Emission Control Technology Market Outlook:

Emission Control Technology Market size was over USD 159.79 billion in 2025 and is anticipated to cross USD 317.28 billion by 2035, growing at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of emission control technology is assessed at USD 170 billion.

Automotive manufacturers are deploying sophisticated emission control systems due to stringent environmental regulations on reducing automotive greenhouse gas emissions. Globally, governments are implementing robust emission regulations to tackle air pollution, which is leading to the installation of technologies such as diesel particulate filters, selective catalytic reduction systems, and catalytic converters by manufacturers into the vehicles. In March 2024, the Biden- Harris Administration of the U.S. enforced strict new vehicle emission regulations aimed at eliminating more than 7 billion tons of carbon dioxide emissions.

Vehicle emission reduction technologies such as catalytic converters and particulate filters are receiving increasing investments due to the regulatory requirements, which cover all vehicle types, including conventional, hybrid, and electric. The industry is increasingly adopting selective catalytic reduction (SCR) systems for diesel applications owing to their ability to fulfill emerging environmental quality standards, and this technology reduces emissions with the help of diesel exhaust fluid, which produces harmless nitrogen and water.

Key Emission Control Technology Market Insights Summary:

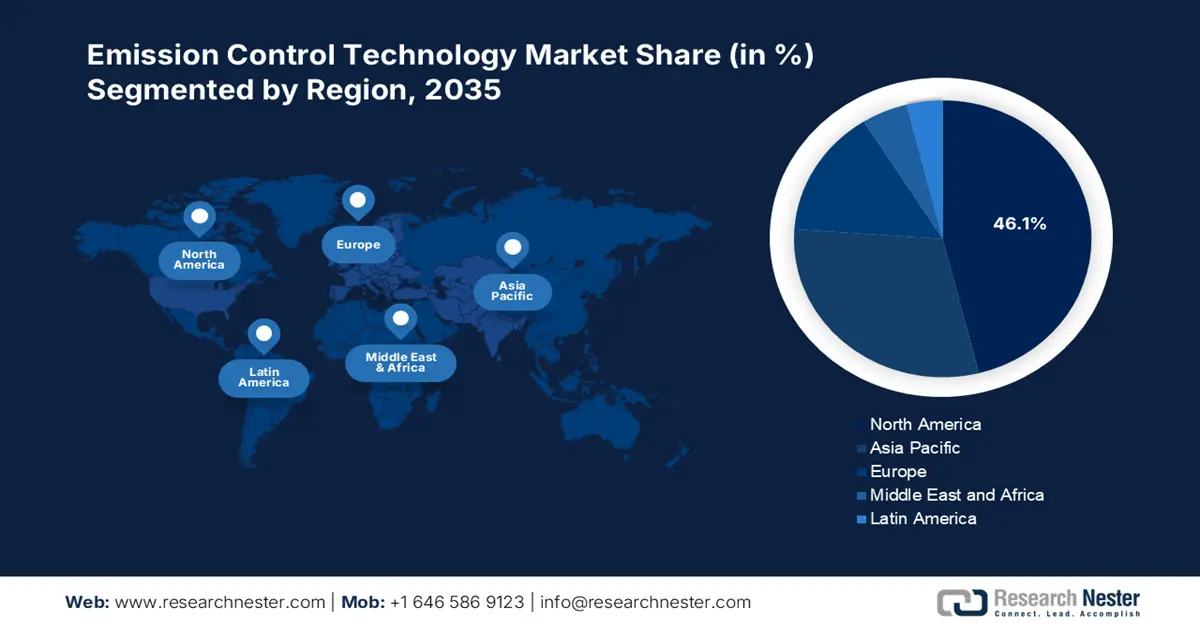

Regional Highlights:

- North America commands the Emission Control Technology Market with a 46.1% share, fueled by the rising adoption of hydrogen-based alternative fuel technologies, driving growth through 2026–2035.

Segment Insights:

- The Diesel Particulate Filter segment is forecasted to reach 50.3% market share by 2035, propelled by strict standards and regulations requiring diesel particulate filters.

Key Growth Trends:

- Rising awareness regarding climate change

- Integration of AI in emission control technologies

Major Challenges:

- High initial costs and maintenance expenses

- Limited infrastructure for CCS technology

- Key Players: SDCL International Inc., Umicore, Tenneco Inc., CORMETECH, Clean Diesel Technologies, Inc.

Global Emission Control Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 159.79 billion

- 2026 Market Size: USD 170 billion

- Projected Market Size: USD 317.28 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.1% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Emission Control Technology Market Growth Drivers and Challenges:

Growth Drivers

- Rising awareness regarding climate change: Increasing awareness about climate change and air pollution is driving industries to implement technologies such as carbon capture technology for reducing greenhouse gas emissions. Leveraging corporate sustainability initiatives that support global net-zero targets is fueling businesses across various sectors to utilize emission control technologies to satisfy changing environmental regulations. The carbon capture and storage (CCS) technology stands out due to its ability to capture CO₂ emissions produced by industrial operations, power plants, and refineries and safely store them.

Companies are increasingly utilizing the CCS technology to reduce carbon emissions, which is leading to substantial environmental protection. In March 2025, Baker Hughes collaborated with Frontier Infrastructure to build the Sweetwater Carbon Storage Hub in Wyoming to bolster CO₂ sequestration using modern monitoring systems and compression technologies. The partnership represents an expanding industry interest in big-scale CCS efforts as it highlights a transition to carbon-free industrial operations. This project relies on state-of-the-art monitoring technologies for maintaining long-term storage stability while meeting regulatory specifications, thus establishing a model practice for global counterparts.

- Integration of AI in emission control technologies: There has been an increase in industrial transformation with the rising investments in AI-based control systems for emission monitoring, which is resulting in real-time tracking capabilities for emissions. Advanced environmental regulations by governments are prompting industries to use IoT-enabled sensors and AI technologies for optimal operational management. The AI sensors are delivering reliable automated monitoring capabilities, enabling companies to identify their pollution sources strongly and reduce their impact efficiently. Businesses are collaborating and are being benefitted from AI platforms that mitigate emission patterns and predict potential regulatory breaches so that they can take proactive measures. For instance, in January 2023, Converge collaborated with DEWALT to launch AI-based systems and sensors that lower carbon emissions. Through this partnership, the companies are gaining real-time monitoring features that optimize their materials usage while limiting carbon emissions.

Challenges

- High initial costs and maintenance expenses: The high costs, coupled with continuous maintenance expenses for emission control technologies, are the primary constraints for their widespread implementation. The implementation of technologies such as selective catalytic reduction (SCR) and diesel particulate filter (DPF) as carbon capture solutions is demanding increased costs from SMEs, creating an accessibility challenge. The acquisition of catalysts and urea for SCR, along with sensor maintenance costs, are placing substantial financial burdens on operations. Businesses that focus on cost effectiveness are refraining from purchasing emissions reduction technologies due to high expenditures, limiting the industry expansion.

- Limited infrastructure for CCS technology: Carbon capture and storage (CCS) technology is facing adoption restrictions due to insufficient infrastructure, which is obstructing the deployment at an extensive scale. CO₂ transportation expenses are high, while storing CO₂ requires geological formations with specific conditions, and long-term security risks cannot be fully assessed, which is reducing feasibility for this method. Slow deployment of CCS projects is occurring, as governments are failing to provide adequate incentive programs and funding for CCS project expansion. Insufficient policy support, coupled with funding limitations, requires improvement as this limits the current usage of this technology, which is restricting industrial emissions to fight against global warming.

Emission Control Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 159.79 billion |

|

Forecast Year Market Size (2035) |

USD 317.28 billion |

|

Regional Scope |

|

Emission Control Technology Market Segmentation:

Technology (Diesel Particulate Filter, Gasoline Particulate Filter, Diesel Oxidation Catalyst, Selective Catalytic Reduction, Exhaust Gas Recirculation)

Diesel particulate filter segment is expected to hold emission control technology market share of over 50.3% by the end of 2035. The implementation of strict standards and regulations regarding diesel particulate filters by governments and environmental agencies requires manufacturers to add DPFs in their vehicles to fulfill regulatory requirements. The global implementation of DPF technology is leveraged from government-imposed and non-government-imposed regulations.

Additionally, the increasing awareness regarding air quality and its impact on health is creating a significant demand for cleaner and more friendly diesel engine technologies. Consumers and industries are valuing sustainable practices in an increased manner that is driving the production and use of DPFs to control harmful emissions. Initiatives favoring environmental best practices are also strengthening the segmental growth as businesses are supporting global efforts to enhance air quality as well as public health.

Fuel Type (Gasoline, Diesel)

The diesel segment in emission control technology market is expected to witness a steady growth due to the dual-fuel systems that integrate diesel with alternative fuel substances such as ethanol. For instance, in July 2024, the partnership between Vale, Komatsu, and Cummins, aimed at developing the Dual Fuel Program, was focused on transforming 830E and 930E diesel trucks into engines capable of using ethanol-diesel dual-fuel systems. Heavy-duty vehicle emission reduction is experiencing a major step forward through this partnership, which is supporting Vale's 2030 carbon reduction ambitions and is proving the industry's dedication to sustainable business practices.

Our in-depth analysis of the global emission control technology market includes the following segments:

|

Technology |

|

|

Fuel Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Emission Control Technology Market Regional Analysis:

North America Market

In emission control technology market, North America segment is set to hold revenue share of more than 46.1% by 2035, owing to the rising adoption of hydrogen-based alternative fuel technologies by companies. Several industries are moving toward hydrogen combustion engines, fuel cells, and biofuels to deploy innovative emission control systems for development. In addition, the environmental policies being adopted at the state level are accelerating industries toward implementing advanced emission reduction technologies.

The U.S. Environmental Protection Agency is strengthening emission regulations in automotive power generation and manufacturing industries, which is creating a need for innovative solutions such as advanced particulate filters and low-NOx combustion technologies. Major technology companies, including Amazon, Meta, Microsoft, and Google, are using their technological resources to develop carbon capture and storage solutions for their operations, especially those related to data centers. In December 2024, Meta pursued a Louisiana-based carbon capture partnership with Entergy for new gas plant emissions reduction. The USD 10 billion funding initiative is aimed at restoring the economic base of Northeast Louisiana through its workforce development and infrastructure expansion, which in turn generates substantial regional development.

The emission control technology market in Canada is witnessing a steady growth, owing to new partnerships as well as significant investments. The Canada Growth Fund and Strathcona Resources collaborated in July 2024 to invest up to USD 2 billion in developing carbon capture and sequestration infrastructure at Saskatchewan and Alberta oil sands facilities with the objectives of carbon emission reduction and employment generation in these areas. The emission control technology in the country is receiving additional support from the government through enhanced incentives that are driving the industries to implement advanced emission control systems. Companies are accelerating the installation of low-emission technologies in manufacturing, transportation, and energy sectors through support from tax credits, investments, and regulatory support, thus creating a more sustainable industrial environment.

Asia Pacific Market Analysis

The emission control technology market in Asia Pacific is expected to witness a significant expansion during the forecast period due to the implementation of financial support from governments. The growth of carbon market is driving industries to choose cleaner technologies. For instance, many companies in the region are creating a clean carbon exchange platform and are driving industries to participate in emissions trading as part of their initiative for emission reduction. Through regulatory and economic incentives, industries across the region are advancing their adoption of sophisticated pollution control systems, which is building a sustainable industrial zone.

The China emission control technology market is experiencing a steady growth, owing to the adoption of regulatory standards by the local government. The introduction of China VI vehicle standards and tightened industrial emission requirements is driving industries to purchase superior, advanced emission control solutions. The adoption of high-efficiency particulate filters and pollution reduction systems along with catalytic converters is growing rapidly in automotive power and manufacturing industries as government environmental standards are getting stricter.

The emission control technology market in India is highlighting a steady expansion, attributed to the implementation of emission trading systems, which is providing industries with economic advantages and forcing them to foster cleaner technologies through emission permit trading. Companies in the country are rolling out innovations and advancements to curb emissions. For instance, in March 2024, Intangles Lab Pvt. Ltd. unveiled an AI-powered diesel particulate filter solution for the commercial vehicle industry to enhance engine performance and fuel efficiency. The country’s adherence to the international climate agreements is also accelerating the industries to upgrade their emission control systems through the implementation of better pollution reduction technology.

Key Emission Control Technology Market Players:

- DCL International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Umicore, Tenneco Inc.

- CORMETECH

- Clean Diesel Technologies, Inc.

- Clariant

- Corning Incorporated

- BASF SE

- AeriNox

- Johnson Matthey

The competitive landscape of the emission control technology market is rapidly evolving, attributed to the integration of advanced technologies in the industry by key players. They are focused on advancing the existing, as well as developing new technologies catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position. Here are some key players operating in the global emission control technology market:

Recent Developments

- In July 2024, ExxonMobil and CF Industries entered into a CCS agreement to transport and permanently store 500,000 tonnes of CO₂ annually starting in 2028. Additionally, ExxonMobil began designing a large-scale plant dedicated to producing low-carbon hydrogen at its Baytown, Texas, complex, positioning it to become the world's largest low-carbon hydrogen project.

- In February 2023, Orica partnered with Cognizant to develop a digital platform that is capable of reporting greenhouse gas emissions. The collaboration is aimed at delivering an ESG data strategy through agile methods that provides real-time reporting and forecasting of scope 1 and 2 greenhouse gas emissions.

- Report ID: 7342

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Emission Control Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.