Electronic Board Level Underfill and Encapsulation Material Market Outlook:

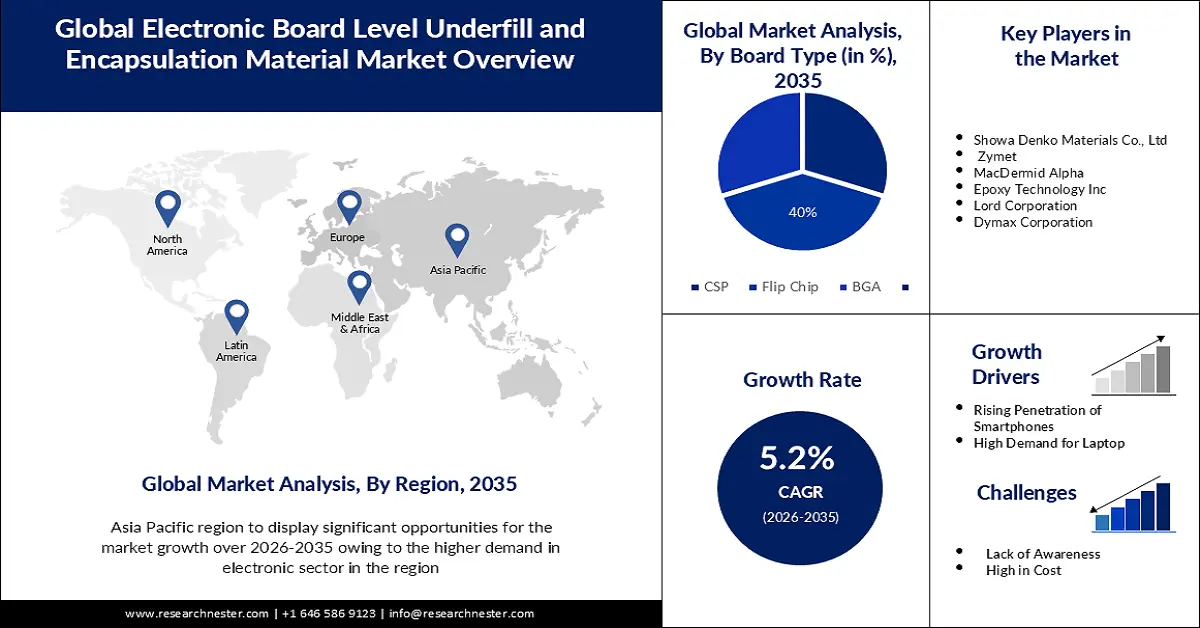

Electronic Board Level Underfill and Encapsulation Material Market size was over USD 358.63 million in 2025 and is projected to reach USD 595.39 million by 2035, witnessing around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic board level underfill and encapsulation material is evaluated at USD 375.41 million.

In addition to helping to connect the circuit board to the wire and providing impact resistance against falls or sudden temperature changes, electronic circuit board level underfill and encapsulation materials are an integral part of smartphones. With growing production to meet consumer demand for new and fresh models, the demand for mobile phones is accelerating around the world. For example, according to data from the Consumer Technology Association in October 2020, sales of smartphones will increase by 2022, with 76% of all mobile phones having 5G capability.

As electronic devices become smaller, the number of components on a circuit board increases. This evolving trend is driving demand for thinner, smaller, and more highly integrated circuit boards featuring flip-chip technology. Nanotechnology and microelectromechanical systems are gaining capabilities and acceptance in a variety of industries, including consumer electronics and others. The need for printed circuit boards (PCBs) will increase in the upcoming years due to the present pace of electronic devices shrinking. The utilization of Underfill materials in encapsulation and cavity-filling applications has increased due to the shrinking of electronic devices such as laptops, cellphones, and other consumer electronics products. Consequently, it is anticipated that the demand for electronic board level underfill and encapsulation materials will grow.

Key Electronic Board Level Underfill and Encapsulation Material Market Insights Summary:

Regional Insights:

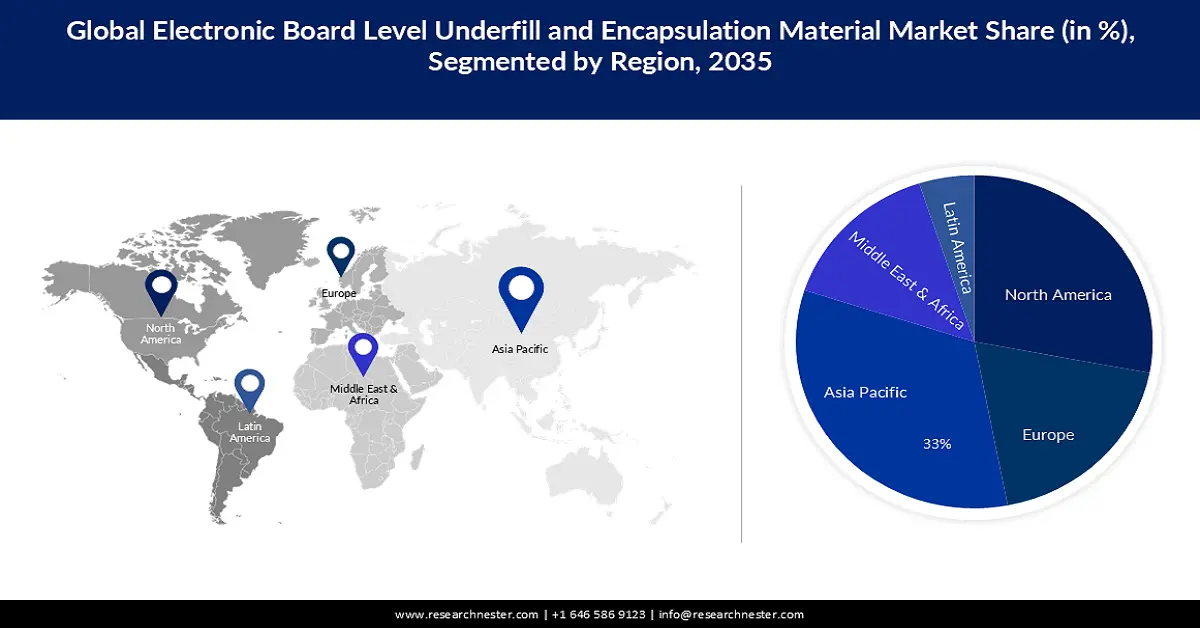

- By 2035, the Asia Pacific region is projected to secure a 33% share in the electronic board level underfill and encapsulation material market, encouraged by the rapid expansion of the consumer electronics sector.

- North America is expected to witness substantial growth through 2035 as rising disposable incomes and elevated spending on electronic devices stimulate higher consumption of board-level underfill materials.

Segment Insights:

- In the electronic board level underfill and encapsulation material market, the epoxy polymer segment is anticipated to record the highest CAGR by 2035, supported by its strong adhesion capabilities and resilience to mechanical and thermal shocks.

- The flip chip segment is set to command a 40% share during the projected period, bolstered by growing miniaturization trends that elevate the need for reliable underfill performance in flip-chip assemblies.

Key Growth Trends:

- Growing Investment in the Electronic Industry

- High Demand for Laptops

Major Challenges:

- Production of Void in Flip Chip

- High Cost of Material is Set to Hamper the Market Growth in the Forecast Period

Key Players: Showa Denko Materials Co., Ltd., Zymet, MacDermid Alpha, Epoxy Technology Inc, Lord Corporation, Dymax Corporation.

Global Electronic Board Level Underfill and Encapsulation Material Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 358.63 million

- 2026 Market Size: USD 375.41 million

- Projected Market Size: USD 595.39 million by 2035

- Growth Forecasts: 5.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Brazil

Last updated on : 27 November, 2025

Electronic Board Level Underfill and Encapsulation Material Market - Growth Drivers and Challenges

Growth Drivers

- Growing Investment in the Electronic Industry - The electronics industry is one of the most dynamic sectors of the economy, and its rapid rise has led to significant changes in financing. The consolidation of manufacturing networks in the electronics sector has benefited the ASEAN region, enabling better trade with Asian economic powers such as China. However, China is important to Asia's electronics sector not just as a rival but as a developing market. China buys raw materials and components from other Asian countries and ships them around the world.

- High Demand for Laptops - Electronic circuit board level underfill materials are widely used in laptops. These are used in a wide range of integrated packages and solid-state drive laptops. The demand for laptops is increasing globally due to increasing production and sales and this is expected to drive the market growth during the forecast period. For example, Lenovo is expanding its local manufacturing capacity in India across various product categories, including laptops, according to his 2021 data from India Brand Equity Foundation.

Challenges

- Production of Void in Flip Chip - One of the main concerns has been the creation of voids in the Flip-chip process, which could have a negative impact on market growth over the forecast period. To demonstrate the reliability of the package, an underfill shall be applied in the manufacture of flip chip devices. The formation of a void, which delays the filling procedure, takes place in the underfill process.

- High Cost of Material is Set to Hamper the Market Growth in the Forecast Period

- Lack of Awareness is another Significant Barrier for the Market Growth in Upcoming Period

Electronic Board Level Underfill and Encapsulation Material Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 358.63 million |

|

Forecast Year Market Size (2035) |

USD 595.39 million |

|

Regional Scope |

|

Electronic Board Level Underfill and Encapsulation Material Market Segmentation:

Material Type (Quartz/Silicone, Alumina Based, Epoxy Based, Urethane Based, Acrylic Based)

In terms of material type, epoxy polymer segment in the electronic board level underfill and encapsulation material market is anticipated to hold the highest CAGR by the end of 2035. Epoxy polymer-based underfill increases product reliability and provides excellent adhesion to a variety of substrates. In addition, these underfills have excellent resistance to various mechanical and thermal shocks, allowing electronic products to function normally even under large fluctuations in ambient temperature. These diverse properties have led to the increasing use of epoxy polymer-based electronic circuit board-level underfills in the market.

Board Type (CSP, BGA, Flip Chips)

Based on board type, the flip chip segment is set to dominate the electronic board level underfill and encapsulation material market with a share of 40% during the projected period. Electronic circuit board level underfill and encapsulation material is widely used in flip chip applications, where underfill increases the durability of flip chip assemblies and increases the reliability of both electrical connections and physical contact. Rising demand for miniaturization of electronic devices has led to an increase in flip-chip applications and is expected to drive market growth during the estimated period. For example, according to his August 2021 issue of the Journal of the American Society of Mechanical Engineers, with the rapid development of the microelectronics industry, flip-chip applications are widely used in microelectronic packages and devices.

Our in-depth analysis of the global electronic board level underfill and encapsulation material market includes the following segments:

|

Product Type |

|

|

Material Type |

|

|

Board Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Board Level Underfill and Encapsulation Material Market - Regional Analysis

APAC Market Forecasts

The electronic board level underfill and encapsulation material market in the Asia Pacific region is poised to hold the largest revenue share of 33% during the time period between 2024 – 2035. The high demand for underfill materials at the electronic circuit board level is due to the expansion of the consumer electronics sector in the region. The increasing demand for consumer electronics has increased the demand for PCBs, which is expected to increase the demand for underfill materials during the forecast period. According to his May 2021 statistics on China.org.cn, Huawei became his second largest manufacturer in China's notebook field in 2020, with a market share of 16.9%. The consumer electronics and consumer electronics sector is similarly expected to double its current market size, reaching a market value of USD 21.18 billion by 2025, according to statistics from India Brand Equity Foundation. Such a massive expansion of the consumer electronics sector in the region is expected to stimulate the increased use of underfill materials at the electronic circuit board level.

North American Market Statistics

The electronic board level underfill and encapsulation material market in the North America region is predicted to grow significantly during the estimated timeframe. Rapid growth in demand for electronics across the country is expected to increase consumption in the country during the forecast period. Americans' high disposable income and per capita spending has created a huge demand for electronic devices such as home automation equipment, smartphones, laptops, and tablets. This is expected to further increase sales of underfill materials at electronic board level during the forecast period. Similarly, increased shipments of electronic products during the evaluation period will provide growth opportunities for major U.S. manufacturers.

Electronic Board Level Underfill and Encapsulation Material Market Players:

- Protavic America

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Henkel

- Namics AI Technology, Inc

- H.B. Fuller

- Showa Denko Materials Co., Ltd.

- Zymet

- MacDermid Alpha

- Epoxy Technology Inc

- Lord Corporation

- Dymax Corporation

Recent Developments

- MacDermid Alpha stated in December 2021 that it will showcase its underfill solutions from the ALPHA HiTech portfolio at the IPC APEX EXPO in California. MacDermid Alpha will be able to increase the market share of its underfill products portfolio thanks to these advancements.

- Dymax Corporation unveiled Multi Cure -9037-F, an encapsulation for printed circuit board assembly, in June 2020.

- Report ID: 5595

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Board Level Underfill and Encapsulation Material Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.