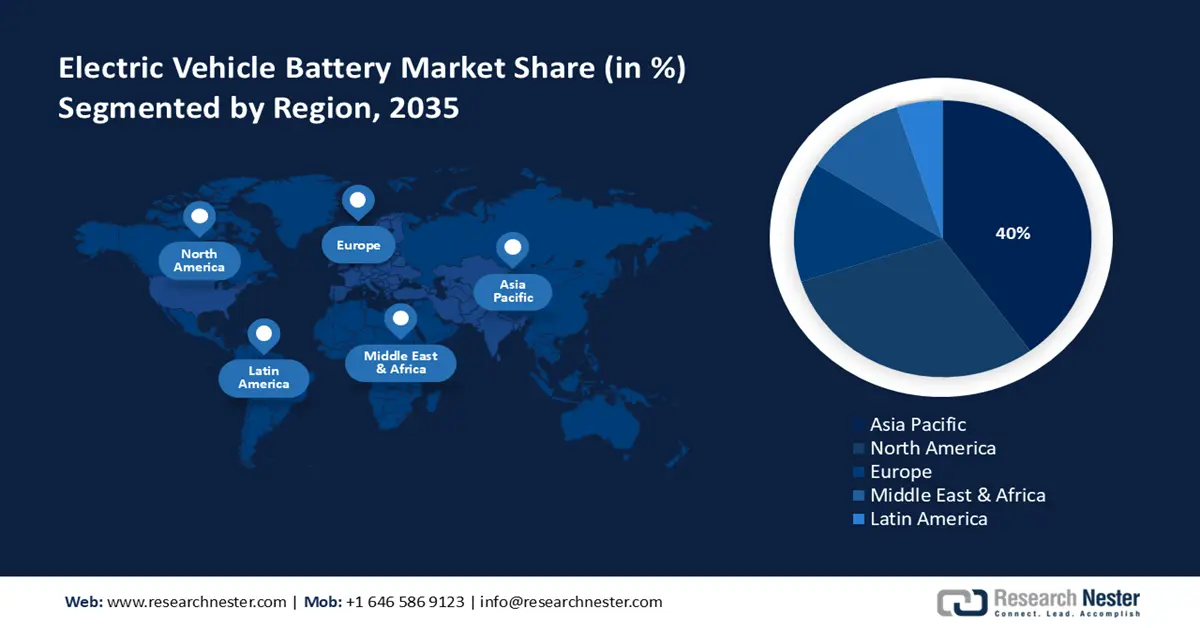

Electric Vehicle Battery Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to garner a robust share of 40% from 2026 to 2035 due to strong government backing, increasing urbanization, and rising environmental concerns. Countries such as China, Japan, South Korea, and India are investing heavily in EV infrastructure and battery manufacturing. Consumer demand for affordable, low-emission transport is encouraging battery innovation and production. Additionally, regional supply chain integration and access to raw materials are accelerating market growth.

China is projected to lead the Asia Pacific EV battery market with a significant revenue share by 2035, driven by strong government backing and targeted industrial strategies promoting electric vehicle adoption. In comparison to the same period of the previous year, the Chinese market grew by 33% between January and May 2025, supported by initiatives that merge EV production with upgrades in ICT infrastructure. Additionally, government incentives and regulations about battery recycling and next-gen technologies are reinforcing its dominant position.

EV Sales in China (2014-2030)

|

Year |

Total EV Unit Sales |

EV Sales Ratio (%) |

Total EVs in Use |

Total EVs as % of All Vehicles |

|

2014 |

6K |

0.32% |

12K |

0.13% |

|

2024 |

11M |

50%-60% |

25M |

7% |

|

2030 (Predicted) |

35M |

80% |

100M |

30% |

(Source: climatescorecard.org)

North America Market Insights

The electric vehicle battery market in North America is projected to hold 30% by 2035 due to growing environmental awareness and supportive government policies. Rising investments in clean energy infrastructure and stricter emissions standards are encouraging EV adoption across the region. Automakers in the region are also scaling up EV production, directly fueling the demand for EV batteries. Additionally, strong collaborations between tech-oriented companies and manufacturers boost innovation in battery technologies.

The U.S. EV battery market is rapidly growing due to rising federal funding, tax incentives, and increasing consumer interest in electric mobility. Major battery manufacturing facilities, such as gigafactories, are being built to fulfill the surging demand. With tax incentives still available for qualified vehicles through the end of 2025, the US market is still expanding moderately at a rate of 4% year to date, which could support continued growth in EV sales. The U.S. also benefits from a stable research ecosystem that backs advancements in battery performance and safety. Growing support for domestic supply chains is helping reduce dependence on imports.

Europe Market Insights

The electric vehicle battery market in Europe is projected to hold 14% by 2035 due to the EU battery value-chain strategy and Europe's mandate for zero-emission autos are driving rapid industrialization and demand for batteries. Through the first 5 months of the year, the European EV market grew 27%, with 1.6 million units sold. For many of the major European countries, growth in the electric vehicle battery market continues to accelerate. As national member-states are developing gigafactory projects and implementing the EU batteries law, there's a forecast for massive growth in cell manufacturing, recycling capacity, and materials processing across the union from the period of 2026-2035.

The UK has accelerated its support for electric vehicles, culminating on July 15, 2025, in the launch of the £650 million Electric Car Grant. This would provide tiered subsidies of £3,750 to car makers, which could be used at the point of sale on new electric cars priced at or below £37,000, provided they satisfy several rigorous sustainability conditions. This builds on other recent initiatives to expand low-cost home charging and reduce the cost of electrification, as the UK continues to increase its support for cleaner transport infrastructure.