Electrostatic Precipitator Market Outlook:

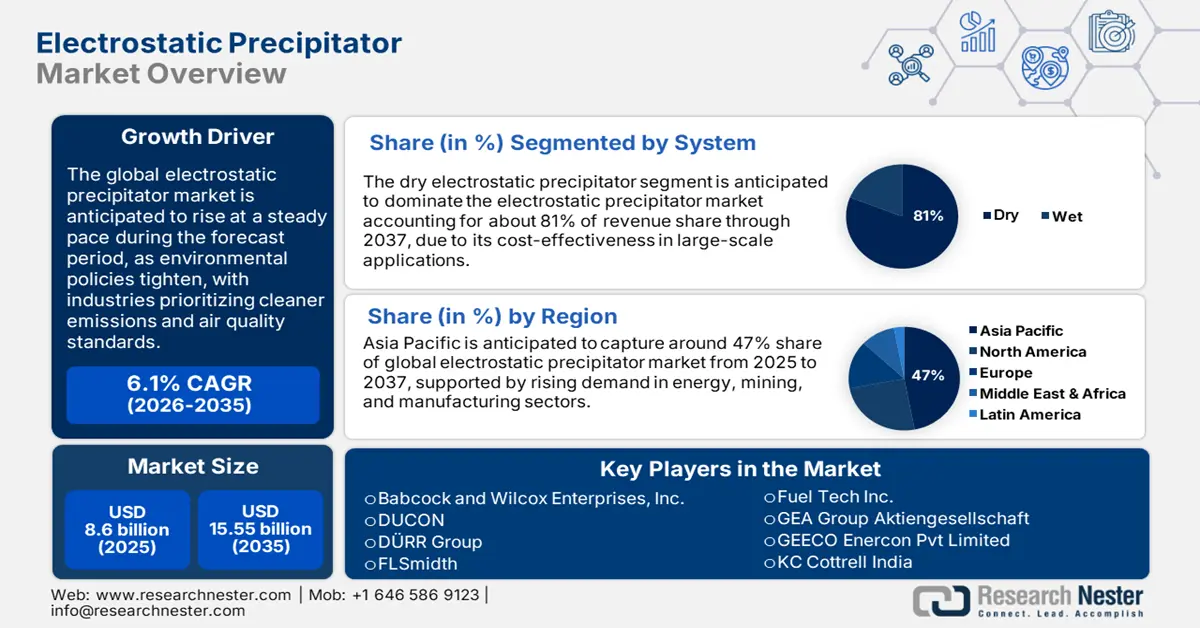

Electrostatic Precipitator Market size was over USD 8.6 billion in 2025 and is projected to reach USD 15.55 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrostatic precipitator is evaluated at USD 9.07 billion.

The electrostatic precipitator market is witnessing rapid growth due to various growing environmental regulations and pollution control measures in industries such as cement, steel, and power generation. With the rise in the stringency of emission standards around the globe, advanced ESPs are being used in industries to meet these compliance standards and further support ambitions regarding the environment. For example, FLSmidth launched a new generation ESP in March 2022 that improved particulate collection efficiency by 10% due to various emerging air quality challenges facing many industries in their production processes. Such innovations further improve the performance of ESPs, in tune with global initiatives toward ensuring a reduction in industrial pollution.

Government initiatives have also been instrumental toward driving the growth with agencies across varied regions imposing strict emissions controls and offering incentives for cleaner technologies. Such regulations boost the adoption of ESPs within the regions that are recording fast industrialization. For example, statistics from the United States Environmental Protection Agency show a drastic decline in air pollutants in sectors that have adopted the use of ESPs. Due to such factors, the ESP market is anticipated to expand with enhanced global support for clean air policies, propelled both by regulatory frameworks and industrial commitments to environmental compliance.

Key Electrostatic Precipitator Market Insights Summary:

Regional Highlights:

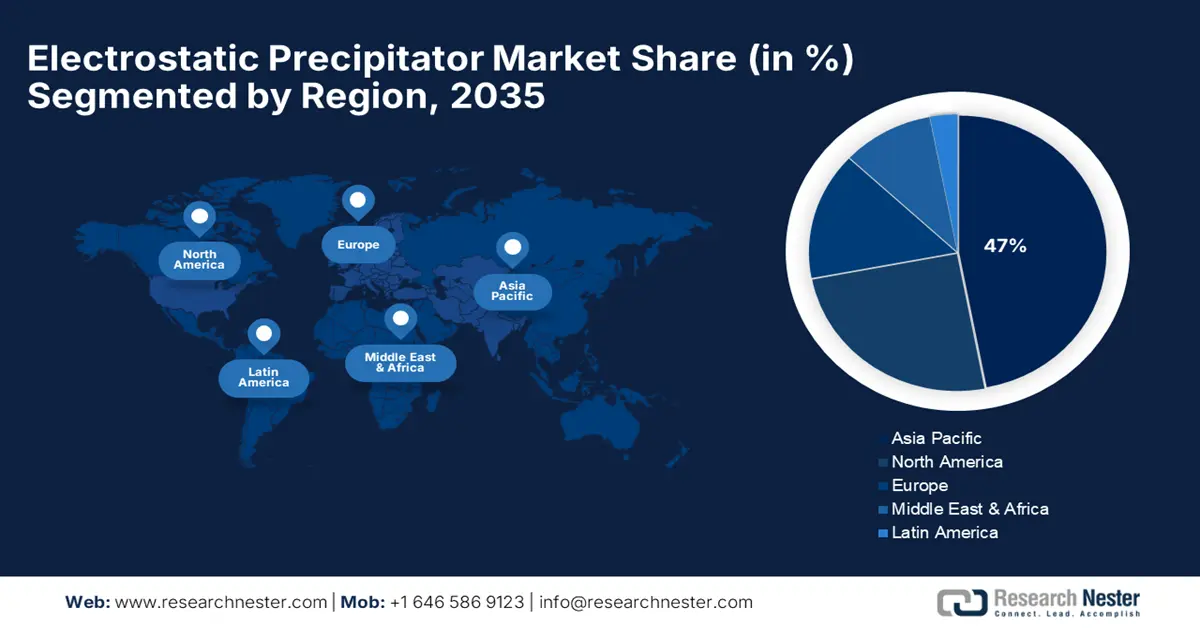

- The Asia Pacific electrostatic precipitator market will dominate over 47% share by 2035, driven by stricter pollution regulations and clean air initiatives.

- The North America market is set for significant CAGR during 2026-2035, fueled by regulatory pressure and EPA emission compliance needs.

Segment Insights:

- The tubular design segment in the electrostatic precipitator market is forecasted to achieve an 88% share by 2035, fueled by its compact, space-saving design suitable for constrained industries.

- The dry system segment in the electrostatic precipitator market is projected to capture an 81% share by 2035, influenced by its wide use in cement, steel, and power industries, and cost-effectiveness.

Key Growth Trends:

- Stricter environmental regulations

- Industrial expansion in emerging markets

Major Challenges:

- Compliance with locally accepted emission standards

- Fine particulates handling

Key Players: DUCON, S.A. Hamon, Trion Solutions, Inc., Babcock & Wilcox Enterprises Inc., Amec Foster Wheeler, Thermax Limited, Siemens AG, Mitsubishi Power, Ltd.

Global Electrostatic Precipitator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.6 billion

- 2026 Market Size: USD 9.07 billion

- Projected Market Size: USD 15.55 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 September, 2025

Electrostatic Precipitator Market Growth Drivers and Challenges:

Growth Drivers

- Stricter environmental regulations: With emission standards becoming stricter globally, companies are trying to cope with the regulatory demands by commissioning ESPs. Most countries have put in place regulations to equip industrial sites with pollution control equipment for different applications, further accelerating the implementation of ESPs. In February 2021, GEA secured an order from CEPSA to install Hot Electrostatic Precipitators on Spanish refineries to ensure compliance with the emission levels by 2024 end. Developments such as these indicate how regulations, along with other factors, serve as a growth driver in the ESP market.

- Industrial expansion in emerging markets: Rapid industrial expansion of emerging markets such as Asia Pacific and Latin America is increasing demand for ESPs. These regions are investing in advanced air quality solutions to align with global environmental standards. For example, Andritz began a project at Skelleftea Kraft's biomass plant in Sweden for superior emission control in September 2023, which underlines the priority being given to ESP by countries worldwide. Furthermore, clean air solutions are witnessing a surge in demand from these regions, thereby acting as a strong growth factor.

- Enhanced ESP technology: Advances in Electrostatic Precipitator (ESP) technology, including greater efficiency and lower operational costs, play a critical role in driving growth. Innovations like Selective Catalytic Reduction (SCR) technology improve particulate removal, making it easier for facilities to meet strict air quality standards. Additionally, modern ESP designs are increasingly adaptable to different industrial applications, further broadening their appeal. Due to the fact that environmental regulations are getting tighter everywhere in the world, such high demand for these solution methods is likely to encourage innovation in this sector.

Challenges

- Compliance with locally accepted emission standards: One of the major issues with ESP technologies is that emission requirements differ among regions. This means that different countries may have to make unique adaptations either in design or operation. For example, there are significant differences in the limits related to sulfur dioxide and nitrogen oxides between the EU, U.S., and China regulations. Market success thus requires customization in order to ensure compliance with different regulatory demands. This sometimes makes the process of ESP product offerings costly and time-consuming as the manufacturer tries to adapt it to the particular demands of a local market.

- Fine particulates handling: Electrostatic precipitators are quite efficient in dust particles of larger size, however, fail to handle finer particulates, especially below 2.5 micrometers (PM2.5), which remain challenging and technically demanding. The issue has increasingly become a pressing need as governments tighten up on air quality regulations. For instance, the World Health Organization calls for strict limits on PM2.5 to reduce health risks. Attainment of such standards, therefore, demands ESP designs that can efficiently target ultrafine particles often evaded by ordinary collection methods, which can be costly as well as may be difficult for some companies to implement.

Electrostatic Precipitator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 8.6 billion |

|

Forecast Year Market Size (2035) |

USD 15.55 billion |

|

Regional Scope |

|

Electrostatic Precipitator Market Segmentation:

System

Dry segment is expected to account for around 81% electrostatic precipitator market share by 2035. Wide applicability in cement, steel, and power generation industries, along with cost-effectiveness, are driving the demand for dry ESPs. This segment is also preferred in regions with water conservation policies, thus becoming ideal for resource-constrained territories. For example, in December 2022, ProcessBarron continued its expansion into Canada with the dry ESP offering, which further reflects the prospects available in the segment as industries seek pollution control solutions that are cost-effective.

Design

In electrostatic precipitator market, tubular segment is projected to hold revenue share of more than 88% by 2035 due to their compact design. This is going to drive the demand since some industries are built in restricted areas. The ESPs are in high demand for boilers and industries where the emission is concentrated. Furthermore, tubular ESPs are anticipated to maintain the lead owing to their adaptive and space-efficient designs, which suit a variety of industries, from manufacturing to power generation.

Our in-depth analysis of the electrostatic precipitator market includes the following segments:

|

System |

|

|

Design |

|

|

Emitting Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrostatic Precipitator Market Regional Analysis:

Asia Pacific Market Insights

By 2035, Asia Pacific electrostatic precipitator market is predicted to capture over 47% revenue share. The governments in this region impose various strict regulations in most of the urban areas to bring down the level of air pollution. For example, India aims to cut industrial emissions with initiatives such as the Long-Term Low Emissions Growth Strategy, which is likely to increase demand for ESPs. Such policies form one of the drivers for growth as industries work to comply with national and international environmental standards.

With the government of India initiating several initiatives to improve air quality across industries, demand for ESPs has started to grow in the country. As a result, companies are increasing their capacities to satisfy the growing domestic demand driven by new regulations for better emission standards. The concentration on pollution control systems falls in line with India's current initiative to upgrade urban air quality and public health.

China is also on a course to meet its ambitious clean air targets under the 14th Five-Year Plan by reducing industrial emissions achieving carbon neutrality by 2060. In September 2023, Valmet received an order to supply ESP to Shandong Huatai Paper Co., Ltd. in China with a view to achieving vast emission reductions in pulp production. This type of project is indicative that China is taking a proactive approach where companies invest in advanced ESP systems to ensure compliance with national emission standards and support environmental initiatives.

North America Market Insights

North America electrostatic precipitator market is anticipated to observe significant growth till 2035. The market is driven by the strict air quality standards stipulated by the U.S. Environmental Protection Agency, especially for power generation industries, which have created a considerable demand for pollution control solutions to maintain a high level of compliance with regulations. Growth in industrial activities coupled with regulatory pressures continues to keep the demand for ESPs high as integral parts of emission control in North America.

The U.S. remains a key market for ESPs since most industries have invested hugely in pollution control to meet the set EPA regulations. Furthermore, the market is witnessing growth due to rising industrial air quality standards by government authorities. For example, FLSmidth and ThyssenKrupp Industrial Solutions AG reached an agreement on the completion of a merger transaction to acquire Thyssenkrupp's mining business. Through such an integration, the company can expand client connectivity and product portfolio, gaining wider geographic exposure and strengthening its position in the mining industry.

Canada is also a considerable market for electrostatic precipitators driven by stringent environmental standards in the country that significantly raise the bar on ESP demand for several industries, especially energy. Government incentives toward the adoption of clean technology further promote this market growth. These initiatives fall under the goals of national sustainability, which would further encourage businesses to integrate ESP solutions into their operations. Besides, growing regulatory pressure to switch to cleaner processes pushes sectors to act in favor of ESP demand.

Electrostatic Precipitator Market Players:

- Babcock and Wilcox Enterprises, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DUCON

- DÜRR Group

- FLSmidth

- Fuel Tech Inc.

- GEA Group Aktiengesellschaft

- GEECO Enercon Pvt Limited

- KC Cottrell India

- Monroe Environmental Corp.

- TAPC

- Trion

- Valmet

- Wood Plc

Asia Pacific industry is expected to dominate majority revenue share by 2037, propelled by growing industrial pollution in the region. Product portfolios and geographical presence are being expanded by these firms in order to meet the ever-increasing demand for electrostatic precipitators in both developed and developing regions. In turn, smaller regional players play important roles, especially in areas like Asia and Europe, where regulatory frameworks are relatively stringent.

This competition is driven by the rise of advanced pollution control solutions from a global perspective. In April 2021, Dürr Megtec's Part. X PW launched an advanced wet electrostatic precipitator (WESP) designed to enhance particulate matter and aerosol removal across various industries. This next-generation WESP features a modular design, allowing quick installation, improved performance, and compliance with global environmental standards. With active company inventions or improvements in ESP technology, the market is observing considerable growth driven by the dual pressures of regulatory compliance and industrial demand for eco-friendly solutions.

Here are some leading players in the electrostatic precipitator market:

Recent Developments

- In February 2024, Valmet announced it would supply electrostatic precipitators (ESPs) for the recovery boiler at Nordic Paper’s Backhammar mill in Sweden, with completion expected by the end of 2025. This initiative aligns with Nordic Paper’s sustainability goals and aims to boost the competitiveness of the Bäckhammar mill, known for its unbleached kraft papers used in packaging.

- In May 2023, Babcock & Wilcox secured a contract to supply an advanced ESP system for a major waste-to-energy plant in Europe. This project is set to enhance emissions control, significantly contributing to pollution reduction efforts in the region and advancing sustainable waste management practices.

- Report ID: 3589

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrostatic Precipitator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.