Electrical Safety Products Market Outlook:

Electrical Safety Products Market size was valued at USD 4.21 billion in 2025 and is likely to cross USD 7.76 billion by 2035, registering more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrical safety products is estimated at USD 4.45 billion.

With global energy demands surging, the adoption of efficient electrical safety products such as surge breakers, insulated tools, insulating gloves & boots, is set to increase. Key players are positioning electrical safety products to meet the surging demand. For instance, in June 2023, Schneider Electric announced improvements to the core VisiPact heavy-duty safety switch offering a new ergonomic handle for safer operations.

Government and private enterprises investing in renewable energy projects, such as solar and wind farms, are poised to create a steady demand by the end of the forecast period. Furthermore, the expansion of smart grids and electrified transportation systems is driving the requirement for advanced electrical safety solutions. Electrical safety products market is estimated to find increasing end use in sectors such as manufacturing, oil & gas, etc., due to reliance on automated processes that require effective safety protocols. Additionally, an increasing awareness regarding workplace safety benefits investments in electrical safety products by companies.

The investments to improve electrical infrastructure in emerging markets in Africa and APAC are projected to expand markets for key manufacturers in the electrical safety products market. For instance, in April 2024, the World Bank announced a partnership with the African Development Bank Group to provide electricity access to an estimated 300 million people in Africa by 2030. Developments as such create emerging revenue streams that key players can leverage to expand their market share. The global electrical safety products market is set to continue its robust growth by the end of the forecast period assisted by favorable trends for the sector.

Key Electrical Safety Products Market Market Insights Summary:

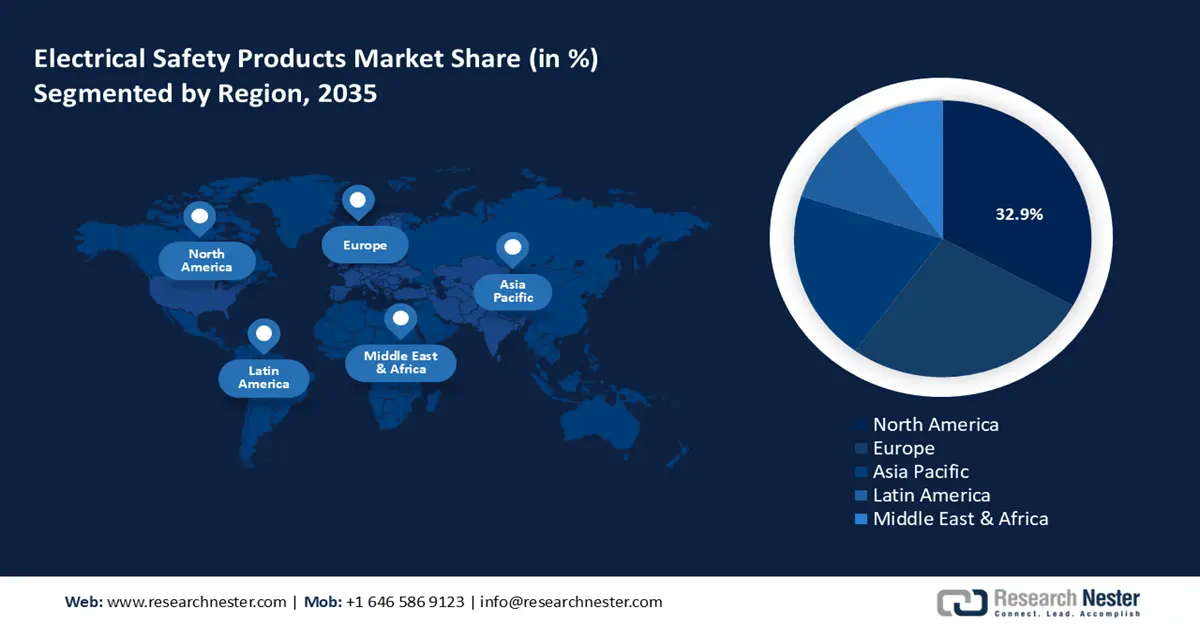

Regional Highlights:

- North America holds a 32.9% share in the Electrical Safety Products Market, fueled by advanced industrial infrastructure and safety regulations, driving robust growth through 2026–2035.

Segment Insights:

- The Arc Flash Clothing Laundering & Repair segment is set for profitable CAGR growth from 2026 to 2035, driven by tightening safety regulations and innovation in protective gear.

- The Personal Protective Equipment (PPE) segment of the Electrical Safety Products Market is anticipated to maintain over 63.4% share by 2035, driven by increasing investment in worker protection and regulatory mandates.

Key Growth Trends:

- Technological advancements in electrical safety products

- Surge in data centers and IT infrastructure development

Major Challenges:

- Competition from unorganized and local players

- Proliferation of legacy systems and infrastructure

- Key Players: Honeywell International Inc., ABB Ltd., Siemens, Hitachi Energy, Ansell Ltd, Schneider Electric, Panduit Corporation, Zhejiang Safetree Industry Tech Co., Ltd., DuPont, BASF, Brady Corporation, GE Vernova.

Global Electrical Safety Products Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.21 billion

- 2026 Market Size: USD 4.45 billion

- Projected Market Size: USD 7.76 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Electrical Safety Products Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in electrical safety products: Continuous innovation in electrical safety products is a key driver of the market. IoT sensor integrated user-friendly safety devices can provide real-time data and improve operational safety. The rising importance placed on equipment and worker safety aligns with advancements in electrical safety products.

Additionally, manufacturers can provide electric panels with smart technology to cater to the demand for advanced safety products in personal homes. For instance, in July 2023, Schneider Electric announced a new solution for homeowners in the U.S., to retrofit smart panel functionality to existing systems. Furthermore, electrical safety products for babies are an emerging segment in the market with an increasing number of households investing in infant safety. - Surge in data centers and IT infrastructure development: The expansion of data centers globally, along with rapid IT infrastructure development in emerging economies, is poised to create multiple new revenue streams in the electrical safety products market. Data centers require robust safety solutions to prevent equipment failures and disruptions. Electrical safety products such as grounding systems, arc-flash protection, and surge suppressors are in high-demand to maintain operational continuity. In August 2023, Rockwell Automation demonstrated new levels of arc flash protection via ArcShield Technology for up to 600V and 3000 A current rating.

Furthermore, IT hubs are increasingly being set up in emerging economies, boosting demand for electrical safety products. For instance, in October 2024, Mastercard opened a new state-of-the-art tech hub in India. - Rapid urbanization and increasing industrial automation: Rapid urbanization has boosted electricity demands worldwide, and contributes to large-scale infrastructure projects that require electrical safety products. Residential complexes, commercial spaces, and smart cities drive demand for circuit breakers and grounding equipment benefiting the growth of the electrical safety products market.

Businesses are taking advantage of the demands by investing to expand manufacturing capabilities. For instance, in November 2024, Panduit Corporation announced expansion of electrical connectivity and grounding capabilities with a new manufacturing plant in Mexico. Furthermore, the push for Industry 4.0 and smart factories is positioned to create steady opportunities in the electrical safety products market.

Challenges

- Competition from unorganized and local players: Local players in unorganized markets can cause intense price competition in the electrical safety products market. Unregulated players offer low-cost alternatives that do not adhere to national or international safety standards, undermining established manufacturers. Furthermore, price sensitivity among end users, especially among homeowners in low-and-middle income economies can deter the adoption of premium electrical safety products.

- Proliferation of legacy systems and infrastructure: Numerous industries, facilities, and residential spaces operate on outdated electrical systems. The outdated systems can be incompatible with modern electrical safety products, and cost of retrofitting can deter end users. The resistance from legacy infrastructure and limit market penetration and stymy modernization.

Electrical Safety Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 4.21 billion |

|

Forecast Year Market Size (2035) |

USD 7.76 billion |

|

Regional Scope |

|

Electrical Safety Products Market Segmentation:

Product Type (Personal Protective Equipment, Insulating Materials, Others)

Personal protective equipment (PPE) segment is projected to hold more than 63.4% electrical safety products market share by 2035. The segment’s growth is attributed to rising investment in worker protection in high-risk environments. The rising demand for rubber insulation gloves, dielectric footwear, arc-flash suits for personal protection is poised to lead the segment’s revenue growth.

Furthermore, strict guidelines by regulatory bodies, such as the Occupational Safety and Health Administration (OSHA) necessitate electrical safety products as a guarantee for workplace safety, boosting end use by various sectors. Recent market developments among key players in the industry are a testament to the profitable opportunities in the segment. For instance, in November 2024, Honeywell announced its decision to sell its Personal Protective Equipment (PPE) to Protective Industrial Products for an all-cash transaction worth USD 1.32 billion.

The insulating materials segment of the electrical safety products market is projected to expand during the forecast period. The growing adoption of insulating materials to prevent electrical leakage benefits the segment’s growth. Manufacturers of insulating materials such as ceramic, rubber, plastic composites, etc., stand to benefit from the increasing industrial reliance on high-voltage equipment. Furthermore, innovations in nanotechnology and polymer science can refine insulating materials to improve their dielectric properties. In August 2024, UNIFI Inc., announced the launch of a revolutionary insulation material, ThermaLoop that will be available in fiberball, padding, and down-like fiber.

Application (Arc flash clothing laundering and repair, Certified laboratory testing, On-site testing, Others)

By application, the arc flash clothing laundering & repair segment is poised to register a profitable revenue share in electrical safety products market during the forecast period. Arc flash clothing ensures the longevity of PPE, boosting its adoption. Furthermore, regulatory bodies are tightening regulations related to arc flash clothing. Key players in the market can benefit by offering arc flash suits that do not compromise on the wearer’s comfort to stand out in the competitive sector and expand their revenue shares. For instance, in July 2024, FallTech launched the first premium ultra-compact Arc Flash Mini Pro that provides superior protection as well as wearer comfort.

Our in-depth analysis of the electrical safety products market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End use |

|

|

Voltage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrical Safety Products Market Regional Analysis:

North America Market

North America industry is poised to hold largest revenue share of 32.9% by 2035, The advanced industrial infrastructure of the region along with safety regulations drives demand for electrical safety products. Regulatory bodies, such as the OSHA, have maintained strict guidelines to ensure worker safety. For instance, in November 2024, OSHA released new guidelines for worker protection by necessitating that arc-flash protective clothing and equipment must be worn by anyone working on or near energized equipment. The stringent enforcement of regulatory guidelines drives demand for electrical safety products.

The U.S. leads the revenue share of the electrical safety products market in North America. Rising investment to modernize electrical infrastructure and advancements of microgrids create emerging revenue streams in the sector by driving demand for effective electrical safety products. Furthermore, the rise of smart homes in the U.S. boosts demand for residential electrical safety products and electrical safety products for babies.

Stringent regulatory standards such as the NFPA 70E in the U.S. ensure investments in workplace safety, while the robust industrial base creates steady demand in end users such as utilities, manufacturing, and construction. Key players in the domestic market can leverage the increasing government contracts to modernize grid infrastructure, by supplying robust electrical safety products. For instance, in August 2024, the government invested USD 2.2 billion in the nation’s grid to improve rising electricity demand and boost protection against adverse weather conditions.

Canada is a profitable electrical safety products market in North America, and is expected to expand its share by the end of the forecast period. The Canadian Standards Association (CSA) provides safety standards for electrical appliances in the country, and non-compliance can result in extensive penalties. Furthermore, the mining, oil, and gas sectors in the country drive demand for robust electrical safety solutions.

The government is investing in offshore wind farms in the provinces of Nova Scotia and Newfoundland creating emerging opportunities for electrical safety solutions. Recent acquisitions of key players in the insulation segments of the sector indicate favorable market trends. For instance, in October 2024, Carlisle Companies announced an agreement to acquire the manufacturer of expanded polystyrene insulation products, Plasti-Fab for USD 259.5 million in cash.

APAC Market Forecast

The APAC electrical safety products market is projected to register the fastest growth curve during the forecast period. The rapid urbanization and industrialization in APAC fuel demand for electrical safety products. China, India, Japan, South Korea, and Australia account for profitable shares in the market. Additionally, the region has established itself as a premier manufacturing hub in the global supply chains, and with major companies investing in IT hubs in APAC to leverage the cost-effective workforce of the region, the demand for electrical safety products is expected to surge by the end of the forecast period. For instance, in July 2024, BrightNight Australia announced the securing of grid approval to connect the 360-megawatt (MW) Mortlake Energy Hub to the national electricity market.

China occupies a leading share in the electrical safety products market of APAC. China’s status as the world’s largest manufacturing hub creates a burgeoning sector for electrical safety products. Furthermore, China is rapidly increasing renewable energy production creating emerging opportunities to supply electric safety solutions in large-scale projects. In October 2024, the Institute of Engineering and Technology called for a standardized approach for electric vehicle (EV) charging equipment known as Open combined protective and neutral (PEN) conductor detection devices (OPDDs). Standardized protocols can lead to new profitable revenue streams in the large-scale EV manufacturing sector of China for safety products.

Additionally, the Made in China 2025 initiative by the country is set to bolster PPE manufacturing in the country improving its position as a cornerstone of the global supply chain. Global companies are leveraging the profitable opportunities by expanding their portfolios in China. For instance, in May 2024, ABB Ltd., acquired the wiring accessories business of Siemens in China to expand their electrification portfolio.

India is emerging in the electrical safety products market. Investments to boost domestic manufacturing and aggressive infrastructure development are key drivers of the electrical safety products market in India. Strict regulations by the Bureau of Indian Standards ensure companies invest in workplace and worker safety from electrical mishaps. Additionally, the increasing number of data centers in the country creates a steady end user base for electrical safety products. Increasing investments by global players in the domestic market are a testament to the domestic market’s potential. In February 2024, Panasonic expanded its lighting business in India by launching a new facility with an investment worth USD 177.5 million.

Key Electrical Safety Products Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- Siemens

- Hitachi Energy

- Ansell Ltd.

- Schneider Electric

- Panduit Corporation

- Zhejiang Safetree Industry Tech Co., Ltd.

- DuPont

- BASF

- Brady Corporation

- GE Vernova

The electrical safety products market is projected for a rapid growth during the forecast period. Key players in the sector are investing to improve insulation features of products and provide effective electrical safety products to various end users.

Here are some key players in the market:

Recent Developments

- In November 2024, GE Vernova Inc., announced the securing of a new contract from Powerlink Australia to supply essential electrical equipment for the upcoming Capital Work Program. Under the agreement, GE Vernova will supply 69 Dead Tank Circuit Breakers (DTCBs) to boost Queensland’s renewable energy goals.

- In June 2024, BASF and Siemens announced their first electrical safety product that utilizes components made from biomass-balanced plastics. The Siemens SIRIUS 3RV2 circuit breaker will be used across industrial applications.

- Report ID: 6759

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.