Electrical Services Market Outlook:

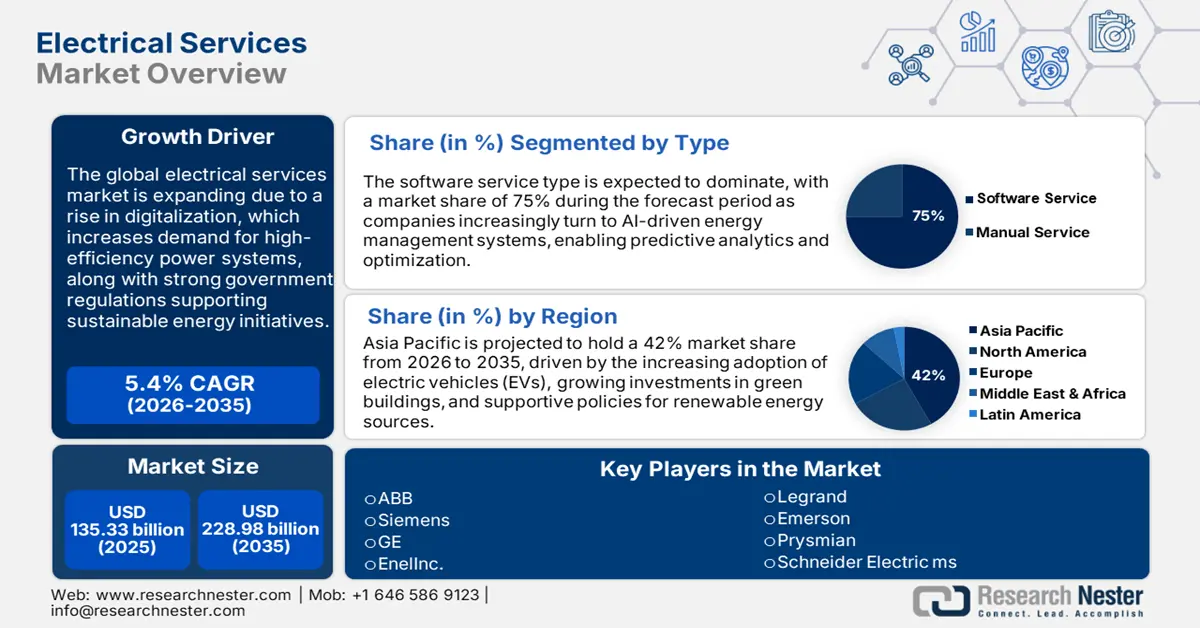

Electrical Services Market size was over USD 135.33 billion in 2025 and is anticipated to cross USD 228.98 billion by 2035, growing at more than 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrical services is assessed at USD 141.91 billion.

The surge in infrastructure development and the demand for sustainable energy solutions is driving growth in the electrical service market. There is an increased demand for dependable, competent, timely, and efficient electrical services in residential and commercial areas. Hence, companies are scaling up to meet these demands. For example, in October 2024, FirstEnergy Corp. decided to expand its substation in Northwest Ohio. This project, aimed at enhancing the stability and efficiency of the regional power grid, joins an industry trend toward boosting reliability and customer service. Such developments underpin how strategic expansions are becoming a necessity in the market, whereby investment to maintain and improve service reliability is paramount.

In addition, supportive government policies, as well as incentives for green energy projects, are creating new avenues for growth among electrical service providers. For example, most governments are placing great emphasis on updating electrical infrastructure and stimulating the use of clean energy sources. Both aspects prompt firms to implement renewable solutions in their services with a view towards minimizing environmental degradation that furthers the attainment of nations' sustainability objectives. Furthermore, government-driven initiatives, such as subsidies for the installation of electric vehicle charging infrastructure, drive electrical services market growth.

Key Electrical Services Market Insights Summary:

Regional Highlights:

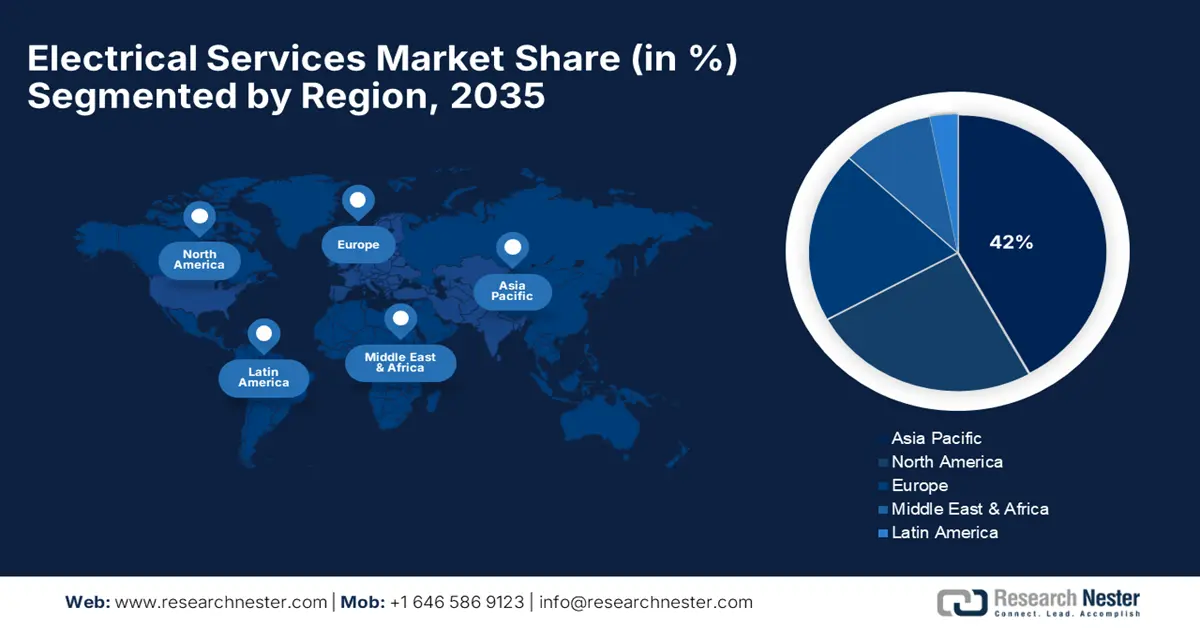

- Asia Pacific electrical services market will account for 42% share by 2035, fueled by rapid industrialization and investments in renewable infrastructure.

- North America market will register significant growth during the forecast period 2026-2035, attributed to infrastructure modernization and green energy initiatives.

Segment Insights:

- The software service segment in the electrical services market is projected to achieve remarkable growth till 2035, fueled by digitalization and remote monitoring demands across electrical systems.

- The solutions segment in the electrical services market is expected to hold a 43% share by 2035, attributed to the rising need for integrated, end-to-end electrical service offerings.

Key Growth Trends:

- Expanding renewable energy projects

- Increased electrification in rural and underserved areas

Major Challenges:

- Shortage of skilled professionals

- Regulatory compliance and environmental standards

Key Players: Emerson, Prysmian, Schneider Electric, ABB, Siemens, GE, Enel, Legrand, Iberdrola, State Grid Corp. of China, Grainger, Inc., Electrical Safety Specialists, G&W Electric Company, Fluor Corporation, Design Systems, Inc..

Global Electrical Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 135.33 billion

- 2026 Market Size: USD 141.91 billion

- Projected Market Size: USD 228.98 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Electrical Services Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding renewable energy projects: The global push for renewable energy sources such as solar and wind has opened new avenues for electrical services. Developments and infrastructure building by companies in greener alternatives also drive demand for specialized electrical services. In March 2024, Local Power Ltd. partnered with Kingston Refrigeration & Electrical Services Ltd. in Cork to focus on the installation of solar PV for local farmers and businesses. This contract caters to growing green energy demand and underlines the increasing involvement of electrical services in renewable projects for commercial and community needs.

- Increased electrification in rural and underserved areas: Most governments around the world are working to electrify rural and underserved areas. This has increased the demand for electrical installation and maintenance services. Southern Home Services acquired Elite Electric in February 2024 to expand its services more widely within Florida. With the acquisition, the company aims to offer key services to people in less fortunate communities, with the sole objective of ensuring that energy is easily accessed and that response times are quick. In fact, such projects suggest that electrification in diverse areas is becoming a key growth driver for the electrical services market.

- Advances in smart grid technology: Smart grid technology is transforming energy management. Hence, there is a significant demand for advanced electrical services to install, maintain, and upgrade these systems. Smart grids make energy use more efficient and offer real-time monitoring, benefiting both consumers and providers significantly. In July 2024, Quanta Services acquired Cupertino Electric Inc. for USD 1.54 billion as part of its strategy to improve infrastructure solutions, particularly in smart grid technology. Now, with the inclusion of advanced capabilities from Cupertino Electric, Quanta is establishing itself as the front-runner in modern electrical services and in finding solutions for the complex needs of the smart energy landscape.

Challenges

-

Shortage of skilled professionals: The need for more skilled electrical service professionals is hampering the capacity of the industry to meet growing demand with increasing complexity. The government has recently reported a further qualified labor shortfall, with fewer young professionals entering the trade and therefore seriously compromising the pipeline of the workforce. This will not only lead to compromised scaling of services but will also burden the existing professionals in the industry who wish to undertake projects of high complexity.

- Regulatory compliance and environmental standards: Companies in the electrical services industry must maintain compliance with strict environmental and safety standards. The shift towards sustainable energy propulsion needs to be in tune with evolving regulations, which often influence the operation and cost structure of service providers. Furthermore, frequent updates to these regulations place organizations under pressure for continuous adaptations to avoid any penalties from authoritative regulatory bodies, hence increasing the sector's compliance burden.

Electrical Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 135.33 billion |

|

Forecast Year Market Size (2035) |

USD 228.98 billion |

|

Regional Scope |

|

Electrical Services Market Segmentation:

Type

Software service segment is set to dominate around 75% electrical services market share by the end of 2035. The segment has become dominant owing to the increasing integration of smart solutions and digitalization within electrical systems, which maintain efficiency easily and allow for remote monitoring of facilities. Complementing this trend, Voltech Group opened a new electrical testing facility in Chennai, India, in March 2020, with the capacity to test electrical products such as motors, transformers, and switchgear. This is in line with the growing demand for reliable software services that each of these smart systems requires for safety and operational reliability.

Component

By 2035, solutions segment is anticipated to dominate over 43% electrical services market share. The segment has further garnered growth through the increasing demand for integrated services that provide end-to-end solutions for hardware, software, and consulting needs. In February 2024, Redwood Services invested in Albany Service Co., further expanding its portfolio of residential HVAC and electrical services in New York state. This development underlines the growing demand for bundled solutions serving both residential and commercial clients and shows a strong preference for comprehensive service packages.

Our in-depth analysis of the market includes the following segments:

|

Types |

|

|

Service Provider |

|

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrical Services Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is expected to account for largest revenue share of 42% by 2035. This is due to rapid industrialization, expansion of cities, and a sound thrust on renewable energy solutions. In the region, countries are putting more emphasis on infrastructure upgrades that will accommodate projects related to sustainability, hence increasing the demand for electrical services at an accelerated pace. Furthermore, government investments in infrastructure modernization and green energy projects present a strong impetus toward electrical services market growth.

The growth of the electrical services market in India is directly influenced by the overall push from the government toward electrification and grid modernization. Initiatives like the National Smart Grid Mission are playing an important role in upgrading the country's vast energy resources. For example, I Squared Capital reflected the trend of sustainable energy solutions in India through an acquisition of Priority Power in July 2024. This acquisition is also in sync with the energy strategy of India that leverages the dual levers of reliability and sustainability in energy access, further driving electrical services market growth.

China is witnessing significant growth in the electrical services market, driven by widespread urbanization and equally ambitious smart grid initiatives. With the rapid industrialization of the country, it needs much electrical infrastructure in order to sustain its growing economy and urban populace. In September 2024, Ogden Electrical opened a new office in Utah as part of an initiative that seeks to make services more accessible while aligning with the country’s emphasis on efficient, scalable energy solutions. This not only demonstrates the commitment to infrastructure development but also forms part of the country's wider ambition to enhance energy efficiency and accessibility.

North America Market Insights

North America region is set to witness significant growth till 2035, propelled by modernization in infrastructure and renewable energy projects. Favorable regulations and a number of incentives concerning regional investments positively support the development of sustainable and resilient systems of energy supply. Furthermore, the U.S. and Canada hold leading positions in North America due to heavy investments being made to ensure the reliability of service and reach the green energy target.

The electrical services market in the U.S. is expanding at a considerable rate due to the modernization initiative, to achieve improved infrastructure that will enable the country to reach its ambitious green energy goals. In November 2023, Greenbelt Capital Partners acquired Saber Power Services with further expansion of power infrastructure services as a goal. The strategic purchase is part of a wider initiative that will boost the use of renewable energy within the country and make the grid resilient. This positions the U.S. electrical services market for continued leadership and prominence toward securing a sustainable and reliable electrical network in the coming years.

The growth in Canada electrical services market is driven through government-led funding to improve infrastructure and renewable energy projects. Most significantly, there has been industry consolidation that shows the country is committed to modernizing its energy systems. In March 2024, Cassady Electrical Contractors merged with Huston Electric to broaden the service offerings and make operations more efficient to meet the country's growing energy demands. The merger is a sign that Canada is focusing on increasing energy access and efficiency, placing it as a lucrative country in the electrical services sector.

Electrical Services Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens

- GE

- Enel

- Legrand

- Emerson

- Prysmian

- Schneider Electric

- Iberdrola

- State Grid Corp. of China

- Grainger Inc.

- Electrical Safety Specialists

- G&W Electric Company

- Fluor Corporation

The global electrical services market is competitive, with some key players holding dominant shares, such as Emerson, Prysmian, Schneider Electric, ABB, Siemens, and General Electric. These firms invest heavily in upgrading technologies, acquisitions, and market expansions to meet growing demand. Their prime focus includes infrastructure, renewable energy, and safety solutions, which places them in a leading position in the electrical services landscape.

For example, FirstEnergy Corp.'s extension at a Northwest Ohio substation, planned for completion in October 2024, reflects the commitment toward grid improvement and service expansion. The development also represents some of the competitive strategies employed by market players in their pursuit of infrastructure improvement to meet various consumer objectives. With higher infrastructure investment and strategic regional expansions, such companies solidify their lead in a dynamic market.

Here are some leading players in the electrical services market:

Recent Developments

- In May 2024, U.S. Electrical Services, Inc. (USESI) acquired Askco Electric Supply, a family-owned distributor based in Glens Falls, NY, serving residential, commercial, and industrial markets. This acquisition aims to enhance USESI's presence in the Northeast by integrating Askco into its Electrical Wholesalers and HZ Electric Supply region while retaining Askco's operational identity.

- In November 2023, GE Vernova and Our Next Energy Inc. (ONE) signed a term sheet to collaborate on advancing battery energy storage solutions in the United States using locally manufactured lithium iron phosphate (LFP) batteries. This agreement focuses on supplying U.S.-made LFP battery modules and cells for GE Vernova's Solar & Storage Solutions projects, aiming to support the U.S. energy transition and leverage incentives from the Inflation Reduction Act and Investment Tax Credits.

- Report ID: 6670

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrical Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.