Electric Vehicle Inverter Market Outlook:

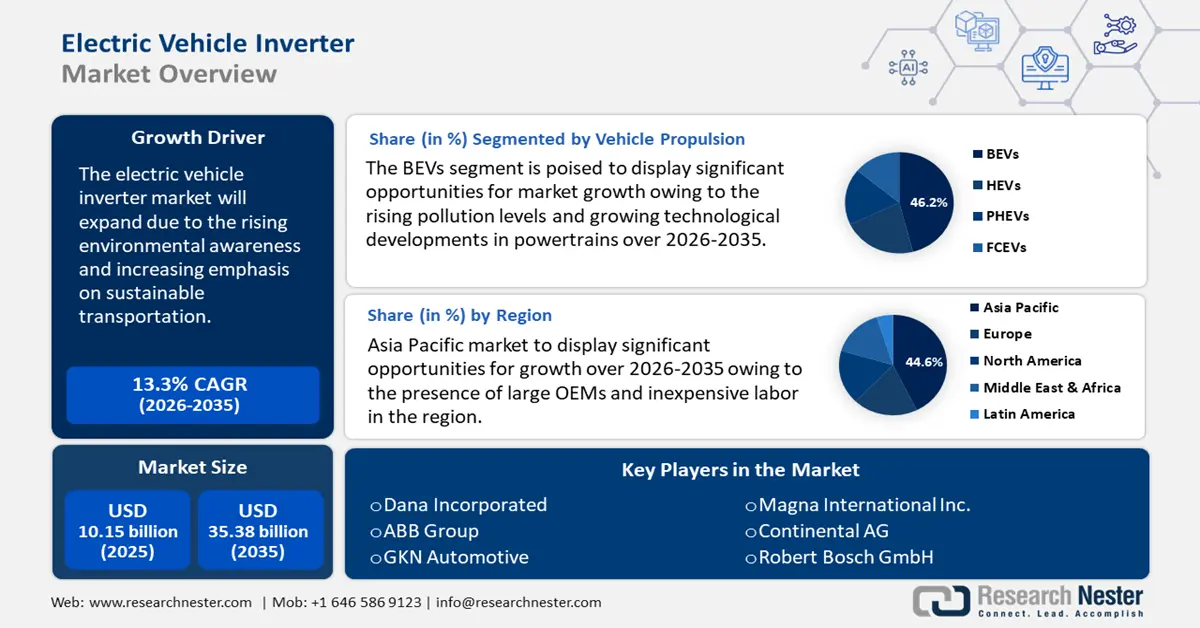

Electric Vehicle Inverter Market size was over USD 10.15 billion in 2025 and is projected to reach USD 35.38 billion by 2035, witnessing around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle inverter is evaluated at USD 11.36 billion.

The expansion of the electric vehicle inverter market is closely tied to the rising environmental awareness and increasing emphasis on sustainable transportation, which have significantly boosted the global adoption of electric vehicles.

Additionally, the urgency to reduce carbon emissions, coupled with decreasing manufacturing costs and supportive government incentives for EV purchases, is further driving the demand for renewable energy sources like solar and wind power. For instance, since January 1, the U.S. government has paid out USD 2 billion in advance point-of-sale consumer electric vehicle (EV) tax credits for over 300,000 automobiles in October 2024. Also, in India, the Cabinet has authorized the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme, which will cost USD 128 million and went into effect on October 1, 2024, and last until March 31, 2026. The scheme's main objectives are to build a strong EV manufacturing ecosystem nationwide, construct necessary charging infrastructure, and hasten the adoption of electric vehicles.

Key Electric Vehicle Inverter Market Insights Summary:

Regional Highlights:

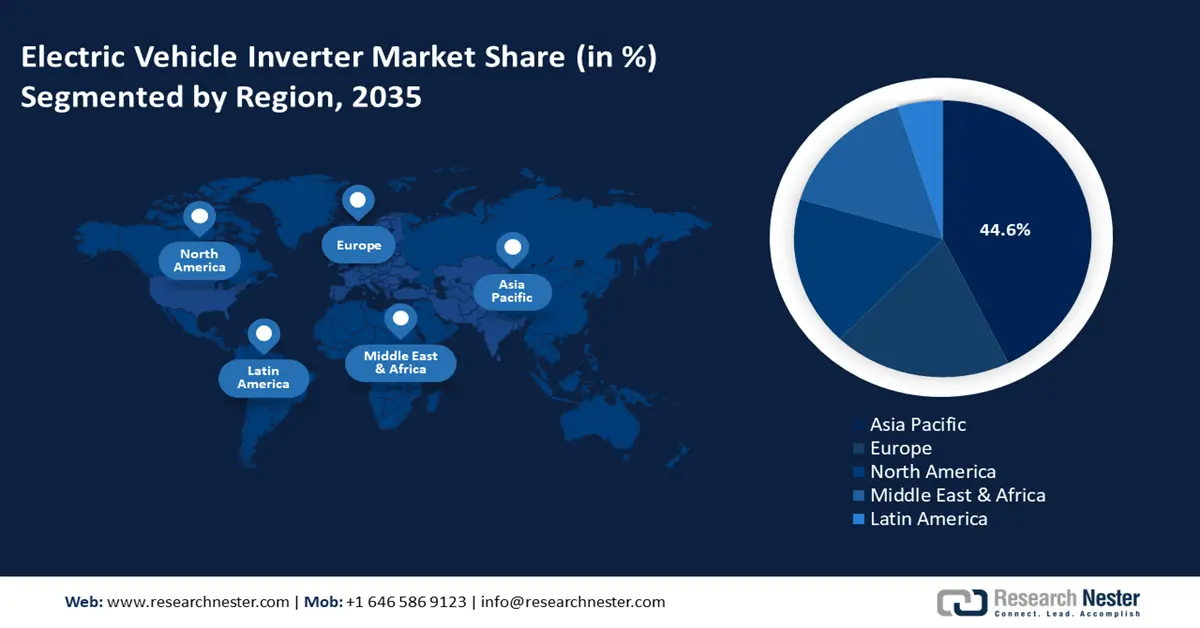

- Asia Pacific electric vehicle inverter market will account for 44.60% share by 2035, driven by increasing consumer spending power, low levels of car penetration, and rising vehicle production.

Segment Insights:

- The bevs segment segment in the electric vehicle inverter market is expected to achieve a 46.20% share by 2035, driven by rising environmental concerns, technological advancements in power electronics, and improved inverter efficiency.

Key Growth Trends:

- Increasing adoption of electric vehicle wireless charging systems

- Emergence of bidirectional charging

Major Challenges:

- Limited battery lifespan

- High cost of materials

Key Players: Dana Incorporated, ABB Group, GKN Automotive, Magna International Inc., Continental AG, Robert Bosch GmbH, Eaton Corporation Plc, BorgWarner Inc., Marelli Holdings Co., Ltd., Infineon Technologies AG.

Global Electric Vehicle Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.15 billion

- 2026 Market Size: USD 11.36 billion

- Projected Market Size: USD 35.38 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Electric Vehicle Inverter Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing adoption of electric vehicle wireless charging systems: Wireless charging systems require high-frequency inverters that convert DC power to AC power, which is transmitted wirelessly to the vehicle. The crucial role that AC/DC and DC-DC converters play in managing and converting electrical energy between transmitter and reception systems justifies their thoughtful construction and operation. The supplied voltage is changed from low to high frequency using a high-frequency inverter. A high frequency contributes to the transmitter's increased flux variation, which raises the coupling factor. The capacity to transfer power is enhanced by a high coupling factor.

EV manufacturers are incorporating wireless charging systems into their cars as the infrastructure for wireless charging grows, which increases demand for sophisticated inverters that provide quicker charging times and a better user experience. According to the International Energy Agency (IEA), there were 2.7 million public charging stations by the end of 2022, with over 900,000 installed in the same year globally. This represents a 55% increase over 2021 stock and is equivalent to the 50% pre-pandemic growth rate between 2015 and 2019. -

Emergence of bidirectional charging: The role of power electronics in EV battery charging has grown even more complex and sophisticated with the introduction of bidirectional charging technology, also known as Vehicle-to-Grid (V2G). These systems also have power electronics built to charge the car and return power from the battery to the grid or home during blackouts or periods of high demand. In wireless charging systems for electric vehicles, power electronics adjust the power to match the flow from the vehicle's battery to the primary coil, secondary coil, and grid. Combining processes, rectification, and inversion, ensures strong energy transfers without sacrificing safety protocols and requirements. The growing demand for bidirectional charging technology has increased the adoption of advanced inverters to control advanced algorithms to direct bidirectional power flow, ensure grid stability, and enhance energy transfer.

-

Advances in inverter technology: Power inverters are continuously improving in terms of power efficiency, thermal resistance, and dependability. They are also utilized in hybrid and fuel cell automobiles, and battery-electric vehicles, where they serve as a balance and backup for the continued operation of the vehicle's electrical systems. Modern inverters are lightweight and compact in weight and size, especially compared to the whole vehicle mass. The advantages of lowering inverter weight are diminished for commercial vehicles with significantly larger curb weights.

Major players are launching new products in the market which is driving the electric vehicle inverter market growth. For instance, in September 2021, Hitachi Astemo, Ltd. and Hitachi, Ltd. jointly announced the development of a small, lightweight direct-drive system for the growingly popular EV market, that integrates the brake, inverter, and motor into a single unit. Furthermore, SiC and GaN semiconductors are expected to replace traditional silicon-based transistors in traction inverters, providing greater efficiency, faster switching rates, and higher power density.

Challenges

-

Limited battery lifespan: The costliest part of an EV is the battery, and as the battery ages over time, concerns around maintenance expenses and battery replacement schedules arise. Although battery technology is developing quickly, modern electric cars frequently have a range of only 250–300 miles before needing to be stopped for recharging. Many drivers worry about being stranded on lengthy road journeys without readily available charging facilities due to this range of anxiety. The widespread use of electric vehicles will depend on resolving issues with battery life and greatly increasing vehicle range through advancements in charging technology and battery size.

-

High cost of materials: Due to their excellent electrical characteristics and minimal power losses, silicon carbide (SiC) and graphene oxide (GaN) are crucial semiconductors for increasing the efficiency of power inverters in electric vehicles. Power inverters require larger initial investments since these semiconductors are more expensive and difficult to manufacture than conventional silicon-based semiconductors. Therefore, the high cost of these materials will impede the growth of the electric vehicle inverter market.

Electric Vehicle Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 10.15 billion |

|

Forecast Year Market Size (2035) |

USD 35.38 billion |

|

Regional Scope |

|

Electric Vehicle Inverter Market Segmentation:

Vehicle Propulsion Segment Analysis

By 2035, BEVs segment is set to capture electric vehicle inverter market share of over 46.2%. The segment growth can be attributed to the growing concerns that rising pollution levels are causing climate change and harsh weather conditions around the globe. According to the International Organization of Motor Vehicle Manufacturers, 16% of man-made CO2 emissions worldwide are caused by automobile transportation. Also, to power their electric motors, battery electric vehicles (BEVs) use inverters to transform the direct current (DC) electricity from their batteries into alternating current (AC). Moreover, wide-bandgap semiconductors like silicon carbide and gallium nitride are among the technological developments in power electronics that are propelling inverter efficiency gains, which will increase electric vehicle performance and range.

Inverter Type Segment Analysis

The IGBT segment in electric vehicle inverter market will garner a notable share in the forecast period. By transforming DC power from batteries into AC electricity to power electric motors, IGBTs (Insulated Gate Bipolar Transistors) are essential components of electric cars. These inverters are perfect for EV applications due to their great efficiency, quick switching times, and capacity to manage high voltages and currents. The growing demand for electric vehicles due to environmental concerns and government policies supporting sustainable transportation are the main factors driving the market for IGBT EV inverters.

Vehicle Type Segment Analysis

The passenger cars segment is estimated to gain a significant electric vehicle inverter market share in 2035. An EV inverter is an essential part of passenger cars that transforms the direct current (DC) stored in the battery into alternating current (AC) to power the electric motor. This conversion is necessary to regulate the motor's speed and torque, allowing for seamless acceleration and effective electric vehicle operation. The continuous pursuit of greater energy efficiency and range is one factor propelling the development of EV inverters in passenger cars. Enhancing the effectiveness of the inverter increases the driving range of electric vehicles on a single charge, which makes them more useful for daily use. Furthermore, improvements in EV inverter technology contribute to a reduction in energy losses during power conversion, which enhances overall performance and lowers running expenses for owners of electric vehicles.

Our in-depth analysis of the global electric vehicle inverter market includes the following segments:

|

Inverter Type |

|

|

Power Range |

|

|

Vehicle Propulsion |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Inverter Market Regional Analysis:

APAC Market Insights

In electric vehicle inverter market, Asia Pacific region is likely to capture over 44.6% revenue share by 2035. The market is expanding due to consumers' increasing spending power which has increased the sales of EVs. Low levels of car penetration, cost advantages for OEMs, and rising vehicle production present alluring market prospects for automakers and suppliers of automotive components. Numerous large OEMs have established production facilities in the region or partnered with significant domestic automakers due to low production costs and inexpensive labor.

The Government of China is encouraging its people to drive electric cars. The electric vehicle inverter market in China is anticipated to increase as a result of contracts and agreements for the sale of electric buses between Chinese automakers and other nations. The adoption of electric mobility and a rise in the production of vehicles for export to other nations are the main factors anticipated to enhance demand for electric car power inverters in China. According to the U.S. International Trade Commission, from 2018 to 2023, China's EV exports grew by 1,016 percent, reaching around 1.6 million units in 2023 (the highest amount of any exporter). From USD 295 million in 2018 to USD 36.7 billion in 2023, the value of Chinese EV exports increased by an even larger 12,334 percent. Since 2021, China has also been the second-largest exporter of EVs in terms of value.

Moreover, India has a higher rate of urbanization and environmental concern, and its largest cities are at the forefront of the electric vehicle adoption trend. In 2023, India's urban population as a percentage of the country's overall population was estimated to be 36.36%. There is a significant demand for EVs and EV inverters as a result of this urban concentration. Significant advancements have also been made in the nation’s EV charging infrastructure development, which has improved the electric vehicle inverter market viability of EV adoption.

Europe Market Insights

Europe electric vehicle inverter market will hold a substantial share in the forecast period. Large-scale EV adoption is being fueled by stricter pollution laws and government programs and subsidies in major nations including Germany, France, and the UK, increasing the region's need for inverters. For instance, the European Commission proposed Euro 7, a new emissions standard for road cars, in November 2022. In keeping with the Green Deal's goal of zero pollution, the new regulations will significantly reduce air pollution from new motor vehicles (both light-duty and heavy-duty) sold in the EU. Additionally, the existence of major international automakers gives European inverter producers access to a captive electric vehicle inverter market.

With its pioneering efforts to switch to electric mobility, Germany in particular has shown tremendous promise. For high-end EV cars, several leading German auto suppliers have created cutting-edge inverter designs and technologies. As a result of this Europe is now more competitive in the high-end electric vehicle inverter market segment. To strengthen local economies, Germany and other countries aggressively encourage production and innovation inside the domestic EV supply chain.

Electric Vehicle Inverter Market Players:

- Dana Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Group

- GKN Automotive

- Magna International Inc.

- Continental AG

- Robert Bosch GmbH

- Eaton Corporation Plc

- BorgWarner Inc.

- Marelli Holdings Co., Ltd.

- Infineon Technologies AG

Players in the fiercely competitive electric vehicle inverter market compete, collaborate, and make large R&D investments to capture a sizable portion of the market. Due to growing competition, more cooperative partnerships, and other strategic choices made to improve operational efficiency, the electric vehicle inverter market is rather fragmented. To stay competitive and grow their clientele, these companies concentrate on improving and diversifying their offerings.

Recent Developments

- In May 2024, ABB launched an innovative new package for electric buses, comprised of an AMXE250 motor and a HES580 inverter. The new propulsion package, designed to function together to provide a more efficient, dependable, and widely available solution for the industry, represents a big step forward in cleaner, more sustainable transportation solutions.

- In May 2023, Dana Incorporated expanded its Spicer Electrified e-Powertrain portfolio to include e-Transmissions for medium-duty electric vehicle applications.

- Report ID: 6932

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Inverter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.