Embalming Fluid Market Outlook:

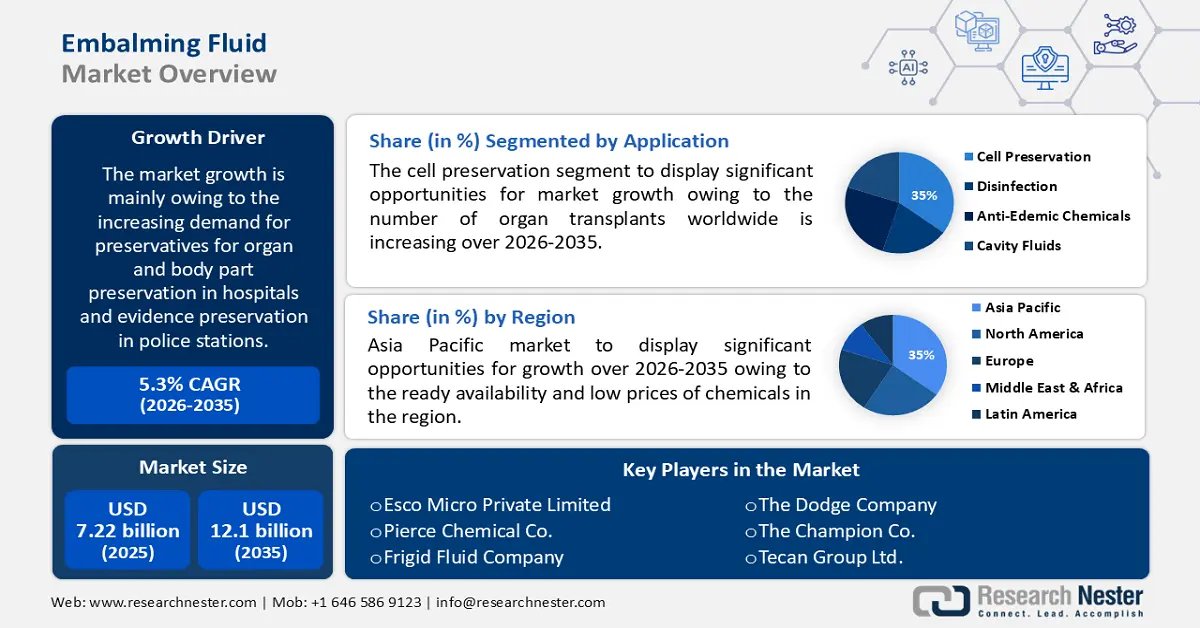

Embalming Fluid Market size was over USD 7.22 billion in 2025 and is projected to reach USD 12.1 billion by 2035, witnessing around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of embalming fluid is assessed at USD 7.56 billion.

The market growth is mainly owing to the increasing demand for preservatives for organ and body part preservation in hospitals and evidence preservation in police stations. An embalming solution is a chemical used to temporarily prevent spoilage. Rising demand for embalming solutions in hospitals for preserving organs from donors is estimated to fuel the growth of the market. According to the Global Observatory on Donation and Transplantation, worldwide in the year 2019, 41,860 organs were donated to deceased people.

Additionally, increasing adoption of preservatives for corpse preservation in funeral homes is expected to boost the market growth. In addition, various uses of these chemicals, such as, regulating water hardness, removing excess water from the body and inactivating chemotherapy drugs, are expected to drive the market growth over the forecast period. It was noted that in the year 2022, over 42,000 transplants had been performed. Embalming is the process of chemically preserving tissue using chemical fixatives such as formalin and other liquids that can interfere with toxicological analysis. Common ingredients in embalming solutions include formaldehyde, methanol, sodium borate, sodium nitrate, glycerin, dyes, and water.

Key Embalming Fluid Market Insights Summary:

Regional Highlights:

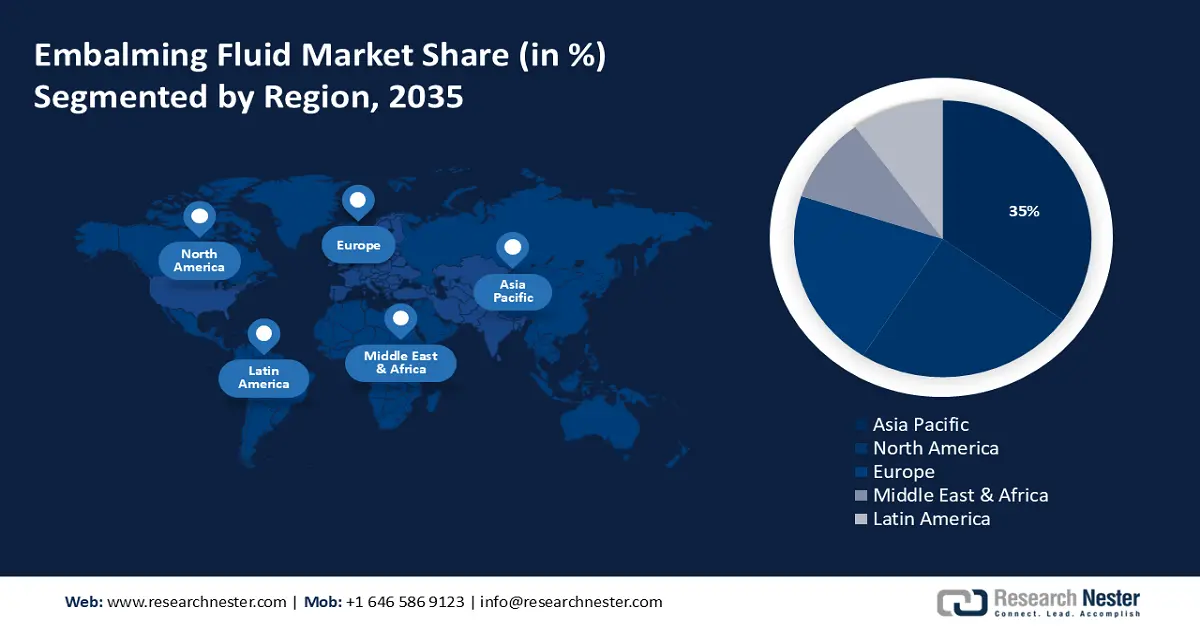

- By 2035, the Asia Pacific region is anticipated to secure a 35% share of the embalming fluid market, supported by the expanding chemical manufacturing base and rising acceptance of embalming fluids in funeral homes owing to a rapidly aging population.

- North America is projected to command a 24% share by 2035, spurred by escalating organ transplant procedures that heighten the use of embalming solutions.

Segment Insights:

- The cell preservation segment is projected to account for 35% of the market by 2035 in the embalming fluid market, bolstered by the rising volume of global organ transplants.

- The hospital segment is set to capture around 30% share by 2035, propelled by the increasing number of patients requiring transplants alongside the expanding hospital infrastructure.

Key Growth Trends:

- Rising Demand for Organ Transplants

- Increasing Prevalence of Chronic Kidney Disease

Major Challenges:

- Side Effects of Embalming Fluid

- Low awareness of drugs among people in low and middle income countries

Key Players: Arlington Chemical Company, Bondol Laboratories, Inc., Kelco Supply Company, TrinityFluids, LLC, Esco Micro Private Limited, Pierce Chemical Co., Frigid Fluid Company, The Dodge Company, The Champion Co., Tecan Group Ltd.

Global Embalming Fluid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.22 billion

- 2026 Market Size: USD 7.56 billion

- Projected Market Size: USD 12.1 billion by 2035

- Growth Forecasts: 5.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 20 November, 2025

Embalming Fluid Market - Growth Drivers and Challenges

Growth Drivers

- Rising Demand for Organ Transplants – Rising need for organ transplantation, supported by increasing prevalence of chronic diseases, is expected to boost the growth of the global embalming fluid market. Chronic diseases such as renal failure, cystic fibrosis, hepatitis, chronic kidney disease, and diabetes are associated with organ transplantation. Organs from deceased donors are stored for a short period of time using an embalming solution. A total of 166,579 transplants were performed in the year 2019, according to the Global Observatory on Donation and Transplantation.

- Increasing Prevalence of Chronic Kidney Disease – Chronic kidney disease is known to be a progressive disease that affects more than 800 million people worldwide, or more than 10% of the general population. Chronic kidney disease is more common in older people, women, ethnic minorities, and people with diabetes or high blood pressure. Chronic kidney disease places a particularly heavy burden on low- and middle-income countries, which are least prepared to deal with its consequences. Chronic kidney ailment has turn out to be one of the main reasons of loss of life across the globe and is one of the few non-communicable illnesses that has shown an increase in associated deaths over the last decades.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for organ transplantation. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in 2019.

- Rising Healthcare Spending – According to the latest spending data, global healthcare spending has increased over the past two decades, effectively doubling from 8.5% in 2000 to USD 8.5 trillion in the year 2019, increasing GDP reached 9.8%. The boom will continue during the forecast period.

- Worldwide Prevalence of Cancer – Cancer incidence is expressed as the number of people living without being diagnosed with cancer. It is defined by how common cancers develop (incidence) and how long they live after diagnosis (survival). Therefore, the most common cancers with the longest survival rates have the highest prevalence. For instance, the prevalence of breast cancer in women and prostate cancer in men is high, estimated at 42% and 43% in the year 2019. Organ transplantation is widely used in cancer treatment. Hence, it is estimated to be a major growth driver.

Challenges

- Side Effects of Embalming Fluid – Increasing personal concern about side effects associated with the use of embalming fluid is one of the major factors expected to slow down the market growth.

- Low awareness of drugs among people in low and middle-income countries

- Lack of reimbursement policies for organ transplantation in some countries

Embalming Fluid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 7.22 billion |

|

Forecast Year Market Size (2035) |

USD 12.1 billion |

|

Regional Scope |

|

Embalming Fluid Market Segmentation:

Application Segment Analysis

The global embalming fluid market is segmented and analyzed for demand and supply by application into cell preservation, disinfection, anti-edemic chemicals, cavity fluids, and others. Out of the five types of applications, the cell preservation segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to the fact that the number of organ transplants worldwide is increasing, fueled by rising cases of organ failure and other chronic diseases. Living donation, deceased donation, tissue donation, pediatric donation. The reality for many on the organ transplant list is that the wait is long and uncertain. Living donor is a type of organ donation that provides another option for transplant candidates. Organs that can be transplanted are heart, lung, liver, kidney, intestine, and pancreas. Transplantation is the removal of an organ, tissue, or group of cells from one person (donor) and either surgically transplanting it into another person (recipient) or surgically transplanting it from one place to another in the same person. The brain is the only organ in the human body that cannot be transplanted. In the United States, the most commonly transplanted organs are kidney, liver, heart, lung, pancreas, and intestine. Every day, about 100,000 people are on active organ donation waiting lists, but only about 14,000 organ donors were noted to die in the year 2021, giving an average of 3.5 organs each.

End-user Segment Analysis

The global embalming fluid market is also segmented and analyzed for demand and supply by end user into funeral homes, government and police station, hospital, research laboratories, and others. Amongst these five segments, the hospital segment is expected to garner a significant share of around 30% in the year 2035. The growth of the segment can be accredited to the large number of patients requiring organ transplant for surgery or treatment of chronic conditions. The hospitals are also growing rapidly in number. For instance, by the year 2022 there was noted to be approximately 6,100 hospitals in the United States. Hospitals provide a wide range of medical care. Physicians, called hospital doctors, typically specialize in internal medicine, pediatrics, or general practice. They have the knowledge to solve common problems and the resources to solve more complex medical problems. Hospitals may also offer specialized care, such as neurology, obstetrics and gynecology, and oncology. By definition of a hospital, a county hospital is typically a primary medical facility in a region with numerous intensive care and mobile beds for patients requiring long-term care.

Our in-depth analysis of the global market includes the following segments:

|

By End User |

|

|

By Application |

|

|

By Methanol Content |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Embalming Fluid Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 35% by 2035. The regional growth can majorly be attributed to the ready availability and low prices of chemicals in developing countries are underpinned by a developing chemical manufacturing industry in the region. Moreover, increasing acceptance of embalming fluids in funeral homes supported by a large population in the Asia Pacific region is estimated to spur the growth of the regional market over the forecast period. The regional market growth can also be accredited to the growing aged population in the region. Elderly people are more susceptible to chronic diseases, which requires often transplant to treat. The Asia Pacific population is aging faster than anywhere else is in the world. Sixty per cent of the world's total elderly population, that is, 630 million aged people reside in the Asia-Pacific region. The region's elderly population is expected to reach 1.3 billion by the year 2050. Moreover, the government's role in raising awareness of the use of embalming fluid is expected to spur market growth in the region. Moreover, increasing number of CKD patients, and increased funding for medical infrastructure are expected to impact the growth of the market in the region.

North American Market Insights

The embalming fluid market in the North America region, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to the fact that there is a growing demand for organ transplants in the region. According to the United States, 37,584 people received organ transplants in the United States in the year 2020, according to the Health Resources Services Administration (HRSA). Organ transplantation is a medical procedure in which an organ is removed from the body and transplanted into the recipient's body to replace a damaged or missing organ. The donor and recipient may be in the same location, or the organ may be transported from one donor location to another. The embalming solution is usually a 2% solution of formaldehyde, a pungent volatile acid. About 1 pint of embalming liquid is used per carcass in addition to 1 pint of stone weight. An embalming solution is a mixture of chemicals used to prevent corpses from decaying after death. Chemicals include formaldehyde, methanol, glutaraldehyde, and others. Embalming is the process of chemically preserving tissue using chemical fixatives such as formalin and other liquids that can interfere with toxicological analysis. Common ingredients in embalming solutions include formaldehyde, methanol, sodium borate, sodium nitrate, glycerin, dyes, and water.

Europe Market Insights

Further, the embalming fluid market in the Europe region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the expansion of funeral industry in the region. Embalming fluid is a chemical solution used to preserve human or animal remains. The demand for embalming fluid is largely driven by the funeral industry, which has a stable market as death is a natural and inevitable part of life. In Europe, the funeral industry is regulated and standardized, which has led to a consistent demand for embalming fluid. The embalming fluid market in Europe is competitive, with several companies offering a range of products. Some of the key players in the market include Pierce Chemicals, Thermo Fisher Scientific, Frigid Fluid Company, and Dodge Chemical Company. These companies offer different types of embalming fluids such as formaldehyde-based and non-formaldehyde-based fluids, catering to the varying needs of the funeral industry.

Embalming Fluid Market Players:

- Arlington Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bondol Laboratories, Inc.

- Kelco Supply Company

- TrinityFluids, LLC

- Esco Micro Private Limited

- Pierce Chemical Co.

- Frigid Fluid Company

- The Dodge Company

- The Champion Co.

- Tecan Group Ltd.

Recent Developments

-

Kelco Supply Company has announced price increases for its preservatives following the slowdown in demand caused by the COVID-19 pandemic.

-

The World Health Organization and the National Association of Funeral Directors (NFDA) are committed to ensuring that all safety procedures and precautions are followed during and after funerals to ensure that people who have died of confirmed or suspected COVID-19 have died. Approved for antiseptic treatment.

- Report ID: 3808

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Embalming Fluid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.