD 300 |

30% of cost, up to USD 600 |

|

Efficient air conditioners |

||

|

Efficient water heating equipment |

USD 150

|

30% of cost, up to USD 600 |

Other Energy Efficiency Upgrades

|

Electric panel/ circuit upgrades for new electric equipment |

N/A |

30% of cost, up to USD 600 |

|

Insulation materials |

10% of cost |

30% of cost |

|

Windows, including skylights |

10% of cost |

30% of cost, up to USD 600 |

|

Exterior doors |

10% of cost |

30% of cost, up to USD 600 for doors |

|

Home Energy Audits |

N/A |

30% of cost, up to USD 500 for doors (up to USD 250 each) |

|

Home Electric Vehicle Charger |

30% of cost, up to USD 1,000 |

30% of cost, up to USD 1,000 |

Source: U.S. DOE

Energy Retrofit Systems Market Players:

- Orion Energy Systems Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trane Technologies

- Ameresco Inc

- Johnson Controls International Plc

- AECOM

The energy retrofit systems industry has the presence of several key companies that are seeking to capitalize on the emerging net zero trend. They are capitalizing on supportive government initiatives to propel their product adoption. Some of the top strategies implemented by the energy retrofit systems market players are product launches, geographical expansions, R&D activities, and mergers and acquisitions. Some of the key companies are:

Recent Developments

- In January 2025, Ontario announced its plan to launch new energy-efficiency programs, including the Home Renovation Savings Program offering rebates of up to 30% for home energy-efficiency renovations and improvements.

- In October 2024, ABB Robotics announced the launch of energy efficiency services to provide manufacturers with a combination of consultation services and tools to save costs and enhance sustainability by upto 30%.

- In September 2024, Wärtsilä Gas Solutions announced its plan to supply reliquefaction systems for retrofit installation onboard floating storage regasification units (FSRUs). The project is expected to enhance the environmental footprint of FSRU operations.

- In September 2024, Eaton collaborated with Tesla to streamline novel and retrofit home energy storage. This system is expected to boost the functionality and adoption of solar installations and home energy storage in North America.

- Report ID: 5357

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Energy Retrofit Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.