Electromagnetic Therapy Devices Market Outlook:

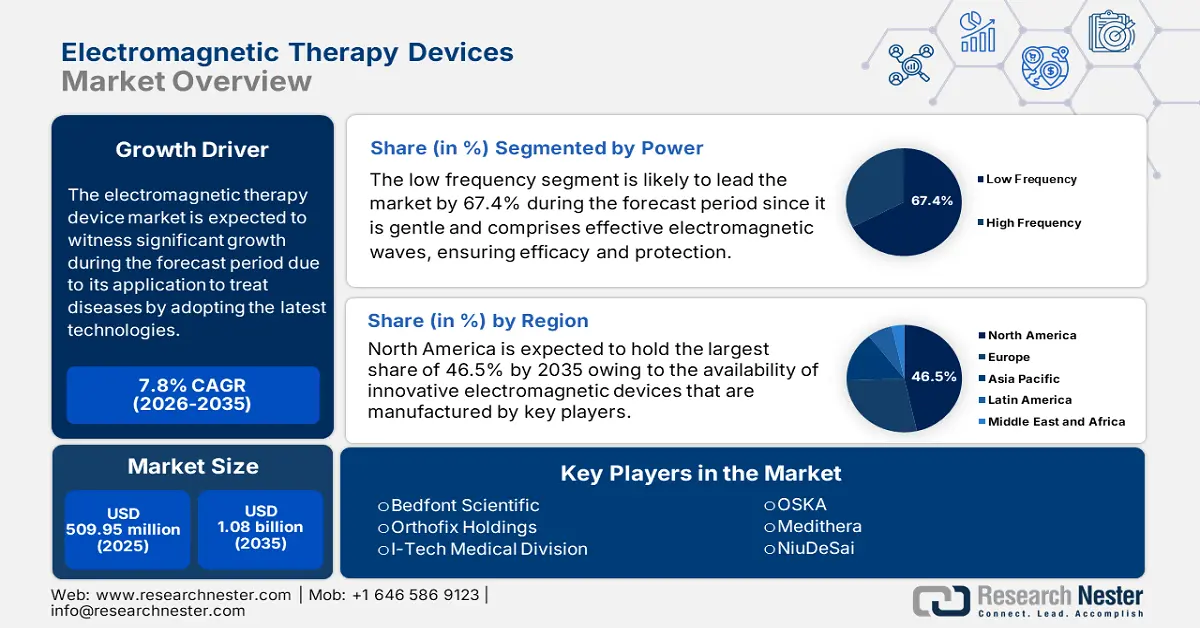

Electromagnetic Therapy Devices Market size was valued at USD 509.95 million in 2025 and is likely to cross USD 1.08 billion by 2035, registering more than 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electromagnetic therapy devices is assessed at USD 545.75 million.

Electromagnetic devices make effective use of electromagnetic pulses to provide therapy to patients suffering from severe disorders. This procedure is an alternative form of medicine that assists in aiding diseases by the application of electromagnetic radiation on the body. As per a clinical study conducted by Biomedicine & Pharmacotherapy in November 2020, the nominal success rate of pulsed electromagnetic fields is 77.4%, thereby denoting its suitability for potential early diagnosis for delayed musculoskeletal disorders. This procedure is non-invasive and safe to effectively treat tendon disorders, osteoporosis, osteoarthritis, and other non-union fractures, thereby driving the upliftment of the market globally.

Furthermore, the growth and evolution of the market depend upon the rising prevalence of chronic degenerative joint disorders such as osteoarthritis. This particular disorder is continuously affecting the aging population internationally. According to the October 2024 report by Frontiers Organization, it is the 12th leading cause of disability across nations. However, to manage this condition, patients face a significant pricing strategy that affects their economic burden of USD 12,400 for direct costs and USD 16,000 for indirect costs. Besides, the incremental costs of the electromagnetic therapy treatment are €1,320 (USD 1,499.9), €4,377 (USD 4,973.7), and €19,715 (USD 22,402.7) for mild and severe osteoarthritis.

Key Electromagnetic Therapy Devices Market Insights Summary:

Regional Highlights:

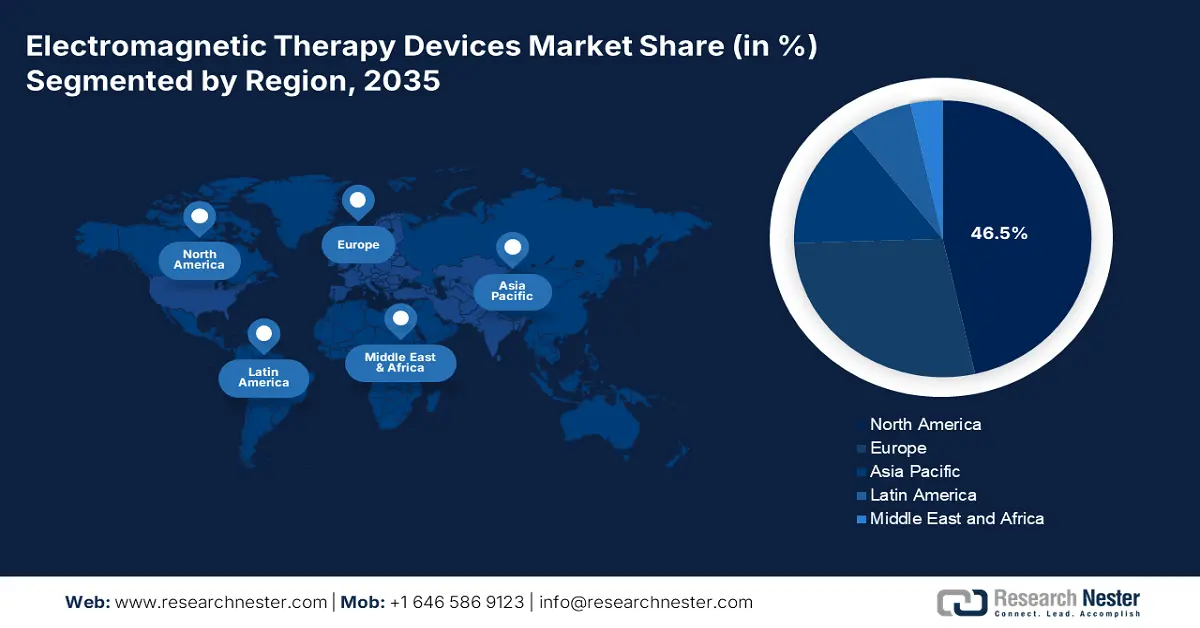

- North America electromagnetic therapy devices market will account for 46.50% share by 2035, driven by the adoption of advanced therapies and strong medical infrastructure.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, attributed to rising healthcare expenditure and awareness of progressive therapies.

Segment Insights:

- The low frequency segment in the electromagnetic therapy devices market is projected to achieve a 67.40% share by 2035, fueled by effective and gentle electromagnetic waves ensuring protection and efficiency, along with increasing acceptance.

- The pain management segment is projected to achieve a 49.80% share by 2035, driven by rising demand for non-invasive devices to cater to pain-related disorders.

Key Growth Trends:

- Focus on technological advancements

- Efficacy from clinical studies

Major Challenges:

- Huge costs of therapy devices

- Poor clinical evidence

Key Players: Medtronic plc, Biotronik SE & Co. KG, Boston Scientific Corporation, St. Jude Medical (Abbott), Orthofix Medical Inc., BEMER Group, Curatronic Ltd., Oxford Medical Instruments, iMRS Systems LLC, Pulse Centers.

Global Electromagnetic Therapy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 509.95 million

- 2026 Market Size: USD 545.75 million

- Projected Market Size: USD 1.08 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Electromagnetic Therapy Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Focus on technological advancements: Rapid innovations are undertaken in the electromagnetic therapy devices market globally. Healthcare and medical professionals are highly supporting the usability of wearable devices to effectively monitor overall body movements. For instance, a review-based study was published by NLM in January 2022 wherein 189 wearable devices were evaluated. It was found that 45.5% of these devices focused on fitness tracking, 25.9% on primary movements, 53.1% on tracking steps, 30.7% on heart rate, and 28.5% on sleep duration. Therefore, technology innovation has been proven to be useful in maintaining overall body functions, thus suitable for market growth.

Other Wearable Devices for Evaluation Percentage

|

Measurement Parameters |

Percentage |

|

Blood Pressure |

1.7% |

|

Skin Temperature |

1.7% |

|

Oximetry |

1.7% |

|

Respiratory Rate |

1.1% |

|

Wrist |

73% |

Source: NLM January 2022

- Efficacy from clinical studies: The ongoing conduction of clinical trials is resulting in the increased credibility of the market across nations. For instance, a systematic study was conducted as published by NLM in December 2022, wherein 14 clinical studies were evaluated regarding electromagnetic treatment for body contouring. The study revealed that the intensity of the therapy increased from 90% to 100% based on the highest tolerable energy settings. Besides, with the combination of radiofrequency and electromagnetic therapy, the intensity was 100% at the procedure commencement, thus driving the market growth.

Challenges

- Huge costs of therapy devices: The growth of the market is hindered by high price tags that create a barrier to its increasing adoption by patients. Besides, countries with poor economies are unable to afford such devices to aid diseases that affect patients. In addition, these countries face immense financial obstacles that eventually restrict the accessibility of these devices. This further results in delayed prevention of disorders from severely affected patients as well as limited implementation in hospitals.

- Poor clinical evidence: The long-term efficacy and protection of the market create insufficient perception owing to limited evidence from clinical studies. During the conduction of these trials, devices might show positive responses but their long-term usability cannot be known. This creates skepticism among researchers, health professionals, and physicians to embrace the technology and cater to aid patients with rare disorders, thereby having a negative impact on market expansion.

Electromagnetic Therapy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 509.95 million |

|

Forecast Year Market Size (2035) |

USD 1.08 billion |

|

Regional Scope |

|

Electromagnetic Therapy Devices Market Segmentation:

Power Segment Analysis

Low frequency segment is anticipated to account for electromagnetic therapy devices market share of around 67.4% by 2035. This segment is characterized by its effective and gentle electromagnetic waves that ensure protection and efficiency. Besides, the acceptance of these devices and their awareness readily drive the development of the segment. Low frequency therapy is suitable for glioblastoma which is a malignant tumor that occurs in the central nervous system. According to a report published by the Journal of Advanced Research in March 2025, with the implementation of a low frequency devices, the condition has a five-year survival rate of 10.0% with a mean survival of less than two years.

Application Segment Analysis

In electromagnetic therapy devices market, pain management segment is set to hold revenue share of more than 49.8% by 2035. The segment’s growth is attributed to the rising demand for non-invasive devices to cater to pain-related disorders. For instance, as per the August 2022 NLM article, the success rate of a continuous flow left ventricular assist devices (cf‐LVAD) is 88%, which denotes increased life expectancy of patients, thereby driving the segment’s development. Therefore, with the utilization of such devices, the segment is gaining more attention owing to the user-friendliness of electromagnetic devices for managing pain through therapies.

Our in-depth analysis of the global market includes the following segments:

|

Power |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electromagnetic Therapy Devices Market Regional Analysis:

North America Market Insights

North America in electromagnetic therapy devices market is projected to dominate over 46.5% revenue share by 2035. The growth in the region is fueled by the increasing implementation of innovative and progressive therapy devices with the inclusion of radiotherapy, the presence of organizations, and a robust medical infrastructure. In addition, the rise in the geriatric population, a surge in the occurrence of chronic disorders, and the availability of government strategies are also responsible for the upliftment of the market in the region.

The market in the U.S. is gaining more traction since the majority of the population suffers from rare diseases. As per the November 2024 U.S. FDA report, more than 7,000 rare diseases have affected almost 30 million people in the country. However, with the presence of the Orphan Drug Act, the FDA has been approving numerous drugs and medications to combat these disorders. Therefore, this effectively supports the implementation of electromagnetic therapies with the use of progressive devices to aid people in the country.

Canada's electromagnetic therapy devices market is gaining more exposure through collaborations initiated between organizations and the government. For instance, in June 2024, the Government of Canada and INOVAIT proclaimed an investment of USD 10.7 million for the commercialization of seven research and development projects under the organization’s Focus Fund program. The objective is to focus on the implementation of artificial intelligence in innovative image-guided therapy to ensure standard healthcare and medical results, thus an optimistic outlook for the market to grow.

APAC Market Insights

The Asia Pacific region is poised to be the fastest-growing region in the electromagnetic therapy devices market during the forecast period. This growth is attributed to the availability of regulatory strategies, a surge in healthcare expenses, and the enhancement of consumer awareness regarding the availability of progressive therapeutic solutions. Besides, India, China, and South Korea are the emerging key markets in the region that effectively and efficiently initiate contributions to make substantial improvements towards health infrastructure and accessibility.

The market in India is increasing owing to the development of R&D centers by international organizations. For instance, in June 2024, Olympus Corporation declared its tactical ingenuity to launch an R&D Offshore Development Center (ODC) in Hyderabad, India. This pronouncement came as a result of a premeditated agreement with global technology organization HCLTech, expected to expand Olympus' revolutionary generation activities. Therefore, this eventually constitutes the development of progressive therapies in the country to aid disorders.

There is a huge scope for the market in China owing to the approval of different drugs and injections to support bone growth. For instance, in May 2024, Boan Biotech announced the marketing approval of Boluojia by China’s National Medical Products Administration (NMPA). The purpose of this approval is to provide treatment for giant cell tumor of bone (GCTB) that is unresectable which is likely to result in severe morbidity among adults and skeletally mature adolescents, thereby an optimistic opportunity for market evolution.

Electromagnetic Therapy Devices Market Players:

- Bedfont Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Orthofix Holdings

- I-Tech Medical Division

- OSKA

- Medithera

- NiuDeSai

- Nuage Health

- Oxford Medical Instruments Health

- Bemer

- Karmanos Cancer Institute

- Vertex Pharmaceuticals Incorporated

- Allay Therapeutics

The electromagnetic therapy devices market is experiencing continuous expansion owing to effective contributions initiated by organizations across nations. This includes facility development and expansion, product launches, collaborations, mergers and acquisitions, and service provision. For instance, in December 2024, Karmanos Cancer Institute notified the availability of the innovative TheraBionic P1 devices which is FDA-approved and suitable for remote treatment. This devices is suitable for aiding unconventional liver cancer that produces low levels of 27.12 MHz radiofrequency electromagnetic fields, which are amplitude-modulated at tumor-specific frequencies.

Here's the list of some key players:

Recent Developments

- In January 2025, Vertex Pharmaceuticals Incorporated notified the U.S. FDA approval of JOURNAVX which is a non-opioid, oral, and highly selective NaV1.8 pain signal inhibitor for the treatment of adults with moderate-to-severe acute pain.

- In December 2023, Allay Therapeutics transformed its post-surgical pain management and recuperation for patients and physicians under the advice of Cooley to produce and commercialize ATX101 and other implantable drugs for acute pain.

- Report ID: 7547

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.