Global Electrostatic Discharge (ESD) Packaging Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How They Would Aid The Business?

- Competitive Landscape

- ACHILLES CORPORATION

- Antistat Inc. (Ant Group Ltd.)

- Avery Dennison Corporation

- Bennett and Bennett, Inc.

- Desco Industries, Inc.

- GWP Conductive

- Internaiontal Plastics, Inc.

- Kiva Container

- NEFAB GROUP

- Sealed Air Corporation

- Teknis Limited Ongoing

- Technological Advancements

- Key Player in the ESD Packaging

- Technology Analysis

- Electrostatic Discharge (ESD) Packaging

- End User Analysis

- SWOT Analysis

- PESTLE Analysis

- Product Launch

- Recent Development

- PORTER Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million),

- ESD Bags (static shielding, conductive, anti-static)

- ESD Boxes (rigid containers, collapsible boxes)

- ESD Protective Materials (films, wraps, containers)

- ESD Labels and Tapes

- ESD Trays and Pallets

- Others

- Material Type, Value (USD Million)

- Conductive Materials

- Anti-static Materials

- Static Shielding Materials

- Composite Materials

- Others

- Application, Value (USD Million)

- Electronics Manufacturing

- Automotive

- Aerospace

- Medical Devices

- Telecommunications

- Consumer Goods

- Semiconductor Industry

- Others

- Product Type, Value (USD Million),

- Regional Synopsis, Value (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Product Type, Value (USD Million),

- ESD Bags (static shielding, conductive, anti-static)

- ESD Boxes (rigid containers, collapsible boxes)

- ESD Protective Materials (films, wraps, containers)

- ESD Labels and Tapes

- ESD Trays and Pallets

- Others

- Material Type, Value (USD Million)

- Conductive Materials

- Anti-static Materials

- Static Shielding Materials

- Composite Materials

- Others

- Application, Value (USD Million)

- Electronics Manufacturing

- Automotive

- Aerospace

- Medical Devices

- Telecommunications

- Consumer Goods

- Semiconductor Industry

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- U.S.

- Canada

- Product Type, Value (USD Million),

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Product Type, Value (USD Million),

- ESD Bags (static shielding, conductive, anti-static)

- ESD Boxes (rigid containers, collapsible boxes)

- ESD Protective Materials (films, wraps, containers)

- ESD Labels and Tapes

- ESD Trays and Pallets

- Others

- Material Type, Value (USD Million)

- Conductive Materials

- Anti-static Materials

- Static Shielding Materials

- Composite Materials

- Others

- Application, Value (USD Million)

- Electronics Manufacturing

- Automotive

- Aerospace

- Medical Devices

- Telecommunications

- Consumer Goods

- Semiconductor Industry

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Product Type, Value (USD Million),

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Product Type, Value (USD Million),

- ESD Bags (static shielding, conductive, anti-static)

- ESD Boxes (rigid containers, collapsible boxes)

- ESD Protective Materials (films, wraps, containers)

- ESD Labels and Tapes

- ESD Trays and Pallets

- Others

- Material Type, Value (USD Million)

- Conductive Materials

- Anti-static Materials

- Static Shielding Materials

- Composite Materials

- Others

- Application, Value (USD Million)

- Electronics Manufacturing

- Automotive

- Aerospace

- Medical Devices

- Telecommunications

- Consumer Goods

- Semiconductor Industry

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Product Type, Value (USD Million),

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Product Type, Value (USD Million),

- ESD Bags (static shielding, conductive, anti-static)

- ESD Boxes (rigid containers, collapsible boxes)

- ESD Protective Materials (films, wraps, containers)

- ESD Labels and Tapes

- ESD Trays and Pallets

- Others

- Material Type, Value (USD Million)

- Conductive Materials

- Anti-static Materials

- Static Shielding Materials

- Composite Materials

- Others

- Application, Value (USD Million)

- Electronics Manufacturing

- Automotive

- Aerospace

- Medical Devices

- Telecommunications

- Consumer Goods

- Semiconductor Industry

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Product Type, Value (USD Million),

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Product Type, Value (USD Million),

- ESD Bags (static shielding, conductive, anti-static)

- ESD Boxes (rigid containers, collapsible boxes)

- ESD Protective Materials (films, wraps, containers)

- ESD Labels and Tapes

- ESD Trays and Pallets

- Others

- Material Type, Value (USD Million)

- Conductive Materials

- Anti-static Materials

- Static Shielding Materials

- Composite Materials

- Others

- Application, Value (USD Million)

- Electronics Manufacturing

- Automotive

- Aerospace

- Medical Devices

- Telecommunications

- Consumer Goods

- Semiconductor Industry

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- Saudi Arabia

- UAE

- Oman

- South Africa

- Morocco

- Tunisia

- Algeria

- Rest of Middle East & Africa

- Product Type, Value (USD Million),

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Electrostatic Discharge Packaging Market Outlook:

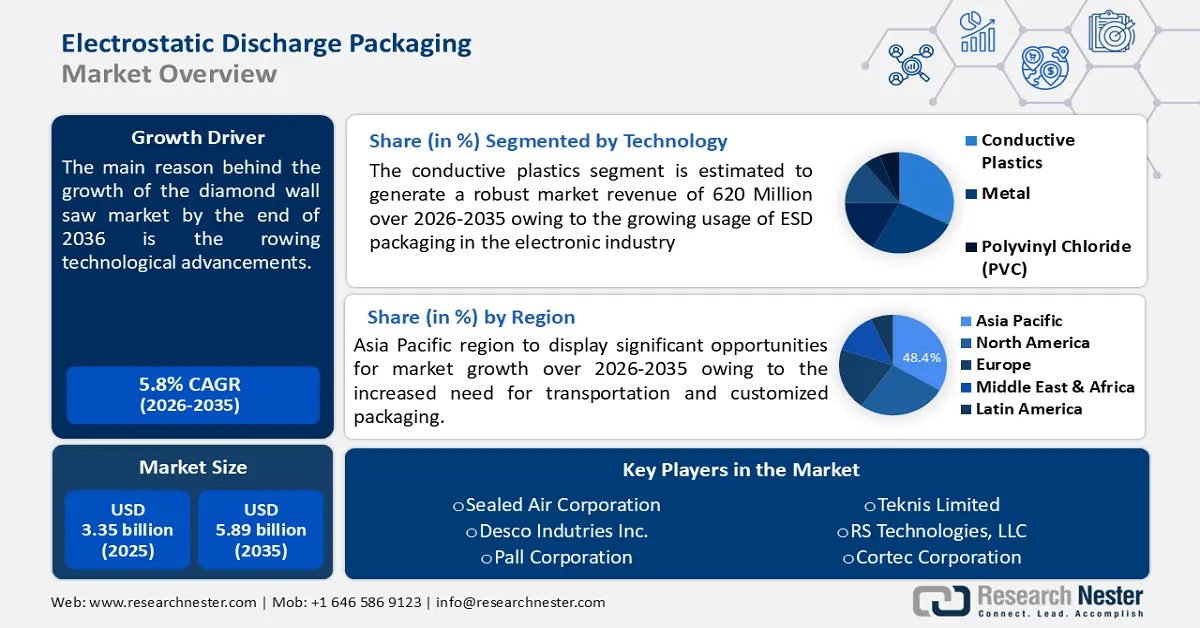

Electrostatic Discharge Packaging Market size was over USD 3.35 billion in 2025 and is projected to reach USD 5.89 billion by 2035, growing at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrostatic discharge packaging is evaluated at USD 3.52 billion.

The electrostatic discharge (ESD) packaging market is on the rise due to the increased use of better protection methods in electronics, semiconductors, and the automotive industry. Since complex electronic devices and components have become more and more sensitive, the protection of ESD packaging, which avoids the effect of static electricity has become essential. In July 2024, Daubert Cromwell launched VCI/ESD poly film and bags that combine the corrosion protection feature with the static shield. This two-in-one packaging satisfies the new electrostatic discharge packaging market requirements and is indicative of a shift toward multiple-layer protection solutions in electronics production and distribution.

Increased government support to improve electronics manufacturing and increase semiconductor production also promotes the ESD packaging market. The U.S. CHIPS and Science Act and similar initiatives in Asia Pacific and Europe create demand for semiconductor fabrication, which increases the need for ESD-safe materials. In November 2024, EcoCortec introduced EcoSonic VpCI-125 PCR HP Films and Bags, which are aligned with sustainability including the use of 30% post-consumer recycled material. This innovation is inline with sustainable development goals and government policies on green packaging solutions to support ESD packaging to advocate for sustainable supply chains.

Key Electrostatic Discharge Packaging Market Insights Summary:

Regional Insights:

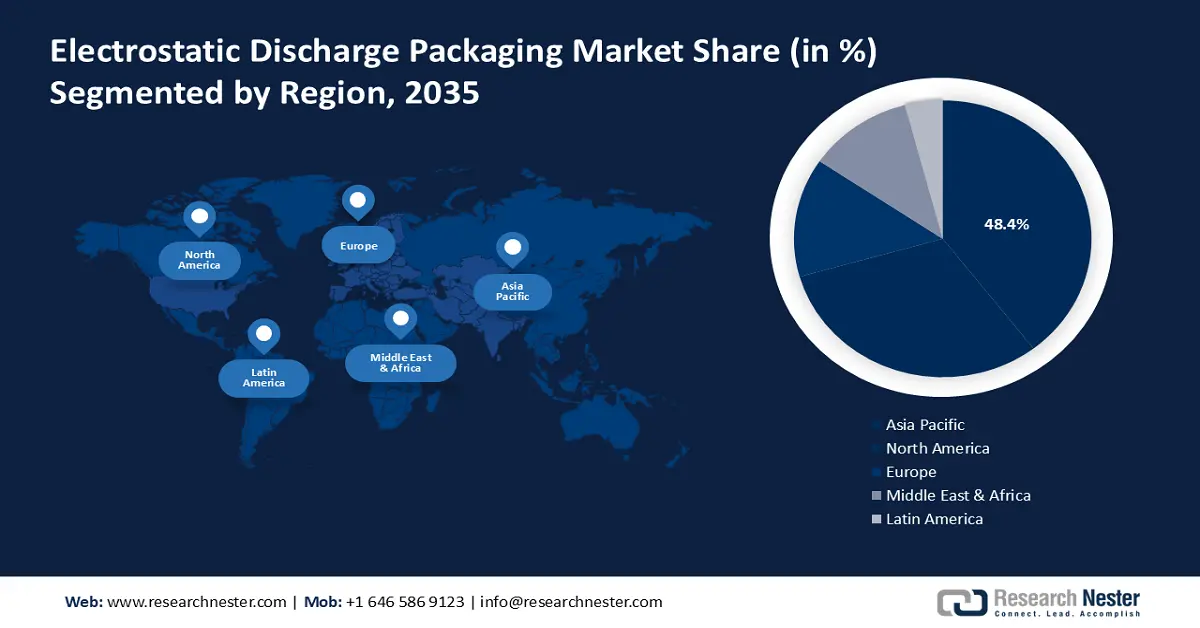

- Asia Pacific is estimated to hold over 48.4% revenue share by 2035, fueled by the growing electronics manufacturing industry and high mobile phone usage.

- North America is anticipated to witness substantial growth through 2035, owing to the expansion of electronics and semiconductor industries.

Segment Insights:

- Conductive materials segment is projected to account for 36.4% share by 2035, propelled by rising semiconductor manufacturing and broadening usage in industries requiring sensitive component protection.

- Electronics manufacturing segment is estimated to capture over 44.7% revenue share by 2035, driven by increased digitalization and connectivity.

Key Growth Trends:

- Growing semiconductor and electronics manufacturing

- Increasing demand for automobiles and aircrafts

Major Challenges:

- Supply chain disruptions impacting raw material availability

- Complex design requirements for next-generation electronics

Key Players: ACHILLES CORPORATION, Antistat Inc. (Ant Group Ltd.), Avery Dennison Corporation, Bennett and Bennett, Inc., Desco Industries, Inc., GWP Conductive, Internaiontal Plastics, Inc., Kiva Container, NEFAB GROUP, Sealed Air Corporation, Teknis Limited.

Global Electrostatic Discharge Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.35 billion

- 2026 Market Size: USD 3.52 billion

- Projected Market Size: USD 5.89 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Vietnam, Thailand, Malaysia, Indonesia

Last updated on : 17 September, 2025

Electrostatic Discharge Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Growing semiconductor and electronics manufacturing: Semiconductor and electronics industries are expected to be the chief growth propellers in the ESD packaging business. With increasing chip manufacturing across the world, it is critical to protect the components against electrostatic charges. According to the Semiconductor Industry Association (SIA) in November 2024, the semiconductor sale achieved USD 166 billion in Q3, which is constant. The growth of these industries has increased the use of ESD packaging in manufacturing, shipping and storage, and thus supports the ESD packaging market’s upward trend. Greater spending in 5G, IoT, and AI technologies expands the need for enhanced ESD solutions even further.

-

Increasing demand for automobiles and aircrafts: Automotive electronics and aerospace use advanced electronics and sensors that require dependable ESD protection as conventional applications. In February 2023, Freudenberg Performance Materials introduced Evolon ESD as a protective product that will be aimed at the automotive and industrial sectors. With the rise of electric vehicles (EVs) and smart aviation systems, the necessity of protecting the components during assembly and transportation boosts ESD packaging demand and increases advanced high-performance materials’ development. The combination of autonomous driving technology and electric power trains even intensifies the ESD packaging needs.

- Trend towards sustainable packaging solutions: Sustainability is already becoming one of the growth factors as industries switch to using environmentally friendly materials in packaging. In November 2024, EcoCortec’s VpCI-125 PCR HP Films demonstrated sustainability by using recycled content while not losing ESD protection. The demand to minimize the use of plastics and meet environmental standards also encourages the production of bio-based and recyclable ESD materials due to changes in trends in the industry towards the use of sustainable packaging. Manufacturers are also going for carbon-neutral packaging types to fit into the international sustainable development goals.

Challenges

-

Supply chain disruptions impacting raw material availability: Global supply chain issues are making it challenging to obtain raw materials needed to package ESD (Electrostatic Discharge) products. The delay of conductive and dissipative material may affect production cycle time and may increase the cost of production. This challenge is well illustrated in the semiconductor and electronic industries that require protective packaging. Suppliers are used more and more flexibly to minimize risks and guarantee operational capacity. However, constant political crises and issues of transportation also remain as risks to consistent material supply.

-

Complex design requirements for next-generation electronics: The continued evolution of next-generation electronics demands innovative and complex ESD packaging requirements. Compact devices are sensitive to static charges, as a result they require packaging designed to afford the best protection while at the same time not being expensive or hard to mass produce. Other factors, such as the use of new technology, including 5G and IoT, also fuel the need for complex packaging designs. This means that companies have to invest in their research and development in order to come up with lightweight, flexible, and durable solutions for the changing ESD packaging market standards.

Electrostatic Discharge Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 3.35 billion |

|

Forecast Year Market Size (2035) |

USD 5.89 billion |

|

Regional Scope |

|

Electrostatic Discharge Packaging Market Segmentation:

Material Type Segment Analysis

Conductive materials segment is poised to account for ESD packaging market share of around 36.4% by 2035. The segment is observing rapid growth as the materials are very useful in protecting electronics from the accumulation of static charges and our ability to protect parts throughout transit and storage. In July 2024, Daubert Cromwell’s VCI/ESD poly film and bags established a new level of conductive material through the integration of corrosion inhibitors and ESD features. Furthermore, the segment’s growth is driven by the rising manufacture of semiconductors as well as the broadening usage in industries that need the protection of sensitive components.

Application Segment Analysis

In ESD packaging market, electronics manufacturing segment is estimated to capture revenue share of over 44.7% by 2035. As consumer electronics, telecommunications, and IoT devices become more popular, it becomes necessary to protect fragile components. In June 2024, Siemens launched new ESD verification tools targeting semiconductor manufacturing that prove that static control is crucial in electronics. The electronics segment continues to grow at a significant pace due to increased digitalization and connectivity, dominating the ESD packaging market.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Material Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrostatic Discharge Packaging Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in ESD Packaging market is estimated to hold over 48.4% revenue share by the end of 2035, due to the growing electronics manufacturing industry. The region’s high mobile phone usage and rising investment in technology infrastructure are other factors driving the electrostatic discharge (ESD) packaging market. As per the report, the number of mobile internet users in APAC is projected to increase from 1.4 billion in 2022 to 1.8 billion in 2030 due to increased consumer demand for electronic gadgets. This surge creates the demand for ESD packaging to safeguard delicate parts from destruction in the manufacturing and shipping stages.

The electronics industry in India is growing at a rapid pace due to government policies that have encouraged the manufacturing of electronic products in the country. In 2022, the sector was valued at approximately USD 3.6 billion, with further expansion driven by the Production Linked Incentive (PLI) scheme. The government of India has also planned to provide INR 40,951 crore (USD 5.5 billion) to encourage the large-scale manufacturing of electronics during the next five years. This initiative increases ESD packaging demand because local manufacturers increase the production of consumer electronics as well as semiconductors.

China is also anticipated to garner considerable demand for ESD packaging during the forecast period. Furthermore, the country’s dominance in the consumer electronics market is bolstered by strong innovation and manufacturing capacity. The Ministry of Industry and Information Technology reported that in 2022, China remained the largest consumer electronics manufacturer in the world, with constantly increasing export and domestic consumption. This dominance underlines the importance of ESD packaging in protecting the components that are highly sensitive to anti-static shocks during mass production as well as international transportation.

North America Market Insights

North America region is anticipated to observe substantial growth through 2035, owing to the growth of electronics and semiconductor industries in the region. The IoT, 5G, and electric vehicle applications push the necessity of ESD packaging for sensitive components during production and logistics. This drives the market growth as the region has a stronger emphasis on research and development of packaging solutions.

The U.S. is one of the significant ESD packaging markets due to the increase in semiconductor and consumer electronics industries. Given that the CHIPS Act promotes the production of semiconductors locally, then the need for ESD packaging is anticipated to increase. The U.S. Department of Commerce in March 2024 unveiled that USD 39 billion will be spent on the improvement of chip manufacturing, hence underlining the importance of reliable ESD protective supplies. This initiative mitigates the inherent risks that are inclined to affect sensitive electronic components crucial for the nation’s technological and manufacturing development.

In Canada, the demand from the electronics industry, such as automotive and telecommunications among others, has been a primary driver of ESD packaging market expansion. The government of Canada investment in technology infrastructure is improving the capacity of domestic production. In 2023, the Canadian ISED provided USD 250 million to boost the production of electronic components. This funding enhances the country’s standing in ESD packaging, thus protecting key components during shipping and construction.

Electrostatic Discharge Packaging Market Players:

- ACHILLES CORPORATION

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Antistat Inc. (Ant Group Ltd.)

- Avery Dennison Corporation

- Bennett and Bennett, Inc.

- Desco Industries, Inc.

- GWP Conductive

- Internaiontal Plastics, Inc.

- Kiva Container

- NEFAB GROUP

- Sealed Air Corporation

- Teknis Limited

The electrostatic discharge (ESD) packaging market is highly fragmented with industry giants including Antistat Inc., Desco Industries, NEFAB GROUP, Sealed Air Corporation, and GWP Conductive that continually invest in innovation and expansion. These companies are increasing production and diversifying their product offerings as global demand for electronics increases and protection needs for sensitive components change. In November 2023, Conductive Containers, Inc. (CCI) acquired Crestline Plastics to expand the range of static control packaging solutions offered and strengthen its position in the electrostatic discharge packaging market. This case is an example of a strategic merger and acquisition that has become common among organizations as they try to develop new capacities and reach new markets.

Businesses incorporating recyclable material, multi-layered packaging, and environmentally friendly static control solutions in their production line should be in a good position to exploit the changing ESD packaging market trends. With the increasing threats of ESD as associated with IoT, 5G, and electric vehicles, the need for creativity in dual-form and high-strength packaging is becoming paramount, enhancing the importance of ESD packaging in defending the electronic environment.

Here are some leading companies in the electrostatic discharge (ESD) packaging market:

Recent Developments

- In August 2024, Cortec Corporation launched EcoSonic ESD Paper, offering an eco-friendly alternative to plastic ESD bags. This paper-based solution provides effective static protection while being biodegradable and recyclable. EcoSonic ESD Paper aims to reduce plastic waste in electronics packaging. Cortec’s launch addresses the growing demand for sustainable packaging without sacrificing performance.

- In July 2023, Smurfit Kappa inaugurated its first North African integrated corrugated plant in Rabat, Morocco. The plant is powered by green energy and focuses on sustainable packaging production. This expansion supports Smurfit Kappa’s global strategy to enhance its environmentally friendly packaging solutions. The facility reinforces the company’s commitment to growth in emerging markets.

- In June 2024, Nefab expanded its Latin American presence by opening a new facility in Viña del Mar, Chile. The facility will meet the increasing demand for sustainable packaging and contract logistics services in the region. This expansion strengthens Nefab’s ability to deliver tailored packaging solutions to industrial clients. The move aligns with the company’s strategy to grow its footprint across high-growth markets.

- Report ID: 6157

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.