Endoscope Drying Cabinets Market Outlook:

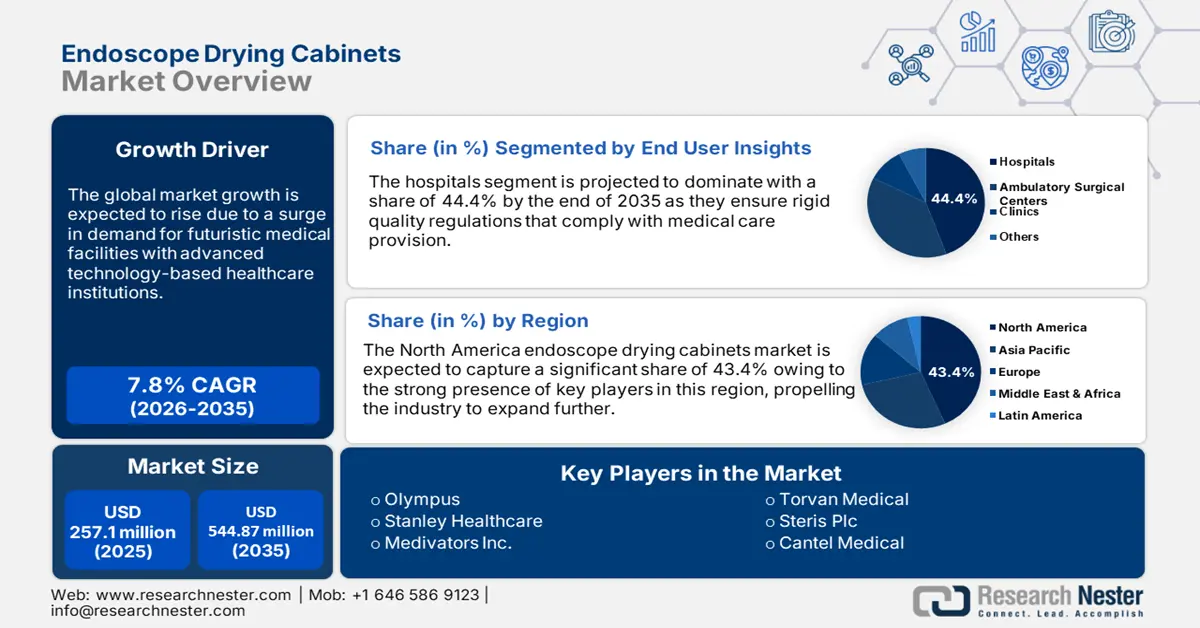

Endoscope Drying Cabinets Market size was valued at USD 257.1 million in 2025 and is set to exceed USD 544.87 million by 2035, registering over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endoscope drying cabinets is estimated at USD 275.15 million.

Technological innovations have led to the evolution of medical imaging that is effectively driving the upliftment of the endoscope drying cabinets market globally. X-ray computed tomography (CT) operates on the basis of X-ray images that create detailed dimensional images, as reported by NLM in June 2022. Moreover, in the U.S., roughly about 50% of overall ionizing radiation exposure comprises medical imaging to measure, manage, treat, and prevent diseases. As stated in the 2024 WHO report, 1 in 6 people will be over 60 years of age by 2030 and this will further increase by 22% by 2050, causing age-related disorders that will eventually enhance the demand for endoscopy devices for therapeutic and diagnostic purposes.

Furthermore, a rise in cancer is another major factor which is expected to boost the development of the endoscope drying cabinets market. According to the Techniques and Innovations in Gastrointestinal Endoscopy report published in 2023, America is subjected to early-onset cancer cases, constituting a rise of 10.5%. Molecular and genetic profiles, sedentary lifestyles, and dietary habits are the main components contributing to the rise. Hence, enhanced therapeutic endoscopy is essential to identify cancerous neoplasms at the early stage. In addition, endoscopic submucosal dissection (ESD) is a solution that ensures en-bloc resection of early gastrointestinal cancer, thereby driving the market growth effectively.

Key Endoscope Drying Cabinets Market Insights Summary:

Regional Highlights:

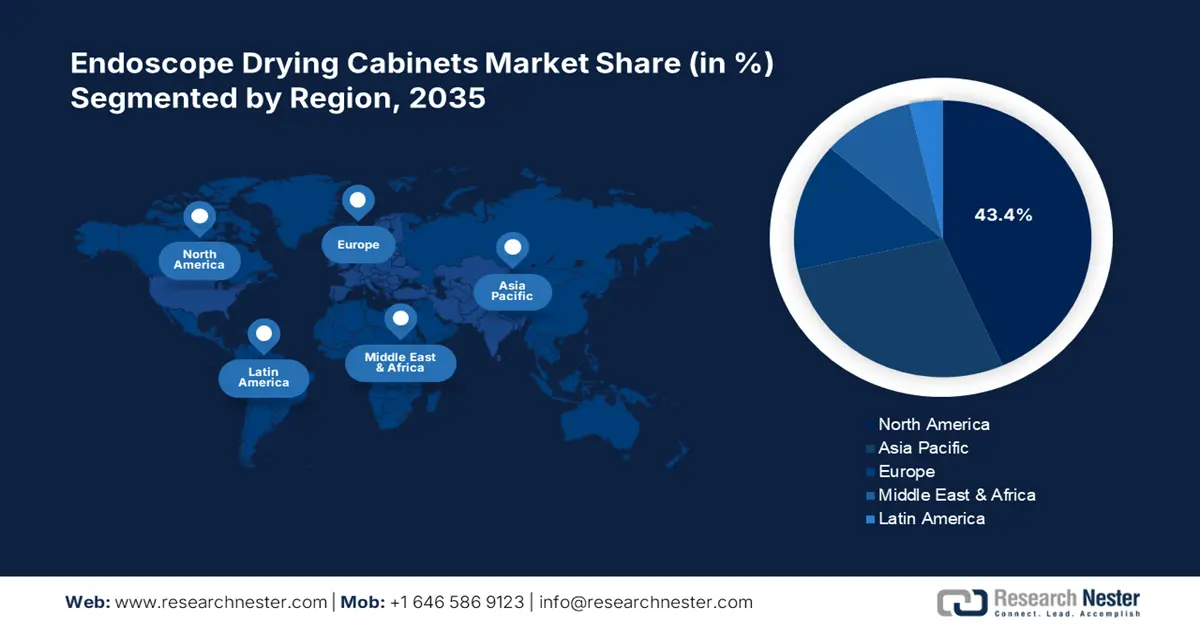

- North America dominates the Endoscope Drying Cabinets Market with a 43.40% share, supported by availability of advanced endoscope drying cabinet products in the region, fostering growth through 2035.

- Asia Pacific’s endoscope drying cabinets market is poised for rapid growth by 2035, driven by the increasing elderly population and medical technology adoption across the region.

Segment Insights:

- The Hospital segment is projected to secure over 44.4% share by 2035, driven by the high volume of complex procedures and strict contamination control standards.

- The Double Door Cabinet segment of the Endoscope Drying Cabinets Market is expected to grow at a considerable rate from 2026 to 2035, propelled by the need for advanced drying methods to ensure endoscope safety and compliance.

Key Growth Trends:

- Rise in occurrence of digestive diseases

- Growth on infection control measures

Major Challenges:

- Delicate design

- Expensive endoscopic procedures

- Key Players: Cantel Medical, Stanley Healthcare, Smartline Medical Pty LTD, MEDIVATORS Inc., Gallay Medical & Scientific.

Global Endoscope Drying Cabinets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 257.1 million

- 2026 Market Size: USD 275.15 million

- Projected Market Size: USD 544.87 million by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.4% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Endoscope Drying Cabinets Market Growth Drivers and Challenges:

Growth Drivers

- Rise in occurrence of digestive diseases: As per the RFGES survey conducted among 50,033 people by the NLM in April 2024, 25.3% were categorized in the sub-diagnostic group, 41.4% suffered from gut-brain interaction (DGBI), and 33.4% did not display frequent gastrointestinal symptoms. Besides, the sub-diagnostic prevalence rate varies from nation to nation, constituting 30.5% in the Middle East and 22.25 in North America. The study further reported that one in four adults without DGBI suffer from gastrointestinal difficulties. Impaired life activities and work productivity are the main reasons, hence driving the demand for the endoscope drying cabinets market.

- Growth on infection control measures: Infection prevention and control (IPC) is an evidence-based and practical approach assisting health professionals and patients from being contaminated by infections. According to the WHO report published in May 2022, IPC strategies can diminish health-based infections by 70%. In addition, 7 out of 100 patients from high-income regions and 15 low- and middle-income nations obtain one healthcare-associated infection (HAI). These people are at high risk since medical devices are reprocessed, ultimately leading to infections. Hence, IPC is a suitable solution to overcome this and boost the growth of the endoscope drying cabinets market.

Challenges

- Delicate design: The processing deficiency, insufficient cleaning, biofilm formation, and lack of safety owing to a high level of disinfection are the main limitations of the market. As per the report published by the Journal of Hospital Infection in April 2021, gastrointestinal endoscopes have complex designs with a length of 3.5-meter, narrow channels with internal diameters ranging between 1 to 1.5 mm for water and air channels, and a 2-6 mm biopsy channel. A design like this is considered critical and the inclusion of channels tend to bifurcate, thereby a restraint in the endoscope drying cabinets market growth.

- Expensive endoscopic procedures: The cost of endoscopy depends upon the type and healthcare providers as well as the location for conducting the procedure. As per the innovative study conducted by the Gastroenterology Organization in January 2022, the expenditure of gastroscopy in the U.S. ranged between USD 1,250 to USD 5,000. However, the price differentiated in China ranging between USD 30 to USD 100, which is one-tenth of the cost across developed nations. Therefore, this extreme out-of-pocket cost strikes a notable financial burden for many patients globally, posing a challenge for the market.

Endoscopy procedure pricing in India as per type

|

Endoscopy Type |

Cost Range |

|

Upper gastrointestinal endoscopy (UGIE) |

USD 45.9 to USD 91.8 |

|

Lower gastrointestinal endoscopy (LGIE) |

USD 57.4 to USD 114.8 |

|

Bronchoscopy |

USD 57.4 to USD 172.2 |

|

Cystoscopy |

USD 57.4 to USD 137.7 |

|

Hysteroscopy |

USD 91.8 to USD 172.2 |

|

Laparoscopy |

USD 114.8 to USD 574.0 |

Source: Care Hospitals, India

Endoscope Drying Cabinets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 257.1 million |

|

Forecast Year Market Size (2035) |

USD 544.87 million |

|

Regional Scope |

|

Endoscope Drying Cabinets Market Segmentation:

End User (Hospitals, Ambulatory Surgical Centers, Clinics)

The hospital segment is set to capture over 44.4% endoscope drying cabinets market share by 2035, based on the end user. Hospitals carry out hefty, complex, and high volumes of endoscopic processes while utilizing expensive devices. Therefore, rigid quality regulations are essential to maintain the compliance factor. According to the 2020 AAMI Organization report, drying of endoscopic devices in hospitals should be initiated by using 70% to 80% ethyl or isopropyl alcohol. The report also stated the conduction of an Australian study where the contamination rate on endoscope devices used in hospitals was 15.5% and the implementation of an automated drying technique was useful to overcome any form of contamination.

Chemical influence on endoscopes drying efficiency

|

Liquid Type |

Effect (%) |

|

Residual liquid in the form of alcohol flush and air purge |

95% |

|

Forced air drying procedure |

83% to 85% |

Source: AAMI Organization 2020

Product Insights (Double Door Cabinet, Single Door Cabinet, Benchtop, Wal-mounted, Floor-standing)

The double door cabinet segment is expected to influence the endoscope drying cabinets market at a considerable rate by the end of 2035. The complete drying procedure of reprocessed endoscopes is essential to maintain patient safety and ensure the absence of residual moisture. Passive, active, and forced-air system ventilations are three types of drying approaches based on which manufacturers design and develop cabinets with double door for endoscope devices. For instance, the AORN September 2022 report suggests stainless steel cabinets by ARC Healthcare Solutions with size range of 78” H x 36” W x 20” D, constituting the capacity for 10 endoscopes. Also, the SureDry High Volume 16 Scope Cabinet with Dri-Scope Aid by Harloff comprise size range of 93” H x 44” W x 24” D with story capacity for 16 endoscopes, uplifting the market.

Our in-depth analysis of the global endoscope drying cabinets market includes the following segments:

|

End User |

|

|

Product Insights |

|

|

Size Insights |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endoscope Drying Cabinets Market Regional Analysis:

North America Market Analysis

North America endoscope drying cabinets market is expected to capture revenue share of over 43.4% by 2035. The availability of advanced endoscope drying cabinet products is the sole factor for the market dominance within the region. For instance, in September 2021, Steelco launched EW 1 S MAXI, the latest innovation in endoscope reprocessing. This further provided operators with efficient and reliable endoscope devices to enhance the safety, ease, and regulation of medical practices. This product comprises a technological evolution that permits the automatic connection of OCS into the chamber without the intervention of the operator, thus minimizing the mechanical time and ensuring an error-free procedure.

The U.S. endoscope drying cabinets market is gaining traction due to a rise in healthcare spending. As reported in the Centers for Medicare & Medicaid Services in December 2024, the U.S. medical expenditure increased by 7.5% in 2023, accounting for USD 4.9 trillion or USD 14,570 for each patient. In addition, the country’s gross domestic product (GDP) catered to a 17.6% share in terms of medical expenses. Moreover, the AMA Organization in July 2024 pointed out the spending outlay, depending on clinical and physician services, home health and nursing facilities, prescription drugs, government administration, health insurance, and investment spending, hence driving the endoscope drying cabinets market growth in the country.

The endoscope drying cabinets market in Canada is witnessing significant growth due to the presence of well-developed healthcare policies. The country’s healthcare system is largely determined by the Canadian Constitution, wherein roles and duties are equally divided among territorial, provincial, and federal government bodies. As stated in the Government of Canada October 2023 report, the Canada Health Act comprises five principles which are public administration, comprehensiveness, universality, accessibility, and portability. Besides, the Government of Canada also states Medicare as the nation’s publicly sponsored healthcare system comprising 13 territorial and provincial health insurance plans that are accessible to residents.

APAC Market Statistics

The endoscope drying cabinets market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. In the regional healthcare landscape, the region accommodates approximately 4.3 billion of the global population and out of this people aged over 6o years are poised to double, which is 1.3 billion by 2050, as reported by the Asian Hospital Healthcare Management 2025. Medical devices such as CT scanners, ultrasound systems, and MRI machines have revolutionized the diagnosis process. For instance, high-resolution-based MRI devices detect vascular abnormalities, neurological disorders, and tumors, thus driving the demand for endoscope drying cabinets to store these devices with safety procedures.

The endoscope drying cabinets market in India is expecting substantial growth due to rising initiatives undertaken by the government to ensure medical tourism. As per the Government of India Ministry of Tourism January 2022 report, the country has been ranked 10th in the Medical Tourism Index (MTI) by the Medical Tourism Association globally. There has been an increase in the number of international patients from 43 billion to 70 billion. Additionally, AYUSH as a traditional medical therapy has gained an advantage for aiding diseases through ayurveda, yoga, naturopathy, and other natural ailments. Moreover, the presence of Joint Commission International and NABH-accredited hospitals is boosting medical tourism and market growth.

The endoscope drying cabinets market in China is gaining exposure owing to an increase in health investments by the government. According to a report published by Frontiers Organization in September 2024, the public financial resources for healthcare escalated from 141.885 billion yuan to 2,254.200 billion yuan as of 2023, thus an increase in health expenditure by 47.51%. Besides, the employee, urban residential, and new rural medical insurance coverages have exceeded over 1.3 billion people, accomplishing a coverage rate of more than 95%. Thereby, government investment is a standard method of resource reallocation, focusing on discrepancy reduction and improving social equity to uplift the endoscopy market growth.

Key Endoscope Drying Cabinets Market Players:

- Cantel Medical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stanley Healthcare

- Smartline Medical Pty LTD

- MEDIVATORS Inc.

- Gallay Medical & Scientific

- Torvan Medical

- Medical Devices Group

- Wassenburg Medical

- Arc Healthcare Solutions

- Belimed AG

Companies dominating the endoscope drying cabinets market are gaining rapid exposure due to continuous acquisition, partnership, and establishment of services. Besides, the effective use of endoscopes is rising based on certain parameters including storage, drying, disinfection, and cleaning, all catering to an accurate reprocessing routine. For instance, in December 2024, PENTAX Medical received US FDA 510(k) clearance for PENTAX Medical i20c Video Endoscope Series models including Right/Left Wheel Extender OE-B17, PENTAX Medical Video Upper GI Scope EG27‑i20c, and PENTAX Medical Video Colonoscope EC34-i20cL, thus driving the market growth.

Recent Developments

- In June 2024, Olympus Corporation notified its strategy to establish an R&D Offshore Development Center (ODC) in Hyderabad, India with the objective to ensure endoscopy engineering support services.

- In May 2024, InfoBionic.Ai and HBox.ai announced their partnership to provide AI-driven technology through “Cardiology Clinic of the Future.” With such a technology, cardiologists strive to utilize endoscopic imaging to integrate monitoring and enhance both patient safety and diagnostic accuracy.

- In July 2023, Capsa Healthcare stated the acquisition of MASS Medical Storage to expand its global position as an exclusive provider of efficient and innovative endoscopic-based solutions to surgery centers, clinics, and hospitals.

- Report ID: 7139

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endoscope Drying Cabinets Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.