- In October 2023, Rhythmlink International, LLC declared the launch of a new product family, concentric needles, which will complement their current product line designed especially for NCV and EMG research. By generally recognized workflows, the concentric needle is available in four sizes or gauges, which also differ in needle diameter, length, and colour.

- In May 2023, Startoon Labs, received US FDA (The U.S. Food and Drug Administration) approval for its wearable device PHEEZEE. It is a helpful in assessing joint health during physiotherapy post musculoskeletal, neurological, spinal cord injuries and neuro-ailments such as paralysis, hemiplegia, paraplegia, muscular dystrophy etc. It generates reports, for the first time in the field of physiotherapy, enabling patients to track their recovery.

Electromyography Devices Market Outlook:

Electromyography Devices Market size was valued at USD 1.27 billion in 2025 and is projected to reach USD 3.1 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, from, 2026-2035. In 2026, the industry size of electromyography devices is evaluated at USD 1.33 billion.

The electromyography (EMG) devices market is experiencing remarkable evolution globally due to a bunch of converging trends. The first enabler is the increasing use of portable and wireless EMG systems that allow patients to be monitored remotely from a clinic to their home. This helps to reduce the burden on the patient and also widens access to the market that has ambulatory and rehabilitation modeled scenarios. Developments in EMG systems are starting to include more Artificial Intelligence (AI) and machine learning capabilities. This is affecting the applications of digitally integrating EMG. This improves the accuracy of the EMG performance, improves clinician workload in delivering continuous assessment and management of neuromuscular conditions. Third, the advent of the wearable EMG devices provides an application for performance optimization in sports and rehabilitation, for real-time continuous use.

Moreover, incidence of neurological and musculoskeletal disorders are contributing to the increased demand. The incidence of Parkinson's Disease, and peripheral neuropathies is on the rise across every area of the globe. This emphasizes the need for accessible and accurate EMG diagnostics. Emerging economies in Asia-Pacific and Latin America are growing rapidly driven by developments in healthcare infrastructure, growing disease awareness, and acceptance of digital health solutions. The EMG Devices market is undergoing a transformation due to confluence of technology advances, changes in healthcare delivery models, demographic needs, and market opportunities around wearables and remote monitoring.

Key Electromyography Devices Market Insights Summary:

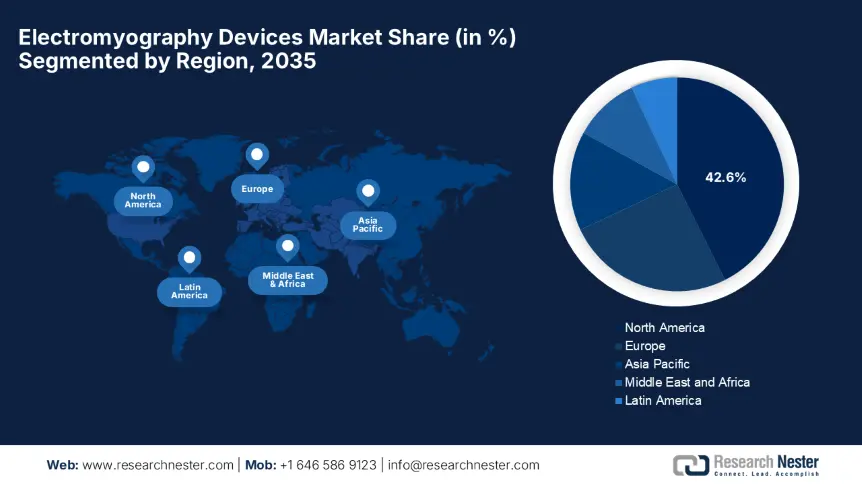

Regional Highlights:

- By 2035, North America is expected to hold a 42.6% share in the electromyography devices market, supported by robust coverage for neuromuscular diagnostics.

- Europe’s electromyography devices market is set to expand substantially through 2026–2035, propelled by rising aging populations and increasing instances of neuromuscular disorders.

Segment Insights:

- By 2035, the needle EMG segment in the electromyography devices market is projected to secure a 42.7% share, bolstered by diagnostic accuracy and favorable reimbursement policies.

- The neurology segment is anticipated to command a 38.4% share by 2035, sustained by rising healthcare spending and supportive government funding for neurotechnology.

Key Growth Trends:

- Rising incidence of neuromuscular disorders

- Growing focus on sports medicine and rehabilitation

Major Challenges:

- High cost of EMG systems

- Data privacy and security concerns

Key Players: Natus Medical Incorporated, Nihon Kohden Corporation, Cadwell Industries, Inc., Noraxon U.S.A. Inc., Compumedics Limited, Medtronic plc, Delsys Inc., ADInstruments, Cometa S.r.l., Neurosoft Ltd., Allengers Medical Systems, NeuroWave Systems Inc., OT Bioelettronica, Zynex, Inc., Biometrics Ltd., Ambu A/S, iWorx Systems Inc., Clarity Medical Pvt. Ltd., Neurosoft Ltd. (Malaysia Branch), Natus Medical (Reconfirmed Branch).

Global Electromyography Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.27 billion

- 2026 Market Size: USD 1.33 billion

- Projected Market Size: USD 3.1 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 12 August, 2025

Electromyography Devices Market - Growth Drivers and Challenges

Growth Drivers

- Rising incidence of neuromuscular disorders: The increased incidence of neuromuscular diseases is generating an increased demand for EMG diagnostic services across the world. A report by Murdoch Children's Research Institute states that every year, between one in 3,500 and 6,000 boys are born with Duchenne muscular dystrophy. Conducting EMG provides for early diagnosis, which aids in determining the most effective treatment plan. This has led to increases in device use and overall demand in hospitals and clinics. The aging population worldwide will continue to compound the impact of neuromuscular diseases. This ensures ongoing demand for EMG technology in clinical and research settings.

- Growing focus on sports medicine and rehabilitation: According to Johns Hopkins University, each year, over 3.5 million injuries occur among players, resulting in some loss of playing time. Electromyography is an emerging area in sports science for monitoring muscle activity, injury prevention, and recovery processes. As more money is being spent on monitoring athletic performance and rehabilitation to improve performance, electromyography technology will be at the forefront of advanced practices in sports medicine. Through instantaneous recording of muscle response, devices that assess these working responses allow practitioners to appropriately monitor their practice activities throughout the training aspect of athlete development.

- Rise in minimally invasive and non-invasive diagnostic procedures: Patients, along with healthcare practitioners, are very interested in non-invasive and minimally invasive diagnostic technologies. Surface electromyography (sEMG) technology is characterized by painless testing and high measurement accuracy. sEMG devices provide certain advantages in pediatric care, physical therapy, and neuro-rehabilitation. Moreover, several companies are developing small, wireless sEMG systems in response to this.

Challenges

- High cost of EMG systems: State-of-the-art EMG devices require a considerable investment to purchase and still require funds to maintain. Many clinics are unable to purchase these devices. Moreover, associated high costs impact reimbursement decisions and budgets of public hospitals. Additionally, the majority of countries have no reimbursement mechanism for allied comprehensive EMG procedures. In developing markets, there is little to no insurance coverage. Even in developed markets, insurers can restrict reimbursement to a limited number of conditions or lower utilization of the equipment, where reimbursement is minimal or non-existent.

- Data privacy and security concerns: Patient data security is a growing concern since wireless EMG devices and cloud storage and processing of EMG data has become so commonplace. Patient data privacy is compounded both technically and legally by compliance. Manufacturers must expend significant resources obtaining regulatory approvals from domestic and international agencies. Rapidly evolving regulations regarding medical devices can create confusion and can significantly delay bringing medical devices to market.

Electromyography Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 1.27 billion |

|

Base Year Market Size (2035) |

USD 3.1 billion |

|

Regional Scope |

|

Electromyography Devices Market Segmentation

Product Type Segment Analysis

Based on product type, the needle EMG segment is anticipated to garner the largest share of 42.7% in the electromyography devices market by the end of 2035. The diagnostic accuracy and favorable reimbursement policies are the key factors positioning the segment at the forefront to generate revenue in this market. Nations such as India and Brazil are opting for public-private partnerships to expand the segment access with a 22% yearly rise in deployments. In summary, the needle EMG component leads because it is more accurate and is growing in emerging markets.

Application Segment Analysis

In terms of application neurology segment is expected to grow at a considerable rate, with a share of 38.4% in the electromyography devices market during the assessed timeframe. Its significance is displayed through the largest proportion of the patient pool affected by neurodegenerative disorders, facilitating the expanded utilization of EMG devices for stroke rehabilitation. Further, advances like wireless, portable, AI-assisted, and cloud-integrated EMG systems are expanding usability. These innovations are broadening market reach and fueling demand in neurology-specific applications. Moreover, rising healthcare spending and supportive government funding for neurotechnology are intensifying adoption in neurology.

End User Segment Analysis

In terms of end end-user hospital segment is likely to grow at a significant rate. Hospitals treat an extensive number of patients. This results in high demand for diagnostic tools such as EMG devices. Furthermore, hospitals accommodate complex cases that require associated diagnostic procedures. Moreover, hospitals employ competent and trained personnel qualified to perform and interpret an EMG test, such as neurologists or clinical neurophysiologists. Due to this highly trained staff, hospitals have a prominent role as users of EMG devices.

Our in-depth analysis of the electromyography devices market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Technology |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electromyography Devices Market - Regional Analysis

North America Market Insights

The North America electromyography devices market is predicted to capture the highest share of 42.6% by the end of 2035. The region’s leadership is attributed to the robust coverage for neuromuscular diagnostics, increasing adoption of AI-integrated portable systems, and substantial R&D investments. Simultaneously, the region’s cutting-edge technological advancements are further solidified by cross-border collaborations, i.e., the U.S. FDA and Health Canada joint review pathway to reduce approval durations.

The U.S. is representing its strong position in the regional electromyography devices market on account of expanded public and private healthcare spending. According to the U.S. Centers for Medicare & Medicaid Services, in 2023, U.S. healthcare spending increased by 7.5% to USD 4.9 trillion, reshaping the foundation of this sector. On the other hand, portable electromyography devices experienced a 36% rise in sales, highlighting the booming demand for these innovative devices and drawing the interest of manufacturers to invest in this technology.

Canada is also portraying steady growth in North America’s electromyography devices market, with remarkable government efforts to enhance neuromuscular care. Furthermore, a 2023 report by the Government of Canada states that over USD 26 million has been invested to promote integrated health care in Canada. This is targeting rural telemedicine with a scope of greater business with cost-optimized solutions.

Europe Market Insights

Europe’s electromyography devices market is set to expand at a remarkable volume over the discussed timeframe. This propagation is highly stimulated by the rising aging populations and increasing instances of neuromuscular disorders. According to the European Commission, over one-fifth (21.6%) of the predicted 449.3 million persons living in the EU as of January 1, 2024, were 65 years of age or older. In addition, the region is a powerhouse of innovation with the presence of leading countries dominating in EMG-adoption and prioritization of neurology diagnostics, hence shaping the future of this landscape.

Germany displays a strong base of reimbursement policies for the electromyography devices market, with the surging demand. Further, growth is also sustained by a rising prevalence of neuromuscular disorders with increased recognition and subsequent demand for precise diagnostics. Additionally, the push for patient-friendly technologies has led to the development of portable and wireless systems, adding to those unmet needs, driving an emerging market.

France is consolidating its leadership in the electromyography devices market with preceding clearances and ever-increasing awareness for this sector. Similarly, the annual rise in Parkinson’s diagnoses reflects the expanded public awareness. Therefore, the presence of these factors portrays a profitable business environment in this landscape. Furthermore, growth is being fueled by increasing awareness and early detection of neuromuscular conditions. Moreover, technology improvements are increasing diagnostic accuracy and convenience to prompt increased use in clinical and rehabilitation settings.

APAC Market Insights

Asia Pacific’s electromyography devices market is likely to exhibit the fastest CAGR over the forecasted tenure owing to the escalating cases of neuromuscular disorders and healthcare modernization. The governments across the region are spending remarkably on neurodiagnostics, further augmenting growth in the region. China and India are at the forefront of this progressive upliftment, establishing a sustainable consumer base for this merchandise. Whereas South Korea leads in AI-based EMG adoption, and Malaysia in terms of funding grants.

China is the powerhouse of expansion in the Asia Pacific’s electromyography devices market, backed by strong healthcare investments and provincial mandates imposed in this sector. For instance, as reported by Frontiers Media S.A., China spent 8,532.749 billion yuan on health care in 2022. Besides the provincial mandates for AI-EMG adoption in tier-1 hospitals, this further propels growth in the country.

India is the pivotal player in the regional market with a strong presence of public healthcare schemes and cost optimization through local assembly partnerships. Additionally, the EMG devices market is growing rapidly in India due to the rise in neuromuscular disorders and neurological disorders. Furthermore, greater recognition of the benefits of an early diagnosis is forcing healthcare institutions to be more reliant on electrodiagnostic devices.

Key Electromyography Devices Market Players:

- Natus Medical Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nihon Kohden Corporation

- Cadwell Industries, Inc.

- Noraxon U.S.A. Inc.

- Compumedics Limited

- Medtronic plc

- Delsys Inc.

- ADInstruments

- Cometa S.r.l.

- Neurosoft Ltd.

- Allengers Medical Systems

- NeuroWave Systems Inc.

- OT Bioelettronica

- Zynex, Inc.

- Biometrics Ltd.

- Ambu A/S

- iWorx Systems Inc.

- Clarity Medical Pvt. Ltd.

- Neurosoft Ltd. (Malaysia Branch)

- Natus Medical (Reconfirmed Branch)

Big players dominate the electromyography devices market with more than 35% share of the global market combined. The degree of competition is dictated by prolifically changing technology, which improves the accuracy of diagnosis and enhances patient comfort. The more established players in the market are attempting to leverage growth opportunities in emerging markets through a combination of mergers and acquisitions, joint ventures, and increased geographic footprint. Noraxon and Delsys are a few companies that have focused their developments on wearable technologies. Medtronic has delivered a capability that integrates EMG more broadly into neuromonitoring systems. This innovation is projected to drive growth in this market.

Recent Developments

- In May 2024, Medtronic introduced the SynergyEMG System, a portable EMG device integrated with telehealth capabilities for remote patient monitoring, and is priced 32% lower than traditional systems, particularly for India and Brazil-based healthcare professionals.

- In March 2024, Natus Medical announced the launch of its next-generation EMG software called NeuroWorks 2.0, featuring AI-powered signal analysis for faster neuromuscular diagnostics, and it significantly reduces interpretation time by 40%.

- Report ID: 891

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electromyography Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.