Energy Management Software Market Outlook:

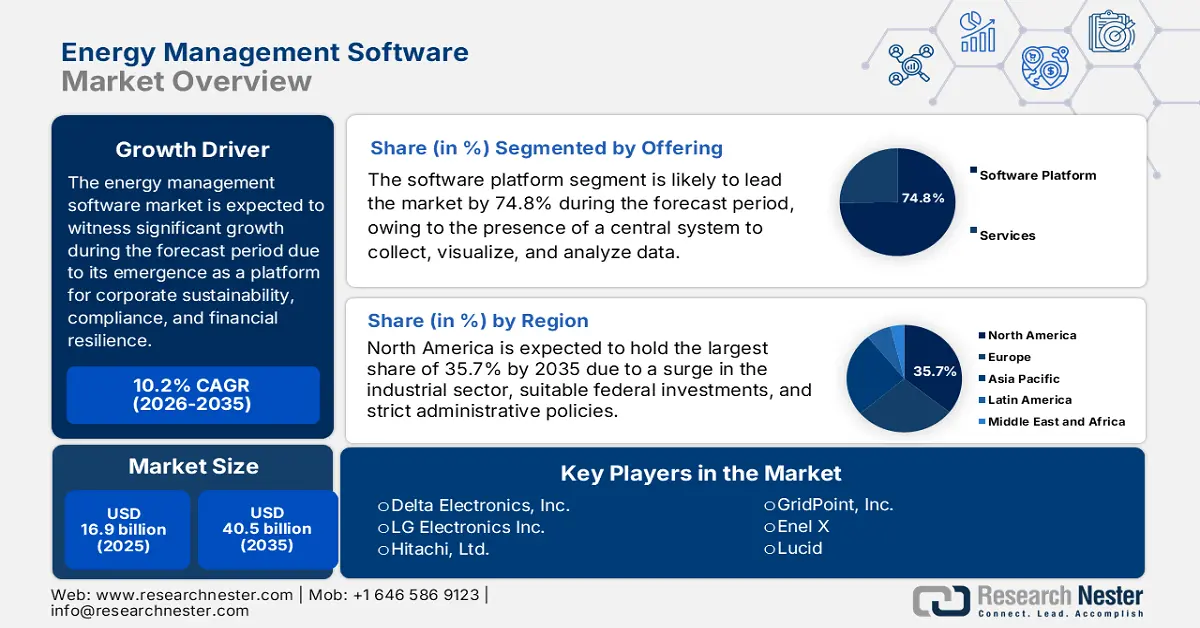

Energy Management Software Market size was over USD 16.9 billion in 2025 and is estimated to reach USD 40.5 billion by the end of 2035, expanding at a CAGR of 10.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of energy management software is estimated at USD 18.6 billion.

The worldwide energy management software market is witnessing a profound transformation, emerging from a niche operational tool for cost reduction into a severe and tactical platform for financial resilience, corporate sustainability, and regulatory compliance. According to a data report published by the IEA Organization in 2025, there has been an increase in the international electricity demand by 4.3% as of 2024, denoting a surge from 2.5% in 2023. In addition, the average pace of electricity requirement between 2010 and 2023 was 2.7%, which is twice the rate of overall energy growth. Besides, the electricity consumption has also increased by 1,080 TWh, which is almost twice the yearly average of the previous decade. Moreover, there has been a continuous change in the overall finalized electricity consumption for a few regions, which is highly responsible for uplifting the energy management software market globally.

Total Final Electricity Consumption Modifications Across Regions (2012-2024)

|

Regions |

2012-2022 (TWh) |

2023 (TWh) |

2024 (TWh) |

|

Advanced Economies |

39.0 |

-140.8 |

230.9 |

|

India |

57.5 |

141.4 |

80.7 |

|

Southeast Asia |

47.1 |

44.0 |

85.9 |

|

Middle East |

30.4 |

28.8 |

29.5 |

Source: IEA Organization

Furthermore, artificial intelligence-based predictive analytics, carbon accounting, ESG integration, SaaS and cloud-native dominance, increased focus on demand response and grid interaction, and hyper-automation in industry and buildings are other drivers for bolstering the energy management software market. As per a report published by the ANL Government in April 2024, through artificial intelligence, commercial powerplant licensing and design readily account for almost 50% of the time to commercialize the latest energy deployments. Besides, the Department of Energy (DOE) has estimated the successful onboarding of 1.6TW of the newest solar capacity, along with 200 GW of the newest nuclear capacity. In addition, the DOE also estimated the demand to diminish expenses to less than USD 100 per net metric ton of carbon dioxide, which is equivalent for both carbon storage and capture to cater to carbon pollution, thereby making it suitable for skyrocketing the market’s exposure.