Electric Vehicle Charging as a Service Market Outlook:

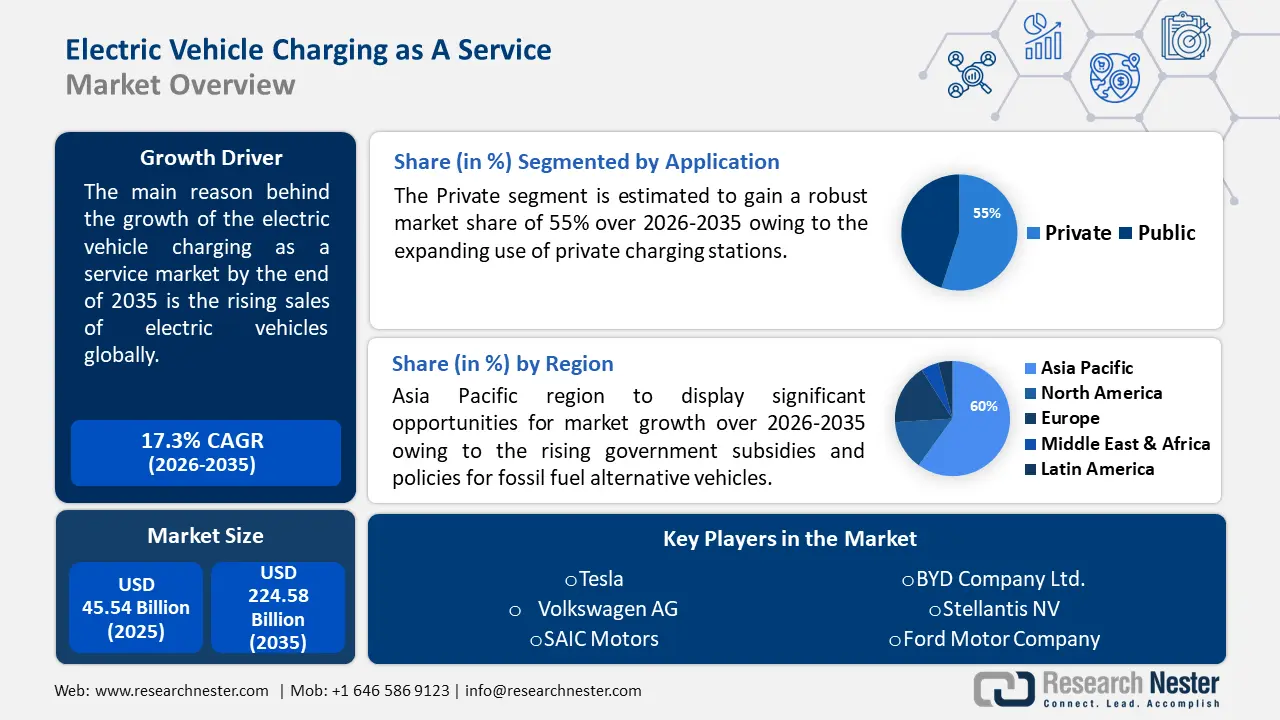

Electric Vehicle Charging as a Service Market size was valued at USD 45.54 billion in 2025 and is likely to cross USD 224.58 billion by 2035, registering more than 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle charging as a service is assessed at USD 52.63 billion.

The reason behind the growth is the rising sales of electric vehicles globally. As stated by the International Energy Association (IEA) released in the year 2024, sales of electric vehicles increased by 3.5 million in 2023 across the globe compared to 2022, a 35% annual rise. In a decade the number of customers of electric vehicles increased per week between 2013 to 2023. This is a weekly total that exceeds the yearly total.

Key Electric Vehicle Charging as a Service Market Insights Summary:

Regional Highlights:

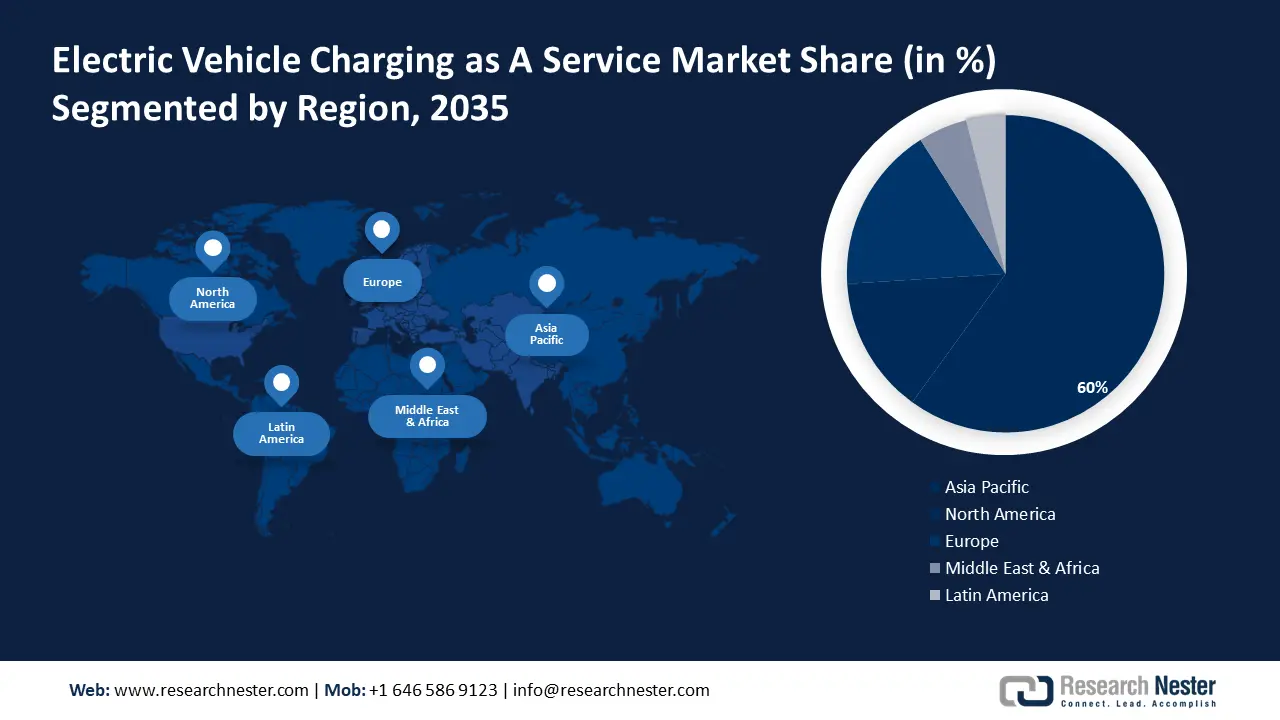

- The Asia Pacific electric vehicle charging as a service market will secure over 60% share by 2035, driven by rising government subsidies and policies for fossil fuel alternative vehicles.

- The Europe market will exhibit massive growth during the forecast timeline, driven by the European government’s oath to achieve carbon neutrality.

Segment Insights:

- The battery changing service segment in the electric vehicle charging as a service market is expected to see substantial growth till 2035, driven by rising consumer demand for battery swapping in electric vehicles.

- The alternate current (normal charging) segment in the electric vehicle charging as a service market is projected to secure a 60% share by 2035, driven by the global expansion of alternate current charging stations.

Key Growth Trends:

- Rising focus on sustainability in the automotive sector

- Increasing customer demands to intensify charging stations for EVs

Major Challenges:

- The higher cost of raw materials of electric vehicles

- Time-consuming charging options of electric vehicles

Key Players: Tesla, Volkswagen AG, SAIC Motors, BYD Company Ltd., Stellantis NV, Ford Motor Company, ABB Group, ChargePoint, Inc., Shell International BV, Schneider Electric, Toyota Motor Corporation, Honda Motor Co. Ltd, Nissan Motor Corporation Ltd., Mitsubishi Motors Corporation.

Global Electric Vehicle Charging as a Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.54 billion

- 2026 Market Size: USD 52.63 billion

- Projected Market Size: USD 224.58 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Electric Vehicle Charging as a Service Market Growth Drivers and Challenges:

Growth Drivers

-

Rising focus on sustainability in the automotive sector - Recently, sustainability has been a hot topic in the media and in society at large. It is also being explored in science from a variety of angles. Due to past corporate scandals, sustainability is becoming increasingly essential, particularly for the automobile sector. Essential concerns of concentration are electric motors, lightweight construction, and reducing CO2 emissions.

As per the World Economic Forum published in May 2024, the car sector is proving that it is willing to adapt. For instance, the Science Based Targets program offers standardized reporting principles, and the EU and the US have committed to producing net-zero carbon cars by 2050. - Rising focus to switch from fossil fuel - The capacity of renewables is expected to increase throughout the next five years. For instance, 96% of new capacity during the timeframe is anticipated to come from solar PV and wind power plants; additions are forecast to be more than fourfold by 2028 compared to 2022 levels, reaching almost 710 GW. Therefore, people are switching from fossil fuel to electric fuel because of the high efficiency and sustainable nature of the later.

In the opinion of the International Energy Association (IEA) released in October 2023, after being locked at almost 80% for decades, the percentage of fossil fuels in the world's energy supply will drop to 73% by 2030, with carbon dioxide (CO2) emissions connected to energy reaching their peak worldwide by 2025. - Increasing customer demands to intensify charging stations for EVs - Electric vehicle charging-as-a-service offers a productive infrastructure that makes charging an electric car (EV) rapid, convenient, and easy. Not only the customers but also the EV charging providers can benefit greatly from charging-as-a-service, or CaaS, as it refrains them from the hassle of setup, control, and maintenance cost.

In conformity with the IEA reported in the year 2024, EV drivers can overnight charge their cars from a standard home outlet in areas where the power grid voltage is 220V or higher. This is the most typical scenario, and it is valid throughout much of Asia, considerable portions of Latin America, Europe, and Australia.

Challenges

- The higher cost of raw materials of electric vehicles - The introduction of new cars is probably going to be slowed down by the increased production costs, which will force automakers to put profitability above volume. Moreover, even one of the most significant EV markets in the U.S. is experiencing a customer crunch because of the high cost of EVs. In fact, the high making cost of EVs makes it accessible to only a few wealthy customers.

- Time-consuming charging options of electric vehicles - The trouble of charging electric vehicles (EVs) is the most evident cause of consumer dissatisfaction. A small percentage of drivers are prepared to arrange their entire life around locating a charging station and waiting for their battery to fully recharge.

Electric Vehicle Charging as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 45.54 billion |

|

Forecast Year Market Size (2035) |

USD 224.58 billion |

|

Regional Scope |

|

Electric Vehicle Charging as a Service Market Segmentation:

Charging Point Type Segment Analysis

Alternate current (normal charging) segment is set to dominate over 60% electric vehicle charging as a service market share by 2035. The rising expansion of charging stations globally providing alternate current will help this segment to have a massive revenue share by the end of 2035.

As mentioned in IEA’s Global EV Outlook 2024, there are 15,900 of private non-home chargers in the US, and more than 2,500,000 chargers in the EU are categorized as having limited access.

Application Segment Analysis

By the end of 2035, private segment is estimated to hold over 55% electric vehicle charging as a service market share. The expanding use of private charging stations will highly drive the market expansion of this segment.

Conforming with the Global EV Outlook 2024 by the International Energy Association (IEA), in several nations, including the US (83%), Canada (80%), and others, a significant portion of EVs are charged at home. In actuality, several nations have well-established infrastructure for home charging.

Charging Service Segment Analysis

In electric vehicle charging as a service market, battery-changing service segment is expected to account for more than 66% revenue share by the end of 2035. The growth of this segment will be noticed because more consumers demand battery swapping for their electric vehicles.

Moreover, as per IEA’s report released in 2024, battery-switching solutions are gaining traction in the expanding markets as well, particularly in India. The Indian State of Maharashtra and the Chinese battery-swapping business Gogoro announced a USD 2.5 billion cooperation in 2023. Gogoro is situated in Taipei.

Our in-depth analysis of the global electric vehicle charging as a service market includes the following segments:

|

Voltage Level of Charging |

|

|

Charging Point Type |

|

|

Application |

|

|

Charging Infrastructure |

|

|

DC Fast Charging |

|

|

Internet Connectivity |

|

|

Charging Service |

|

|

Electric Bus Charging Type |

|

|

Class |

|

|

Drive Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Charging as a Service Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 60% by 2035.

The rising government subsidies and policies for fossil fuel alternative vehicles in this region will exponentially drive the market expansion of electric vehicle charging as a service. As per the Asian Development Bank published in 2018, in Thailand, Indonesia, and India, the limited use of energy will lower the emission of greenhouse gases by 1% to almost 9% by 2030. However, the impact of this cut will be varied by industry and can be affected by the subsidies offered to different energy sources.

Electric vehicle charging as a service is especially going to increase massively in China, driven by the rising adoption of electric vehicles in this country. As specified by the IEA released in 2024, in China, 8.1 million new electric vehicle registrations were made in 2023 which is 35% more than in 2022.

In Japan, electric vehicle charging as a service market will encounter massive growth because of rise in advancement of technologies to develop electric vehicles in this country. For instance, the UK will see the repurposing of used electric car batteries on April 22, 2024, as a result of a recent agreement between Nissan Motors, a Japan-based company, and Ecobat Solutions UK Ltd.

The electric vehicle charging as a service market will also be huge in South Korea due to the huge demand for luxury electric vehicles in this country. In 2022, the total number of electric car sales surpassed those of diesel vehicles for the first time, with 448,934 units sold. With 274,282 sold, hybrids were the most popular EV power source, followed by 164,324 BEVs. This is a 63.7% increase in sales from 2021.

European Market Insights

The European region will encounter massive growth in the sector of electric vehicle charging as a service during the anticipated period.

This quick growth will be noticed mainly due to the European government’s oath to achieve carbon neutrality. As stated by the European Commission in 2019, by 2050, the EU wants to have an economy with net-zero greenhouse gas emissions, or climate neutrality. The European Green Deal’s main regulation is the European Climate Law which explains this future aim of Europe.

The electric vehicle charging as a service market has amplified in the U.K. as a result of the presence of multiple EV charging stations in this country. In line with Gov.UK published in April 2023, almost 19,% of all charging devices, or 7,647, were classified as "rapid" or higher, and around 22,338 chargers were classified as "fast" chargers; this amounts to 56% of all charging gadgets.

In Germany, electric vehicle charging as a service sector will notice enormous growth mainly due to the country’s expansion in the automotive industry. As per Germany Trade and Investment (GTAI) issued in 2023, with more than 3.1 million passenger cars and 351,000 commercial vehicles produced in German factories in 2021, Germany leads Europe in auto manufacturing.

France will notice lucrative growth in electric vehicle charging as a service market during the projected period. The extensive government initiatives to set up EV charging stations in the different cities of France will develop the market growth here. Moreover, in 2019 the Energy and Climate Law, Mobility Orientation Law, and in 2021 Climate and Resilience Law were issued to deploy charging infrastructure in the different cities of France.

Electric Vehicle Charging as a Service Market Players:

- Tesla

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Volkswagen AG

- SAIC Motors

- BYD Company Ltd.

- Stellantis NV

- Ford Motor Company

- ABB Group

- ChargePoint, Inc.

- Shell International BV

Details by competitor are provided by the competitive environment for electric vehicle charging as a service. Many companies are merging, and introducing new innovative technologies across the world. Some major participants in the industry are:

Recent Developments

- Tesla started construction on its own lithium refinery in the greater Corpus Christi, Texas, on May 8, 2023. When finished, the facility would have cost Southwest Texas more than USD 1 billion.

- The Volkswagen Group, unveiled a noteworthy EV charging product innovation Elli on June 7, 2024. The new Elli Charger 2 has an environment that is flawlessly orchestrated, a plethora of services, and much lower charging prices. Customers of Volkswagen may now easily and conveniently purchase their electric car, charger, and power plan from a single site.

- Report ID: 6235

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Charging as a Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.