Encoder ICs Market Outlook:

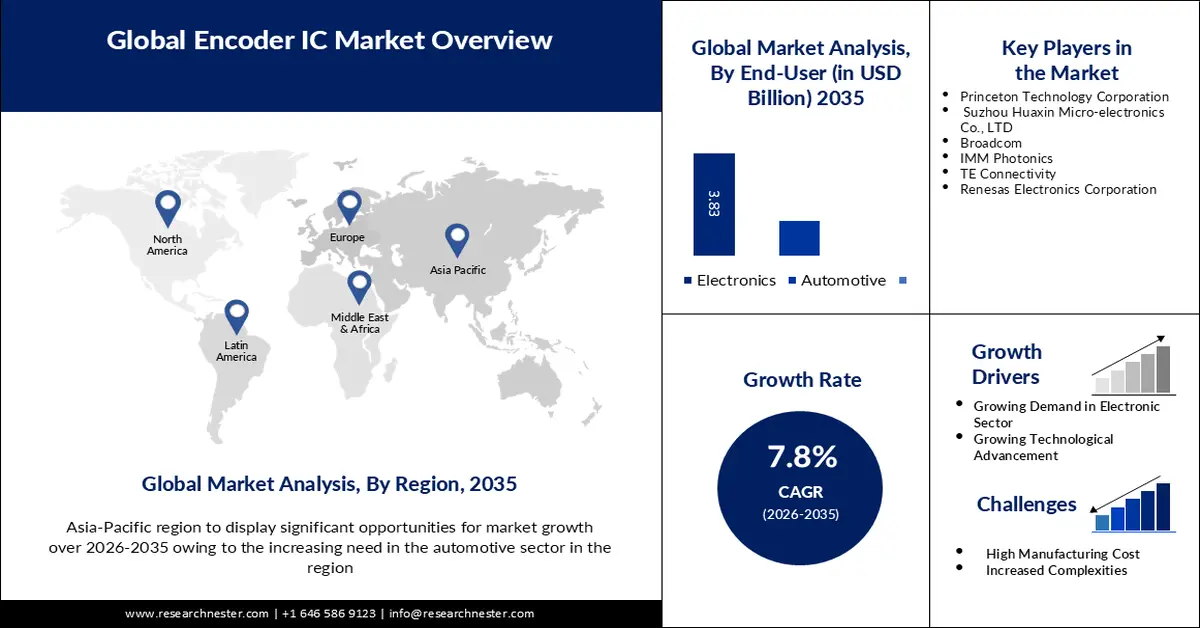

Encoder ICs Market size was over USD 3.37 billion in 2025 and is projected to reach USD 7.14 billion by 2035, growing at around 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of encoder ICs is evaluated at USD 3.61 billion.

Encoder ICs are used in battery administration systems in electric cars to track the location and condition of battery modules and cells. The need for encoder integrated circuits (ICs) is predicted to increase dramatically as automotive technologies move toward electric vehicles, connectivity, and autonomous driving. This will spur innovation and breakthroughs in automotive electronics and control systems. EV sales rose from 9% in 2021 to 14% in 2022 of all new car sales, from less than 5% in 2020 to 9% in 2021.

The demand for encoder ICs is driven by the increasing adoption of automation and robotics in the industrial sector. These devices, which are used in robotic arms, CNC machines, automated guided vehicles, and other industrial applications, provide accurate position feedback that enables precise control of motion. In CNC machines, encoders are used to provide positional feedback during operation, ensuring that the machine tool operates at the optimum speed and accuracy for the job.

Key Encoder ICs Market Insights Summary:

Regional Highlights:

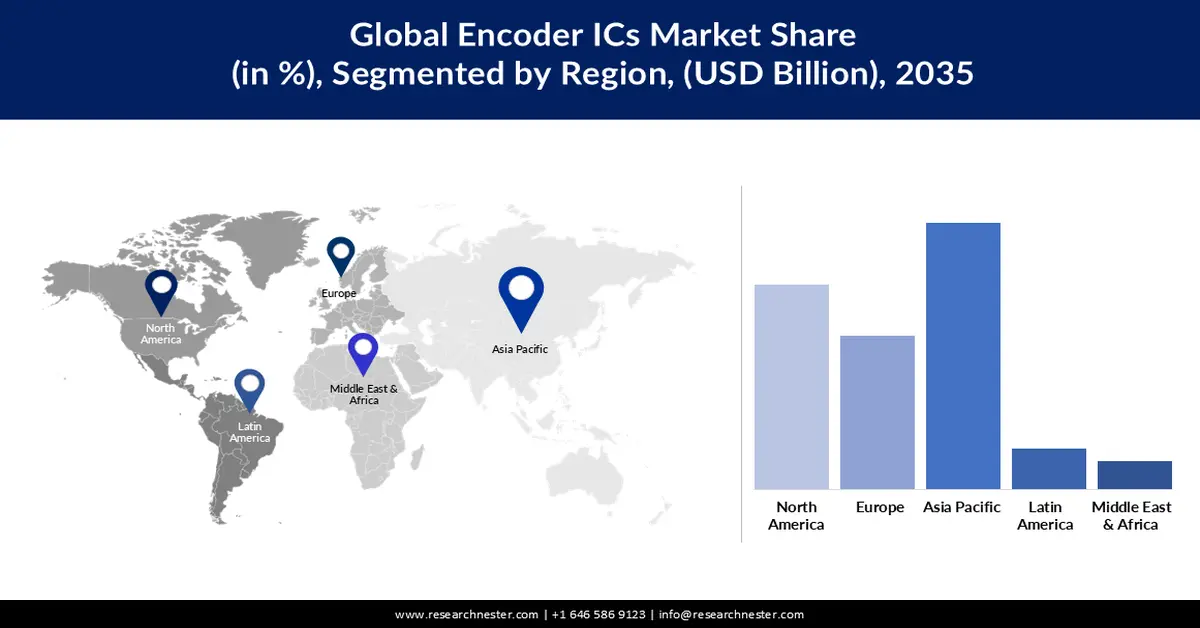

- The Asia Pacific industry is set to command a 38% share by 2035 in the encoder ICs market, underpinned by rapid industrialization, accelerating urbanization, and the widespread adoption of advanced automation and robotics solutions.

- North America is projected to surpass USD 2.30 billion by 2035, supported by expanding use of encoder ICs in consumer electronics including printers, drones, digital cameras, and gaming consoles driven by the rising penetration of smart devices and wearables.

Segment Insights:

- The motion control segment is projected to reach USD 1.66 billion by 2035 in the encoder ICs market, propelled by the essential need for precise positional feedback to ensure accurate and efficient motor and actuator control.

- The electronic segment is expected to attain USD 3.83 billion by 2035, supported by the extensive use of encoders across office equipment such as copiers, printers, answering machines, and scanning devices.

Key Growth Trends:

- Emergence of wireless encoders

- Demand in the automotive sector

Major Challenges:

- Increased complexities associated

Key Players: Princeton Technology Corporation, Suzhou Huaxin Micro-electronics Co., LTD, Broadcom, IMM Photonics, TE Connectivity, Renesas Electronics Corporation.

Global Encoder ICs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.61 billion

- Projected Market Size: USD 7.14 billion by 2035

- Growth Forecasts: 7.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Brazil, Mexico, Indonesia

Last updated on : 24 November, 2025

Encoder ICs Market - Growth Drivers and Challenges

Growth Drivers

- Emergence of wireless encoders - Wireless encoders allow for greater flexibility and ease of installation in different applications, eliminating the need to connect via a physical cable. Furthermore, the HEV-4KW is a wireless HDMI live streaming encoder with an incredibly small and light form factor enabling 4K video to be played from beginning to end. Wireless encoders are seamlessly integrated with the internet of things platforms and cloud-based services, enabling data analytics, precipitary maintenance as well as operational efficiency improvement.

- Demand in the automotive sector - Encoders are used in a wide range of medical applications, including robots to process samples in laboratories, patient tables to be adjusted, and the rotation speed and position of the gantry in CT scanners and surgical robots. In the United States, about 644,000 robot operations were carried out in 2021, and this number is expected to reach 1 million by 2028. Millions more have taken place worldwide.

Challenges

- Increased complexities associated - Encoders are often more complicated circuits than multiplexers, requiring several extra components to operate. Encoder ICs can be difficult to design and implement and require specialized knowledge and expertise, which discourages some users from adopting them in industries where interoperability is of paramount importance. Compatibility issues with current systems or other components are a major barrier to adoption, especially in the industrial sectors.

- The high initial investment required is set to hamper the market expansion further.

- High manufacturing cost is set to obstruct market growth in the future.

Encoder ICs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 3.37 billion |

|

Forecast Year Market Size (2035) |

USD 7.14 billion |

|

Regional Scope |

|

Encoder ICs Market Segmentation:

Application Segment Analysis

Motion control segment in the encoder ICs market is estimated to reach USD 1.66 Billion by the end of 2035. Encoder ICs play a fundamental role in motion control systems by providing critical feedback on the position and movement of motors or actuators, which leads to an essential degree of accuracy for precise controls and efficient operation.

A major driver is the increasing adoption of automation in manufacturing, logistics, and other sectors. For efficient operation, robots, automated vehicles, and others must be able to control their movements precisely so encoder ICs are required. Four out of five warehouses in the world are going to be computerized before 2025. A 40% reduction in costs could be achieved through using robotics for logistics.

End User Segment Analysis

In encoder ICs market, electronic segment is poised to reach USD 3.83 Billion by the end of 2035. Encoders are extensively used in office equipment, including copiers, printers, answering machines, PC-based scanners, and scanners, in this sector.

In addition, there has been a noticeable increase in the use of encoders for consumer electronics applications in the Asia Pacific and North America regions due to the rapid adoption of new technologies and the presence of numerous consumer electronics giants such as Apple, Samsung Electronics, and HP Inc.

Our in-depth analysis of the global encoder ICs market includes the following segments:

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Encoder ICs Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 38% by 2035, due to rapid industrialization, urbanization, and technological progress are leading to increased adoption across a wide range of sectors in the region. Rapid industrialization, urbanization, and technological progress are leading to increased adoption across a wide range of sectors in the Asia Pacific region. In addition, with the adoption of Industry 4.0 and the implementation of advanced automation and robotics solutions, the manufacturing sector is evolving. For example, Asia accounted for 73% of all new robots that have been deployed according to the International Federation of Robotics.

The enormous supply and demand from a large population is the most important factor in India's rapidly growing economy. To promote India's economic stability, the demand and supply sides are working in parallel. India's market is full of opportunities, and demand for encoder IC will continue to grow rapidly over the coming years.

The growth of the market can be accounted for in this region on behalf of the high growth in the consumer electronic sector of the China region. Devices such as smartphones, printers, tablets, and more require encoder ICs to function better and efficiently.

The market growth can ascribed to the back increasing demand for encoder IC in the automotive sector and also growth in EV sales in Japan.

North American Market Insights

Encoder ICs market size for North America region is projected to exceed USD 2.30 Billion by the end of 2035. Encoder ICs are used in consumer electronics in this region such as digital cameras, printers, drones, and gaming consoles where they enhance the device's functionality and performance. The growing demand for encoder ICs in the consumer electronics sector is also driven by the proliferation of smart devices and wearables. By 2025, it is estimated that there will be around 20 interconnected electronic devices in the home of a majority of US households.

The growth can be attributed to its high usage and a growing number of manufacturers in the United States.

This market is expected to grow in Canada due to the increasing integration of encoder IC in the industrial automation domain.

Encoder ICs Market Players:

- Avago Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ShanghaiMagnTek Microelectronics Inc.

- RF Solutions

- RLS d.o.o.

- Princeton Technology Corporation

- Suzhou Huaxin Micro-electronics Co., LTD

- Broadcom

- IMM Photonics

- TE Connectivity

- Renesas Electronics Corporation

Recent Developments

- Avago Technologies has announced a high-resolution, absolute optical encoder for high-performance servo and motor feedback applications. The new AEAT9000 ultraprecision absolute encoder delivers the highest level of accuracy in terms of smooth power drive performance.

- For the next generation of automotive camera applications, Renesas Electronics Corporation has introduced an innovative automotive power management IC. RAA2710 82 is a multi-rail Power IC with a Primary High Voltage Synchronous Buck Regulator, 2 Secondary Low Voltage Synchronous buck Regulators, and a Low Voltage LDO Regulator. This IC is compliant with ISO 26262.

- Report ID: 4527

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Encoder ICs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.