Endoscopy Devices Market Outlook:

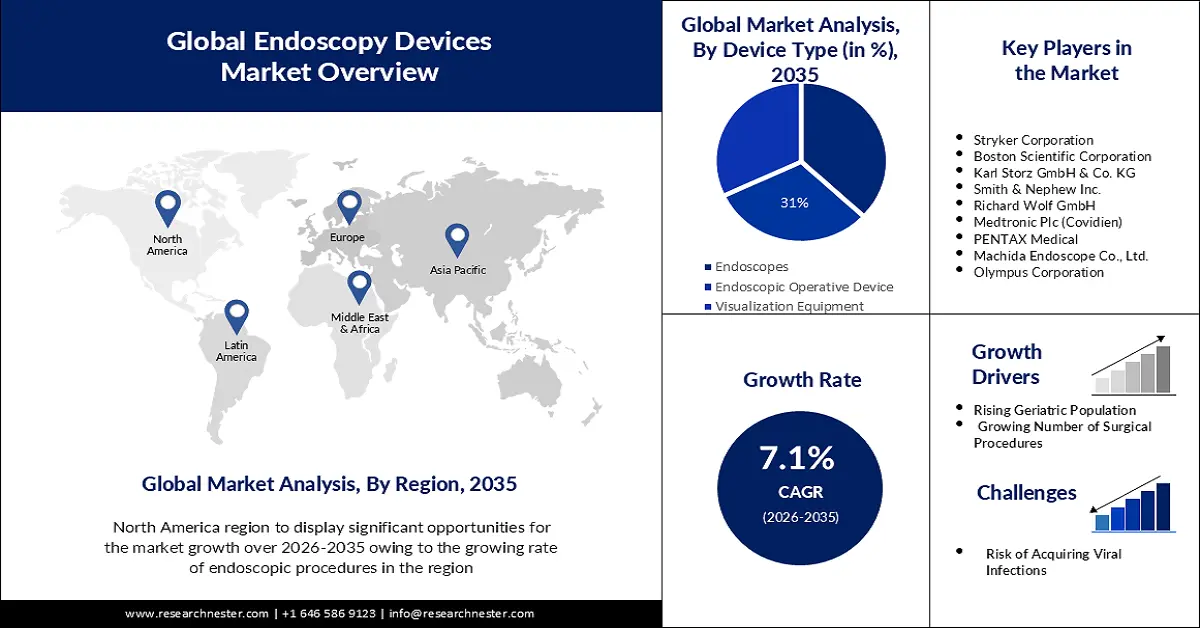

Endoscopy Devices Market size was over USD 62.35 billion in 2025 and is anticipated to cross USD 123.8 billion by 2035, growing at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endoscopy devices is assessed at USD 66.33 billion.

The market is impelled by the increasing worldwide prevalence of chronic ailments such as cancer, gastrointestinal disorders, and cardiovascular diseases (CVD). According to the GLOBOCON statistics, the number of new and death cases of cancer around the globe is expected to reach 4.6 million and 3.5 million by 2050. Similarly, an NLM projection calculated the global count of CVD deaths to reach 20.5 million by 2025 and 35.6 million by 2050. It also predicted 90%, 73.4%, and 54.7% increments in crude prevalence, mortality, and disability-adjusted life-years (DALYs) throughout the same timeframe. These medical issues require high-end diagnostic and therapeutic procedures to enable early detection and intervention to prevent them from worsening.

The payers’ pricing of commodities from the market varies as per the type of procedure, technology used, and device. For instance, in November 2022, NLM published a comparative cost-analysis of oral, transnasal, and magnet-assisted capsule endoscopy, examining the upper gastrointestinal tract in dyspepsia. Per procedure expense for transnasal endoscopy (TNE) had the lowest value of USD 142.8, in comparison to the oral and magnet-assisted one (USD 208.8 and USD 461.7). On the other hand, the annual purchase and maintenance costs of oral and TNE instruments were USD 89982and USD 92805.2, respectively, higher than USD 17490.5 for the magnet-assisted system. Thus, the need for standardized pricing is highly required to make this sector more publicly accessible.