Electric Vehicle Battery Housing Market Outlook:

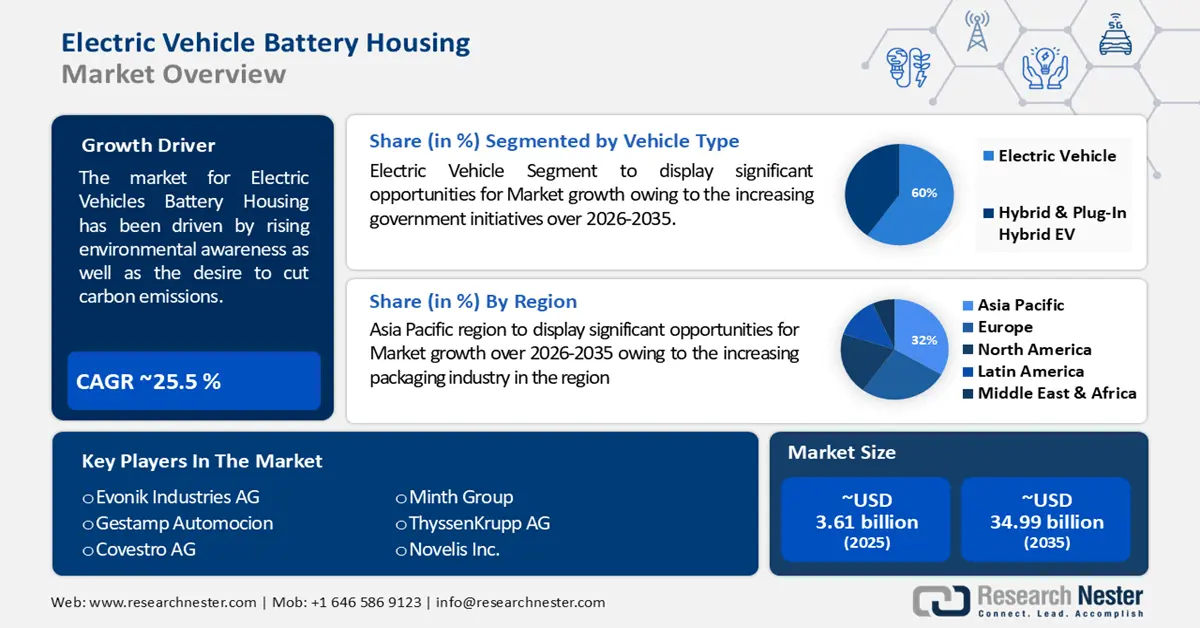

Electric Vehicle Battery Housing Market size was over USD 3.61 billion in 2025 and is poised to exceed USD 34.99 billion by 2035, growing at over 25.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle battery housing is estimated at USD 4.44 billion.

The market for electric vehicles battery housing has been driven by rising environmental awareness as well as the desire to cut carbon emissions. Every year, a typical passenger car emits 4.6 metric tons of CO2. This assumes that the average gas-powered vehicle on the road currently gets about 22.2 mpg and covers 11,500 miles per year. For every gallon of gasoline used, about 8,887 grams of CO2 are created.

In addition to these, policies & incentives from the government will be crucial in determining how the EV battery housing industry develops. Globally, a large number of governments are putting laws and incentives into place to encourage the use of electric vehicles. Subsidies, tax breaks, and legislative initiatives are some of the strategies used to lessen reliance on cars using conventional internal combustion engines. Over the next few years, there will be a major increase in demand for EV batteries and associated components, such as battery housing, as more automakers make investments in electric vehicle technology.

Key Electric Vehicle Battery Housing Market Insights Summary:

Regional Highlights:

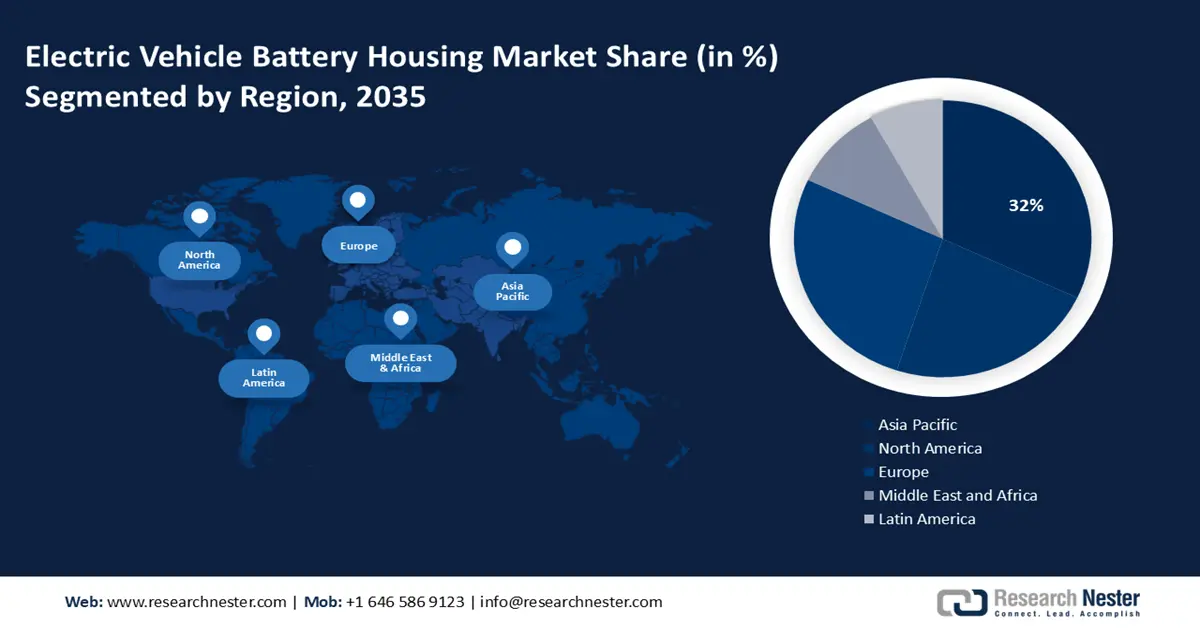

- Asia Pacific electric vehicle (ev) battery housing market will secure over 32% share by 2035, attributed to concerns regarding pollution and air quality due to fast urbanization in the region.

- Europe market will account for 27% share by 2035, driven by significant investments in the production of electric vehicles and battery packs.

Segment Insights:

- The electric vehicle segment in the electric vehicle battery housing market is expected to reach a 60% share by 2035, influenced by government incentives and rapid growth in electric vehicle sales.

- The carbon fiber reinforced polymer segment in the electric vehicle battery housing market is projected to see robust growth through 2035, driven by CFRP's strength, lightweight, and durability enhancing EV efficiency.

Key Growth Trends:

- An Ongoing Trend Is the Increasing Use of Lightweight Materials and Modular Design

- Increasing EV Adoption and Advancing Battery Technology to Drive Market Expansion

Major Challenges:

- An Ongoing Trend Is the Increasing Use of Lightweight Materials and Modular Design

- Increasing EV Adoption and Advancing Battery Technology to Drive Market Expansion

Key Players: Evonik Industries AG, Gestamp Automocion, ThyssenKrupp AG, Nemak, S.A.B. de C.V., Covestro AG, Norsk Hydro ASA, Magna International Inc., Kautex Textron GmbH & Co. KG, Novelis Inc., Minth Group.

Global Electric Vehicle Battery Housing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.61 billion

- 2026 Market Size: USD 4.44 billion

- Projected Market Size: USD 34.99 billion by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 16 September, 2025

Electric Vehicle Battery Housing Market Growth Drivers and Challenges:

Growth Drivers

- An Ongoing Trend Is the Increasing Use of Lightweight Materials and Modular Design- A continuous trend in the industry is the growing use of lightweight materials and modular design. The necessity to improve safety features, overall vehicle efficiency, and design is what's driving this trend. To increase vehicle economy and range, manufacturers, or OEMs, are focusing more and more on adopting lightweight materials for the battery housing of electric vehicles. Because of their qualities, materials like aluminum and high-strength composites are becoming more and more popular. The increasing need for lightweight materials, modular design, and enhanced safety features in electric vehicles is responsible for the electric vehicle battery housing market rise. Battery housing designs for electric vehicles that are modular are becoming more popular since they make scaling and customization simpler. The requirement to support varying battery capacities and configurations for different EV models is what's driving this development.

- Increasing EV Adoption and Advancing Battery Technology to Drive Market Expansion- Because of government incentives and environmental concerns, the number of electric car adoptions rises annually. One of the main reasons for the popularity of EVs is the increase in environmental awareness. Incentives and regulations are being offered by governments to encourage the sale of electric vehicles. Reduced selling costs, no registration fees or minimal registration fees, and free EV infrastructure charging at various charging points are a few of these incentives. The market is expanding as electric car adoption rises. Large battery packs are necessary for these electric cars, and each pack needs a protective casing.

- Increasing Demand for Better Safety Features in Electric Cars to Spur Industry Growth- The primary driver of market expansion is the growing requirement for lightweight materials, modular design, and improved safety features in electric vehicles. The Electric Vehicle (EV) battery housing market is progressing due to the increasing use of lightweight materials for the battery housing of electric vehicles (EVs) by leading manufacturers or OEMs, who want to increase the overall efficiency and range of their vehicles. Because of these qualities, high-strength composites and aluminum are becoming more popular. The market is growing as a result of the growing popularity of modular Electric Vehicle (EV) battery housing designs, which allow for easier customization and scalability.

Challenges

- High Material Costs Could Hinder Market Expansion- The high cost of materials may be the market's limiting constraint. The price of the materials required to make an electric car's battery housing directly affects how much an electric vehicle costs to manufacture altogether. Electric vehicles may become less affordable relative to Internal Combustion Engine (ICE) vehicles due to the high cost of the material. The need for battery housing for electric vehicles may be hampered by the high cost of designing and producing customized battery housing. Battery housing is designed and manufactured under strict safety rules to avoid thermal runaway and fires. This rule may present difficulties and expenses for producers.

- Even though electric vehicles are becoming more and more popular, not much thought has gone into standardizing battery designs.

- The rapid use of electric vehicles is creating supply-chain vulnerabilities and resource problems in addition to raising demand for necessary battery materials.

Electric Vehicle Battery Housing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 3.61 billion |

|

Forecast Year Market Size (2035) |

USD 34.99 billion |

|

Regional Scope |

|

Electric Vehicle Battery Housing Market Segmentation:

Vehicle Type Segment Analysis

Based on vehicle type, electric vehicle segment is anticipated to hold 60% share of the global electric vehicle (EV) battery housing market by 2035. Throughout the world governments is putting in place incentives like tax breaks and subsidies to entice people and companies to select electric cars, creating a thriving market. From 2017 to 2022, the number of electric vehicle sales increased from approximately 1 million to over 10 million in just 5 years. The previous five-year period from 2012 to 2017 demonstrated the exponential nature of EV sales growth, as EV sales increased from approximately 100,000 to one million. Furthermore, improvements in battery technology, which provide increased economy and performance, help explain why electric vehicles are becoming more and more popular in a variety of markets. Together, these initiatives seek to solve environmental issues, lower carbon emissions, and build a more sustainable transportation sector. Since the transportation sector contributes more than 15% of all energy-related emissions worldwide, electric vehicles are essential to the decarbonization of this industry.

Material Segment Analysis

Based on material, carbon fiber reinforced polymer segment is anticipated to hold 35% share of the global electric vehicle battery housing market by 2035. because of its attractive qualities. The exceptional strength and light weight that CFRP provides increases the overall efficiency and range of electric cars. The material's remarkable corrosion resistance and endurance add to battery systems' lifespan. Furthermore, CFRP's resistance to impact improves EV safety. The need for CFRP-based EV battery housing is only growing as the automotive industry places a greater emphasis on sustainability, efficiency, and performance. Sales of electric vehicles surpassed 10 million worldwide in 2022.

Our in-depth analysis of the global market includes the following segments:

|

Form |

|

|

Vehicle Type |

|

|

Cell Format Type |

|

|

Application |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Battery Housing Market Regional Analysis:

APAC Market Insights

Electric vehicle (EV) battery housing market in Asia Pacific region is estimated to hold largest revenue share of about 32% during the forecast period. Concerns regarding pollution and air quality have grown as a result of the fast urbanization of many Asian cities. The World Health Organization (WHO) considers the air that about 90% of people in the Asia-Pacific area frequently breathe to be hazardous. A center for manufacturing know-how and technical innovation is the Asia Pacific area. China, Japan, and South Korea have been major players in the development of sophisticated battery technology and EV battery housing due to their leadership positions in these areas and their manufacturing capabilities.

Europe Market Insights

Electric vehicle battery housing market in Europe region is projected to hold second largest revenue share of about 27% during the forecast period. Europe has the second-largest market share because the continent was a pioneer in the use of electric cars. Due to manufacturers' significant investments in the production of electric vehicles, the manufacturing of EV battery packs and housing has become more innovative and widely used. European businesses have been actively involved in the development of cutting-edge battery technology, management safety, and the material used to house electric vehicles (EVs). The need for battery housing for electric vehicles is fueled by such advances.

Electric Vehicle Battery Housing Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gestamp Automocion

- ThyssenKrupp AG

- Nemak, S.A.B. de C.V.

- Covestro AG

- Norsk Hydro ASA

- Magna International Inc.

- Kautex Textron GmbH & Co. KG

- Novelis Inc.

- Minth Group

Recent Developments

- February 2021: Leading a group of collaborators, Essen, Germany-based Evonik Industries unveiled a novel high-voltage battery housing idea for e-mobility solutions. With the use of glass fiber-reinforced epoxy sheet molding compound (SMC), this innovative design produces a lighter and more affordable alternative. The goal of the entire battery system concept is to offer traditional metals and more expensive carbon fiber-reinforced plastics (CFRP) an alternative that is safer and more energy-efficient for the automotive industry.

- October 2022: Gestamp presented a wide array of technologies and products at the IZB 2022 in Wolfsburg, Germany. Oversized parts, cutting-edge joining technologies, cell-to-pack ideas, chassis systems, battery enclosures, creative lightweight solutions, Active Frunks, and power doors were a few of the highlights. Key technologies and breakthroughs from Gestamp's three business segments—Body, Chassis, and Mechanics (Edscha)—were showcased by the company's research and development teams.

- Report ID: 5949

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.