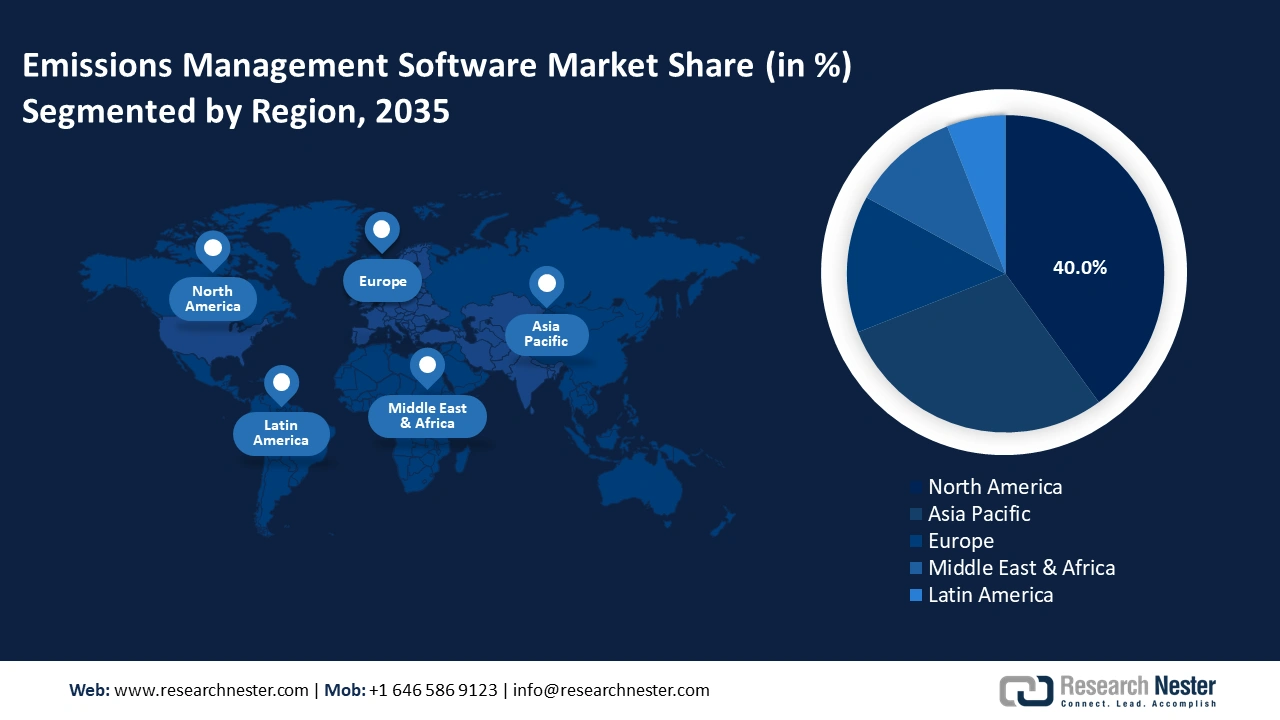

Emissions Management Software Market - Regional Analysis

North America Market Insights

The emissions management software market in North America is anticipated to hold a 40% share during the forecast period due to strong environmental regulations and rising pressure from investors for transparent ESG reporting. Major oil and gas, manufacturing, and transportation industries are adopting advanced software solutions to ensure compliance with evolving federal and state emission standards. The overall adoption in the region has been supplemented by the presence of industry-leading companies and a well-established technological infrastructure. Additionally, ESG goals have pushed businesses to hasten the adoption of analytics tools and live monitoring platforms. The integration of these trends has ensured a sustained expansion of the North America market.

The U.S. emissions management software market is expected to register rapid growth, driven by stringent environmental regulations and a rise in clean energy investments. In Q2 2025, clean energy and transportation investments in the U.S. totaled 68 billion, holding 4.8% of total private investments in structures, equipment, and durable consumer goods. This surge of capital is encouraging the adoption of emissions management solutions across industries. Additionally, the market is bolstered by advancements in AI and IoT technologies, allowing real-time emissions tracking and compliance with changing regulatory frameworks.

The Canada emissions management software market is expected to surge rapidly, driven by government initiatives and an increasing emphasis on sustainability in industries. The federal government’s 2030 Emissions Reduction Plan depicts a sector-by-sector approach to achieve a 40% reduction in emissions from 2005 levels by 2030, with a long-term goal of net-zero emissions by 2050. This future-oriented strategy is encouraging demand for advanced emissions management solutions. In addition, Canada's Carbon Management Strategy aims to develop a world-class, multi-billion-dollar carbon management sector, supporting high-value employment and a sustainable economy. Such initiatives are creating a favorable environment for the growth of emissions management software, as businesses seek tools to comply with regulations and achieve their carbon reduction targets.

Asia Pacific Market Insights

Asia Pacific is anticipated to exhibit the fastest growth during the forecast period due to increased environmental awareness and regional efforts to align with global sustainability standards. Governments are introducing stricter emissions regulations, especially in sectors such as power generation, cement, and transport. The rapid digital transformation across industries is also making it easier to implement real-time emissions tracking solutions. Additionally, the growing investor interest in green investments is forcing companies toward developed emissions reporting.

The China emissions management software market is projected to hold a significant share during the forecast period due to the focus on climate goals and industrial decarbonization. The enforcement of national carbon trading and environmental inspections is forcing heavy industries to take up digital emissions monitoring solutions. China’s recent launch of zero-carbon industrial parks in June 2025 by the National Development and Reform Commission (NDRC), the Ministry of Industry and Information Technology (MIIT), and the National Energy Administration (NEA) is increasing demand for emissions management software. The policy necessitates digital carbon management platforms to monitor, forecast, and streamline emissions across industrial operations, assuring compliance and efficiency. This nationwide initiative is building a strong market push, as businesses adopt advanced software to meet regulatory goals and support China’s decarbonization strategy.

The emissions management software market in India is expected to gain rapid momentum, driven by new carbon pricing reforms and regulatory mandates. In July 2024, India introduced the Carbon Credit Trading Scheme (CCTS), a rate-based Emissions Trading System covering energy-intensive sectors, which compels firms to track and validate emissions data. Additionally, initiatives such as the National Green Hydrogen Mission, backed by huge financial budgets, are forcing industries to adopt cleaner processes and digital tools to measure carbon footprints. India’s long-term climate commitments are serving as a major push for the growth of the market.

The government’s targets to raise non-fossil fuel energy capacity to 500 GW and fulfill 50% of national energy demand from renewable sources by 2030 are fueling the need for precise monitoring and reporting mechanisms. Additionally, commitments to decrease one billion tons of carbon emissions and reduce carbon intensity by over 45% within the same timeframe create demand for advanced digital tools to guarantee compliance, transparency, and efficiency across industries. Looking ahead, the nation's commitment to achieve carbon neutrality by 2070 is bolstering the demand for robust emissions management software, making it a critical enabler of the country’s net-zero transition strategy.

Europe Market Insights

The emissions management software market in Europe is predicted to expand at a steady pace between 2026 and 2035 as stricter regulations under the Green Deal and the Industrial Emissions Directive and Industrial Emissions Portal Regulation (IEPR) push industries to enhance how they track and disclose emissions, resource consumption, and pollutant emissions. The updated IEPR, effective May 2024, requires standardized electronic reporting and greater transparency, which is fueling the need for advanced digital tools. At the same time, the European Green Digital Coalition has issued methodologies for measuring the climate impact of ICT solutions, helping software providers prove their role in emissions reduction and encouraging wider adoption.

Emissions management software is growing in the UK as government support combines digital innovation with industrial decarbonization funding. The UK has invested in AI-driven tools to support industries in optimizing energy use and cutting carbon emissions, while the Industrial Energy Transformation Fund (IETF) provides grants for efficiency and emissions-reduction projects. The IETF, introduced in 2020, is structured into three phases and is stated to provide USD 584.39 million in funding till 2028. Together, these initiatives lower costs and drive adoption of advanced software solutions across energy-intensive sectors. These moves are reinforcing corporate commitments and regulatory compliance, pushing demand for emissions management platforms that integrate datasets, forecasts, and verification for both internal use and compliance.

In Germany, the adoption of emissions management software is rapidly expanding, driven by national industrial digitization strategies, investments in digital data ecosystems, and regulatory mandates to cut greenhouse gas emissions in key manufacturing sectors. A USD 2.57 billion state aid program is backing industrial decarbonization through electrification and hydrogen-based processes, which depend heavily on software for modeling, monitoring, and reporting progress. According to the European Investment Bank’s February 2025 survey, over 90% of German companies have taken steps to reduce greenhouse gas emissions, while about 80% have invested in energy efficiency improvements, placing them ahead of many European peers.