End-stage Renal Disease Market Outlook:

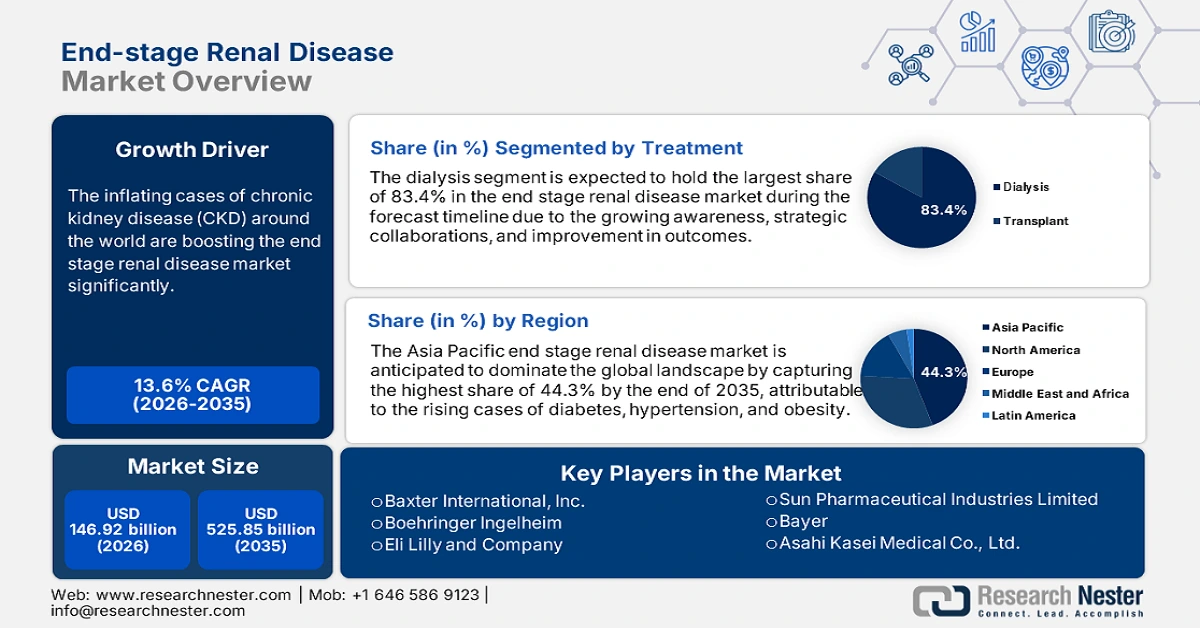

End-stage Renal Disease Market size was over USD 146.92 billion in 2025 and is projected to reach USD 525.85 billion by 2035, witnessing around 13.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of end-stage renal disease is evaluated at USD 164.9 billion.

The inflating cases of chronic kidney disease (CKD) around the world are boosting the end-stage renal disease (ESRD) market significantly. The advanced progression of CKD most often leads to this end-point stage if not treated in time. Thus, being a major cause of the occurrence, this condition has dragged the focus of global healthcare organizations on acquiring effective solutions, fueling this sector. According to NLM, over 843.6 million people were reported to have this progressive condition globally till March 2022, affecting more than 10% of the general inhabitants. The epidemiology further identified the individuals with a high risk of prevalence such as the aging population, women, racial minorities, and patients with diabetes mellitus & hypertension.

The efforts to compensate for the heavy financial burden of available remedies from the end-stage renal disease market are fostering a scope of innovation. As per the International Society of Nephrology (ISN), the volume of the global community, requiring dialysis or transplantation ranged between 5.3 million and 10.5 million till 2024. A major portion of this figure lacks in receiving proper treatment due to sustained financial barriers, particularly in developed countries.

Country-wise Annual Cost of Hemodialysis per Patient:

|

Country |

Annual Cost of Treatment-Patient |

|

The U.S. |

USD 88,195 |

|

Germany |

USD 58,812 |

|

Belgium |

USD 83,616 |

|

France |

USD 70,928 |

Source: ISN 2024

This has pushed the countries to seek more accessible and affordable options to increase availability. Many are introducing therapeutic medicines for prevention and supportive medication for end-stage kidney disease (ESKD). For instance, in July 2021, Bayer attained FDA approval for its first-in-class nonsteroidal mineralocorticoid receptor antagonist (MRA), KERENDIA (finerenone) to prevent ESKD in CKD patients with type II diabetes. The phase III FIDELIO-DKD trial showcased its abilities to decrease the likelihood of sustained eGFR decline, kidney failure, cardiovascular death, non-fatal myocardial infarction (MI), and hospitalization before developing the need for dialysis or, transplantation.

Key End-stage Renal Disease Market Insights Summary:

Regional Highlights:

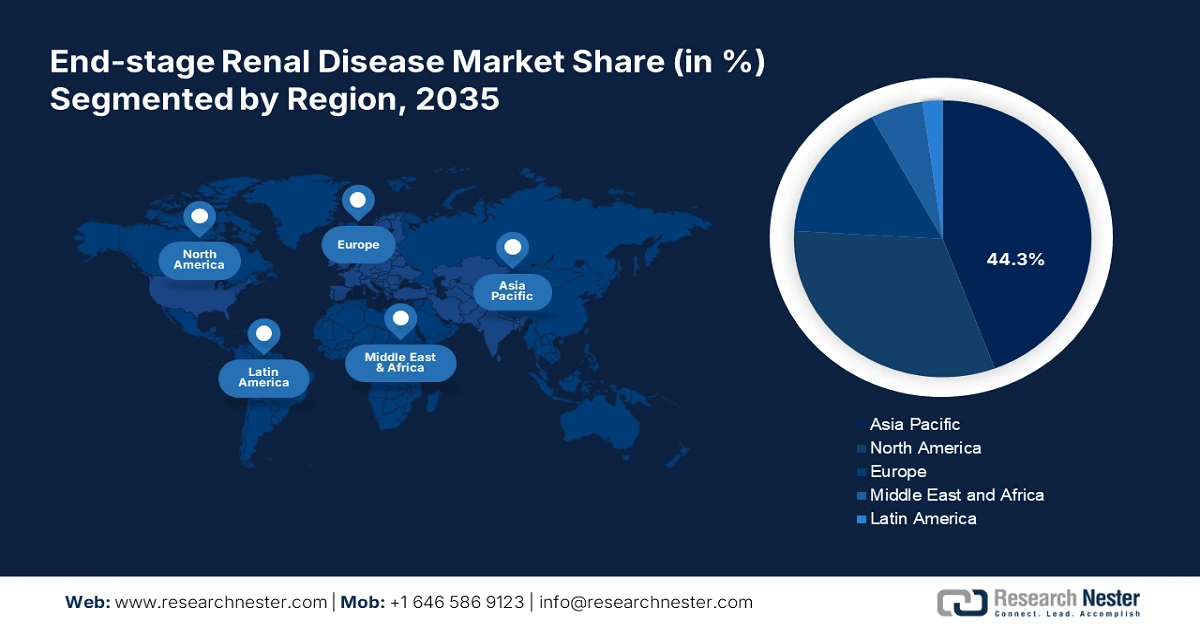

- Asia Pacific holds a 44.3% share of the End-stage Renal Disease Market, fueled by the rising cases of diabetes, hypertension, and obesity, ensuring robust growth through 2026–2035.

- North America’s end-stage renal disease market is set to maintain a leading share by 2035, driven by advances in early diagnosis and strong emphasis on biotechnology.

Segment Insights:

- The dialysis segment is anticipated to dominate with over 83.4% share by 2035 in the end-stage renal disease market, fueled by advancements in dialysis technologies and increasing awareness.

Key Growth Trends:

- Widespread awareness about prevention and treatment

- Increased investments in extensive R&D

Major Challenges:

- Financial drainage in long-term process

- Limitation in adequate diagnostic measures

- Key Players: Baxter International, Inc., Boehringer Ingelheim, Eli Lilly and Company, Unicycive Therapeutics, Inc., Bayer, Sun Pharmaceutical Industries Limited.

Global End-stage Renal Disease Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 146.92 billion

- 2026 Market Size: USD 164.9 billion

- Projected Market Size: USD 525.85 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.3% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: China, Japan, United States, Canada, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

End-stage Renal Disease Market Growth Drivers and Challenges:

Growth Drivers

-

Widespread awareness about prevention and treatment: Various private and government initiatives are playing a pivotal role in promoting the available options in the end-stage renal disease market. Their continuous efforts to educate people have led to a remarkable increment in enrollment and purchase. On this note, in September 2020, Sanofi Genzyme partnered with the American Kidney Fund (AKF) to commence an education and awareness campaign for Fabry disease. This collaboration helped to identify unknown causes behind ESKD, allowing early intervention. Moreover, improvements in healthcare access in emerging landscapes are encouraging companies and institutions to engage their resources in this field.

-

Increased investments in extensive R&D: Considering the importance of financial support in enabling progress in the end-stage renal disease (ESRD) market, many authorities are offering funds and grants. Their attempts to revolutionize conventional methods of therapies and diagnosis are leveraging the standards and accessibility of the existing product pipeline. For instance, in September 2022, the Leonard Davis Institute of Health Economics (LDI) at the University of Pennsylvania started a USD 2.5 million worth of CKD research initiative. The three-year program was funded by Monogram Health, which focused on diluting the functional and racial barriers to using dialysis therapies, transplantation, and palliative care.

Challenges

-

Financial drainage in long-term process: Despite the government support, many individuals still suffer in affording the medicaments and therapies from the end-stage renal disease market. The burden of associative costs on their healthcare budget during elongated hospitalization often discourages them from enrollment. Moreover, the absence of complete reimbursement policies for expensive procedures in low-income regions, particularly in rural areas, hinders the optimum expansion of this field due to the lack of adoption.

-

Limitation in adequate diagnostic measures: Delayed diagnosis is a significant negative impact on the end-stage renal disease (ESRD) market. Underdiagnosed CKD patients often reach a certain stage where the treatments fail to showcase their effectiveness, shrinking the possibilities of utility. As the cure for highly declined kidney functions is still under development, the scope for generating profitable revenue from this sector is limited. Furthermore, high mortality cases in low-resource countries dilute the interest of companies in extending their territory.

End-stage Renal Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 146.92 billion |

|

Forecast Year Market Size (2035) |

USD 525.85 billion |

|

Regional Scope |

|

End-stage Renal Disease Market Segmentation:

Treatment (Transplant, Dialysis)

The dialysis segment is likely to dominate end-stage renal disease market share of over 83.4% by 2035. This segment’s growth is fed by growing awareness, strategic collaborations, and improvement in outcomes. For instance, in September 2023, the team of Cytecare Hospitals and Humanist Centre for Medicine founded a cutting-edge nephrology and dialysis institution to provide comprehensive and holistic healthcare for renal dysfunction or failure. The institute intends to address the availability and affordability gap by offering a well-equipped facility for every individual. Additionally, with the integration of advanced technologies, the functionalities of this method have remarkably improved, penetrating innovation in this segment.

Our in-depth analysis of the global ESRD market includes the following segments:

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

End-stage Renal Disease Market Regional Analysis:

APAC Market Statistics

By 2035, Asia Pacific end-stage renal disease market is set to capture over 44.3% revenue share. The proprietorship of this region is fueled by the rising cases of diabetes, hypertension, and obesity. As a result of rapid urbanization and lifestyle changes, the heightened prevalence is creating a surge for better diagnosis and remedy. This is attracting global leaders to invest in this category. For instance, in January 2024, Catalys Pacific inaugurated a clinical-stage biopharmaceutical company, Renalys Pharma, Inc., to streamline the investigational dual-acting mendicant FILSPARI (sparsentan) for IgA nephropathy in Japan. This launch was intended to expand its product reach across Asia.

With the aim of becoming the leading pioneer in the end-stage renal disease (ESRD) market, India is elevating its R&D capabilities in the pharmaceutical industry. Besides the significant extension in pharmacology and biotechnology, the country’s focus on enhancing infrastructure is garnering a greater scope of innovation. For instance, in August 2024, researchers at Agharkar Research Institute unveiled the efficacies of zinc oxide nanoparticles (ZON) in fighting diabetic nephropathy (DN) and managing ESKD. Further, the attempts from the governing bodies to mitigate healthcare disparities in both rural and urban societies have levitated the standards and access in this field.

China is propagating the end-stage renal disease market by introducing cost-effective solutions while delivering satisfactory results. The expenditure on related curatives signifies the growing need for immediate medical response for severe cases. In February 2021, NLM estimated the spending on dialysis per year in China to be USD 50.0 billion. It also calculated the distinguished uptakes of other renal replacement therapy (RRT) modalities, where hemodialysis (HD) accounted for 86.0% and peritoneal dialysis (PD) ranged between 14.0% and 73.0% in 2021. These figures are further multiplying with the rising disease burden, economy, and healthcare expenditure.

North America Market Analysis

North America is predicted to witness the fastest growth in the end-stage renal disease market throughout the assessed timeframe, 2025-2035. The well-established clinical infrastructure and advances in early diagnosis have leveraged its pace of progress in this sector. The region’s strong emphasis on biotechnology is also helping it avail a wide range of effective therapies, broadening options to fit every requirement. The introduction of innovative solutions such as artificial kidneys and regenerative medicines are also cultivating a beneficial environment for this category.

The U.S. end-stage renal disease market is marking progress with the high influence of favorable regulatory frameworks and government policies. The upgraded Medicare & Medicaid services are encouraging inhabitants to adopt remote & in-center RRTs and organ donation by issuing subsidiary programs. For instance, in November 2024, the Centers for Medicare & Medicaid Services (CMS) announced an increment of 2.7% on base rates under the ESRD segment, amounting to USD 273.8 for the RRT facilities. The new ESRD Treatment Choices Model ensured a total payment of USD 6.6 billion for around 7,700 dialysis service providers.

Canada is also paving a strong network for the end-stage renal disease market by enacting supportive federal considerations and implementing adequate embellishments. The frequency of incidences of this condition has pushed its provinces to take action to combat the widespread and reduce patient population. According to an NLM report, more than 50,000 cases of end-stage kidney disease were reported in 2020, among which 23,000 started renal replacement and 1500 underwent kidney transplant surgery. The report further estimated the annual expenditure on these patients to be USD 1.8 billion, where 42.6% was dedicated to in-center HD.

Key End-stage Renal Disease Market Players:

- Fresenius Medical Care AG & Co. KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter International, Inc.

- Medtronic Plc

- B. Braun Melsungen AG

- BD

- Cantel Medical

- Boehringer Ingelheim

- Eli Lilly and Company

- Unicycive Therapeutics, Inc.

- Bayer

- Sun Pharmaceutical Industries Limited

The competitive dynamics of the ESRD market are steadily shifting toward more sustainable and affordable solutions. The sector’s potential to earn profitable revenues is now attracting global pharma leaders to participate in this cohort. For instance, in January 2024, Sun Pharmaceutical signed an agreement with Bayer to gain marketing and distribution rights for the second brand of Finerenone, Lyvelsa in India to treat CKD patients with type 2 diabetes. The drug is able to fight against the risk of eGFR decline, end-stage kidney disease, cardiovascular death, non-fatal myocardial infarction, and hospitalization for heart failure in adults. Established service providers are also continuing their research process to solidify their position, diversifying the landscape. Such key players are:

Recent Developments

- In November 2024, Unicycive Therapeutics received a New Drug Application (NDA) approval from the FDA for Oxylanthanum Carbonate (OLC) to treat hyperphosphatemia, which is a common serious condition in end-stage chronic kidney disease. The company further aimed for 505(b)(2) FDA allowance for the drug to support patients on dialysis.

- In September 2023, Boehringer Ingelheim gained FDA acceptance for Jardiance 10 mg tablets for high-risk CKD patients, in collaboration with Eli Lilly Company. The drug is intended to reduce the risk of decline in estimated glomerular filtration rate (eGFR), end-stage kidney disease, cardiovascular death, and hospitalization in adults.

- Report ID: 7153

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

End-stage Renal Disease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.