Electric Scooter Market Outlook:

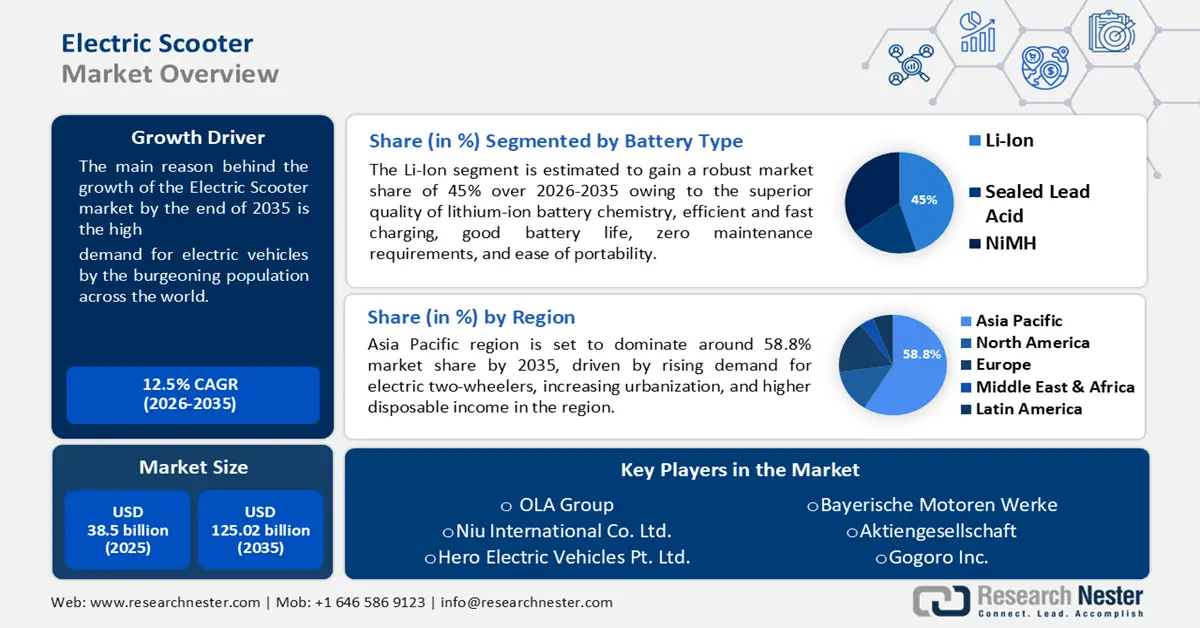

Electric Scooter Market size was valued at USD 38.5 billion in 2025 and is expected to reach USD 125.02 billion by 2035, expanding at around 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric scooter is evaluated at USD 42.83 billion.

The primary factor attributed to the growth of the global electric scooter market size is the high demand for electric vehicles by the burgeoning population across the world. The reports by the International Energy Agency (IEA) stated that the sales of electric vehicles (EVs) doubled in 2021 from the previous year to a new record of 6.6 million. The rising government initiatives to reduce the use of fuel to decrease dependency on other countries for oil, petrol, or diesel resources. The increasing cost of fuel production decreases economic growth, thereby increasing poverty levels in these countries. The use of electric scooters reduces fuel costs, increases the efficiency of the vehicles, and also decreases environmental pollution. Electric vehicles are run by electric batteries, electricity, or fuel cells that can be recharged whenever required with less energy consumption.

The increasing demand for fuel-efficient vehicles, coupled with growing concerns over greenhouse gas and carbon emissions, is anticipated to drive the adoption of electric scooters (e-scooters) during the forecast period. As a result, the rising government support to produce electric scooters is anticipated to expand the electric scooter market size. A report of 2021 stated that the Indian government has increased the subsidy under the second phase of the FAME India scheme on electric two-wheelers by 50 percent, making them more affordable. The use of fossil fuels such as oil, diesel, or petrol release greenhouse gases on combustion leads to environmental damage. On the other hand, electric scooters do not emit any gases and work on electricity consumption or chargeable batteries. The rising concern of people about global warming is attributed to the increasing preference for electrical scooters.

Key Electric Scooter Market Insights Summary:

Regional Highlights:

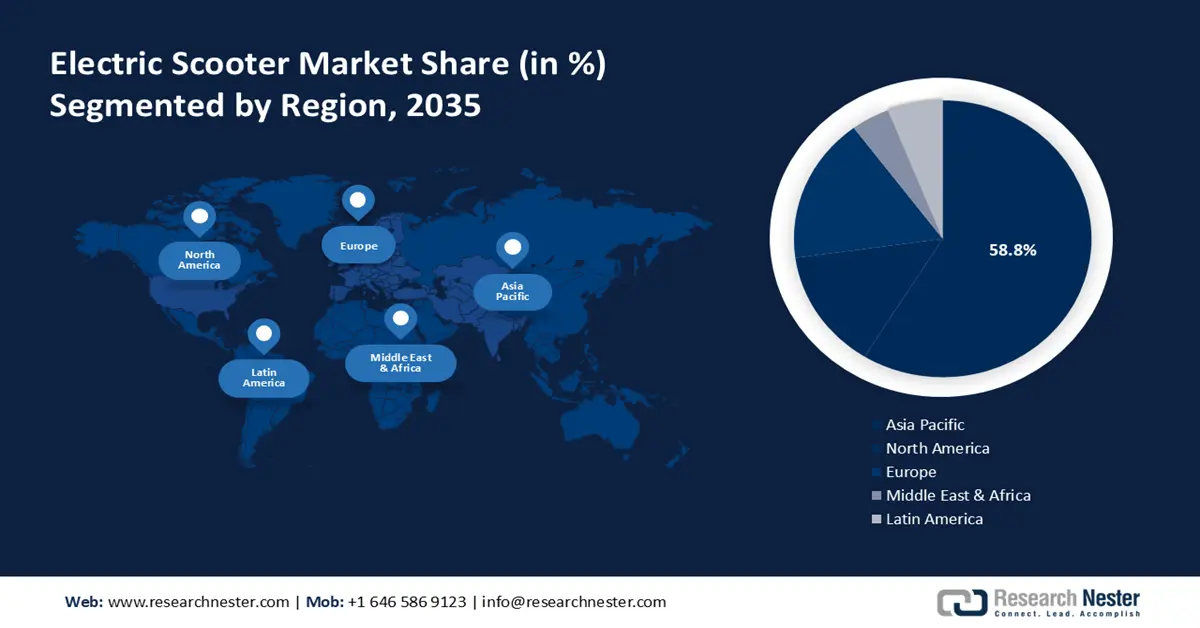

- Asia Pacific electric scooter market will dominate more than 58.8% share by 2035, driven by rising demand for electric two-wheelers, increasing urbanization, and higher disposable income in the region.

Segment Insights:

- The folding (product) segment in the electric scooter market is projected to hold a significant share by 2035, driven by portability, compact storage, and suitability for small urban living spaces.

- The li-ion segment in the electric scooter market is anticipated to maintain the highest market share by 2035, attributed to lithium-ion's high efficiency, durability, fast charging, and low maintenance requirements.

Key Growth Trends:

- Increasing Concern for Rising Air Pollution Owing to the Release of Harmful Gases from Fuel Vehicles

- Hike in Motor Fuel Prices with Rising Dependency and Transport Issues During COVID-19 Crisis

Major Challenges:

- Lack of Infrastructure in Emerging Nations

- High Cost of Electric Scooters

Key Players: OLA Group, Niu International Co. Ltd., Hero Electric Vehicles Pvt. Ltd., Bayerische Motoren Werke Aktiengesellschaft, Gogoro Inc., Mahindra Group, Vmoto Limited, Zhejiang Luyuan Electric Vehicle Co., Ltd, Yadea Technology Group Co. Ltd., Terra Motors Corporation.

Global Electric Scooter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 38.5 billion

- 2026 Market Size: USD 42.83 billion

- Projected Market Size: USD 125.02 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (58.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Netherlands

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Electric Scooter Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Concern for Rising Air Pollution Owing to the Release of Harmful Gases from Fuel Vehicles – The ever-increasing air pollution in the atmosphere is harmful to human health and the environment on a global scale. Therefore, the high number of deaths owing to high air pollutants is expected to increase the adoption rate of electric scooters in the forecast period. The World Health Organization in recent data stated that almost all of the global population i.e. 99% breathe air that exceeds World Health Organization guideline limits that contain a high level of pollutants.

- Hike in Motor Fuel Prices with Rising Dependency and Transport Issues During COVID-19 Crisis– As per a report by the Bureau of Transportation Statistics published in 2022, the price of regular motor gasoline rose almost 49% from January 2022 to June 2022. Whereas, the price of diesel fuel rose to 55% in the same period.

- Enhanced Energy Consumption with High-Efficiency Battery Performance - A standard electric scooter with a 25 km range has a 6400 mAh 36 Volt battery and it usually takes about 4 or 5 hours to charge fully.

- Upsurge in Traffic Congestion Leads to More Greenhouse Gas Emissions – The burning of fuels from automobiles releases smoke and carbon dioxide along with harmful greenhouse gases and carcinogens with an increasing number of vehicles on the road. To reduce this overcrowding, electric scooters are a good choice thereby decreasing the emission of toxic gases. The latest report calculated that Americans lost almost 4 billion hours owing to congestion in 2021.

Challenges

- Lack of Infrastructure in Emerging Nations

- Electric vehicles also need charging points similar to fuel stations, as there is no such advanced infrastructure in many regions which hinders the use of electric scooters which in turn limits the growth of the market. There is a huge need for charging stations at every 50 km as the battery of electric scooters does not last more than that which is not sufficient for the long journey.

- High Cost of Electric Scooters

- Lack of Good Road Network

Electric Scooter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 38.5 billion |

|

Forecast Year Market Size (2035) |

USD 125.02 billion |

|

Regional Scope |

|

Electric Scooter Market Segmentation:

Battery Type Segment Analysis

The global electric scooter market is segmented and analyzed for demand and supply by battery type into sealed lead acid, NiMH, Li-Ion, and others. Out of these, the Li-Ion segment is attributed to garnering the highest market share, owing to the superior quality of lithium-ion battery chemistry, efficient and fast charging, good battery life, zero maintenance requirements, and ease of portability. For instance, compared to the average lead acid battery's 85% efficiency, lithium battery charge with a nearly 100% efficiency. Li-Ion batteries include properties such as tolerance to damage, durability, and low cost, that increases their demand in the automobile industry for manufacturing batteries. Lithium-ion battery is lighter than lead acid battery with more energy density and longevity I.e., they can be recharged many times in their lifetime. These batteries also charge very fast providing more power in less time, with a life span of about 5 years.

Product Segment Analysis

The global electric scooter market is also segmented and analyzed for demand and supply by the product into retro, self-balancing, and folding. Amongst these three segments, the folding segment is expected to garner a significant share. Folding electric scooters are in high demand owing to their small size, portability, lightweight, and easy start without any kick rods. Followed by the rising fuel prices and the increasing use of e-scooters by children above 8 years for various uses. This type of scooter is available in different sizes and is customizable based on the age group. Also, they occupy less parking space which can be stored under desks, inside cabinets, and on bookshelves. In addition, they can be transported or carried in a car trunk very easily owing to their foldable nature and small size. This convenient storage option makes it the best option for people living in small residential apartments or rooms with no parking space. The maintenance cost is low compared to other conventional motor vehicles and comes at an affordable price.

Our in-depth analysis of the global market includes the following segments:

|

By Vehicle Type |

|

|

By Battery Type |

|

|

By Product |

|

|

By Technology |

|

|

By Voltage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Scooter Market Regional Analysis:

APAC Market Insights

Asia Pacific region is set to dominate around 58.8% market share by 2035, driven by rising demand for electric two-wheelers, increasing urbanization, and higher disposable income in the region. A report from 2022 stated that electric two-wheelers register a staggering 130% growth in 2021 in India. Further, the growing stances of traffic congestion, upsurge in carbon emission regulations, and growing urbanization in the region. For instance, in 2021, Mumbai's congestion level accounted nearly 54%, which represents that it took 54% longer time to get from one point to another than in a free-flow scenario. Increasing urbanization with advancements in lifestyle and rising living standards of people owing to more disposable income leads to economic growth in the region. The rising economic standards increase the spending capacity of people on trending goods including electric scooters, bikes, and dockless bikes, and it is expected to boost the market’s growth in the region. Moreover, the rising preference for electric scooters is attributed to their eco-friendly and convenient nature with less cost and high efficiency.

Electric Scooter Market Players:

- OLA Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Niu International Co. Ltd.

- Hero Electric Vehicles Pvt. Ltd.

- Bayerische Motoren Werke Aktiengesellschaft

- Gogoro Inc.

- Mahindra Group

- Vmoto Limited

- Zhejiang Luyuan Electric Vehicle Co., Ltd

- Yadea Technology Group Co. Ltd.

- Terra Motors Corporation

Recent Developments

-

OLA Group has acquired an Amsterdam-based electric scooter startup to produce and launch its line of two-wheelers as soon as this year.

-

Hero Electric Vehicles Pvt. Ltd. is all set to finalize the dealership in Hyderabad in partnership with Kukatpally Ankur Motors to meet the growing demand for electric 2-wheelers in the area.

- Report ID: 4655

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Scooter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.