Endoscopes Market Outlook:

Endoscopes Market size was over USD 24.2 billion in 2025 and is anticipated to cross USD 45.43 billion by 2035, growing at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endoscopes is assessed at USD 25.62 billion.

The factors driving the growth of the endoscope market include the increasing prevalence of chronic diseases such as ulcerative colitis and the demand for minimally invasive procedures. According to data published by the National Institute of Health (NIH), in 2019, 74% of the deaths were caused by chronic diseases worldwide.

Key Endoscopes Market Insights Summary:

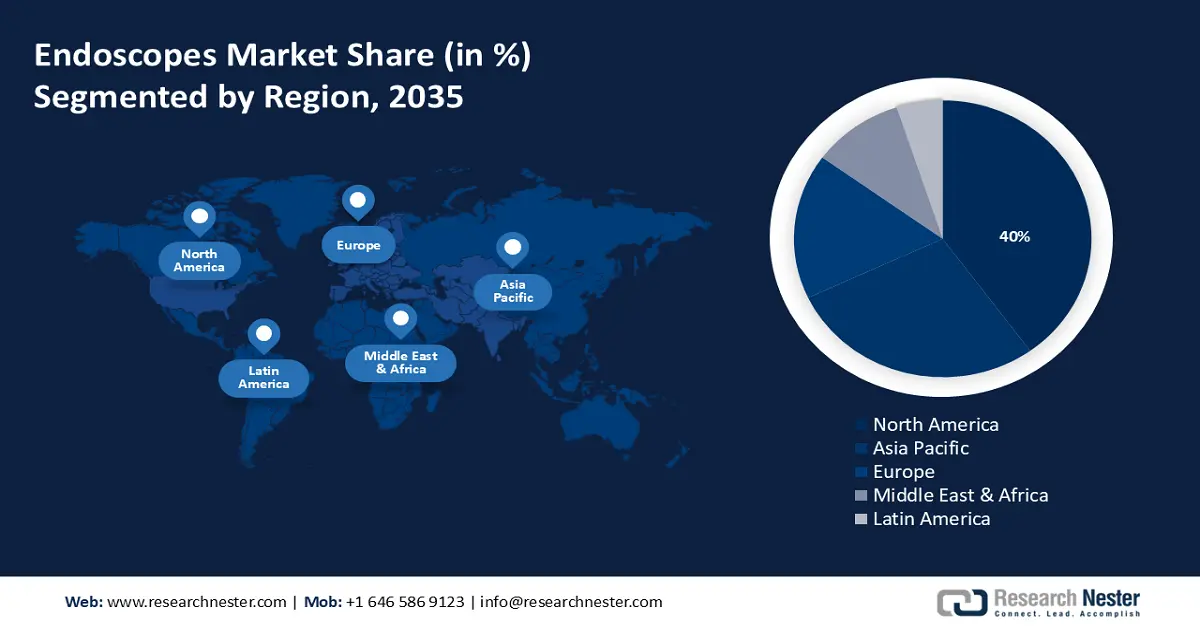

Regional Highlights:

- The North America endoscopes market is anticipated to capture 40% share by 2035, driven by a rapidly aging population and greater adoption of elective endoscopic procedures.

- The Asia Pacific market will exhibit significant growth during the forecast timeline, driven by innovative endoscopic product launches, rising elderly population, and increasing chronic disease cases.

Segment Insights:

- The flexible endoscopes segment in the endoscopes market is expected to achieve significant growth till 2035, driven by rising gastrointestinal disorders and preference for minimally invasive procedures.

- The outpatient facilities segment in the endoscopes market is anticipated to witness lucrative growth till 2035, driven by convenience, affordability, and efficient diagnostic services.

Key Growth Trends:

- Rising cancer cases worldwide

- Increasing preference for minimal invasive processes

Major Challenges:

- Presence of well-established market players

- Side effects of endoscopy procedures

Key Players: Olympus Corporation, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, Stryker Corporation, Boston Scientific Corporation, Pentax Medical (Hoya Corporation), Medtronic plc, Richard Wolf GmbH, Smith & Nephew plc, Ambu A/S.

Global Endoscopes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.2 billion

- 2026 Market Size: USD 25.62 billion

- Projected Market Size: USD 45.43 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Endoscopes Market Growth Drivers and Challenges:

Growth Drivers

-

Rising cancer cases worldwide - The development of sophisticated endoscopic biopsy including laparoscopy, thoracoscopy, and mediastinoscopy has eliminated the need for surgical cytology. According to the American Cancer Society, in 2024 611,720 cancer deaths are estimated in the U.S. Colorectal Cancer is the first leading cause of death in men and second in women.

Endoscopy plays a vital role in detecting upper gastrointestinal (GI) cancer lesions. Prominent cutting-edge technologies include wide-area transepithelial sampling (WATS), confocal laser endomicroscopy (CLE), Video capsule endoscopy (VCE), and dye-based electronic or virtual chromo-endoscopy (ECE) have become the gold standard for upper GI cancer screening. In February 2023, ANXROBOTICA launched NAVICAM SB system in the U.S. It allows clear and accurate visualization of obscure GI lesions and bleeding in patients with inflammatory bowel disease (IBD). The rising cancer cases have fostered innovation in endoscopic screenings. - Increasing preference for minimal invasive processes - Wireless capsule endoscopy (WCE) has emerged as a groundbreaking technology which radically minimizes the risks associated with sedation. A standard WCE device can be ingested and it actively passes through the GI tract, capturing images for diagnostics. It uses technologies such as near-field wireless power transmission, ultra-wideband/intrabody communication, magnetic field active drive, hybrid localization, magnetic-controlled diagnosis and treatment, and AI-based autonomous lesion detection. In April 2023, Laborie Medical Technologies launched a new GERD diagnostics system, alpHaONE. It is a WCE pH reflux testing system with advanced GI motility and caters to esophageal disease diagnosis. Typically, with WCE most cases are treated on an outpatient basis, meaning fewer hospital stays.

Challenges

-

Presence of well-established market players - The endoscopes market has numerous competitors, which creates hurdles for new entrants to fit in. The increase in mergers and acquisitions has also established a sense of risk for the newcomers. Therefore, the high competition between the small companies and the already renowned big companies is harnessing the growth of the market.

- Side effects of endoscopy procedures - These procedures are usually safe however some side effects have been noticed in a few patients such as tears in the esophagus, duodenum, and stomach, internal bleeding, mild cramps, and other major complications. the allied data was from 2018 data, which is relatively old. That is why it has been removed.

Endoscopes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 24.2 billion |

|

Forecast Year Market Size (2035) |

USD 45.43 billion |

|

Regional Scope |

|

Endoscopes Market Segmentation:

Product Segment Analysis

Flexible endoscopes segment is expected to hold endoscopes market share of over 47% by the end of 2035. This growth is attributed to the increasing extent of gastrointestinal disorders, screening programs, and the expanding preference for minimally invasive procedures. Flexible endoscopy is used to visualize the upper and lower gastrointestinal system and examination of various other parts. That's why it is an ideal solution for diagnosing challenging situations where visualization is difficult. Flexible endoscopy helps reduce pain and discomfort caused to the patients during colonoscopy. These are also estimated to avoid sedations without stretching the bowels.

End-use Segment Analysis

Outpatient facilities segment in the endoscopes market is set to showcase lucrative growth rate through 2035. The segment is growing due to the numerous benefits it offers such as convenience, cost-effectiveness, and effective diagnosis procedures. Generally, the upper endoscopy is performed as an outpatient procedure where the surgeon may give liquid medicine to gargle or spray numbing medicine in patient's mouth to achieve effective results. Overall, the advantages and affordability of outpatient facilities are highly preferred by people who cannot afford expensive treatments and do not have to pay huge bed fees by not getting admitted.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End - Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endoscopes Market Regional Analysis:

North America Market Insights

North America industry is anticipated to hold largest revenue share of 40% by 2035. The region’s growth is attributed to the rapidly aging population and increasing adoption of elective endoscopic procedures. It is estimated that one in five Americans will be of age 65 or above by 2040.

The United States market is witnessing growth as a result of the increased expenditure on healthcare. As per a National Health Expenditure Fact Sheet presented by the Centers for Medicare & Medicaid Services, in 2022; the healthcare spending in the U.S. reached up to USD 4.5 trillion holding a share of 17.4% in the gross domestic product (GDP).

The market in Canada is expanding due to the rising prevalence of inflammatory bowel diseases and other gastrointestinal disorders. According to the statistics provided by Canadian Government in 2021, approximately 260,000 Canadians had inflammatory bowel disease.

Asia Pacific Market Insights

Asia Pacific region is likely to observe significant growth till 2035, owing to the launch of innovative endoscopic products, a rise in the elderly population, and increasing incidences of chronic disorders. Cardiovascular diseases are one of the major causes of death in Asia Pacific with an estimated 9.85 million deaths in the South- East Asia and Western Pacific regions in 2019.

The market is growing in China because of the increasing cases of gastrointestinal cancers. According to a National Institute of Health survey, stomach cancer in China accounted for 43.9% of the global level and 4.7 million cases in the year 2020.

The market is flourishing in India owing to the high number of breast cancer cases and the growing elderly population. The mortality rate for breast cancer in India is 12.7 per 100000 women.

Endoscopes Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Boston Scientific Corporation

- Medtronic Plc

- CONMED Corporation

- ProSurg Inc

- Cook Group

- Karl Storz

- Smith & Nephew

- Richard Wolf GmbH

The market is dominated by key market players who are gaining traction in the market due to the increasing incidence of gastrointestinal and cardiovascular diseases.

Recent Developments

- In November 2021, Medtronic Plc announced that it received (510k) clearance for PillCam™ B3 @HOME from the U.S. Food and Drug Administration. This revolutionary system provides effective care to the patient dealing with gastrointestinal disorders in their comfort zone.

- In April 2024, Medtronic Plc announced the launch of the latest software named ColonPRO™ for GI Genius™ intelligent endoscopy system. GI Genius™ is a computer-aided detection (CADe) system utilizing AI to detect colorectal polyps.

- Report ID: 6262

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endoscopes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.