Electronic Data Interchange Software Market Outlook:

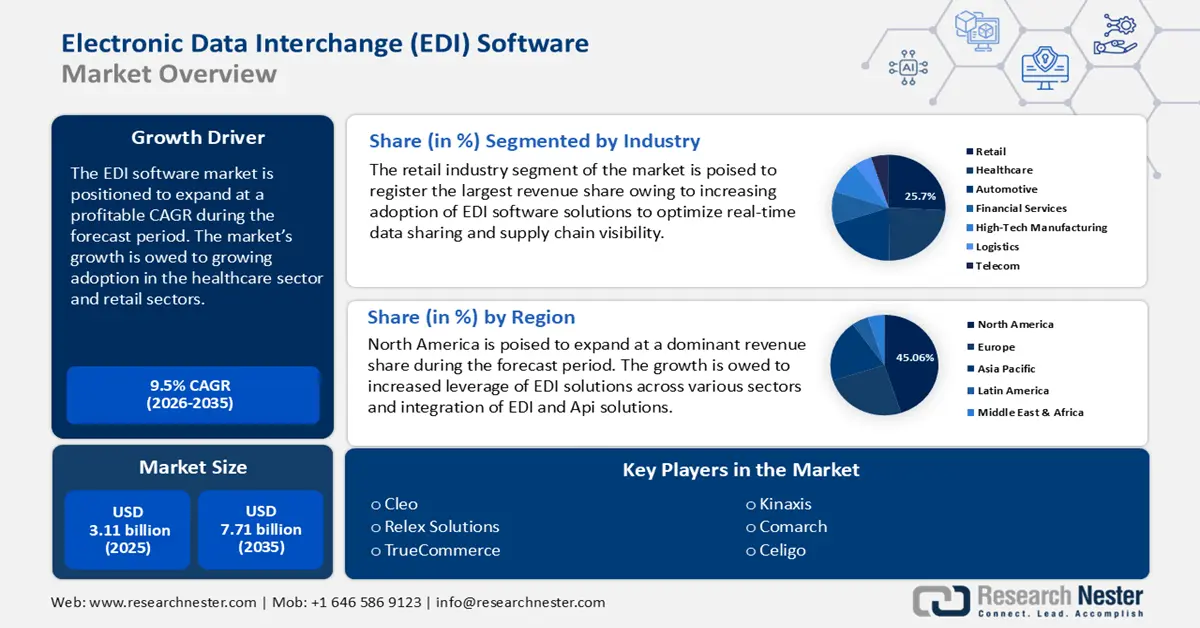

Electronic Data Interchange Software Market size was over USD 3.11 billion in 2025 and is projected to reach USD 7.71 billion by 2035, growing at around 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic data interchange software is evaluated at USD 3.38 billion.

The sector’s robust growth trajectory is attributed to a global push for digitalization and automation spanning across industries. The rapid integration of generative artificial intelligence (AI) solutions to EDI is boosting automated data mapping and increasing adoption across businesses. For instance, in December 2023, Accenture and McDonald’s Corporation announced the expansion of the partnership to execute generative AI solutions across the latter’s restaurants worldwide for operational efficiency.

Industries reliant on just-in-time delivery models are merging with EDI solutions due to improved efficiency and an increase in international sourcing. For instance, in May 2024, Kinaxis was selected by Harley-Davidson as its supply chain management platform solution. Additionally, the growth of e-commerce platforms is positioned to accelerate the adoption of EDI systems as businesses seek to manage inventory and vendor relationships effectively. Key players are investing to expand and improve B2B inventory management solutions to leverage the rising demands. For instance, in June 2023, Unicommerce in India launched its advanced inventory management solution with real-time inventory synchronization capabilities.

The electronic data interchange (EDI) software market is projected to present significant revenue streams due to expansion of EDI into emerging economies. Middle-and-low-income countries in APAC, Latin America, and Africa are experiencing a surge in digitization that can be leveraged by businesses providing B2B communication solutions. Additionally, EDI is increasingly adopted in banking and financial services boosting the sector’s growth. For instance, in September 2024, the Press Information Bureau (PIB) of the Government of India reported a surge in digital payment transactions across the country, from 252.6 million transactions in FY 2017-18 to 226.9 million transactions in FY 2023-24. By the end of the forecast period, the global EDI software market is poised to benefit from the growing focus on interoperability for vendors to develop industry-specific EDI solutions for evolving client needs, and maintain its profitable growth curve.

Key Electronic Data Interchange EDI Software Market Insights Summary:

Regional Highlights:

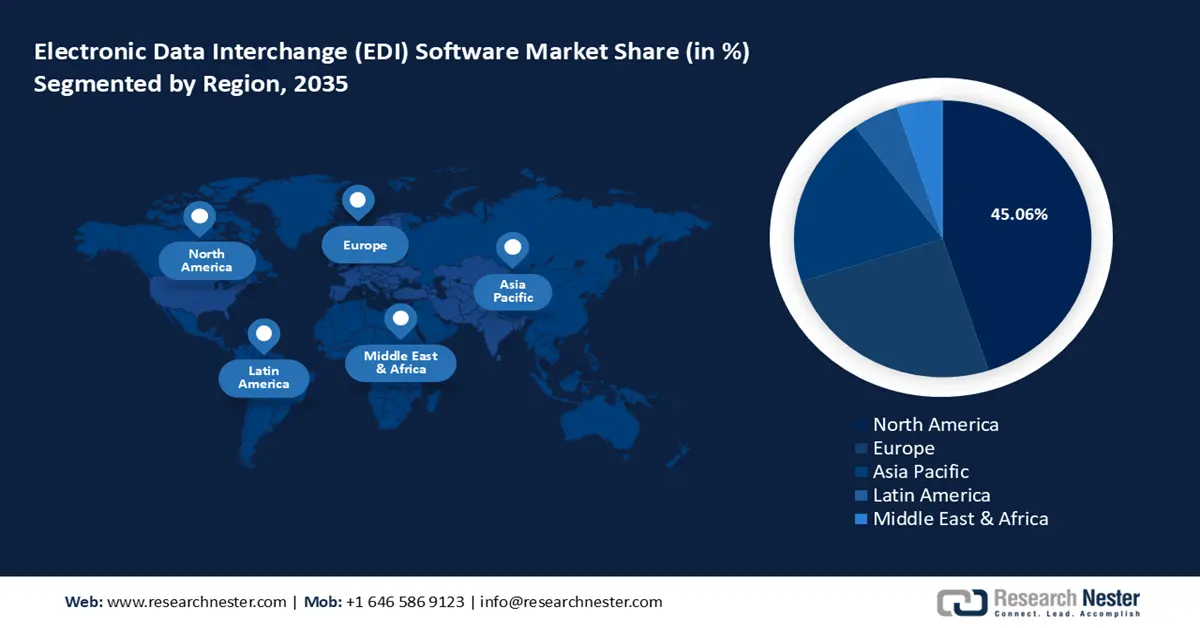

- North America electronic data interchange (EDI) software market will account for 45.06% share by 2035, driven by the expansion of end users of EDI software solutions.

- Europe market will exhibit the fastest growth during the forecast period 2026-2035, driven by the calls to minimize paper-based processes.

Segment Insights:

- The retail segment in the electronic data interchange software market is projected to hold a significant share by 2035, driven by real-time communication needs and omnichannel retail trends.

- The hybrid (electronic data interchange software market) segment in the electronic data interchange software market is projected to hold the largest share by 2035, driven by integration of cloud-based and on-premise EDI solutions.

Key Growth Trends:

- Increasing adoption in the healthcare sector

- Growing blockchain integration with EDI

Major Challenges:

- Lack of standardization

- Lack of standardization

Key Players: Cleo, Relex Solutions, Kinaxis, Celigo, TrueCommerce, Jitterbit, InterTrade Systems, Comarch, MuleSoft LLC.

Global Electronic Data Interchange EDI Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.11 billion

- 2026 Market Size: USD 3.38 billion

- Projected Market Size: USD 7.71 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.06% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Electronic Data Interchange Software Market Growth Drivers and Challenges:

Growth Drivers

- Increasing adoption in the healthcare sector: The surging adoption of electronic data interchange in healthcare is poised to boost the growth of the EDI sector. Stringent regulatory frameworks such as the Health Insurance Portability and Accountability Act (HIPAA) and calls to improve operational efficiency are poised to increase EDI adoption. Electronic data interchange vendors can leverage the trends by providing solutions for seamless healthcare data exchange. For instance, in September 2024, HealthEdge and Edifecs announced a strategic collaboration to make it easier for payers to exchange and connect healthcare data.

Additionally, the rise of telemedicine and digital health platforms amplifies the necessity for secure data sharing void of hiccups. The sector is poised to leverage trends of increased digitization trends in healthcare to provide profitable growth opportunities for EDI vendors during the forecast period. - Growing blockchain integration with EDI: The growing integration of blockchain technology into EDI systems is positioned to improve supply chain operations worldwide. The cryptographic techniques of blockchain along with EDI ensure a tamper-proof exchange of data, and reduce the risk of fraud due to the decentralized nature. The combination of EDI and blockchain can facilitate enhanced compliance with global trade regulations by maintaining rigid records of transactions.

Additionally, the cloud migration of EDI vendors provides scalable infrastructure for blockchain-enabled systems. For instance, in July 2024, CertiK announced the migration of its cloud infrastructure in Asia to Alibaba to improve the security, reliability, and cost-efficiency of CertiK's blockchain applications. The favorable trends are positioned to boost the growth of the electronic data interchange software market during the forecast period. - Investments in post-pandemic supply chain resilience: The COVID-19 pandemic had a profound impact on renewed investments to boost supply chain resilience benefiting the electronic data interchange software sector. The acceleration of EDI adoption across various industries is owed to post-pandemic investments in creating resilient supply chains. Businesses are prioritizing technologies that can ensure continuity in the face of disruptions.

Sectors such as FMCG are increasingly leveraging EDI solutions to strengthen supply chains worldwide. EDI vendors are set to benefit from the growth opportunities by positioning customized solutions to businesses. For instance, in October 2024, Loren Data Corporation announced the release of specialized EDI map packs for retail and hardline businesses.

Challenges

- Lack of standardization: The lack of universally accepted EDI standards across industries and regions can be a challenge for the electronic data interchange software sector. For instance, North America uses ANSI X12 as the most common EDI standard while Europe uses UN/EDIFACT. The lack of standardization can cause delays in processing of transactions.

- Concerns related to data security: The EDI sector faces challenges regarding concerns over the security of sensitive business data. The exchange of financial and personal information of businesses via EDI have to comply with stringent data protection laws such as GDPR in Europe and HIPAA in the U. S. The rising cases of cyberattacks on cloud-storages pose challenges to the sector, with blockchain integration set to mitigate risks to data security.

Electronic Data Interchange Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 3.11 billion |

|

Forecast Year Market Size (2035) |

USD 7.71 billion |

|

Regional Scope |

|

Electronic Data Interchange Software Market Segmentation:

Industry Segment Analysis

Retail segment is anticipated to dominate around 25.7% electronic data interchange (EDI) software market share by the end of 2035. The adoption of EDI in retail sector is increasing owing to real-time communication between suppliers, distributors, and retailers facilitated by EDI solutions. The trends and innovations in the retail sector indicates the rise of omnichannel retailing necessitating retailers to adopt enhanced EDI solutions to synchronize data across e-commerce platforms, physical stores, and third-party logistics. For instance, in July 2023, Jitterbit launched Harmony EDI, i.e., a cloud-based EDI solution providing ease in managing and configuring trade partners. Additionally, the expansion of cross border trade drives demand for streamlined communication, benefiting adoption of EDI to manage international invoicing.

The healthcare segment of the EDI software market is poised for increased adoption of EDI solutions. The growth is owed to the increasing need for efficient data exchange between healthcare providers, insurers, and patients. EDI solutions are experiencing surging adoption in the healthcare sector due to a rise in value-based care models that necessitate seamless data integration to efficiently track patient outcomes. For instance, in October 2024, Edifecs Inc., announced participation at the Workgroup for Electronic Data Interchange National Conference 2024 to discuss the future of healthcare data sharing and interoperability. Additionally, the shift towards electronic health records (EHR) and interoperability demand between healthcare systems is poised to drive the continued growth of the sector.

Type Segment Analysis

The hybrid segment of electronic data interchange (EDI) software market is poised to attain the largest revenue share during the forecast period. The rising integration of cloud-based and on-premise EDI solutions boosts the growth of the market. The hybrid EDI solutions allow organizations to leverage the scalability and cost-effectiveness of cloud solutions as well as the combine the customization offered by on-premise systems. Businesses with complex legacy systems require integration with new cloud technologies to expand functionalities.

Additionally, hybrid models support faster data exchange, increasing adoption rates. Vendors are poised to leverage the surging demands by positioning their solutions. For instance, in November 2023, AWS B2B Data Interchange was launched facilitating organizations to automate and monitor EDI-based business transactions at a cloud scale.

Our in-depth analysis of the Electronic Data Interchange (EDI) Software Market includes the following segments:

|

Industry |

|

|

Type |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Data Interchange Software Market Regional Analysis:

North America Market Insights

North America in electronic data interchange (EDI) software market is expected to hold over 45.06% revenue share by the end of 2035. The expansion of end users of EDI software solutions is a major growth driver of the regional market. Industries such as retail, manufacturing, and healthcare are driving demands for EDI software solutions owing to the digital transformation and to streamline supply chains. For instance, in June 2024, Oracle launched the Oracle Health Insurance Data Exchange Cloud Service to assist healthcare insurers simplify complex data exchange requirements.

The U.S. leads the revenue share in the EDI software market of North America. The growth of the domestic U.S. market is owed to rising integration between EDI and application programing interface (API) systems. The trends are favorable for businesses that are offering hybrid solutions for efficient data exchange across different platforms. For instance, in May 2024, TrueCommerce launched EDI integration with the SAP S/4HANA Cloud Public Edition that is poised to be groundbreaking for the industry.

Additionally, EDI software solutions are increasingly leveraged in cross-border transactions boosted by the support from U.S. Customs and Border Protection. For instance, in May 2023, the U.S. Customs and Border Protection release guidelines and benefits of filing data through EDI for cross-border transactions.

Canada is a major contributor to the revenue share of the electronic data interchange (EDI) software market of North America. The domestic market is positioned to leverage favorable trends to increase market share by the end of the forecast period. In addition to various sectors in the country leveraging EDI software solutions to streamline tasks, the increase in cross-border trade of Canada, particularly with the U.S., drives demand for EDI solutions. The country has profitable mining and energy sector, that leverages EDI solutions to optimize procurement and inventory management to curb operational delays.

Businesses are poised to leverage the opportunities in the domestic electronic data interchange (EDI) software market of Canada by forwarding new solutions. For instance, in August 2024, Celigo announced the launch of B2B manager designed to simplify self-service EDI management.

Europe Market Insights

Europe is projected to exhibit the fastest growth in the electronic data interchange (EDI) software market during the forecast period. A key driver of the sector in the region is the calls to minimize paper-based processes. Regulatory requirements such as eInvoicing directive, that requires EU public administrations to receive all electronic invoices issued under contracts where EU public procurement directives apply boost adoption of EDI solutions to improve transparency. Additionally, the push for unified digital economy boosts larger adoption of cross-border EDI solutions. For instance, in August 2024, the European Union and China launched cross-border data flow communication mechanism.

The electronic data interchange software sector in Germany is poised to thrive by the end of the forecast period. The industry 4.0 initiatives of Germany boosts adoption of EDI software solutions to optimize the management of supply chain and provide support o just-in time production strategies. The export-driven economy of Germany requires seamless data exchange with international trade partners, boosting the adoption of hybrid EDI solutions. For instance, in 2022, the World Bank estimated overall exports from Germany at USD 1.7 billion.

Additionally, initiatives boosting digitization in the country encourages adoption of EDI in sectors such as retail and logistics. For instance, in November 2024, Wipro announced strategic partnership with RELEX solutions to optimize end-to-end retail operations and inventory planning.

The electronic data interchange software sector of France is poised to increase its revenue share during the forecast period by leveraging favorable trends in Europe benefiting EDI vendors. The automotive and retail sectors in France are increasingly adopting EDI solutions to improve efficiency of business. Additionally, the B2B e-invoicing mandates that necessitates suppliers and public administrators to exchange electronic invoices through the Chorus Pro Platform, is poised to increase adoption of EDI solutions. Domestic businesses in France can leverage the opportunities by tailoring EDI solutions in compliance with the General Data Protection Regulation (GDPR) of the European Union.

Businesses are investing on B2B EDI solutions to transform their supply chains and increase revenue shares. For instance, in February 2024, Rexel France announced Relex Solutions to automate and optimize its French subsidiary’s supply chain forecasting, planning and replenishment processes.

Electronic Data Interchange Software Market Players:

- Cleo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Relex Solutions

- Kinaxis

- Celigo

- TrueCommerce

- Jitterbit

- InterTrade Systems

- Comarch

- MuleSoft LLC

The electronic data interchange software sector is poised for a profitable growth curve during the forecast period. The key players in the market are investing in providing hybrid EDI solutions to improve their portfolios to increase the scope of services for multiple end user industries.

Here are some key players in the EDI software market:

Recent Developments

- In November 2024, Cleo and Logan Consulting announced partnership to empower businesses with scalable integration solutions across ERP and B2B e-commerce platforms. The partnership will allow Cleo to provide a fully integrated, efficient, and user-friendly B2B EDI solution.

- In July 2024, ThroughPut.Ai released new inventory management capabilities to boost revenues and optimize costs. The current release enables businesses to minimize the risk of overstocking and stockouts by leveraging AI insights offered by inventory projection, predictions, and recommendations for short, mid, and long-term needs.

- Report ID: 6762

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Data Interchange EDI Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.