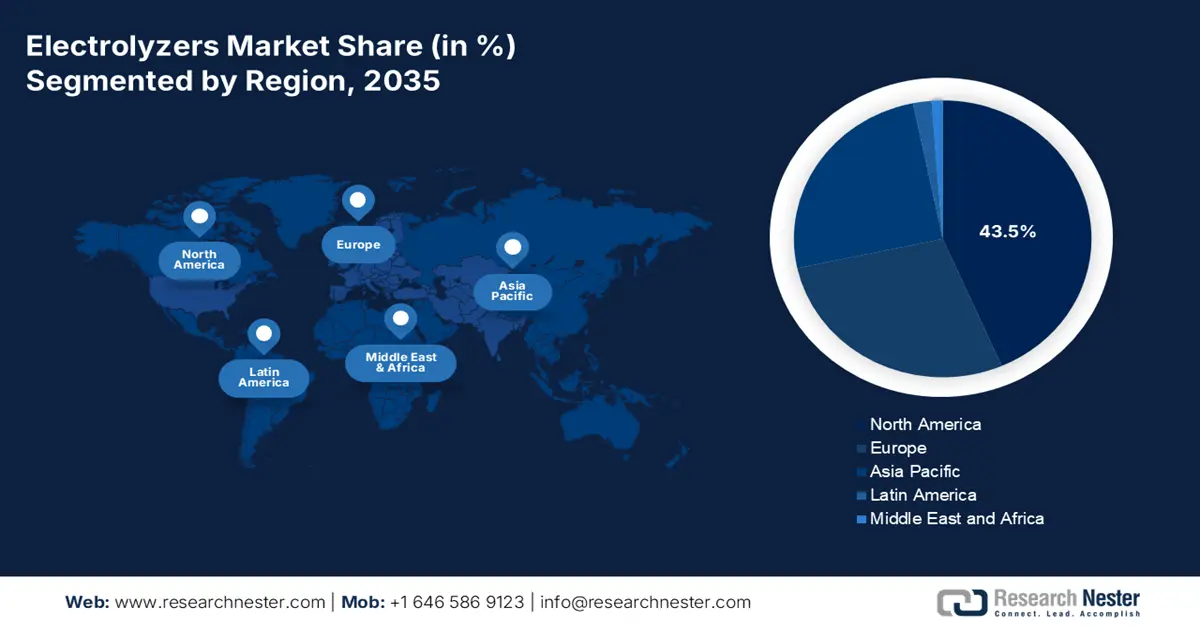

Electrolyzers Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the highest share of 43.5% by the end of 2035. The market’s upliftment in the region is highly attributed to the fiscal support from the U.S., along with the unprecedented regulatory assistance. In addition, the U.S. Inflation Reduction Act (IRA) has successfully established a production tax credit for clean hydrogen with fundamentally altering project economics. According to an article published by the IEA Organization in 2025, the U.S. readily approved USD 1.7 billion for six hydrogen-based projects under the Industrial Demonstration Program. Besides, the tactical colocation of a gigawatt-scale electrolyzer infrastructure with present refinery and chemical centers along with the Midwest and Gulf Coast is another notable trend, which has significantly enabled decarbonization of incumbent processes and developing the latest green export value chains.

The U.S. in the electrolyzers market is growing significantly, owing to the direct fiscal incentives through the IRA, the presence of the DOE's Hydrogen Shot and Regional Clean Hydrogen Hubs (H2Hubs) program, and the crucial role of administrative agencies to encourage the adoption of sustainable chemical processes. As per an article published by the Warner Senate Government in September 2022, the U.S. Department of Energy (DOE) successfully generated USD 7.0 billion in funding for clean hydrogen centers across the country. The fund’s purpose is to develop a suitable power source in the overall region’s future clean energy economy, which accelerated the national deployment of clean hydrogen fuel. As stated in the August 2025 White House Government article, AbbVie declared a USD 10.0 billion investment for more than 10 years, with the intention of supporting volume growth and adding 4 latest manufacturing facilities to its own network. This further included a USD 195 million investment to extend its domestic drug production capacity. Besides, other companies also made generous investments, which are readily bolstering the market.

U.S.-based Investments by Organizations (2025)

|

Company Name |

Investment Amount |

Explanation |

|

Apple |

USD 600 billion |

Additional components of its advanced manufacturing and supply chain system |

|

IBM |

USD 150 billion |

Ensuring domestic growth and manufacturing operations in upcoming 5 years |

|

Johnson & Johnson |

USD 55 billion |

Investment for manufacturing, research, development, and technology for 4 years |

|

Bristol Myers Squibb |

USD 40 billion |

Optimize research, development, technology, and manufacturing operations |

|

Eli Lilly and Company |

USD 27 billion |

Doubling the regional manufacturing capacity |

|

Venture Global LNG |

USD 18 billion |

Ensuring liquefied natural gas infrastructure in Louisiana |

Source: White House Government

Canada market is also growing due to the hydrogen strategy, the Strategic Innovation Fund (SIF), low-cost and abundant renewable electricity potential, regulatory certainty, and carbon pricing. As stated in an article published by Mission Innovation in August 2022, the country presently produces approximately 3 million tons of hydrogen every year, denoting 4% of international hydrogen production. Besides, the nation has also identified barriers to this particular production method and has currently legislated the Canada Net Zero Emissions Accountability Act to shift to net-zero by the end of 2050. Meanwhile, the National Research Council (NRC) has estimated that between CAD 5 billion to CAD 7 billion of private and public sector investment. This is readily required to develop the country’s hydrogen economy and ensure different funding mechanisms for hydrogen’s research, development, and deployment.

APAC Market Insights

The Asia Pacific market is projected to emerge as the fastest-growing region during the stipulated timeline. The market’s development in the region is highly fueled by energy security to industrial decarbonization, the existence of manufacturing activities, which lead to a substantial need for hydrogen in refining and chemical industries. As per a report published by the Economic Research Institute for ASEAN and East Asia in January 2024, the increasing demand for notable energy applications has resulted in employing ammonia as a fuel and hydrogen for fuel cells, which is projected to experience a 1.2% growth every year by the end of 2030. This is further followed by a rapid CAGR boost of 6.4% per year between 2030 and 2050, which caters to effectively uplifting and deliberately initiating expansion for the overall market in the region.

The electrolyzers market in China is gaining increased exposure due to the state-driven and centralized industry policy, huge domestic demand from the chemical sector, and unparalleled scale of manufacturing. Additionally, the National Development and Reform Commission (NDRC), along with the Ministry of Industry and Information Technology (MIIT), recognized green hydrogen as a tactical emerging sector. As mentioned in an article published by the Climate and Energy Partnership Organization in September 2025, the country’s hydrogen consumption is predicted to reach 60 million tons by the end of 2050, as well as 100 million tons by 2060. By this duration, the majority of the demand is anticipated to remain in the chemical sector, accounting for 60%. Meanwhile, the transportation industry’s share is predicted to make small portions, with 5% and 4% of hydrogen utilization, thus making it suitable for the market’s upliftment.

The electrolyzers market in India is also developing, owing to the government’s National Green Hydrogen Mission, the availability of mandates for sectoral consumption, demanding notable sectors, such as fertilizers and refining, which is followed by huge consumers’ demand for grey hydrogen. According to an article published by the Ministry of New and Renewable Energy in November 2025, an outlay of ₹17,490 crore will be provided between 2029 and 2030 as an incentive for manufacturing electrolyzers and production for green hydrogen. Moreover, an outlay of 455 crore within the same year has been allocated for low-carbon steel projects, 496 crore between 2025 and 2026 for mobility pilot projects, and ₹115 crore for shipping pilot projects. Therefore, with such generous funding provision, there is a huge growth opportunity for the market in the country.

Europe Market Insights

Europe in the electrolyzers market is projected to witness steady growth by the end of the forecast duration. The market’s growth in the region is highly driven by the aggressive and cohesive policy framework, with increased focus on the REPowerEU Plan. According to an article published by the Ammonia Energy Association in June 2022, the Europe Commission has declared its newest plan to diminish the region’s reliance on the REPowerEU, which is poised to target the regional production of 10 million tons of renewable hydrogen every year by the end of 2030. In addition, this model significantly suggests 4 million tons annually for hydrogen as ammonia, which will be successfully imported by the same year. Further, this approximately equates to almost 20 million tons of ammonia, which is proposed to be suitable for the Fit-for-55 package, which is positively impacting the overall market in the region.

RePowerEU and Fit-for-55 Package Comparison for Hydrogen Utilization by the Regional Sector in 2030

|

Sector Type |

RePowerEU (Million Tons) |

Fit-for-55 Package (Million Tons) |

|

Ammonia/Derivatives Imports |

4.0 |

- |

|

Blending |

1.3 |

- |

|

Synthetic Fuels |

1.8 |

1.9 |

|

Blast Furnaces |

1.5 |

1.2 |

|

Petrochemicals |

3.2 |

1.3 |

|

Transport |

2.3 |

0.9 |

|

Industrial Heat |

3.6 |

0.8 |

|

Refineries |

2.3 |

0.6 |

Source: Ammonia Energy Association

Germany’s electrolyzers market is gaining increased traction, owing to the presence of a massive industrial base, a wide-ranging hydrogen strategy, along with the government identifying hydrogen as crucial for decarbonizing its cornerstone sectors, such as refining, steel, and chemicals. As stated in an article published by the Federal Government in 2025, the country’s government possesses an expectation that its regional demand for hydrogen derivatives and hydrogen is projected to reach from 95 TWh to 130 TWh by the end of 2030. It is further expected that almost 50% to 70%, which is 45 TWh to 90 TWh, of overall hydrogen products are needed to be imported from international countries or regions. Moreover, the demand for hydrogen and its derivatives is intended to increase between 360 TWh to 500 TWh, while an estimated 200 TWh of hydrogen derivatives is predicted to increase by the end of 2045.

Spain’s market is also growing due to the unparalleled competitive edge in low-cost wind and solar energy, that has the ability to power electrolyzers at a reduced Levelized Cost of Hydrogen (LCOH). According to an article published by the Renewable Institute Organization in 2025, the Spanish government has currently accepted an increase in the target to successfully install 12 gigawatts of electrolyzers, which is predicted to produce green hydrogen by the end of 2030. This is considered to be part of the current updated National Integrated Energy and Climate Plan 2023 to 2030, and is thrice the amount of the previous target set as of 2020, with the last 4 GW objective. Furthermore, the Ministry for the Ecological Transition and the Demographic Challenge (MITECO) has also streamlined the aspect of permitting renewable hydrogen projects and is proactively channeling regional NextGeneration recovery funds.