EV Charging Cables Market Outlook:

EV Charging Cables Market size was over USD 1.78 billion in 2025 and is anticipated to cross USD 14.69 billion by 2035, witnessing more than 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of EV charging cables is assessed at USD 2.16 billion.

The market is driven by the staggering growth in the EV sector. According to the International Energy Association (IEA), electric cars are witnessing robust growth as global sales reached 14 million units in 2023, surpassing previous records. Several factors underpin the progressive shift toward sustainable transportation from traditional ICE vehicles. An equitable transition to electric mobility hinges on the successful launch of affordable EVs. Established automakers are expanding their operation and entrants are competing for EV charging cables market share. Intensifying competition has impelled companies to cut prices to the minimum profit margin in order to sustain the current landscape. For instance, between 2022-2024, Tesla cut the price of its Model Y car from USD 65, 000 to USD 45. 000 in the U.S. This booming growth in affordable EVs and its subsequent adoption has propelled the demand for charging cables.

Key Electric Vehicle Charging Cables Market Insights Summary:

Regional Highlights:

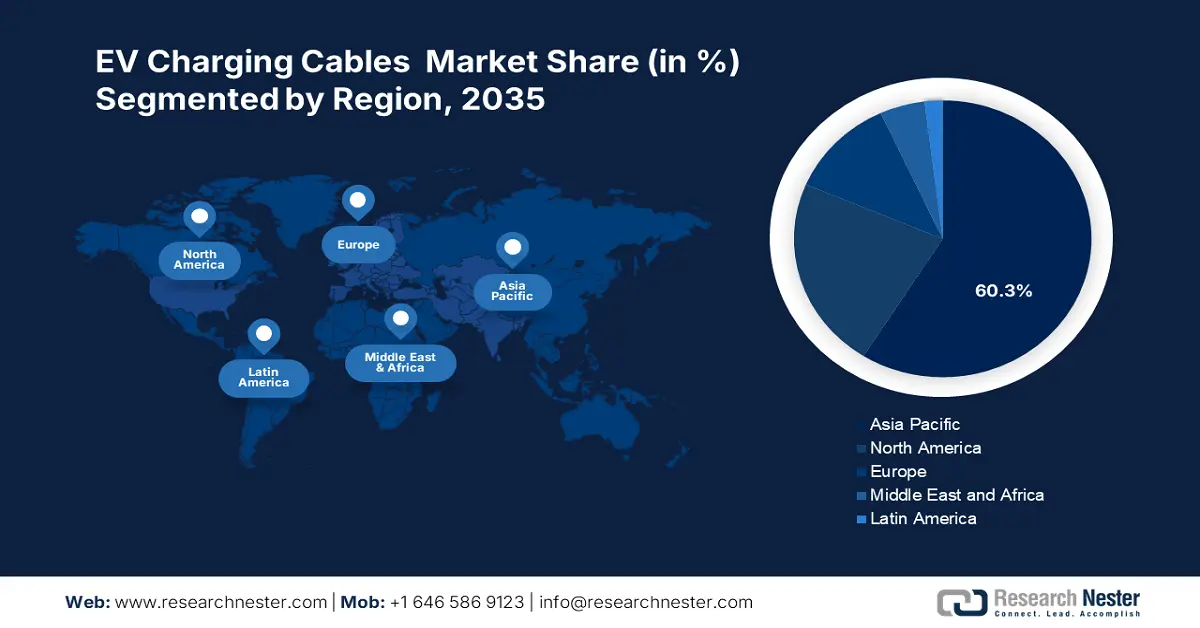

- The Asia Pacific EV charging cables market will dominate around 60% share by 2035, driven by strong EV sales, rising R&D spending, and supportive government policies.

- The North America market will exhibit remarkable growth during the forecast timeline, driven by growing demand for EVs and strong environmental commitments by manufacturers.

Segment Insights:

- The ac charging segment in the ev charging cables market is projected to grow significantly by 2035, driven by the cost-efficiency and compatibility of AC charging with residential and business power systems.

- The straight segment in the ev charging cables market is projected to hold a 60.20% share by 2035, driven by its simplicity, cost-efficiency, and flexibility for home and commercial applications.

Key Growth Trends:

- Surging government initiatives to encourage EV adoption

- Growing adoption of advanced technology in EV charging cables

Major Challenges:

- The rising price of EV charging cables\

- Surging demand for wireless charging technology

Key Players: Leoni AG, Prysmian Group, Nexans S.A., TE Connectivity Ltd., Aptiv PLC, Coroplast Fritz Müller GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, Dyden Corporation, Sumitomo Electric Industries, Ltd., Brugg Group.

Global Electric Vehicle Charging Cables Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.78 billion

- 2026 Market Size: USD 2.16 billion

- Projected Market Size: USD 14.69 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

EV Charging Cables Market Growth Drivers and Challenges:

Growth Drivers

- Surging government initiatives to encourage EV adoption - Emissions from automobiles have notably impacted air quality across the globe. A report published by the U.S. Environmental Protection Agency in 2023 stated, that over 4.6 metric tons of carbon dioxide are released from passenger vehicles in the U.S. every year. Owing to this, the government is encouraging the adoption of electric vehicles.

Several governments have introduced policies to incentivize lighter and smaller passenger car purchases. For instance, in Norway since 2023, electric cars have been given an exception from the weight-based purchase tax, unlike ICE counterparts. Furthermore, governments are implementing strict regulations and emission standards to boost EV sales and achieve the goal of net zero projects. - Growing adoption of advanced technology in EV charging cables - One of the most advanced technologies experiencing deployment in EVs is vehicle-to-grid (V2G) infrastructure. V2G enables electric vehicles to serve as mobile batteries, with the capability of delivering electricity back to the grid as needed. Therefore, this bidirectional energy flow serves both owners of electric vehicles and the power grid.

Since V2G offers bi-directional charging, EV owners can sell excess energy stored in their automobiles back to the electricity networks. The rising investments in smart energy storage and management systems has fostered the development of V2G infrastructure. For instance, on 17 October 2023, Phoenix Motor Inc. in collaboration with Fermata Energy LLC, announced the integration of V2G capabilities for all the medium-duty EVs manufactured by Phoenix motorcars. Consequently, this is anticipated to drive the expansion of the electric vehicle charging cable market. - Development of high-speed charging infrastructure - Fast charging solutions have been growing in popularity among long-haul vehicles. Strategic public investments in installing charging stations are aiding in EV adoption. As part of the U.S. National Electric Vehicle Infrastructure (NEVI) program, the government has invested USD 7.5 billion to build 500,000 EV high-speed chargers along America’s major interstates and freeways by 2030. Another USD 2.5 billion is offered as competitive grants to states to fill gaps along charging corridors. The adoption of high-speed electric vehicle charging cables is fostering market expansion.

Challenges

- The rising price of EV charging cables - The expensive nature of EV production has served as a substantial barrier to their widespread use. Electric vehicles cost significantly more than ICE vehicles since they demand expensive rechargeable lithium-ion batteries. In addition, the cost of the cathode has an enormous effect on the price of the batteries. This is due to the high cost of the materials utilized in these batteries, including cobalt, nickel, lithium, and magnesium. As a result, the installation cost of charging stations incurs high capital expenditure. All of these factors are anticipated to hamper the market’s overall growth.

- Surging demand for wireless charging technology - With the advancement of technology, the popularity of wireless technology is also growing. As a result, the market is predicted to be hindering industry growth.

EV Charging Cables Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 1.78 billion |

|

Forecast Year Market Size (2035) |

USD 14.69 billion |

|

Regional Scope |

|

EV Charging Cables Market Segmentation:

Shape Segment Analysis

Straight segment is expected to dominate over 60.2% EV charging cables market share by 2035, owing to its advanced features, such as being simpler and less costly. The fundamental layout of straight EV charging cables decreases manufacturing complexity, leading to cost savings passed on to customers.

Moreover, they provide more flexibility and are appropriate for a wide range of applications, including home and commercial power stations. In April 2023, the Energy Efficiency & Conservation Authority reported, that over 97% of EV users charge their vehicles at home, with about 80% charging only half across the globe.

Furthermore, a straight design reduces the likelihood of bends, which may damage the cable's integrity over the years. Aside from that, they are simpler to use and operate, particularly when connecting to and removing from the charging station. Therefore, the market is estimated to expand.

Power Supply Segment Analysis

By 2035, AC charging segment is projected to dominate over 75.6% EV charging cables market share. The segment’s notable growth rate can be attributed to the fact that most of the houses and businesses utilize AC power supplies, making them a good option for consumers.

Unlike DC charging, AC charging stations are cheaper to establish and operate as they do not require specialized equipment or broad changes to current electrical networks. In contrast to DC chargers, AC chargers are evaluated to be over 74 times cheaper.

Besides, it can be smoothly incorporated into current electrical grids without the need for advanced or expensive modifications. Furthermore, AC charging enables excellent battery control and management, resulting in effective energy utilization.

Our in-depth analysis of the global EV charging cables market includes the following segments:

|

Shape |

|

|

Power Supply |

|

|

Charging Level |

|

|

Application |

|

|

Length |

|

|

Mode |

|

|

Diameter |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

EV Charging Cables Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 60% by 2035, The market growth in this region is set to be dominated by the growing government efforts to inspire key players to develop electric vehicle charging infrastructure. Additionally, the Asia Pacific region consists of countries with the highest production and sales of electric vehicles. More than 35 % of the new cars sold in China were electric vehicles in 2023.

Additionally, the market in China for EV charging cables is also projected to rise, with the highest revenue compared to other regions, owing to the rising construction of EV power stations. Moreover, at least 1 in 3 new car registrations in 2023 was electric in China.

Furthermore, the India market is to observe a surge by 2035 due to the growing manufacturing of EVs in the country, followed by the increase in number of EV manufacturers. For instance, there were more than 350 EV manufacturers in India, till 31 July 2021.

Additionally, the Japan market is also set to experience growth on account of growing spending by authorities on EV research & development. Additionally, the increasing sale of EVs in Japan is expected to boost the market growth. In the FY 2022, the sale of foreign electric passenger cars soared by nearly 60%.

North America Market Insights

The North America EV charging cables market is set to experience remarkable growth over the coming years. The major factor driving market expansion in this region is the presence of key electric vehicle equipment supply manufacturers with strong commitments toward the environment. According to the TE’s annual corporate responsibility report, announced on June 12, 2023, the business has increased its target to cut emissions that are directly created by Scope 1 or Scope 2, by 70% by 2030, as compared to 2020.

Furthermore, in this region, the U.S. market for EV charging cables is predicted to be dominated by growing demand for electric bikes. Hence, EV charging cables can charge e-bikes at a public or public place.

Moreover, the deployment of electric buses has grown in Canada, which is additionally set to boost the market expansion for EV charging cables in this nation.

EV Charging Cables Market Players:

- TE Connectivity

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- Tesla

- General Cable Technologies Corporation

- Coroplast

- Aptiv

- Phoenix Contact

- Dyden Corporation

- Leoni AG

- BESEN International Group Co., Ltd.

The EV charging cables market is poised to be influenced by the key players present in the market. These companies are constantly working on enhancing their products and offering the best and easiest solution to the end user. Some of them include:

Recent Developments

- August 18, 2020, TE Connectivity (TE) recently introduced a new end-to-end range of connectors pre-qualified for the particular requirements of modern 48-Volt car electrical systems. The portfolio compiles TE's proven and trustworthy connectors into a single catalog, thereby rendering it easier for clients to locate and purchase the parts they want.

- September 30, 2021, ABB unveiled an improved all-in-one Electric Vehicle (EV) charger which delivers the fastest charging performance on the market. ABB's new Terra 360 is a modular charger designed for charging up to four vehicles at the same time through dynamic power distribution.

- Report ID: 6268

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.