Energy-based Aesthetic Devices Market Outlook:

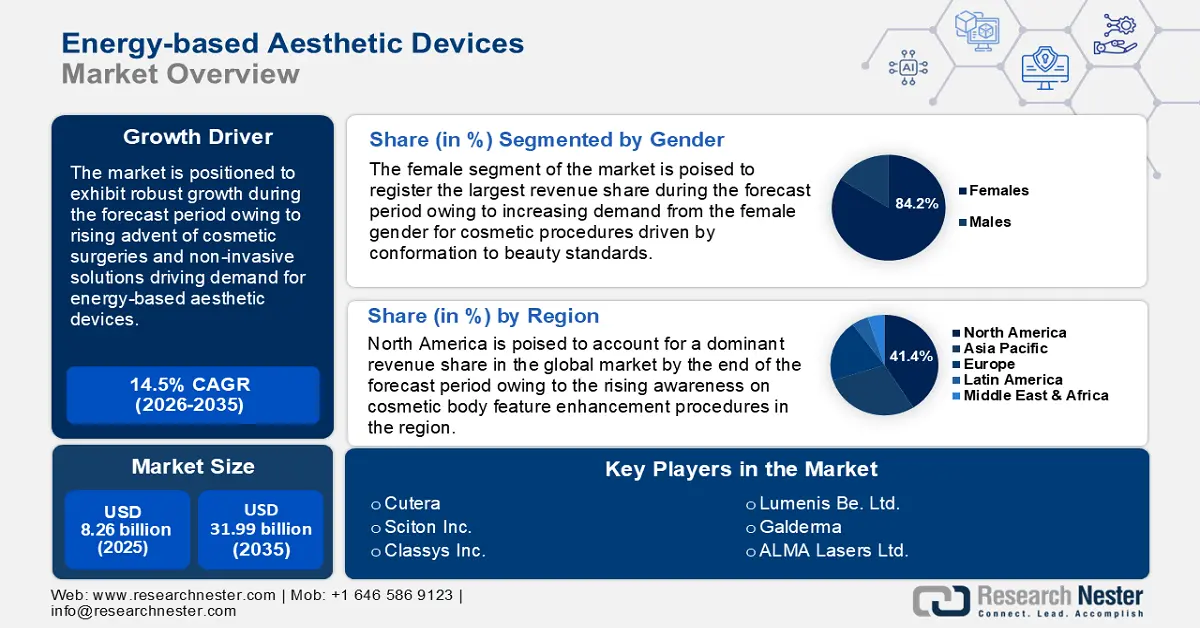

Energy-based Aesthetic Devices Market size was valued at USD 8.26 billion in 2025 and is likely to cross USD 31.99 billion by 2035, registering more than 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of energy-based aesthetic devices is assessed at USD 9.34 billion.

The major driver of the energy-based aesthetic devices industry is the growing demand for non-invasive cosmetic treatments. In the backdrop of the demand, energy-based aesthetic devices are cemented as a cornerstone of modern cosmetic treatments. Furthermore, these devices offer minimal recovery time coupled with effective results which drives demand. The American Society of Plastic Surgeons published a report stating that from 2022 to 2023, there was a 7% increase in the cases of cosmetic minimally invasive procedures. The increasing statistics of non-invasive cosmetic procedures augurs well for the energy-based aesthetic devices industry. In August 2024, the National Library of Medicine published a 14-year analysis of the International Society of Aesthetic Plastic Surgery (ISAPS) which published figures indicating a global increase in surgical and non-surgical aesthetic procedures. For instance, in 2023, a global increase of 3.4% in aesthetic procedures was reported including 34.9 million surgical and nonsurgical aesthetic procedures, out of which nonsurgical procedures outnumbered the surgical procedures.

Additionally, the study indicated a whopping 40% increase in cosmetic procedures from 2019 to 2023 indicating lucrative opportunities in the energy-based aesthetic devices sector. The rising percentage of cosmetic procedures worldwide is a key feature highlighting a shift toward technology-driven beauty and aesthetics solutions. Energy-based aesthetic devices are positioned to experience widespread adoption in the industry with clinicians offering tailored treatments to optimize outcomes for diverse patient needs. Furthermore, the advent of social media trends has led to the proliferation of body aesthetics trends which has expanded the end user for aesthetic procedures, driving demand for energy-based devices in emerging markets.

Moreover, trends in the energy-based aesthetic devices market indicate major players expanding portfolios to cater to rising demand. For instance, in September 2023, Sciton Inc. announced the expansion of the mJOULE system to improve patient outcomes, with the system utilizing laser technology for aesthetic applications. The market trends provide favorable opportunities for key players in the sector to continue to invest in improving the portfolio for energy-based aesthetic devices, and expand their revenue shares by the end of the forecast period.

Key Energy-based Aesthetic Devices Market Insights Summary:

Regional Highlights:

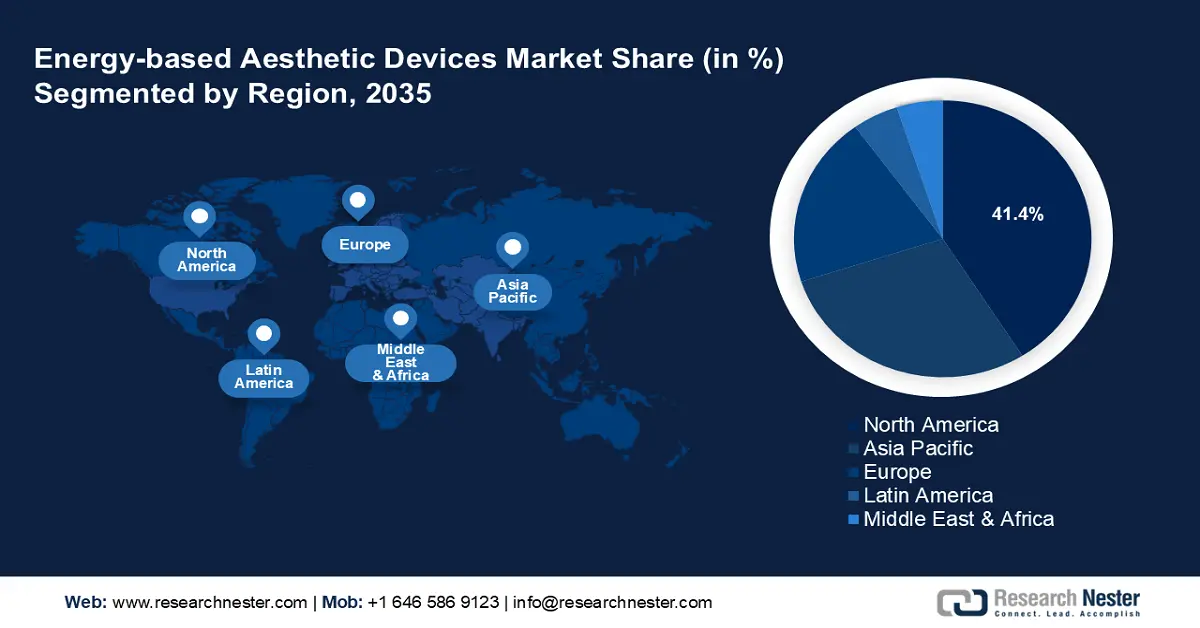

- North America dominates the Energy-based Aesthetic Devices Market with a 41.4% share, driven by the growing demand for non-invasive cosmetic treatments, fueling strong growth prospects through 2026–2035.

- The APAC region is expected to witness significant growth in the Energy-based Aesthetic Devices Market from 2026 to 2035, driven by rising consumer awareness and favorable demographic trends.

Segment Insights:

- Laser-based aesthetic devices segment are expected to see substantial growth through 2035, driven by rising demand for non-invasive cosmetic procedures like tattoo and hair removal.

- The Female segment is set for significant growth from 2026-2035, driven by high demand for non-invasive cosmetic procedures influenced by cultural beauty standards.

Key Growth Trends:

- Rising demand for breast augmentation and liposuction procedures

- Growing consumer awareness, aesthetic trends, and disposable income

Major Challenges:

- Intense market competition and rapid advancements

- Risk of adverse effects

- Key Players: Cutera, Sciton Inc., Cartessa Aesthetics, Classys, Inc, ALMA Lasers Ltd., Merz Pharma GmbH & Co., Galderma, AbbVie Inc., Lumenis Be. Ltd., Cynosure, Inc., Daeyang Medical Co., Ltd..

Global Energy-based Aesthetic Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.26 billion

- 2026 Market Size: USD 9.34 billion

- Projected Market Size: USD 31.99 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Energy-based Aesthetic Devices Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for breast augmentation and liposuction procedures: The energy-based aesthetic devices market is poised to expand owing to the increasing usage of complementary treatments for breast-related procedures. Radiofrequency or ultrasound devices are used for pre and post-surgical tightening while lasers are applied for scar management. The growing percentage of breast augmentation procedures globally is creating lucrative opportunities for key players in the industry to increase the supply of energy-based devices that support the procedure. For instance, the International Society of Aesthetic Plastic Surgery (ISAPS) estimated liposuction and breast augmentation to be the most popular cosmetic procedures globally from 2022 to 2023. Liposuction procedures incorporate laser or ultrasound-based devices to liquefy fat and improve skin elasticity after the procedure.

Recent advancements in energy-based devices bode well for the sector by offering opportunities for businesses to forward innovative solutions. For instance, in May 2023, Apyx Medical Corporation announced clearance from the U.S. Food & Drug Administration (FDA) for the use of Renuvion (helium plasma and radiofrequency technology) in procedures for the coagulation of soft tissues following liposuction. - Growing consumer awareness, aesthetic trends, and disposable income: The energy-based aesthetic devices market is poised to expand owing to rising consumer awareness for cosmetic procedures worldwide, supported by beauty trends and a growing rate of disposable income. For instance, the American Society of Plastic Surgeons published a study reporting macroeconomic trends in the U.S. had an impact on traditional aesthetic procedures while microeconomic trends had an impact on minimally invasive aesthetics. In August 2024, the Organization for Economic Co-operation and Development (OECD) reported real household income per capita in the OECD rose by 0.9% in the first quarter of 2024, indicating favorable trends for the global energy-based aesthetic devices market with an expected increase in spending for aesthetic procedures.

Furthermore, the evolving aesthetic trends play a significant role in the market’s growth. There has been a shift towards treatments offering natural-looking enhancements devoid of traditional surgical procedures over the years. Such trends drive demand for energy-based aesthetic devices as laser-based skin resurfacing becomes popular. With the evolving contemporary beauty standards fueled by media, the demand for energy-based devices in cosmetic procedures is expected to heighten by the end of the forecast period. - Rapid expansion of medical tourism: The rapid growth of the medical tourism sector is a major driver of the energy-based aesthetic devices market as the growing footfall of medical tourists seeking aesthetic procedures drives demand for energy-based devices. Furthermore, evolving marketing trends have led to investments by cosmetic clinics in targeted ad campaigns based on contemporary beauty trends, such as the popularity of Korean aesthetics, to attract medical tourists. Additionally, the expansion of clinics offering cosmetic procedures expands end users for energy-based aesthetic devices creating favorable opportunities for the sector’s growth.

Brazil, Japan, Turkey, China, South Korea, and India, are among the top medical tourism destinations for cosmetic procedures. Global players in the energy-based aesthetic devices industry find greater opportunities to expand the supply of their products to the emerging markets in these countries. For instance, in October 2024, SONIRE Therapeutics Inc., from Japan, announced the designation of its next-generation HIFU (High-Intensity Focused Ultrasound) therapy system as a breakthrough device by the FDA. The advancements are indicative of the cutting-edge aesthetic procedures available in countries that are popular destinations for medical tourism in cosmetic procedures.

Challenges

- Intense market competition and rapid advancements: The rapid technological innovation in the energy-based aesthetic devices market is beneficial, but can also prove to be a market challenge due to frequent product entrants. Companies must invest continuously in R&D to remain competitive in the sector which can cause a strain on operations. Additionally, the emergence of viral skincare routines such as the salmon sperm facial, often propelled by celebrities, can become alternative non-invasive treatments causing a challenge for the sector.

- Risk of adverse effects: The adoption rate of energy-based aesthetic devices can be stymied in case of side effects such as scarring, burns, etc. Patient dissatisfaction can cause repercussions in the market’s growth. Furthermore, the failure of any device offered by a business can severely impact the revenue share of the company with alternatives readily available in the competitive market.

Energy-based Aesthetic Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 8.26 billion |

|

Forecast Year Market Size (2035) |

USD 31.99 billion |

|

Regional Scope |

|

Energy-based Aesthetic Devices Market Segmentation:

Gender (Females, Males)

In energy-based aesthetic devices market, female segment is set to dominate revenue share of over 84.2% by 2035. The demand from women for non-invasive beauty treatments is increasingly fueled by shifting cultural perceptions of beauty. Additionally, the female gender is more receptive to cultural beauty standards, and the growing disposable income of females especially in high-income countries such as Norway, the U.S., Germany, etc., has driven the popularity of cosmetic procedures for the female gender. Furthermore, within the sub-segment of the female segment, the 19 to 34 age group accounts for a profitable share due to rising demand from women in the age group for various cosmetic procedures.

ISAPS reported that between 2022-2023, liposuction was the most common aesthetic surgical procedure for women followed by breast augmentation, with 1.8 million liposuction procedures performed globally indicating a 29% increase from 2021. Furthermore, ISAPS reported that 53.7% of breast augmentations took place in 18- to 34-year-olds. Advancements in new non-invasive therapeutics are poised to drive demand for energy-based aesthetic devices in the female segment. For instance, in April 2024, Cartessa Aesthetics launched PHYSIQ 360 which elevates non-invasive body contouring in partnership with DEKA, a leading aesthetic laser manufacturer. Additionally, social media platforms have ensured greater visibility of aesthetic treatments for women driving the segment’s continued growth.

The male segment of the energy-based aesthetics devices market is poised to expand during the forecast period. A major driver of the market is the post-modern perceptions of masculinity with increasing acceptance of cosmetic enhancements. The change in male beauty standards has led to a growing demand for aesthetic procedures catering to males. Furthermore, the rapid increase in non-invasive procedure demands for hair loss treatment is poised to ensure sustained growth of the segment. For instance, in July 2023, the American Society of Plastic Surgeons reported that the previous decade witnessed a growing demand from men for aesthetic surgeries indicating shifting masculinity tropes. The trends indicate the evolving landscape of male aesthetic perceptions which augurs well for the continued growth of the segment.

Product (Laser-based Aesthetic Device, Radiofrequency (RF)-based Aesthetic Device, Light-Based Aesthetic Device, Ultrasound Aesthetic Device, Other Products)

By product, the laser-based aesthetic device segment is poised to register a significant revenue share in the energy-based aesthetic devices market. The rising demand for non-invasive cosmetic procedures is a major driver of the segment. The surging applications of laser devices in tattoo and hair removal has created a steady revenue stream for manufacturers. Additionally, the surging popularity of laser hair removal amidst females drives demand for laser solutions in aesthetic procedures.

The advent of cutting-edge laser removal solutions indicates the potential for expansion of the segment, with businesses leveraging the expanding percentage of end user demanding laser removal solutions. In October 2024, Outset Skin Studio launched laser tattoo removal services equipped with Astanza Trinity Laser Systems. The advent of advanced laser solutions is poised to drive further adoption, creating profitable revenue streams in the energy-based aesthetic devices market.

Our in-depth analysis of the global energy-based aesthetic devices market includes the following segments:

|

Gender |

|

|

Product |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy-based Aesthetic Devices Market Regional Analysis:

North America Market Forecast

In energy-based aesthetic devices market, North America region is expected to capture over 41.4% revenue share by 2035. The growing demand for non-invasive cosmetic treatments in the region is a major driver of the sector’s growth. The U.S. and Canada hold leading revenue shares in the market. Additionally, the energy-based aesthetic devices market benefits from the heightened consumer awareness owing to North America being a major consumer of movies and entertainment which shapes idyllic beauty trends.

The heightened demand for anti-aging cosmetic procedures in the region is poised to create sustained opportunities for the major stakeholders in the regional energy-based aesthetic devices market. For instance, in March 2023, Acclaro Medical Corporation announced that its Cold Ablative Fiber Laser for resurfacing all skin tones was awarded the New Beauty award and FDA clearance. The advancements are poised to drive demand for anti-aging laser treatments in the region.

The U.S. energy-based aesthetic devices market holds a dominant share in North America. The early adoption of cutting-edge aesthetic solutions in the country drives market growth. The advanced healthcare infrastructure of the U.S., along with the growing disposable income has ensured continued demand for energy-based devices in aesthetic cosmetic procedures. Additionally, the growing awareness has ensured the diversification of demand in various age groups and genders, leading to opportunities for energy-based aesthetic devices market expansion.

A key indicator of the sector’s growth in the U.S. is the recent launch of cutting-edge energy-based aesthetic devices to cater to the rising demand. For instance, in October 2024, Powered by MRP, launched ECHO in the U.S., as a cutting-edge laser hair removal system. The shifting beauty standards have ensured a steady demand for laser hair removal solutions in the U.S.

Canada energy-based aesthetic devices market is poised to expand during the forecast period. Cultural and demographic factors influence the market in Canada with a growing preference for subtle aesthetic improvements aligning with natural beauty standards driving demand for non-invasive aesthetic procedures. The popularity of anti-aging treatment drives demand for energy-based aesthetic devices market while providing lucrative opportunities for major players in the U.S. to expand services to Canada. For instance, in September 2024, Merz Aesthetics launched Ultherapy PRIME, i.e., a non-invasive procedure that provides long-lasting skin lift with zero downtime. Furthermore, a supportive regulatory ecosystem and healthcare infrastructure ensure the integration of energy-based aesthetic devices into cosmetic procedures.

APAC Market Forecast

The APAC energy-based aesthetic devices market is poised to exhibit robust growth during the forecast period. The APAC market’s expansion is attributed to rising consumer awareness and favorable demographic trends in the region. The shifting beauty trends in the region along with an aging population drive demand for cosmetic enhancement procedures requiring advanced energy-based devices. Furthermore, manufacturers are projected to find profitable opportunities in APAC in the diverse markets of China, South Korea, India, Japan, etc. For instance, in March 2023, AAYNA, a leading provider of aesthetic solutions in India announced the launch of its exclusive AAYNA renew treatment as a cutting-edge micro-needling RF (radio frequency) treatment.

The China energy-based aesthetic devices market is poised to exhibit rapid expansion during the forecast period. The rapid growth of disposable income in China ensures a promising market for increasing spending on cosmetic procedures driving demand for energy-based devices. The growing prevalence of beauty influencers in the country’s domestic social media platforms such as Weibo, Douyin, WeChat, etc., has created a rising demand for cosmetic enhancement procedures.

The popular beauty standard among females in China is having large eyes with double-fold eyelids. The growing demand for cosmetic enhancements in the country has driven the need for energy-based aesthetic devices which brands are leveraging by expanding distribution to China. In August 2022, Softwave announced a key distribution and collaboration agreement with HTDK Group to advance Softwave sales in China and leverage the rapidly growing aesthetics industry in the country.

The South Korea energy-based aesthetic devices market is poised for growth during the forecast period. The heightened popularity of cosmetic surgeries in the country is a major driver of the market. The country’s beauty trends indicate a focus on flawless beauty and youthful appearance, with beauty trends from Korea making waves globally. Furthermore, the energy-based aesthetic devices market also benefits from the growing medical tourism with international patients seeking cost-effective high-quality treatment. The trends create a favorable ecosystem for manufacturers of energy-based aesthetic devices.

The K-beauty wave has fueled a sustained demand for aesthetic treatments such as skin resurfacing, body contouring, etc., leading to an expansion of key players from South Korea to the U.S. For instance, in November 2024, Cartessa Aesthetics announced a partnership with Classys Inc., to bring EVERESSE by Volnewmer, i.e., a cutting-edge monopolar radiofrequency technology to the U.S. energy-based aesthetic devices market.

Key Energy-based Aesthetic Devices Market Players:

- Cutera

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sciton Inc.

- Cartessa Aesthetics

- Classys, Inc

- ALMA Lasers Ltd.

- Merz Pharma GmbH & Co.

- Galderma

- AbbVie Inc.

- Lumenis Be. Ltd.

- Cynosure, Inc.

- Daeyang Medical Co., Ltd.

The energy-based aesthetic devices market is poised to expand during the forecast period. Key players in the market are investing in collaborating to expand the distribution of energy-based aesthetic devices in various markets. Key players are expanding product portfolios to cater to a broader range of aesthetic procedures to increase profitability.

Additionally, strategic partnerships with clinics and hospitals ensure the expansion of global footprint. In July 2024, Alpha Aesthetics Partners announced significant growth in the first quarter of 2024 and is on the trajectory for major expansion indicating the lucrative trends within the market.

Here are some key players in the energy-based aesthetic devices market:

Recent Developments

- In April 2024, Sciton Inc., launched the BBL HEROic, i.e., that will incorporate intelligent control and unique skin positioning system for improved patient outcomes. The intelligent control acts as the system’s brain to process 3D spatial data for automated pulse delivery.

- In January 2024, Lumenis introduced FoLix, i.e., a breakthrough laser system designed to combat hair loss cleared by the FDA. With its launch, FoLix became the first and only fractional laser choice for safe, effective, and natural hair loss treatment for women and men in the United States.

- Report ID: 6938

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.