Electrical Steel Coatings Market Outlook:

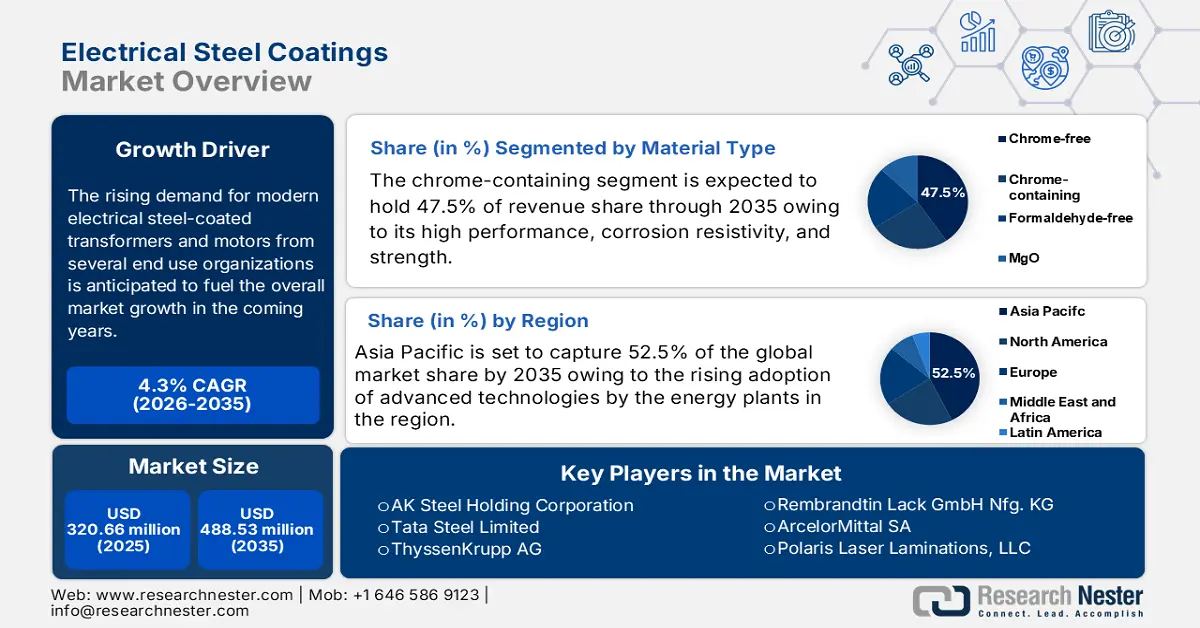

Electrical Steel Coatings Market size was over USD 320.66 million in 2025 and is anticipated to cross USD 488.53 million by 2035, witnessing more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrical steel coatings is assessed at USD 333.07 million.

The rising demand for advanced industrial components such as transformers and electric motors is fuelling the application of electrical steel coatings to mitigate energy losses.

The C5 coatings have widespread use cases in carbon steel and galvanized steel due to their superior surface resistivity and high performance, aiding its revenue growth. The growing industrial activities worldwide are boosting the use of C5 coatings for enhanced performance and durability of materials. C5 electrical steel coatings are projected to capture 39.8% of the revenue share by 2037 owing to the increasing application in refrigerator motors and large turbogenerators.

Key Electrical Steel Coatings Market Insights Summary:

Regional Highlights:

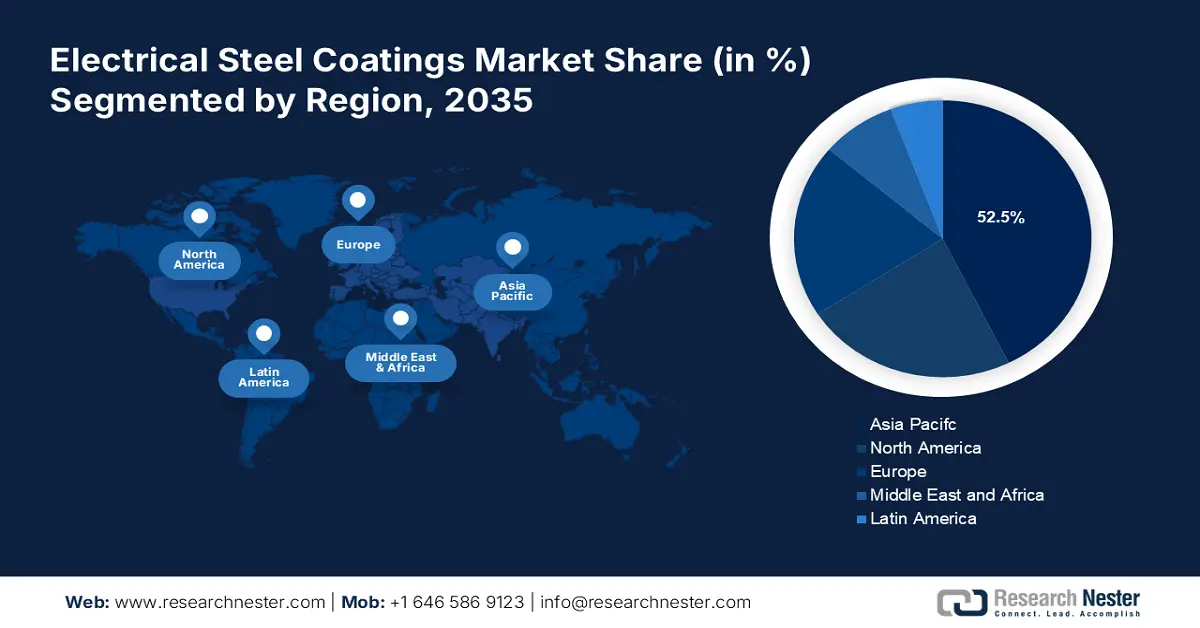

- Asia Pacific electrical steel coatings market is anticipated to capture 52.50% share by 2035, driven by booming automotive and construction sectors and technological advancements.

- North America market will account for 28.50% share by 2035, driven by rising investments in R&D and demand for automobiles and consumer electronics.

Segment Insights:

- The chrome-containing segment in the electrical steel coatings market is expected to hold a significant share by 2035, driven by chromium's corrosion resistance and widespread use in stainless steel and pigment industries.

Key Growth Trends:

- Growing industrial automation

- Automotive electrification and expansion of renewable energy

Major Challenges:

- High product costs

- Presence of alternatives

Key Players: AK Steel Holding Corporation, Tata Steel Limited, Axalta Coating Systems Ltd., ThyssenKrupp AG, and Rembrandtin Lack GmbH Nfg. KG.

Global Electrical Steel Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 320.66 million

- 2026 Market Size: USD 333.07 million

- Projected Market Size: USD 488.53 million by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Electrical Steel Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Growing industrial automation: Increased automation in manufacturing processes drives demand for efficient electric motors and transformers, thereby supporting the market. Around 76% of companies in the manufacturing sector plan to implement automation by 2027. Automation can reduce defects in manufacturing by 90%. Automated systems require components that can withstand rigorous operating conditions. Electrical steel coatings provide improved corrosion resistance and durability. Moreover, the rise of robotics and AI in manufacturing increases the need for precise and efficient electrical components, further propelling demand for quality electrical steel coatings. The adoption of industrial robots in manufacturing sector is expected to increase by 100% by 2025.

- Automotive electrification and expansion of renewable energy: The shift toward electric vehicles is increasing the need for high-quality electrical steel in motors and batteries, boosting the electrical steel coatings market. Also the growth of renewable energy sources, such as wind and solar power, necessitates high-performance electrical steel for generators and transformers, driving demand for coated products.

Challenges

- High product costs: The manufacturing process for electrical steel and its coatings is quite expensive due to the complex steps and raw materials involved. For instance, electrical steel is often made from iron, and alloyed with silicon to improve its magnetic properties, the fluctuations in the raw material prices directly influence the overall product cost. Also, continuous technological advancements uplift the production cost, which may limit its electrical steel coating sales growth to some extent.

- Presence of alternatives: The increasing use of alternative materials such as aluminum and other technologies can potentially hamper the demand for electrical steel coating products. Aluminum and composites are lighter than steel and are finding increasing applications in the automotive manufacturing sector. They effectively aid in weight reduction and lead to energy efficiency. Such characteristics are anticipated to make alternatives more attractive and impact the sales of electrical steel coatings.

Electrical Steel Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 320.66 million |

|

Forecast Year Market Size (2035) |

USD 488.53 million |

|

Regional Scope |

|

Electrical Steel Coatings Market Segmentation:

By Material Type Segment Analysis

By 2035, chrome-containing segment is estimated to capture over 47.5% electrical steel coatings market share. Chromium is vital in various end use industries including stainless steel production due to its ability to enhance corrosion resistance and durability. According to the U.S. Geological Survey Publications Warehouse, 18% of chromium is used in stainless steel production. Chromium is also essential in chemicals and pigment production that are widely used in various manufacturing processes, fuelling the application area of chrome-containing coatings.

Application Segment Analysis

The transformers segment is anticipated to drive the electrical steel coatings market with a notable market share. The rise of renewable energy sources, such as wind and solar, requires efficient transformers for grid integration. This increases the demand for electrical steel coatings that can enhance the performance of transformers in these applications. Moreover, ongoing urbanization and infrastructure projects necessitate the installation of new transformers, leading to higher demand for electrical steel coatings used in transformer cores.

Our in-depth analysis of the electrical steel coatings market includes the following segments:

|

Coatings Type

|

|

|

Material Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrical Steel Coatings Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 52.5% by 2035. The booming automotive and construction sectors are making high use of electrical steel coatings in Asia Pacific. Technological advancements in materials and coating processes such as nanocoating technology also contribute to the market growth. India, China, South Korea, and Japan are leading the sales of electrical steel coatings in the region.

India is the second largest producer of crude steel in the world, the steel production of the country grew 4-7% to 123-127 MT in 2024. Various government initiatives and supportive policies are contributing to the electrical steel coatings market growth in India. For instance, India Brand Equity Foundation revealed that the Government of India in the 2023 to 2024 union budget allocated around USD 8.6 million to the Ministry of Steel for the promotion of self-reliance in the steel industry. Such policy supports are anticipated to augment the sales of electrical steel and its coatings in the country during the forecasted period.

North America Market Insights

In electrical steel coatings market, North America region is expected to account for more than 28.5% revenue share by the end of 2035 owing to the presence of leading electrical steel coating manufacturers. The rising investment in research and development activities for the production of advanced coating materials and increasing demand for automobiles and consumer electronics are boosting the electrical steel coatings market growth in the region.

In the U.S. the rising investments in power projects and the growing popularity of renewable energy sources are boosting the applications of electrical steel coatings. Hydropower plants are prime energy suppliers in the U.S., which is driving high demand for electrical steel-coated generators and transformers in such plants.

In Canada, the rising adoption of electric vehicles is set to fuel the demand for electrical steel coatings in the coming years. For instance, according to Statistics Canada, around 3.0% of the light-duty vehicles registered in Canada in 2022 were EVs.

Electrical Steel Coatings Market Players:

- AK Steel Holding Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tata Steel Limited

- Axalta Coating Systems Ltd.

- ThyssenKrupp AG

- Rembrandtin Lack GmbH Nfg. KG

- ArcelorMittal SA

- Wuhan Iron & Steel Corporation

- Proto Laminations Inc.

- Dorf Ketal Chemicals

- Filtra Catalysts and Chemicals Ltd.

Key players in the electrical steel coatings market are adopting several tactics such as new product launches, partnerships, regional expansion, and mergers & acquisitions to earn high-profit shares. Leading companies are investing heavily in R&D activities to introduce advanced coating materials with enhanced electrical efficiency and thermal stability. They are also forming strategic alliances with other players to increase electrical steel coatings market reach.

Some of the key players include:

Recent Developments

- In April 2024, ArcelorMittal SA revealed its plans to build an advanced manufacturing faculty in Calvert, Alabama, which is anticipated to offer around 150kt domestic production of non-grain-oriented electrical steel each year. In support of this project, the U.S. Internal Revenue Service awarded USD 280.5 million in investment tax credits.

- In March 2023, ThyssenKrupp AG announced the expansion of its competence center for electric mobility at the Bochum site. This strategy is anticipated to deliver around 2,18,000 metric tons of non-grain-oriented electrical steel per year.

- Report ID: 6460

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrical Steel Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.