Electronic Grade Hydrofluoric Acid Market Outlook:

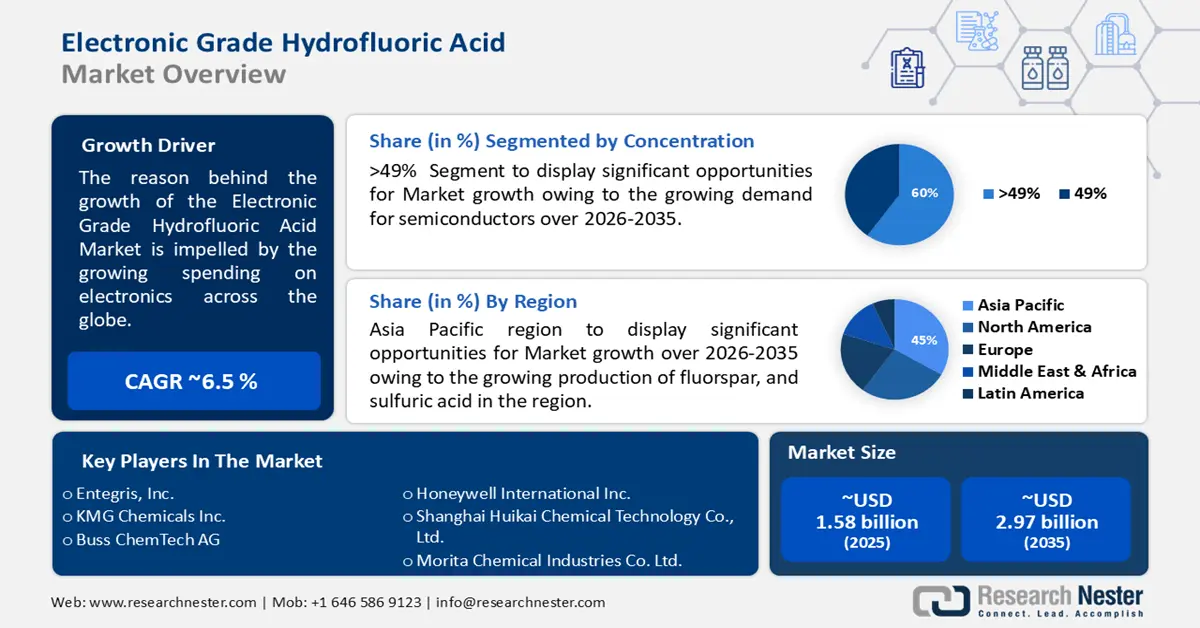

Electronic Grade Hydrofluoric Acid Market size was over USD 1.58 billion in 2025 and is poised to exceed USD 2.97 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic grade hydrofluoric acid is estimated at USD 1.67 billion.

The electronic grade hydrofluoric acid market is predominantly driven by steep growth in consumer electronics and semiconductors. The producer pricing index (PPI) for the electronic product manufacturing sector in the U.S. showcased a steady month-on-month rise. The PPI in November 2024 was 102.827, a percent change of 0.2% from October 2024, signifying a growth in the prices that domestic manufacturers received on electronic goods.

U.S. general imports of electronic products by selected trading partner countries in 2020 by value (USD millions) & share (%)

|

Country |

Value |

Share |

|

China |

160,999 |

33.3 |

|

Mexico |

80,092 |

16.6 |

|

Taiwan |

32,212 |

6.7 |

|

Malaysia |

30,877 |

6.4 |

|

Vietnam |

29,347 |

6.1 |

|

Japan |

19,292 |

4.0 |

|

South Korea |

18,876 |

3.9 |

|

Thailand |

16,786 |

3.5 |

|

Rest of the World |

95,193 |

19.7 |

|

Total |

483,674 |

100 |

Source: USITC

Fluorspar is a key raw material component of the hydrofluoric acid supply chain. Other context of use cases apart from hydrofluoric acid, include fluorocarbons and refrigerants. It is also used in steel manufacturing and is a vital material for fluxes. In the 2022 fourth quarter, imports of some fluorine-constituted materials produced using fluorspar were 16,500 tons of hydrofluoric acid, 5,010 tons of aluminum fluoride, and 6,470 tons of cryolite. For the entire 2022, the U.S. imports of these materials were 99,400 tons of hydrofluoric acid, 21,200 tons of aluminum fluoride, and 27,800 tons of cryolite. Mexico emerged as the key hydrofluoric acid supplier, ascribing to 83% of imports in 2022 Q4, and 88% cumulatively for 2022. Furthermore, the acid-grade fluorspar annual unit value of imports reached USD 384 per metric ton, marking a 19% surge from 2021, which was USD 322 per metric ton.

Mongolia is the biggest exporter of fluorspar (<97% calcium fluoride), with a global export trade value of USD 107 million. It is the world's 3176th most traded product, with an overall trade value of USD 384 million as reported in 2022 by the OEC. The key exporters include Mongolia (USD 107 million, 27.9% share), China (USD 105 million, 27.4% share), Mexico (USD 37.6 million, 9.8% share), South Africa (USD 23 million, 5.9% share), and Pakistan (USD 20.9 million, 5.4% share). Mongolia plays a pivotal role in the global mining sector and has drawn international attention to a plethora of resources and opportunities the country offers. In 2023, the Mongolian mining sector witnessed a 24% rise in gross domestic products, 72% growth in industrialization, 94% in total exports, 83% in FDI, and a 25% rise in state budget.

Year-on-year trajectory of Mongolia Flurospar exports (Volume in Thousand Tons)

|

Year |

Export volume |

|

2019 |

699 |

|

2020 |

679 |

|

2021 |

644 |

|

2022 |

388 |

|

2023 |

744 |

Source: Mongolian Association of Fluorite Miner, Manufacturer, and Exporter

The world trade of hydrofluoric acid (hydrogen fluoride) was USD 1.13 billion in 2022, wherein China surfaced as a top exporter, valuing USD 537 million. It is the 997th most exported product from the country and primarily destined for South Korea (USD 10.3 million), Japan (USD 5.9 million), Chinese Taipei (USD 4.4 million), Brazil (USD 927k), and UAE (USD 907k). In October 2024 China's hydrofluoric acid exports were valued at USD 26 million and imports at USD 1.63 million, resulting in a USD 24.4 million positive trade balance. In 2023, prominent companies such as CrimsonLogic (with recorded 98.6k shipments), Itourscm (19.1k), and IKEA Group (48.7k), were at the forefront of shipping hydrofluoric acid from China to the U.S.

Electronic grade hydrofluoric acid market is further driven by the boom in industrial production and capacity utilization of manufacturing assembly. As per a December 2024 Federal Reserve Release, the manufacturing capacity utilization (including HF-based electric utilities) output increased by 1.2% between November 2023 and November 2024.

|

Capacity Utilization |

2023, Nov. |

2024 |

Capacity growth Nov.’23- Nov.’24 |

||||||||

|

June |

July |

Aug. |

Sep. |

Oct.

|

Nov. |

||||||

|

Total industry Previous estimates |

78.4 |

78.2 78.2 |

77.6 77.6 |

77.9 77.9 |

77.4 77.4 |

77.0 77.1 |

76.8 |

1.2 |

|||

|

Manufacturing Previous estimates |

77.7 |

77.2 77.2

|

76.6 76.7 |

77.0 77.0 |

76.6 76.7 |

75.9 76.2 |

76.0 |

1.3 |

|||

|

Mining |

89.2 |

89.2 |

88.8 |

90.1 |

89.6 |

89.5 |

88.8 |

-8 |

|||

|

Utilities (including electric & electronics) |

72.5 |

73.2 |

72.1 |

71.1 |

70.5 |

71.2 |

70.0 |

3.6 |

|||

Source: Federal Reserve