Emergency Notification System Market Outlook:

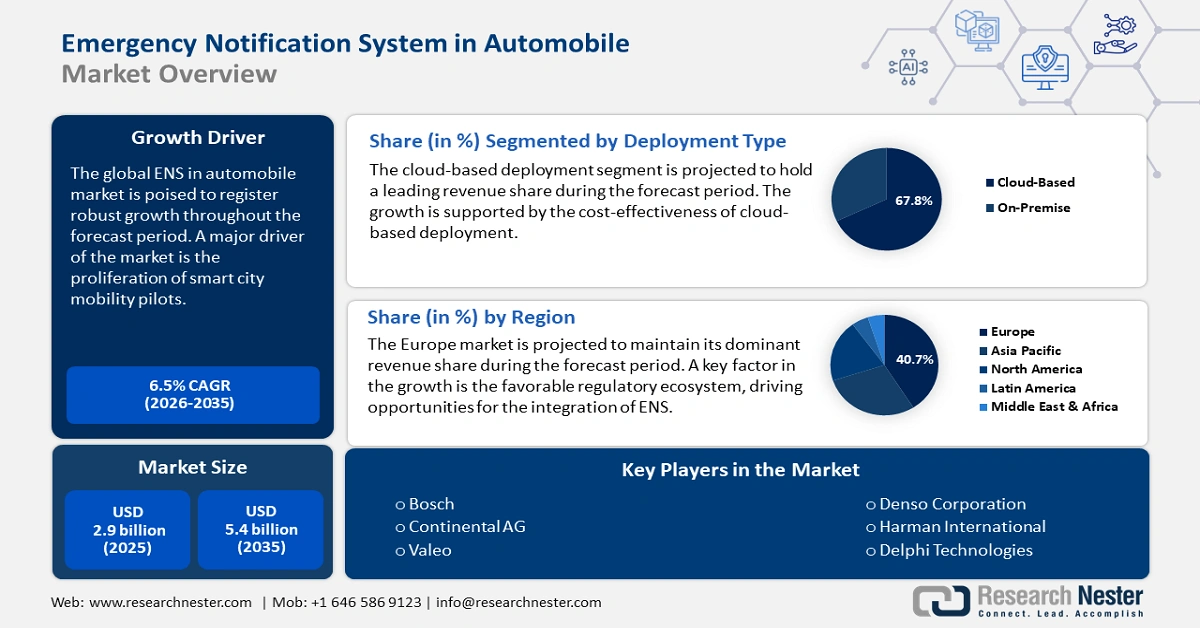

Emergency Notification System in Automobile Market size was valued at USD 2.9 billion in 2025 and is projected to reach USD 5.4 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the emergency notification system in automobiles is assessed at USD 3 billion.

The global supply chain for the emergency notification system (ENS) in automobiles comprises component manufacturers, software developers, vehicle assemblers, and others. Specialized suppliers in regions with established electronics manufacturing hubs provide vital components such as sensors, communication modules, and control units. These components are integrated in vehicles on assembly lines, which have been reshaped with the advent of AI and ML. Trade dynamics have played a major role in the ENS supply chains. The export opportunities are rife from economies with a well-established automotive sector, such as Germany, Japan, and the U.S., against the backdrop of a growing demand for advanced safety features. Additionally, regions lacking in domestic production capabilities are reliant on imports of multiple components. This creates an interdependence that amplifies the importance of mutually beneficial trade relations and the potential impact of tariffs on the cost of ENS technologies.

The ENS market's structural changes are exhibited via the Producer Price Index (PPI) and the Consumer Price Index (CPI). For instance, the PPI for motor vehicle parts manufacturing stood at 130.527 in August 2025, according to the U.S. Bureau of Labor Statistics. Whereas, the CPI for motor vehicle maintenance and repair was calculated at 441.987 in the same timeframe by the Federal Reserve Bank of St. Louis. The upheavals in these indices highlight the rising costs of production as well as the maintenance of automotive safety systems.

|

PPI industry group data for Motor vehicle parts manufacturing, not seasonally adjusted |

||||||||||||

|

2022 |

121.569 |

121.869 |

122.696 |

123.257 |

123.454 |

123.845 |

124.551 |

125.026 |

125.242 |

125.146 |

125.673 |

125.744 |

|

2023 |

126.487 |

126.325 |

126.452 |

126.735 |

126.965 |

126.990 |

127.236 |

127.224 |

127.334 |

127.520 |

127.582 |

127.411 |

|

2024 |

127.861 |

128.009 |

128.234 |

128.370 |

128.243 |

128.368 |

128.438 |

128.556 |

128.541 |

128.369 |

128.381 |

128.406 |

|

2025 |

128.869 |

128.858 |

128.907 |

129.350 |

129.820(P) |

130.109(P) |

130.404(P) |

130.527(P) |

|

|

|

|

Source: U.S.BLS

Key Emergency Notification System in Automobile Market Insights Summary:

Regional Highlights:

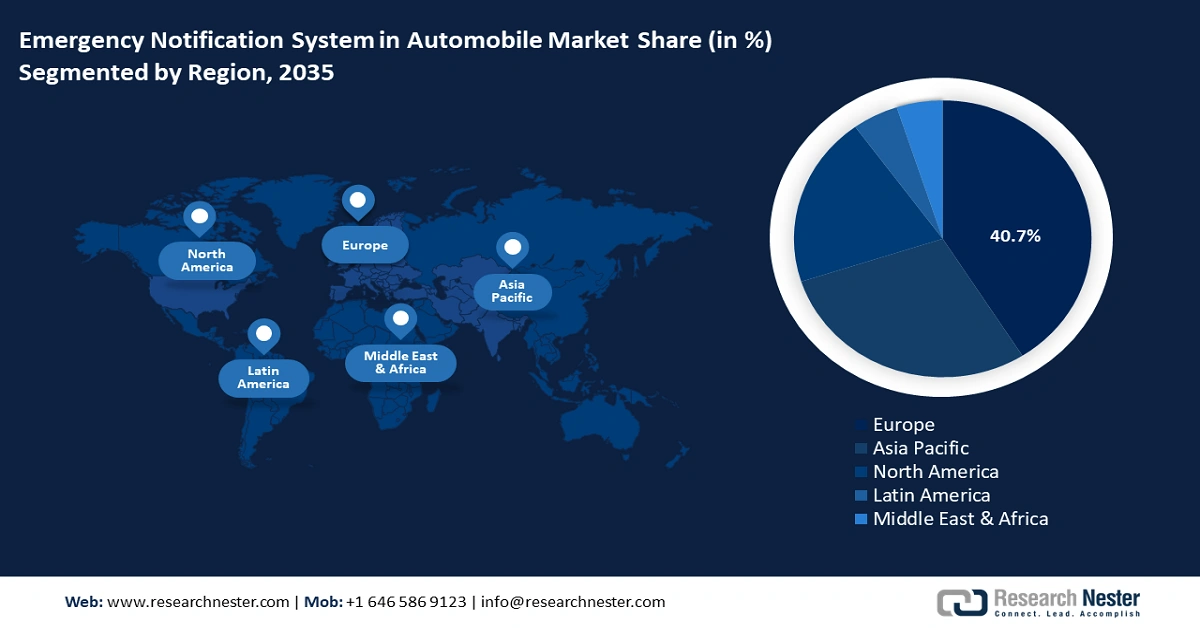

- The Europe emergency notification system in automobile market is expected to command over 40.7% revenue share by 2035, underpinned by stringent eCall regulations and the region’s emphasis on strategic autonomy in component manufacturing.

- The APAC region is anticipated to register the fastest CAGR of 10.4% during 2026–2035, boosted by the surge in autonomous vehicle adoption and harmonized safety initiatives such as the ASEAN-Japan Hanoi Action Plan.

Segment Insights:

- The cloud-based deployment segment of the mergency notification system in automobile market is projected to secure a 67.8% revenue share during the forecast period, driven by its scalability, OTA update capabilities, and enhanced performance enabled by 5G connectivity.

- The emergency communication segment is anticipated to capture a 42.3% share by 2035, supported by increasing integration of vehicle-to-emergency service communication systems and the adoption of interoperable national frameworks such as NG911 and eCall 112.

Key Growth Trends:

- Insurance-driven telematics and V2ES mandates in smart city mobility pilots

- Technological advancements

Major Challenges:

- Over-reliance on diverse telecommunication standards

- High retrofit and integration cost

Key Players: Bosch, Continental AG, Valeo, Denso Corporation, Harman International, Delphi Technologies, LG Electronics, Infineon Technologies, u-blox, Telit Wireless Solutions, Ficosa International, Visteon Corporation, Flairmicro, Thales Group, STMicroelectronics

Global Emergency Notification System in Automobile Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 5.4 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (40.7% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: Germany, United States, Japan, China, France

- Emerging Countries: India, Indonesia, Thailand, Mexico, Vietnam

Last updated on : 30 September, 2025

Emergency Notification System in Automobile Market - Growth Drivers and Challenges

Growth Drivers

- UN-level mandates and automotive compliance thresholds fueling demand: The proliferation of international agreements and safety frameworks, such as the UNECE WP.29 regulations and the global NCAP protocols, is a major driver of the sector. The frameworks have created a homogenous compliance ecosystem across multiple economies, facilitating ENS vendors to streamline market entries in regional markets. For instance, the UNECE WP.29 alone influences more than 60 countries scattered across Europe, APAC, the Middle East, and Latin America. Regionally, India introduced the Bharat NCAP in 2023, which mirrors the Euro NCAP protocols by awarding higher star ratings for vehicles equipped with emergency call systems. Additionally, the adoption curve in MENA and Latin America has steepened, creating lucrative segments for the ENS vendors. By analyzing the cascading nature of regulations, the driver is slated to have a decade-old momentum runway, positively reinforcing the growth curve of the global ENS in automobile market.

- Insurance-driven telematics and V2ES mandates in smart city mobility pilots: The proliferation of several smart city mobility pilots in North America, the Middle East, and APAC has expanded the scope of integration of telematics data streams for real-time crash response. Major automotive insurers have incentivized the proliferation in a bid to reduce claim settlement times. Applications can be mapped in major pilot programs such as Vision Zero Abu Dhabi and Mobility-as-a-Service Helsinki, where EMS is integrated into city-wide emergency response algorithms. Moreover, competitive implications highlight that opportunities are expected to be rife for the ENS vendors that offer telematics platforms that meet insurer APIs and municipal emergency response standards. The opportunities are expected to rise from government procurement contracts and fleet-based SaaS recurring revenue models.

- Technological advancements: Technological advancements are the backbone of the global ENS in automobile market. Improvements in ENS systems significantly reduce the adverse impacts of serious crashes by providing emergency medical care on time. For instance, the integration of AI into eCall systems is a major evolution in emergency response as algorithms are able to rapidly analyze data from various sensors to determine the severity of an accident. Another burgeoning trend has been the advancements in vehicle-to-everything communications, which have improved road safety and converged with the proliferation of smart traffic management systems globally.The 5G and the proliferation of IoT networks are also transforming the performance of emergency notification systems (ENS) in automobiles. With 5G or more advanced wireless connectivity networks, emergency alerts reach Public Safety Answering Points (PSAPs) almost in real time. This high-speed ability is set to fuel the sales of next-gen ENSs in the years ahead. One of the recent examples to support this trend is the collaboration of Vodafone and Porsche with HERE held in July 2021 to use 5G for real-time safety alerts between vehicles. Thus, continuous technological advancements are projected to double the revenues of key players during the foreseeable period.

Challenges

- Over-reliance on diverse telecommunication standards: The emergency notification system in automobiles is overly reliant on diverse telecommunication standards spanning across regions and vehicle manufacturers. This creates a bottleneck due to the fragmented ecosystem, pushing ENS vendors to develop adaptable systems and adding to the overall integration costs. Additionally, unlike other automotive subsystems, such as infotainment or navigation, ENS has to support the rapid and fail-safe message delivery across heterogeneous networks, compounding the challenge of multi-protocol integrations.

- High retrofit and integration costs: High retrofit and integration costs are among the biggest challenging factors in the emergency notification system in automobile market. The retrofitting of older cars with ENS requires additional hardware and specialized materials, which adds to the costs. Thus, many old fleet operators often defer from modernizing their vehicles, leading to low profit margins for key players in price-sensitive markets.

Emergency Notification System in Automobile Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 5.4 billion |

|

Regional Scope |

|

Emergency Notification System in Automobile Market Segmentation:

Deployment Type Segment Analysis

The cloud-based deployment segment is poised to hold a 67.8% revenue share during the forecast period, attributed to its scalability and the ability to provide ease in over-the-air (OTA) updates. Trends highlight that automakers and fleet operators increasingly favor cloud-based ENS solutions to support V2X communications. Additionally, with 5G networks maturing globally, cloud-native platforms are slated to benefit from the lower latency and higher bandwidth to improve instantaneous alerts for emergency services. The centralized architecture has significantly lowered the operational overhead for OEMs by reducing the requirement for localized data storage.

Application Segment Analysis

The emergency communication segment is poised to account for a 42.3% revenue share by the end of 2035. The segment is impacted by the rising demand for instant communication between vehicles, emergency services, and traffic control authorities. A major trend has been the proliferation of autonomous and semi-autonomous vehicles, which has created an expanded scope of application for emergency communication telematics. Governments across the EU, Japan, and North America are integrating national emergency communication infrastructure, such as the Next-Generation 9-1-1 (NG911) and the EU’s eCall 112, which projects the need for interoperable ENS capable of cross-border communication.

Component Segment Analysis

The software segment is projected to account for the largest market share through 2035, owing to the reliance of modern systems on advanced software algorithms. The scalability and regulatory compliance are key factors driving the sales of these emergency software systems. Ongoing improvements, such as AI that predicts crashes or connects with vehicle-to-everything (V2X) systems, are likely to increase their use worldwide. In November 2024, Dealerware launched Advanced Geofencing & Alerts to meet new industry demands. Its latest offering helps car dealerships prevent vehicle theft, stop unauthorized use, reduce insurance risks, and improve fleet management and efficiency. Companies are increasingly investing in R&D to double their revenues and attract a wider consumer base.

Our in-depth analysis of the global emergency notification system in automobile market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Application |

|

|

Vehicle Type |

|

|

Component |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Emergency Notification System in Automobile Market - Regional Analysis

Europe Market Insights

The Europe emergency notification system in automobiles is estimated to hold a dominant revenue share of over 40.7% by 2035. A major driver of the regional market is a favorable regulatory ecosystem exemplifying an interplay between national implementations and supranational mandates. The eCall regulation mandate in Europe has been an early entry in proactive regulations that require new vehicles to be equipped with automatic emergency call systems. A key trend has been the EU’s push for strategic autonomy, against the backdrop of trade tensions with the U.S., which is expected to create opportunities for manufacturing critical components of ENS within Europe.

The France emergency notification system in automobile market is estimated to expand at a rapid pace during the anticipated timeline. The market is impacted by the principles of dirigisme, where the state plays a central role in economic planning. The regional market is also impacted by the France Relance plan, which has allocated funds for digital transformation across multiple sectors. The impact has been felt on automotive safety technologies. Additionally, the market is set to be further impacted by the country's commitment to linguistic preservation, creating opportunities for ENS vendors that can offer systems catering to the French language requirements.

The major center for technology and automobiles, Germany, is expected to provide great opportunities for companies making emergency notification systems (ENS) in the coming years. In 2023, the Federal Statistical Office of Germany (Destatis) reported 2,830 deaths from road accidents, which fuels the need for advanced emergency alert systems. The EV trend and V2X (vehicle-to-everything) communication pilots are also accelerating the trade of automobile emergency notification technologies.

APAC Market Insights

The APAC emergency notification system in automobile market is slated to increase the fastest CAGR of 10.4% during the forecast period. The growth is favorably reinforced by the rapid expansion of the automotive sector due to a heightened demand for advanced mobility solutions. Additionally, the proliferation of autonomous as well as semi-autonomous vehicles across APAC has created ample opportunities for ENS vendors. The ASEAN-Japan Cooperation reinforced the Hanoi Action Plan, improving the harmonization of vehicle safety protocols across Thailand, Indonesia, and Vietnam. Procurement cycles in the APAC market tend to be tied to lunar calendars and festival logistics. Additionally, with Japan retreating from its role as a sole supplier to become a regional enabler, mid-tier countries in APAC have transformed into full participants in the supply-value coordination of ENS systems.

The China emergency notification system in automobile market is poised to maintain its leading share in APAC throughout the study period. The Dual Circulation Strategy has prioritized domestic consumption while insulating critical auto-tech from external shocks. The MIIT directive requires all Level 2+ autonomous vehicles sold in Tier 1 and Tier 2 cities to be eCall-enabled and linked to BeiDou satellites rather than GPS. Additionally, local firms such as Neusoft and Desay SV have pivoted and have been proactive in bundling ENS with locally adapted infotainment systems that are attuned to dialect-specific voice prompts and WeChat. Opportunities are set to be rife for ENS deployment in the urban buses in Chengdu, co-funded by the City Brain initiative.

The India emergency notification system in automobile market is foreseen to increase at the fastest pace throughout the study period. The high road traffic and rising vehicle connectivity are fueling the adoption of emergency notification systems. Further, the government's emphasis on road safety makes it a high-potential market for in-vehicle emergency notification. The Ministry of Road Transport & Highways is focused on education, better roads and vehicles, enforcing rules, and emergency care. Overall, investing in India is expected to offer lucrative gains in the years ahead.

North America Market Insights

The North America emergency notification system in automobile market is projected to account for a large revenue share through 2035. The regulatory nudges and consumer demand for safety are propelling the trade of emergency notification systems. The rise of connected car ecosystems is also contributing to the increasing sales of emergency notification solutions. The dominance of key automakers in the region is further expected to push the installation of emergency notification systems.

The U.S. leads the North American market, owing to the early adoption of telematics-based emergency services. The modern auto makers are leading the sales of emergency notification systems. In July 2025, the Arizona Department of Public Safety (AZDPS) launched the Turquoise Alert system, a new program to help quickly find missing and endangered people under 65, including those from tribal communities. Alerts are shared regionally through the Emergency Alert System, wireless phone alerts, Arizona Department of Transportation message boards, the requesting agency’s social media, and the AZDPS Alerts website. The strict government regulations and initiatives are further boosting the adoption of emergency notification solutions.

The Canada emergency notification system in automobile market is estimated to expand at the fastest CAGR from 2026 to 2035. The federal road safety strategies and the country’s push toward connected and autonomous vehicle readiness are boosting the overall market growth. The swift expansion of wireless connectivity networks is also contributing to the increasing sales of automobile emergency notification systems.

Key Emergency Notification System in Automobile Market Players:

- Bosch

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Valeo

- Denso Corporation

- Harman International

- Delphi Technologies

- LG Electronics

- Infineon Technologies

- u-blox

- Telit Wireless Solutions

- Ficosa International

- Visteon Corporation

- Flairmicro

- Thales Group

- STMicroelectronics

The ENS in automobile market is currently in a phase of growth, which is fueled by the rising focus on road safety and advancements in vehicle communication technology. The sector is also exhibiting signs of moderate consolidation, with key players forming strategic partnerships. The ENS in the automobile has a promising future outlook, with the adoption expected to increase significantly in emerging markets, reinforced by the rising vehicle sales. The table below highlights the major players of the global ENS in the automobile system market:

Recent Developments

- In August 2025, the Great New York State Fair announced a new Fairgrounds Alert System for the 2025 Fair. Visitors can text NYSF to 888777 to sign up for text message updates about weather, security, and other important information in real time.

- In May 2025, Emergency Safety Solutions (ESS) launched the H.E.L.P. Alert Network, a new system for sharing hazard information in real time. This network provides life-saving alerts and better awareness of road conditions, greatly improving safety for everyone by addressing the problems with old hazard lights and disconnected vehicle technologies.

- Report ID: 3220

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Emergency Notification System in Automobile Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.