Electronic Grade Hydrofluoric Acid Market Outlook:

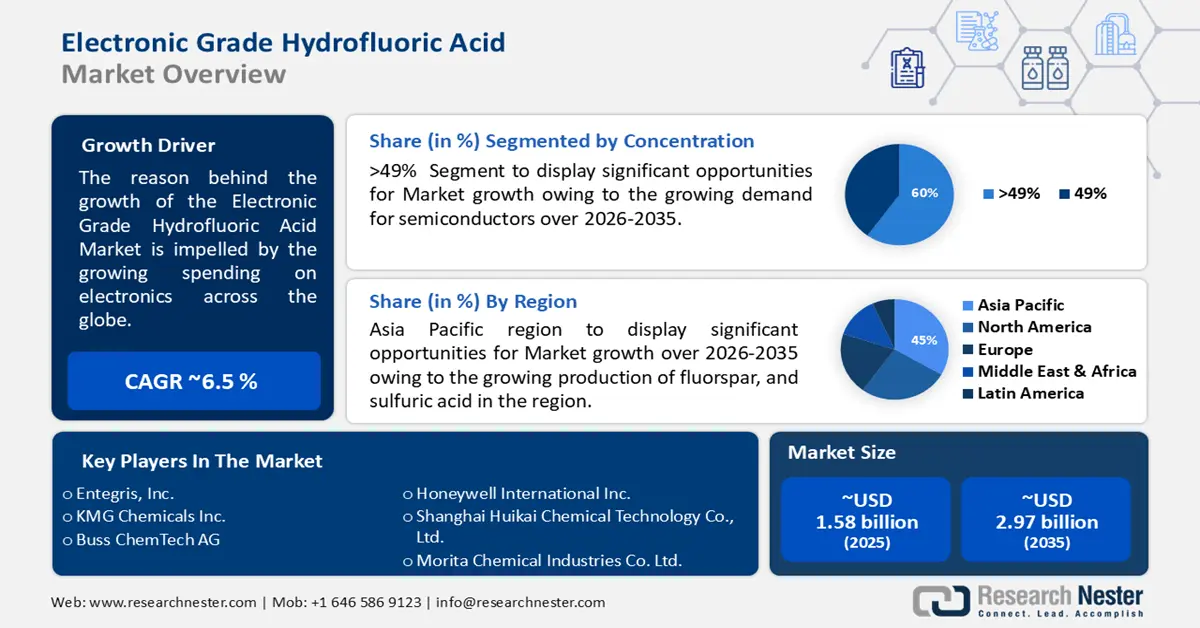

Electronic Grade Hydrofluoric Acid Market size was over USD 1.58 billion in 2025 and is poised to exceed USD 2.97 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic grade hydrofluoric acid is estimated at USD 1.67 billion.

The electronic grade hydrofluoric acid market is predominantly driven by steep growth in consumer electronics and semiconductors. The producer pricing index (PPI) for the electronic product manufacturing sector in the U.S. showcased a steady month-on-month rise. The PPI in November 2024 was 102.827, a percent change of 0.2% from October 2024, signifying a growth in the prices that domestic manufacturers received on electronic goods.

U.S. general imports of electronic products by selected trading partner countries in 2020 by value (USD millions) & share (%)

|

Country |

Value |

Share |

|

China |

160,999 |

33.3 |

|

Mexico |

80,092 |

16.6 |

|

Taiwan |

32,212 |

6.7 |

|

Malaysia |

30,877 |

6.4 |

|

Vietnam |

29,347 |

6.1 |

|

Japan |

19,292 |

4.0 |

|

South Korea |

18,876 |

3.9 |

|

Thailand |

16,786 |

3.5 |

|

Rest of the World |

95,193 |

19.7 |

|

Total |

483,674 |

100 |

Source: USITC

Fluorspar is a key raw material component of the hydrofluoric acid supply chain. Other context of use cases apart from hydrofluoric acid, include fluorocarbons and refrigerants. It is also used in steel manufacturing and is a vital material for fluxes. In the 2022 fourth quarter, imports of some fluorine-constituted materials produced using fluorspar were 16,500 tons of hydrofluoric acid, 5,010 tons of aluminum fluoride, and 6,470 tons of cryolite. For the entire 2022, the U.S. imports of these materials were 99,400 tons of hydrofluoric acid, 21,200 tons of aluminum fluoride, and 27,800 tons of cryolite. Mexico emerged as the key hydrofluoric acid supplier, ascribing to 83% of imports in 2022 Q4, and 88% cumulatively for 2022. Furthermore, the acid-grade fluorspar annual unit value of imports reached USD 384 per metric ton, marking a 19% surge from 2021, which was USD 322 per metric ton.

Mongolia is the biggest exporter of fluorspar (<97% calcium fluoride), with a global export trade value of USD 107 million. It is the world's 3176th most traded product, with an overall trade value of USD 384 million as reported in 2022 by the OEC. The key exporters include Mongolia (USD 107 million, 27.9% share), China (USD 105 million, 27.4% share), Mexico (USD 37.6 million, 9.8% share), South Africa (USD 23 million, 5.9% share), and Pakistan (USD 20.9 million, 5.4% share). Mongolia plays a pivotal role in the global mining sector and has drawn international attention to a plethora of resources and opportunities the country offers. In 2023, the Mongolian mining sector witnessed a 24% rise in gross domestic products, 72% growth in industrialization, 94% in total exports, 83% in FDI, and a 25% rise in state budget.

Year-on-year trajectory of Mongolia Flurospar exports (Volume in Thousand Tons)

|

Year |

Export volume |

|

2019 |

699 |

|

2020 |

679 |

|

2021 |

644 |

|

2022 |

388 |

|

2023 |

744 |

Source: Mongolian Association of Fluorite Miner, Manufacturer, and Exporter

The world trade of hydrofluoric acid (hydrogen fluoride) was USD 1.13 billion in 2022, wherein China surfaced as a top exporter, valuing USD 537 million. It is the 997th most exported product from the country and primarily destined for South Korea (USD 10.3 million), Japan (USD 5.9 million), Chinese Taipei (USD 4.4 million), Brazil (USD 927k), and UAE (USD 907k). In October 2024 China's hydrofluoric acid exports were valued at USD 26 million and imports at USD 1.63 million, resulting in a USD 24.4 million positive trade balance. In 2023, prominent companies such as CrimsonLogic (with recorded 98.6k shipments), Itourscm (19.1k), and IKEA Group (48.7k), were at the forefront of shipping hydrofluoric acid from China to the U.S.

Electronic grade hydrofluoric acid market is further driven by the boom in industrial production and capacity utilization of manufacturing assembly. As per a December 2024 Federal Reserve Release, the manufacturing capacity utilization (including HF-based electric utilities) output increased by 1.2% between November 2023 and November 2024.

|

Capacity Utilization |

2023, Nov. |

2024 |

Capacity growth Nov.’23- Nov.’24 |

||||||||

|

June |

July |

Aug. |

Sep. |

Oct.

|

Nov. |

||||||

|

Total industry Previous estimates |

78.4 |

78.2 78.2 |

77.6 77.6 |

77.9 77.9 |

77.4 77.4 |

77.0 77.1 |

76.8 |

1.2 |

|||

|

Manufacturing Previous estimates |

77.7 |

77.2 77.2

|

76.6 76.7 |

77.0 77.0 |

76.6 76.7 |

75.9 76.2 |

76.0 |

1.3 |

|||

|

Mining |

89.2 |

89.2 |

88.8 |

90.1 |

89.6 |

89.5 |

88.8 |

-8 |

|||

|

Utilities (including electric & electronics) |

72.5 |

73.2 |

72.1 |

71.1 |

70.5 |

71.2 |

70.0 |

3.6 |

|||

Source: Federal Reserve

Key Electronic Grade Hydrofluoric Acid Market Insights Summary:

Regional Highlights:

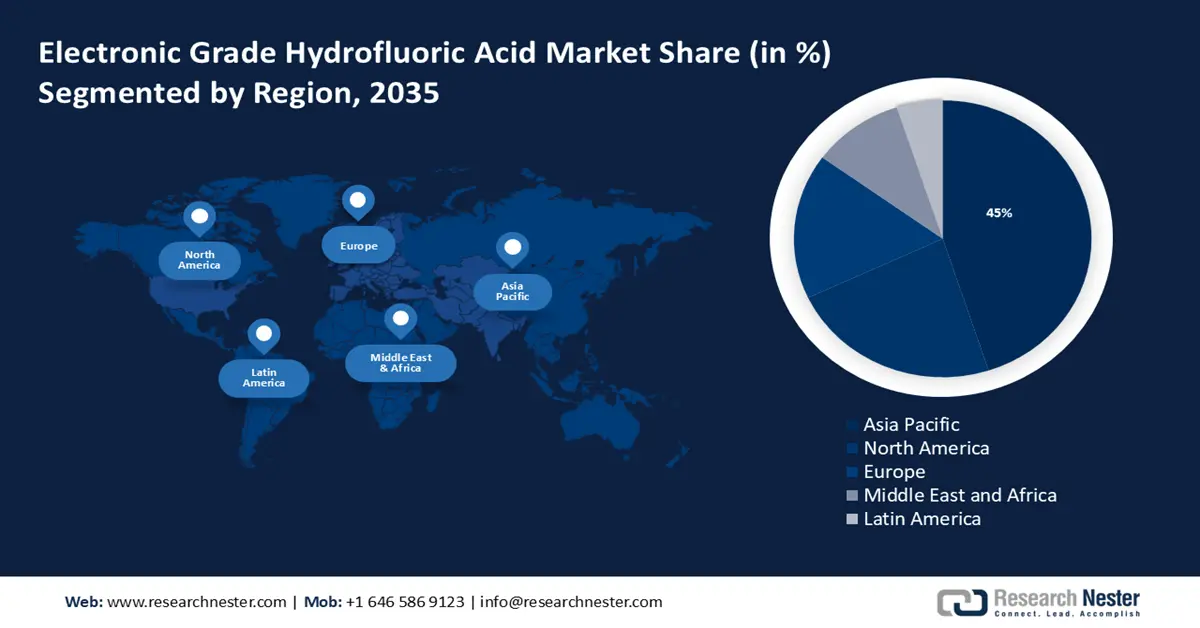

- The Asia Pacific electronic grade hydrofluoric acid market is expected to capture 45% share by 2035, driven by the growing production of fluorspar and sulfuric acid.

Segment Insights:

- The >49% concentration segment in the electronic grade hydrofluoric acid market is set for significant expansion by 2035, fueled by growing demand for semiconductors and advances in etching technology.

Key Growth Trends:

- Massive growth in semiconductor manufacturing

- Rising adoption of renewable energy

Major Challenges:

- Fluctuations in the prices of raw materials

Key Players: Honeywell International Inc., Zhejiang Juhua Hanzheng New Materials Co., Ltd, Shanghai Changhua New Energy & Technology Co. Ltd., KMG Chemicals Inc., Do-Fluoride Chemicals Co., Ltd., Entegris, Inc., Suzhou Crystal Clear Chemical Co., Ltd, Morita Chemical Industries Co. Ltd., Buss ChemTech AG, Zhejiang Sanmei Chemical Incorporated Company.

Global Electronic Grade Hydrofluoric Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.58 billion

- 2026 Market Size: USD 1.67 billion

- Projected Market Size: USD 2.97 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 16 September, 2025

Electronic Grade Hydrofluoric Acid Market Growth Drivers and Challenges:

Growth Drivers:

- Massive growth in semiconductor manufacturing: A robust semiconductor manufacturing framework and infrastructure have become pivotal for a country’s economic competitiveness. The U.S. semiconductor sector has persistently remained a major contender, capturing 40-50% of global revenue. However, in the next five years, China plans to do 40% capacity additions to further consolidate the market. Booming semiconductor demand has prompted investments to surge chip production. Owing to the landmark CHIPS and Science Act, the U.S. is anticipated to capture a significant new private investment share in semiconductor production.

As of August 2024, the key players operating in the semiconductor sector had announced over 90 new production projects in the United States. Approximately, USD 450 billion of investments are already made since CHIPS was first introduced in Congress across 28 states. These investments are estimated thousands of direct and additional jobs in the electronic grade hydrofluoric acid market. - Rising adoption of renewable energy: Electronic grade hydrofluoric acid is frequently used to clean silicon wafers in photovoltaic cells. These are the primary component of silicon-based solar cells that use silicon as their basis to convert sunlight into electricity. For instance, by 2026, renewable energy sources will contribute over 92% of the increase in global power capacity; solar photovoltaics alone will account for more than half of this increase.

Challenge

- Fluctuations in the prices of raw materials: Calcium and fluorine combine to form the industrial mineral fluorite which is mined in more than 15 nations. Moreover, fluorite tends to shatter into tiny fragments after being mined, which makes it challenging to extract, and owing to stringent mining regulations and safety checks, the supply of fluorspar is expected to remain limited, which may hamper the electronic grade hydrofluoric acid market growth.

Electronic Grade Hydrofluoric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.58 billion |

|

Forecast Year Market Size (2035) |

USD 2.97 billion |

|

Regional Scope |

|

Electronic Grade Hydrofluoric Acid Market Segmentation:

Concentration Segment Analysis

The >49% concentration segment in the electronic grade hydrofluoric acid market is estimated to gain a robust revenue share of 60% in the coming years owing to the growing demand for semiconductors. The worldwide semiconductor market is expected to reach trillion-dollar by 2030 and is expected to increase at a rate of over 9% over the next ten years. This is attributed to widespread deployment of 5G, the growing need for smartphones, and the robust demand for AI chips. Etching is a sophisticated technology used in the semiconductor industry that is vital for selectively removing material layers from semiconductor wafers. >49% concentration HF specifically caters to the electronics industry to clean silicon wafers and etch semiconductors. The advancements in semiconductor technologies, such as the development of smaller transistor structures, necessitate more sophisticated etching and cleaning processes, thus driving the demand for high-purity HF.

Application Segment Analysis

The semiconductors segment in electronic grade hydrofluoric acid market is set to garner a notable share by 2035. Chip manufacturing in the U.S. for instance, is estimated to reach 28% of global capacity by 2032 and account for 28% of the overall capital expenditures (capex) between 2024 and 2032, according to the Semiconductor Industry Association (SIA). For better context, in the absence of CHIPS Act implementation, the U.S. would have captured only 9% of the capex by the end of 2032. The CHIPS Program Office (CPO) is making significant progress in the deployment of the USD 39 billion worth of the CHIPS manufacturing incentives program. Consistent with its vision, the CHIPS and Science Act incentives disclosed their efforts to enhance national security, boost the U.S. economy, and create employment. As of August 2024, the CPO has revealed 17 preliminary agreements valuing more than USD 28 billion in loans and USD 32 billion in grants for 26 projects across 16 states.

Our in-depth analysis of the global electronic grade hydrofluoric acid market includes the following segments:

|

Grade Type |

|

|

Concentration |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Grade Hydrofluoric Acid Market Regional Analysis:

APAC Market Insights

Electronic grade hydrofluoric acid market in Asia Pacific industry is expected to dominate majority revenue share of 45% by 2035 impelled by the growing production of fluorspar, and sulfuric acid. With a plethora of Mesozoic igneous rocks and significant reserves of fluorspar, China is by far the world's leading producer of fluorspar from mines. For instance, China continues to be the world's largest producer of fluorspar, producing around 5 million tonnes, or over 55% of the entire volume. Particularly, in 2022, China accounted for a significant global fluorspar mining production, with over 5 million metric tons produced. In addition, China generated more than 90 million metric tons of sulfuric acid in 2022.

Japan is pursuing several cooperative efforts with the U.S. to enhance semiconductor supply chain resilience, including the National Semiconductor Technology Center (NSTC), U.S.-Japan Commercial and Industrial Partnership (JUCIP), Japan’s Leading-Edge Semiconductor Technology Center (LSTC), and the U.S.-Japan University Partnership for Workforce Advancement and Research & Development in Semiconductors (UPWARDS) initiative. Furthermore, Japan has established itself as a major technological and industrial hub in the world map and has emerged as a key contributor of fluorspar to other countries.

North America Market Insights

The North America electronic grade hydrofluoric acid market is estimated to be the second largest regional segment by 2035. In May 2023, the U.S. and Canada established the first North America Semiconductor Conference to strengthen the region’s semiconductor supply chain, comprising workforce and critical minerals. In subsequent dialogues, the governments are committed to collaborating with academic institutions and the private sector to develop policies that will progress regional competitiveness in manufacturing of electronic-grade hydrofluoric acid and semiconductors.

The U.S. electronic grade hydrofluoric acid market is set to experience steep growth owing to supportive government reforms in semiconductor production under the CHIPS and Science Act. These projects include a total investment of USD 350 billion and are anticipated to create 118,000 new employment opportunities, comprising 78,000 construction jobs and 38,000 manufacturing jobs. Furthermore, the Departments of Commerce and Defense is anticipated to receive R&D funding of USD 13 billion as part of the CHIPS Act to boost semiconductor production. U.S. fab capacity is projected to surge by 203% by the end of 2023, thereby tripling U.S. capacity. The U.S. plans to over one-quarter (28%) of the worldwide capex between 2024-2032, an amount estimated at USD 646 billion. In the absence of the CHIPS Act, the U.S. would have captured only 9% of global capex by 2032.

Electronic Grade Hydrofluoric Acid Market Players:

- Solvay S.A

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.,

- Zhejiang Juhua Hanzheng New Materials Co., Ltd

- Shanghai Changhua New Energy & Technology Co. Ltd.,

- KMG Chemicals Inc.

- Do-Fluoride Chemicals Co., Ltd.

- Entegris, Inc.

The market is highly competitive owing to the consolidation of raw material supply in a handful of countries and larger players. Companies are thereby adopting strategic initiatives such as mergers & acquisitions, geographical expansions, capitalizing on supportive government reforms, and seeking investments to strengthen their position in the market. Some of the prominent players operating in the electronic grade hydrofluoric acid market include:

Recent Developments

- In October 2024, Taiwan Semiconductor Manufacturing Company was actively pursuing to establish a green circular regeneration system using electronics grade chemical recycling program.

- In October 2023, Entegris accomplished the sale of Electronic Chemicals Business to Fujifilm. The company sold it for USD 700 million in cash and the transaction was declared on May 2023.

- Report ID: 5896

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Grade Hydrofluoric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.