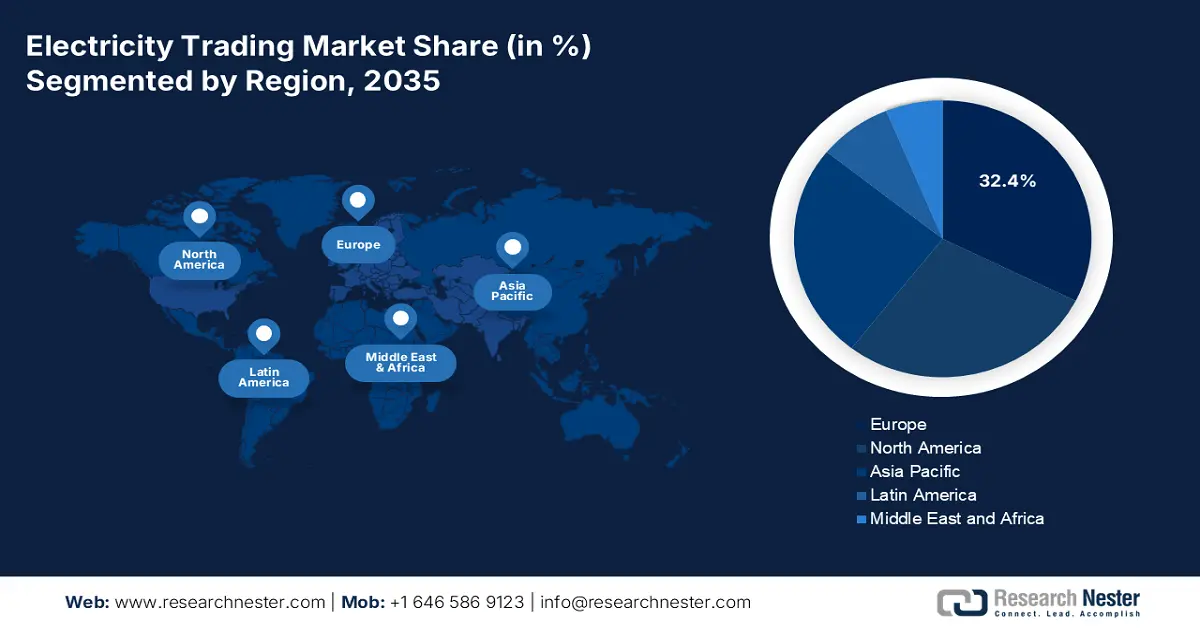

Electricity Trading Market - Regional Analysis

Europe Market Insights

Europe in the electricity trading market is forecasted to garner the largest share of 32.4% by the end of 2035. The market’s upliftment in the region is highly attributed to the presence of the ambitious decarbonization agenda, as well as the Europe Green Deal. Besides, escalation in the carbon pricing under the regional Emissions Trading System (EU ETS) and the phase-out of fossil-fuel generation for increasing dependency on intermittent renewables are also driving the electricity trading market. According to an article published by Energy in May 2025, the Corporate Power Purchase Agreement (CPPA) contract capacity has reached 44.7 GW by the end of 2024. However, in 2023, 10.8 GW were readily contracted through PPAs, along with an additional 7.8 GW by the mid of 2024. In addition, 4.3% of the capacity has been contracted by utilities, with the majority gained by private organizations, thereby making it suitable for proliferating the market.

The electricity trading market in Germany growing significantly due to a decisive energy transition policy, its crucial role as the region’s largest power customer, and its centralized geographic position. Moreover, the accelerated retirement of coal-based plants, along with the mandated phase-out of nuclear power, has created a huge generation gap that needs to be filled by imported power and renewables. According to the 2024 Cefic Organization article, the chemical and pharmaceutical sector in the country accounts for €225.5 billion in turnover, with €14 billion in research and development-based investment, 2,094 organizations, 479,542 employees, and capital expenditure of €9.4 billion. This sector is continuously expanding, and is under huge pressure from the regional ETS and high energy, which is suitable for bolstering the market’s exposure.

The UK in the electricity trading market is also growing, owing to the target of emerging as a completely decarbonized power system by the end of 2035. This particular objective demands an unprecedented build-out of renewables and offshore wind, which has inherently increased the demand for a liquid short-term and flexible market to balance their intermittency. As per an article published by the UK Government in April 2025, the industry and government in the country are operating in partnership, and have the objective to invest nearly £40 billion every year for the upcoming 6 years. The focus is to overcome barriers and ensure growth in the electricity demand, which caters to the market’s expansion. As part of this investment, the country will comprise 43 GW to 50 GW of offshore wind, followed by 27 GW to 29 GW of onshore wind, and 45 GW to 47 GW of solar power. This is projected to further comply with 23 GW to 27 GW of battery capacity, along with 4 GW to 6 GW of long-lasting energy storage.

APAC Market Insights

Asia Pacific is predicted to evolve as the fastest-growing region during the forecast timeline in the electricity trading market. The market’s development in the region is highly propelled by huge renewable energy integration, continuous market liberalization, and a surge in the electricity demand from industries, such as chemicals. As stated in a data report published by the IEA Organization in 2025, coal accounts for 57% of the overall electricity generation in the region as of 2023. In addition, the total electricity production in the region caters to 15,489,513 GWh, denoting a 266% increase between 2000 and 2023, and constituting 51% of the global share. Moreover, the electricity consumption in the region is 3.5 MWh per capita as of 2023, displaying a 192% growth between the same duration, thereby creating an optimistic outlook for the overall electricity trading market.

Electricity Production and Consumption Comparison in the Asia Pacific (2023)

|

Countries |

Electricity Production |

Electricity Consumption |

|

|

GWh |

% |

MWh per capita |

|

|

China |

9,547,540 |

61.6 |

6.5 |

|

India |

1,986,776 |

12.8 |

1.1 |

|

Japan |

1,002,648 |

6.5 |

7.6 |

|

Korea |

610,685 |

3.9 |

11.4 |

|

Indonesia |

433,460 |

2.8 |

1.4 |

|

Australia |

274,474 |

1.8 |

9.8 |

|

Vietnam |

274,016 |

1.8 |

2.5 |

|

Malaysia |

192,986 |

1.2 |

5.0 |

Source: IEA Organization

China in the electricity trading market is gaining increasing traction, owing to the scale of the power system, along with the state-directed transition to a market-based and low-carbon grid. Additionally, the National Energy Administration (NEA) and the National Development and Reform Commission (NDRC) have methodically extended pilot markets and established a national unified electricity market. As per the September 2025 ITA data report, the country is rapidly making expansion in renewable energy capacity by installing 373.6 GW as of 2023, particularly in wind and solar. This has readily brought the nation’s overall renewable energy capacity to 1,827.3 GW, which has successfully exceeded the 1,200 GW target of installed solar and wind by the end of 2030. Besides, the pumped hydro storage significantly accounts for deployed energy storage, which has reached 58.9 million kW by the end of 2024, thus deliberately boosting the market’s growth.

India in the electricity trading market is also developing due to the potent combination of rapid renewable energy deployment, advanced market liberalization, and a surge in electricity demand. As mentioned in a data report published by the Ministry of Power in September 2023, the country’s government has targeted to establish 50% of cumulative electric power installed capacity from non-fossil fuel energy resources by the end of 2030. In this regard, transmission schemes for integrating 66.5GW renewable generation in states such as Tamil Nadu, Andhra Pradesh, Karnataka, Madhya Pradesh, Maharashtra, Gujarat, and Rajasthan have been significantly planned and are currently under implementation stages. Furthermore, nearly 55.08 GW of renewable potential has been recognized in Ladakh, Himachal Pradesh, Gujarat, and Rajasthan, based on which the transmission system planning has been successfully carried out.

North America Market Insights

North America market is projected to witness steady and considerable growth by the end of the stipulated period. The market’s exposure in the region is highly driven by the presence of independent system operators (ISOs), such as ERCOT and PJM, which are characterized by sophisticated and highly liquid financial products. In addition, the escalated energy transition, fueled by the federal policy and the Inflation Reduction Act (IRA) is catalyzing huge investments in grid modernization and renewable generation are driving the market. As per an article published by the EIA Government in November 2025, the retail price for nominal-grade gasoline amounted to USD 3.06 per gallon, denoting only 2 cents per gallon higher than the previous year. Additionally, the price usually ranged between USD 3.05 to USD 3.06 per gallon within the same timeline, demonstrating an increase of 0.017 from last year. Likewise, an increase in diesel fuel pricing also denotes a huge growth of the overall market in the region.

Gasoline and Diesel Fuel Payment Update in America (2025)

|

Components |

Regular Gasoline |

Diesel |

|

Overall Price |

USD 3.06 per gallon |

USD 3.68 per gallon |

|

Crude Oil |

49% |

41% |

|

Refining |

14% |

23% |

|

Distribution and Marketing |

21% |

20% |

|

Tax |

17% |

16% |

Source: EIA Government

The electricity trading market in the U.S. is gaining increased exposure due to the existence of an intense chemical industry, the Department of Energy (DOE) Loan Programs Office, and the increased focus on sustainability and innovative manufacturing. For instance, in March 2024, the U.S. Environmental Protection Agency (EPA) successfully identified 103 manufacturing plants that readily earned the Agency’s ENERGY STAR certification in 2023. This is considered a designation, which is reserved for manufacturing facilities with 25% of energy efficiency in this sector. These facilities have the capability to combat over 8 million metric tons of carbon dioxide emissions, which is equivalent to electricity emissions from more than 1.5 million households. Besides, the industrial sector in the country accounts for 30% of greenhouse gas emissions, usually from energy utilization in manufacturing plants, thus suitable for boosting the market.

The electricity trading market in Canada is also growing, owing to the federal carbon price, the Clean Electricity Regulations (CER), interprovincial transmission build-out, grid modernization, an increase in the corporate demand for renewable energy, electrification of the economy, and Hydro-Québec’s role as a continental battery. According to an article published by the Transportation Research Interdisciplinary Perspectives in November 2024, the country’s government unveiled a CAD 15 per ton of carbon dioxide equivalent greenhouse gas emissions fee between 2023 and 2030. Besides, the livestock and agriculture production industry, excluding emissions from fertilizer manufacturing or fossil fuel utilization, contributes to 10% of the nation’s greenhouse gas emissions. Therefore, to keep control, the country performs competitive evaluation by catering to 80% of emissions from medium or low risk, along with 90% of 95% for high risk, thus making it suitable for the market’s upliftment.