Embedded Die Packaging Market Outlook:

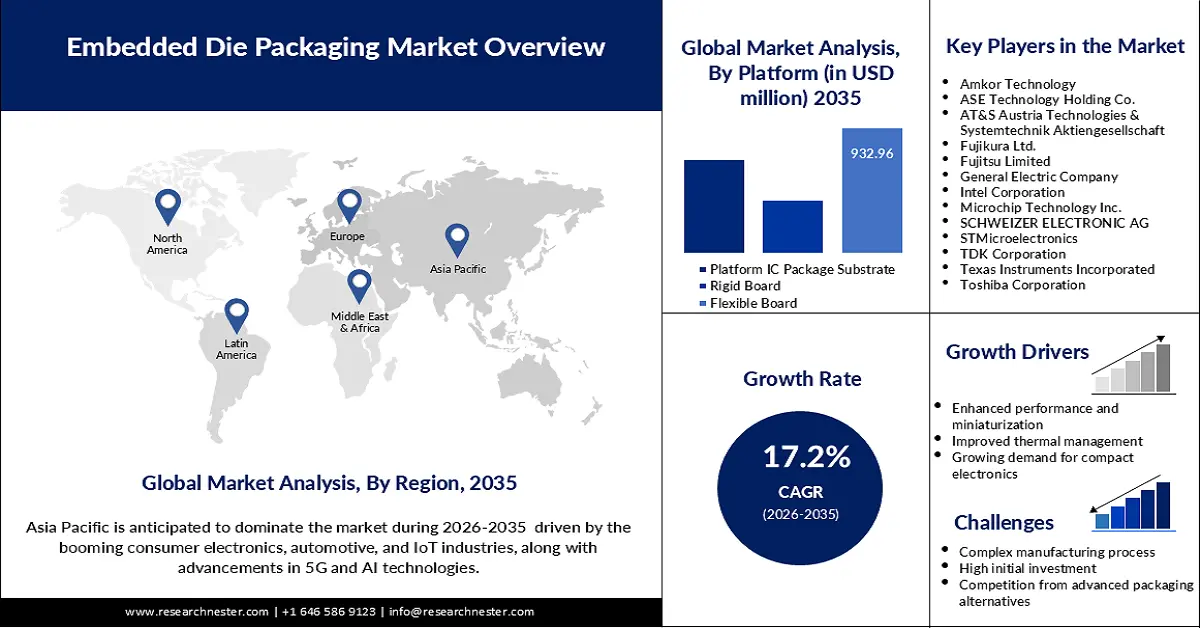

Embedded Die Packaging Market size was over USD 1.52 billion in 2025 and is anticipated to cross USD 7.43 billion by 2035, witnessing more than 17.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of embedded die packaging is assessed at USD 1.76 billion.

Embedded die packaging demand is growing due to the rising adoption of 5G networks, AI technologies, and high-performance computing (HPC). By 2023, 5G networks are expected to cover 40.0% of the world’s population, this implies that there is a need for enhanced packaging solutions for 5G networks that embrace energy efficiency, integration, and high data rate. Worldwide governments are also increasing capital spending on the production of semiconductors in order to enhance the advancement of technologies and decrease import dependency, which in turn will prop up the market.

The automotive industry also supports the growth of embedded die packaging because global EV sales increased by 35.0% in 2023. These technologies find their application in compact designs and improved power management in automotive systems. In March 2023, Infineon Technologies worked with Schweizer Electronic to place SiC chips directly into the PCB to bring longer range and better efficiency to electric vehicles. Also, the global regulatory incentives and sustainability objectives enhance the uptake of advanced embedded die technologies, thus presenting business opportunities for manufacturers.

Key Embedded Die Packaging Market Insights Summary:

Regional Highlights:

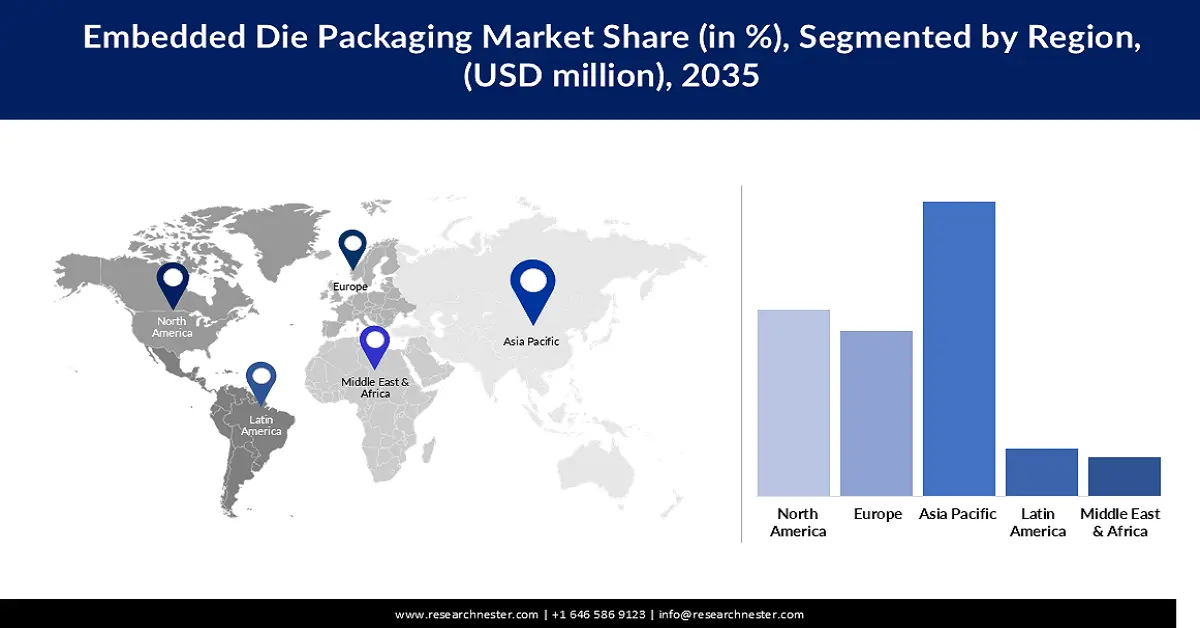

- Asia Pacific embedded die packaging market will account for 37.20% share by 2035, driven by leadership in manufacturing and electronics.

- North America market will account for significant revenue share by 2035, attributed to rising demand for advanced semiconductor packaging.

Segment Insights:

- The flexible board segment in the embedded die packaging market is expected to hold a 46.10% share by 2035, driven by properties like lightweight and ease of use in high-performance applications.

- The high-performance computing segment in the embedded die packaging market is forecasted to capture a 34.20% share by 2035, propelled by increasing demand for efficient processors in AI and cloud computing.

Key Growth Trends:

- Global expansion of 5G networks

- Advanced semiconductor packaging technologies

Major Challenges:

- Design complexity and scalability

- Supply chain disruptions

Key Players: Amkor Technology, ASE Technology Holding Co., AT&S Austria Technologies & Systemtechnik Aktiengesellschaft, Fujikura Ltd., Fujitsu Limited, General Electric Company, Intel Corporation, Microchip Technology Inc., SCHWEIZER ELECTRONIC AG, STMicroelectronics, TDK Corporation, Texas Instruments Incorporated, Toshiba Corporation, Würth Elektronik eiSos GmbH & Co. KG.

Global Embedded Die Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.52 billion

- 2026 Market Size: USD 1.76 billion

- Projected Market Size: USD 7.43 billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, Taiwan, Singapore

Last updated on : 18 September, 2025

Embedded Die Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Global expansion of 5G networks: The deployment of the fifth generation of wireless networks is a growing need for efficient packaging that can meet the high data rate and energy-efficient requirements. Cadence and Intel Foundry announced a new partnership in February 2024 to enhance the Embedded Multi-die Interconnect Bridge (EMIB) for multi-die designs used in 5G and HPC systems. These innovations show how the industry is working to meet the requirements of data transfer rates and power consumption in the development of 5G networks that have embedded die packaging as one of its key solutions.

- Advanced semiconductor packaging technologies: The growth of the complexity of semiconductor devices has led to the growth of packaging technologies in order to meet the required performance and efficiency. Intel opened a Fab 9 plant in New Mexico in January 2024 as part of the company’s USD 3.5 billion investment plan for the improvement of semiconductor manufacturing. This initiative reflects the trends in advancing the packaging of semiconductors for AI, HPC, and the next generation of computing. These advancements are a new reference for integrated packaging systems.

- High-performance computing and AI demand: The increasing use of HPC and AI has led to the integration of embedded die packaging in order to address the need for high density interconnections. These technologies are very important in the reduction of system complexity yet provide high computational capacity. AT&S started shipping IC substrates to AMD in November 2023 for data center processors to highlight how the sector is turning to advanced packaging to address the needs of AI, VR, and cloud computing. As the need for more and more powerful and compact processors in HPC systems grows, the advancements in die packaging techniques are critical to address next-generation workloads.

Challenges

- Design complexity and scalability: The complex nature of embedded die packaging presents a major challenge in the ability to increase production output. To tackle these complex architectures, manufacturers have to employ state-of-the-art tools, workflows, and design practices in order to guarantee dependability in these high performance applications. This challenge requires considerable resources for R&D and the establishment of best practices for production processes throughout the industry.

- Supply chain disruptions: The global semiconductor supply chain remains fragile and affects the material procurement and pricing for embedded die packaging. Owing to the volatility in the availability of key materials, together with political instabilities, risk has emerged in the market. These disruptions are quite detrimental to the production schedules and also increase the cost of manufacturers, which are a hindrance to the growing needs. These risks can be avoided and the continuous supply of components for embedded die packaging can be made possible by sustaining robust supply chains and having a variety of sources in the supply chain.

Embedded Die Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 1.52 billion |

|

Forecast Year Market Size (2035) |

USD 7.43 billion |

|

Regional Scope |

|

Embedded Die Packaging Market Segmentation:

Platform Segment Analysis

The flexible board segment is predicted to capture around 46.1% embedded die packaging market share by the end of 2035 due to properties such as lightweight and ease of use in high performance applications. The most common applications of flexible boards include automotive and consumer electronics, where miniaturization and high dependability are major concerns. In June 2024, Zollner Elektronik collaborated with Schweizer Electronic to improve the power embedding technology as flexible boards become more important in efficient system integration. This segment’s importance is because it supports innovative designs and high performance of advanced electronics.

Application Segment Analysis

By the end of 2035, high-performance computing (HPC) segment is estimated to dominate around 34.2% embedded die packaging market share due to the growing need for efficient and small form factor processors in artificial intelligence, cloud computing, and other data-centric applications. The embedded die packaging has interconnections and thermal management, which are important in HPC systems. The increased use of AI and VR has created a demand for new packaging systems that can handle the increased computational work. This segment’s growth points to the expanding need for embedded die packaging to address performance limits in next-generation computing systems.

Our in-depth analysis of the global market includes the following segments:

|

Platform |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Embedded Die Packaging Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific embedded die packaging market is expected to capture revenue share of over 37.2% by 2035, due to the region’s leadership in manufacturing and electronics. Some of the factors that are boosting the growth in the market include the continuing trend of industrialization and the rising need for miniaturization of semiconductors in packaging. The strong electronics and automotive industries in Asia Pacific make it an ideal region for the development of embedded die packaging technologies.

India embedded die packaging market is also growing due to the country’s building semiconductor manufacturing capacity and government policies such as the Make in India campaign. The rise in electric vehicles and the growing investment in electronics production create a need for better packaging solutions. Local partnerships between Indian firms and foreign semiconductor companies are expected to enhance the local environment. India is likely to become a potential market for embedded die packaging solutions due to its vast consumer base and its strategies for industrial development.

China holds the largest share in the Asia Pacific market due to its position as the world’s manufacturing hub and largest automobile market. According to the research, automobile production in China will be 35 million by 2025, which is likely to create a significant market for semiconductor products to enhance automotive technology. The International Trade Administration recorded that in 2021, 26.3 million vehicles were sold in China, which indicates a high market growth opportunity for the embedded die packaging industry. The country has continued to invest in 5G deployment and IoT that enhances the need for compact and high-performance packaging solutions, thus placing the country at the fore front of the regional market.

North America Market Insights

In embedded die packaging market, North America region is estimated to capture significant revenue share by the end of 2035. The growth of this market is attributed to the rising need for advanced semiconductor packaging solutions in the automotive, aerospace, and consumer electronics industries in the region. The increased uptake of electric vehicles and deployment of 5G networks also create the demand for better packaging density. The U.S. and Canada are two leading markets holding a significant position in advanced manufacturing technologies.

The U.S. is a leading player in North America embedded die packaging market, backed by a strong automotive and electronics industry. According to Quloi, in 2022, the U.S. automotive market was valued at more than USD 104 billion, and the sales of light trucks and cars were 10.9 million and 2.9 million, respectively. Also, federal policies for the return of semiconductor manufacturing and packaging to the United States enhance the position of the U.S. in the supply chain. These efforts are in line with the growing need for new sophisticated packaging technologies to enable new applications in the telecommunications and autonomous vehicles industries.

Due to the growing technology industry and investments in semiconductor research in Canada, the embedded die packaging market in the country is continuously developing. The countries’ vision of clean technologies and electric vehicles is a good starting point to introduce the concept of embedded die packaging. The partnerships between manufacturers and international semiconductor firms improve Canada position in North America market. As a result of favorable government measures and innovation centers, Canada is emerging as an important player in the development of the regional embedded die packaging industry.

Embedded Die Packaging Market Players:

- Amkor Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ASE Technology Holding Co.

- AT&S Austria Technologies & Systemtechnik Aktiengesellschaft

- Fujikura Ltd.

- Fujitsu Limited

- General Electric Company

- Intel Corporation

- Microchip Technology Inc.

- SCHWEIZER ELECTRONIC AG

- STMicroelectronics

- TDK Corporation

- Texas Instruments Incorporated

- Toshiba Corporation

- Würth Elektronik eiSos GmbH & Co. KG

The embedded die packaging market is competitive, and leading companies like Amkor Technology, ASE Technology Holding Co., AT&S Austria Technologies, Intel Corporation, STMicroelectronics, and Microchip Technology Inc. are working to lead the market. These companies have used capital investment and partnerships to enhance production capacities and technology enablers. In November 2024, Amkor Technology signed a memorandum of understanding with Lightmatter to create the largest ever 3D packaged chip complex using the Passage platform to prove the importance of embedded die packaging for the advancement of photonic computing. Such partnerships strengthen the competitive dynamics by driving innovation and maintaining a constant flow of new and innovative offerings.

Here are some leading companies in the embedded die packaging market:

Recent Developments

- In September 2024, Amkor Technology introduced significant advancements to its S-SWIFT package, providing enhanced die-to-die interconnects and increased bandwidth for heterogeneous integration using a high-density interposer. The methodology addresses critical design elements such as over-molding, capillary under-fill, precise warpage control during thermal assembly, fine-pitch μ-bump interfaces, and the mold-side bumping process, setting a new standard in embedded packaging technology.

- In August 2024, ASE Technology Holding Co. invested USD 162 million in its subsidiary Hung Ching Development and Construction Co. for the development of the K18 facility in Kaohsiung's Nanzih District. The factory will leverage cutting-edge technologies, including AI applications and high-performance computing devices, to enhance its capacity for flip-chip and advanced IC pumping packaging, addressing the growing global demand for semiconductors.

- In June 2024, Rapidus Corporation partnered with IBM to establish mass-production technologies for chipset packaging. This collaboration will enable Rapidus to integrate IBM's embedded die packaging technology, supporting the development of high-performance semiconductors and advancing the capabilities of next-generation logic chips.

- Report ID: 6861

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Embedded Die Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.