Energy Efficient Lighting Market Outlook:

Energy Efficient Lighting Market size was valued at USD 60.56 billion in 2025 and is expected to reach USD 128.34 billion by 2035, expanding at around 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of energy efficient lighting is evaluated at USD 64.81 billion.

The sustainability wave is set to significantly boost the adoption of energy efficient lighting technologies in the coming years. The United for Efficiency (U4E) study estimates that eco-efficient lighting technologies such as ultra-efficient LED save up to 60% energy and work 3 to 4 times longer than conventional lighting solutions. Eco-efficient lighting systems are emerging as more cost-effective in the context of soaring electricity and energy security concerns. Continuous innovations in this sector are leading to the constant development of energy efficient lighting solutions. This highlights that energy efficiency needs are set to offer lucrative opportunities for key players in the long run.

Smart city projects are gaining boom in both developing and developed regions due to the growth in urbanization activities. These smart city initiatives are estimated to uplift the adoption of energy efficient lighting technologies in the coming years. The high investments by governments in these projects as well as their aim to reduce carbon footprint through public infrastructure activities are further driving the employment of energy efficient lighting technologies. In Asia Pacific, Singapore, South Korea, Japan, China, and India are leading in the race for smart infrastructure development. Thus, the integration of advanced technologies coupled with sustainability and livability trends are propelling the smart cities market growth and further opening profitable opportunities for energy efficient lighting manufacturers.

Key Energy Efficient Lighting Technology Market Insights Summary:

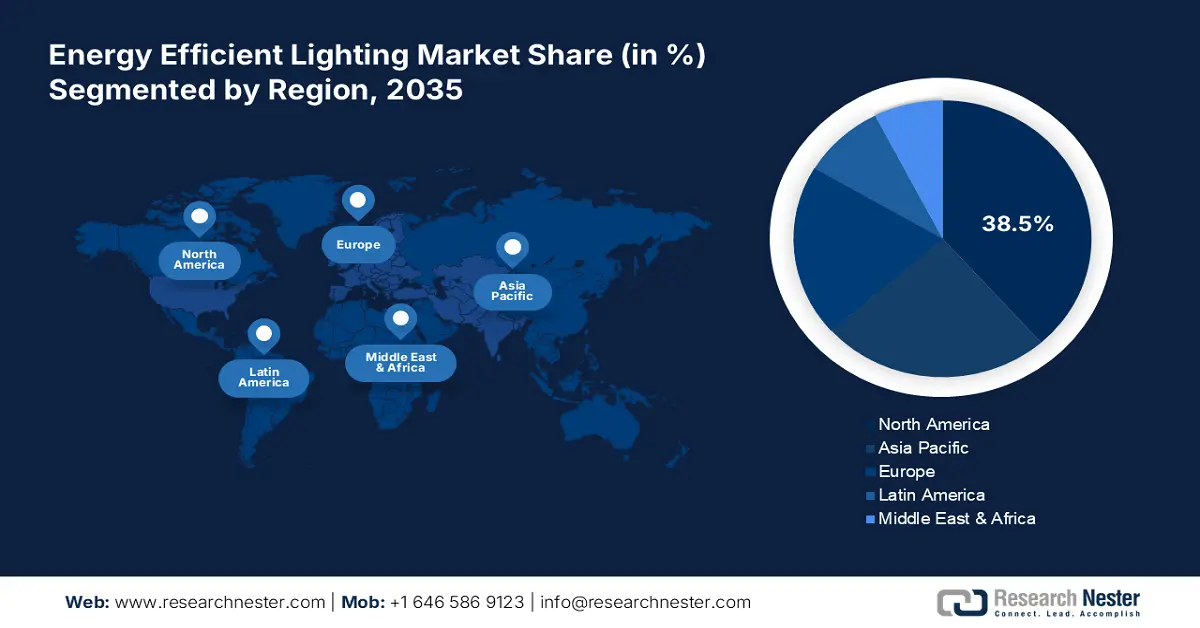

Regional Highlights:

- North America dominates the Energy Efficient Lighting Market with a 38.5% share, fueled by supportive government policies, sustainability initiatives, and technological advancements, ensuring growth through 2026–2035.

- Asia Pacific's Energy Efficient Lighting Market is expected to see robust growth by 2035, driven by high adoption of sustainable energy solutions and rapid urban and industrial activities.

Segment Insights:

- The LED segment is expected to capture a 60.50% market share by 2035, fueled by energy efficiency and widespread LED adoption.

- The Households segment is forecasted to achieve a 45.70% share in the Energy Efficient Lighting Market by 2035, driven by energy savings and smart home integration.

Key Growth Trends:

- Net zero emission goals backing the sales of LED technologies

- Government support augmenting the adoption of smart lighting

Major Challenges:

- High prices de-emphasizing the adoption of energy efficient lighting solutions

- Disposal and recyclability issues

- Key Players: Cooper Lighting, Cree, Inc., Digital Lumens, Inc., Eaton Corporation, and General Electric Co.

Global Energy Efficient Lighting Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.56 billion

- 2026 Market Size: USD 64.81 billion

- Projected Market Size: USD 128.34 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Energy Efficient Lighting Market Growth Drivers and Challenges:

Growth Drivers

- Net zero emission goals backing the sales of LED technologies: The net zero emission goal adopted by a majority of countries across the world is a core factor promoting the sales of energy efficient lighting technologies. The International Energy Agency (IEA) analysis estimates that light holds a major share in electricity consumption and contributes to Co2 emissions. To overcome these issues and perfectly align with the net zero emissions by 2050 scenario countries are predominately investing in eco-friendly lighting technologies such as CFL and LED. Many countries are at the forefront of mitigating the use of fluorescent lighting, which is driving the way for LEDs to become a dominating lighting technology. The same source also highlights that around 50% of global residential lighting sales are led by LEDs.

- Government support augmenting the adoption of smart lighting: The integration of digital technologies such as sensors, cameras, and IoT-enabled components is augmenting the sales of smart lighting solutions. These technologies aid in better energy management and control over lighting technologies. Governments increasing implementation of strict regulations on energy consumption and emission reduction are substantially pushing the adoption of smart and eco-efficient lighting technologies. Various initiatives including tax benefits, incentives, and subsidies are further assisting the sales of energy efficient lighting products. For instance, the IEA report reveals that the East African Community (EAC) embraced a regionally harmonized quality and performance standard in July 2022 that is set to boost the adoption of LED lamps by phasing out the usage of conventional and fluorescent lamps. Also, in May 2023, South Africa disclosed the latest efficiency standards for all General Service Lamps (GSLs) to reach at least 90 lm/W.

Challenges

- High prices de-emphasizing the adoption of energy efficient lighting solutions: Energy efficient lighting technologies are known for long-term benefits but their initial investment cost is high. Customers in price-sensitive energy efficient lighting markets often hesitate to invest in these eco-efficient solutions owing to their high costs. Many end use companies also deter from investing in energy efficient lighting technologies due to limited budgets. Manufacturers need to focus on the cost-effectiveness of their products to attract a larger customer base. The rising awareness and competitive pricing strategies are anticipated to fuel the adoption of energy efficient lighting technologies in the years ahead.

- Disposal and recyclability issues: Even though energy efficient lighting technologies offer multiple environmental benefits, the disposal challenge is a concerning issue limiting the energy efficient lighting market growth to some extent. The materials used in the production of energy efficient lighting systems include foams, plastic, glues, ceramics, and more have recyclability issues. Manufacturers need to focus more on the implementation of efficient disposal and recycling methods to protect the environment from potential harm.

Energy Efficient Lighting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 60.56 billion |

|

Forecast Year Market Size (2035) |

USD 128.34 billion |

|

Regional Scope |

|

Energy Efficient Lighting Market Segmentation:

Technology (LED (Light Emitting Diode), CFL (Compact Fluorescent Lamp), Halogen, Others)

Light emitting diode segment is predicted to dominate energy efficient lighting market share of over 60.5% by 2035. High energy efficiency, durability, and cost savings are prime factors augmenting the sales of LED solutions. The U.S. Department of Energy states that residential LEDs particularly ENERGY STAR-rated products utilize 75.0% less energy and work 25x more than their incandescent counterparts. By 2035, LED lighting technologies are anticipated to save energy up to 569 TWh annually. The widespread awareness and adoption of LED lights are set to propel the overall market in the coming years.

End user (Households, Retail, Hospitality, Healthcare, Education, Others)

In energy efficient lighting market, households segment is anticipated to hold revenue share of more than 45.7% by 2035. Households are the prime consumers of energy and the U.S. Department of Energy states that they hold nearly 15.0% of an average home’s electricity use. The same source also underscores that an average household saves around USD 225 in energy costs annually by employing LED solutions. Rapid urbanization, integration of smart solutions, and environmental awareness programs are augmenting the use of energy efficient lighting technologies in households. In the coming years, innovations leading to efficiency and cost-effectiveness are set to fuel the adoption of eco-efficient lighting solutions such as LED, halogen, and CFL.

Our in-depth analysis of the global energy efficient lighting market includes the following segments:

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy Efficient Lighting Market Regional Analysis:

North America Market Forecast

North America energy efficient lighting market is set to account for revenue share of more than 38.5% by the end of 2035. The supportive government policies, sustainability initiatives, technological advancements, and environmental goals are propelling the energy efficient lighting market growth. The zero carbon emission goals and smart home trends are fueling the adoption of energy efficient lighting solutions in both the U.S. and Canada. The infrastructure upgrade programs are further generating lucrative opportunities for energy efficient lighting manufacturers.

In the U.S., the rising government investments in energy efficient projects are set to boost the revenues of key players during the foreseeable period. The Energy Independence and Security Act and the Department of Energy’s (DOE) better building initiatives are fueling the employment of eco-friendly lighting technologies such as LEDS in all industrial, commercial, and residential sectors. For instance, in August 2021, DOE invested around USD 83.0 million in funding for 44 projects. These projects are aimed at reducing the citizens' energy bills by investing in advanced construction practices, energy-efficient building solutions, and a buildings-sector workforce. Out of these, 11 projects are working in lighting technology, research, development, and field validation.

Similar to the U.S., in Canada the federal and provincial governments are implementing energy-efficient programs and regulations aimed at mitigating energy consumption, which are set to offer lucrative opportunities for key energy efficient lighting market players. Commitment to climate change goals and rising energy costs are driving the attention of Canadians to invest in energy efficient lighting solutions. The high adoption of smart home systems in the country is further fueling the adoption of energy efficient lighting technologies such as LED and CFL. The smart city and infrastructure upgrade programs aimed at energy efficiency are also augmenting the sales of smart and sustainable lighting technologies.

Asia Pacific Market Statistics

The Asia Pacific energy efficient lighting market is poised to expand at a robust pace during the forecast period. The high adoption of sustainable energy solutions is primarily boosting the sales of energy efficient lighting technologies in the region. The rapid urban and industrial activities and infrastructure development projects such as smart cities are also propelling the adoption of energy efficient lighting technologies. South Korea and Japan are dominant marketplaces for energy efficient lighting producers, while China and India are offering high-earning opportunities.

China’s strong semiconductor manufacturing energy efficient lighting market is significantly contributing to the production of advanced and energy efficient lighting technologies. Strict regulations on emissions and rising awareness of sustainable solutions are driving the sales of energy efficient lighting solutions in the country. The IEA analysis estimates that China is the leading manufacturer, exporter, and consumer of LED lighting solutions across the world. The consistent production and supply of these technologies and 100% lighting policy initiatives are directly uplifting the revenues of energy efficient lighting companies.

India’s shift towards renewable energy sources is driving the adoption of energy efficient technologies. The high electricity costs and climate commitments under the Paris Agreement are uplifting the importance of energy efficient lighting installations. Zero carbon emissions by 2070 and scaling up clean energy are also backing the overall energy efficient lighting market growth in India. The booming smart city projects and the strong presence of domestic and international companies are further contributing to the sales of energy efficient lighting systems. India’s strong research and development capabilities are also fueling the development of eco-friendly lighting solutions.

Key Energy Efficient Lighting Market Players:

- Bajaj Electricals Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lezyne

- Bridgelux, Inc.

- Cooper Lighting

- Cree, Inc.

- Digital Lumens, Inc.

- Eaton Corporation

- General Electric Co.

- LED Roadway Lighting Ltd.

- LIGMAN Lighting Co., Ltd.

- OSRAM Licht Group

- Philips Lighting Holding B.V.

- Zumtobel Group AG

The leading companies in the energy efficient lighting business are employing several organic and inorganic market strategies such as new product launches, technological innovations, mergers and acquisitions, collaborations & partnerships, and regional expansions to earn high profits and boost their reach. The energy efficient lighting market players are collaborating with other players to develop innovative energy efficient lighting solutions. They are also entering into strategic partnerships to boost their customer base. Digital marketing strategies are also set to attract new customers and uplift the revenue of industry giants.

Some of the key players include:

Recent Developments

- In August 2023, Lezyne, announced the launch of a newly updated, industry-leading LED product line. The latest offering comes with multi-LED engineered optics, improved battery capacity, advanced heat sink technology, and a waterproof USB-C charging port.

- In April 2023, the University of Missouri College of Engineering revealed that Peifen Zhu a researcher from the university found a special compound that shifts LED lighting from blue toward green hues. The research supported by a Faculty Early Career Development CAREER Award from the National Science Foundation is aiding Zhu in developing more energy efficient materials.

- Report ID: 7119

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Energy Efficient Lighting Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.