Electric Power Sports Market Outlook:

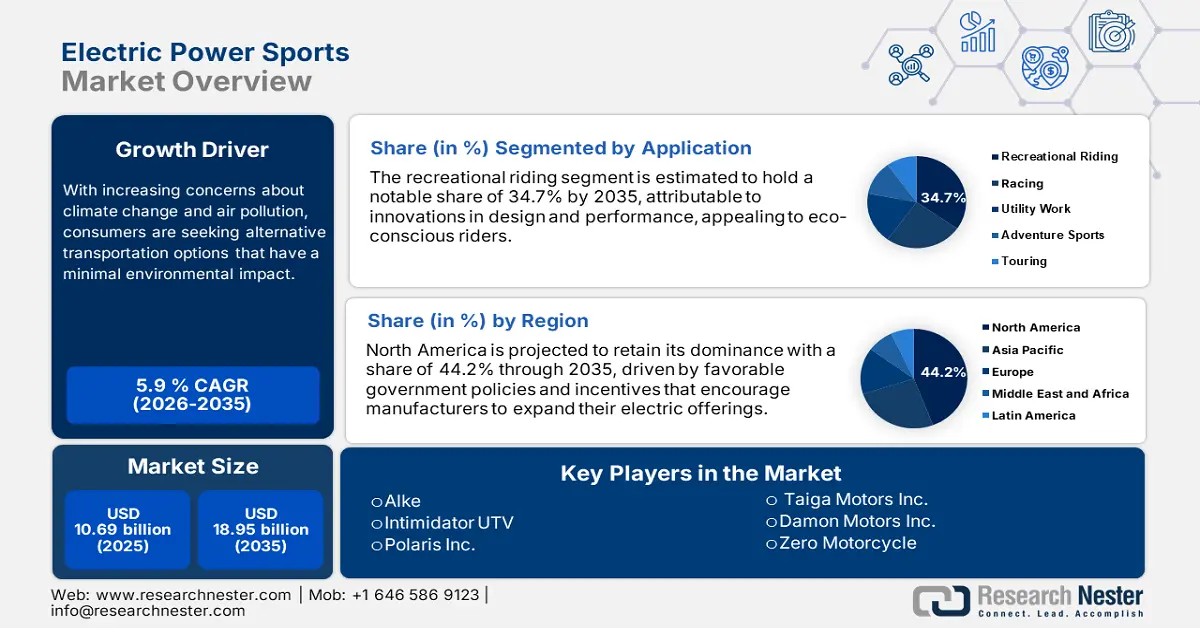

Electric Power Sports Market size was over USD 10.68 billion in 2025 and is anticipated to cross USD 18.95 billion by 2035, witnessing more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric power sports is assessed at USD 11.25 billion.

The electric power sports industry is experiencing profitable growth due to the growing demand for electric propulsion systems. Electric sports vehicles are becoming increasingly popular with consumers due to their improved performance, reduced operating costs, and environmental friendliness. For instance, in February 2023, Lynx and Ski-Doo introduced their newest electric snowmobiles, the Adventure Electric and Grand Touring Electric models. These models offer a unique riding experience making them ideal for beginners keen to learn more about the sport of snowmobiling.

The electric power sports market is being driven by the incorporation of system-on-modules for GPS navigation, a digital dashboard, and wireless connectivity via Bluetooth, Wi-Fi, and LTE cellular networks. These cutting-edge technologies improve the user experience by offering seamless connectivity, real-time data, and navigation support. For instance, in January 2024, Altmin made a major milestone in the value chain of the EV market by investing USD 100 million in the development of lithium-ion batteries in India, along with a 3 GWh plant. The use of such integrated systems in electric power sports vehicles is increasing market growth and competitiveness as consumers seek convenience and connectivity more and more in their outdoor recreational activities.

Key Electric Power Sports Market Insights Summary:

Regional Highlights:

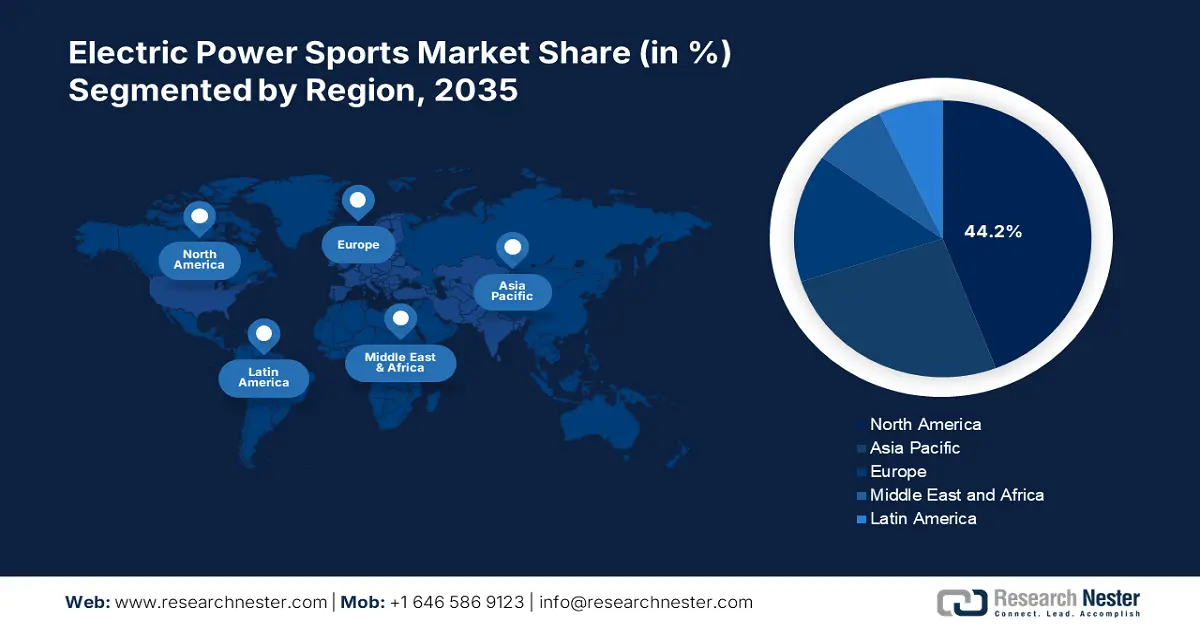

- North America commands the Electric Power Sports Market with a 44.2% share, supported by increasing consumer demand for environmentally friendly recreational options and government incentives for electric vehicles, fostering growth through 2026–2035.

- The Asia Pacific electric power sports market is poised for substantial growth through 2035, attributed to rapid urbanization, disposable income growth, and government initiatives supporting electric mobility.

Segment Insights:

- The Electric Motorcycles segment is anticipated to experience significant CAGR growth from 2026 to 2035, propelled by demand for performance, sustainability, and reduced emissions.

- The Recreational Riding segment of the Electric Power Sports Market is forecasted to achieve around 34.7% share by 2035, driven by consumer preference for sustainable outdoor recreation vehicles.

Key Growth Trends:

- Rising popularity of outdoor activities

- Expansion of sound infrastructure

Major Challenges:

- Battery disposal and recycling

- High initial costs

- Key Players: Polaris Inc., Damon Motors Inc., Intimidator UTV, Alke, Greenworks Commercial, Harley-Davidson Inc.

Global Electric Power Sports Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.68 billion

- 2026 Market Size: USD 11.25 billion

- Projected Market Size: USD 18.95 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Electric Power Sports Market Growth Drivers and Challenges:

Growth Drivers

- Rising popularity of outdoor activities: Electric power sports vehicles in the electric power sports market represent an appealing option for outdoor enthusiasts searching to explore varied terrains with reduced noise and emissions. Furthermore, it is facilitated through the development of electric versions that can be designed towards an array of outdoor recreation activity needs, from off-road bicycle enthusiasts to ATV riders to electronic-powered watercraft. For instance, in April 2024, Polaris announced shipment of its all-electric RANGER XP Kinetic utility which has been using electric technology to provide off-road riders with an unmatched experience and cutting-edge performance capabilities. This growing interest in outdoor experiences leads to a more sustainable and engaging outdoor lifestyle.

- Expansion of sound infrastructure: The development of charging stations, maintenance facilities, and dedicated trails for electric-powered sports vehicles by the governments and private sectors would improve accessibility and practicality for the use of such eco-friendly alternatives. With the expansion of charging infrastructure, consumers can enjoy longer and more adventurous outings, expanding the user base. For instance, in May 2024, Hero MotoCorp planned to broaden its selection of electric models under the VIDA brand to attract more customers. Moreover, it has increased its reach to more than 180 touchpoints and 120 cities. Improved infrastructure will thus aid the electric power sports vehicles market’s operations and generate market growth for the industry.

Challenges

- Battery disposal and recycling: The current recycling processes are limited in capacity and efficiency, which leads to a large volume of waste being generated that would otherwise be reused. Furthermore, the lack of standard recycling programs and consumer awareness about the proper disposal method only makes matters worse. The electric power sports market is still experiencing many challenges concerning the disposal and recycling of batteries because of the environmental and regulatory implications of the lithium-ion batteries used in most of the vehicles employed within the sector.

- High initial costs: The rising costs are a significant barrier to entry in the market. This often prevents potential consumers from making the switch to electric vehicles. The initial investment for an electric motorcycle, ATV, or other electric sports vehicle is usually higher than for its traditional gasoline counterpart. This is mainly due to advanced battery technology and electric drivetrains are expensive. This is worsened by the unaffordable nature of the low models, which may limit the entry into the market of a higher number of individuals.

Electric Power Sports Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 10.68 billion |

|

Forecast Year Market Size (2035) |

USD 18.95 billion |

|

Regional Scope |

|

Electric Power Sports Market Segmentation:

Application (Recreational Riding, Racing, Utility Work, Adventure Sports, Touring)

In electric power sports market, recreational riding segment is projected to account for revenue share of around 34.7% by 2035. As more people tend to seek interest in outdoor adventures, recreational activities such as electric dirt biking, off-road riding, and electric snowmobiling have garnered considerable interest. In addition, electric power sports offer great solutions for consumers inclined towards sustainable alternatives over traditional recreational vehicles. For instance, in December 2023, Toyota announced the sale of its brand-new Crown Sport Plug-in Hybrid Electric Vehicle (PHEV) model. This model in the Crown lineup is intended to improve the fun, sporty driving experience. Thus, the alignment of consumer preference with sustainable innovations assists in the expansion of recreational riding in the market.

Vehicle Type (Electric Motorcycles, Electric ATVs, Electric Snowmobiles, Electric Bicycles, Electric Scooters)

The electric motorcycle segment is projected to garner significant growth traction in the electric power sports market during the forecasted timeline. Electric motorcycles have gained much attention due to their ability to deliver impressive performance characteristics, such as rapid acceleration and enhanced torque, similar to traditional gasoline-powered models. Furthermore, the growing sense of sustainability coupled with reduced carbon emissions is further promoting interest in electric motorcycles. For instance, in February 2024, Revolt introduced the 150-kilometer-range RV400 BRZ electric motorcycle. Its long-range capability makes it more useful and appealing to users looking for sustainable and effective urban commuting options. Thus, the motorcycle segment will continue to evolve and render choices to consumers seeking performance, sustainability, and convenience.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Vehicle Type |

|

|

Power Source |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Power Sports Market Regional Analysis:

North America Market Analysis

By the end of 2035, North America electric power sports market is set to hold over 44.2% revenue share, driven by increasing consumer demand for more environmentally friendly recreational options and improved electric vehicle technology. Growing environmental awareness and supportive government policies, such as tax incentives and funding for charging infrastructure, have contributed to increased adoption. At the same time, post-pandemic, interest in outdoor recreation has surged, driving greater demand for electric power sports, thus making North America a significant market for worldwide electric mobility transition.

The U.S. electric power sports market is witnessing a surge in strategic collaborations between industry leaders to foster knowledge, experience, and enhance market penetration. For instance, in March 2021, according to Polaris' new electrification strategy, it collaborated with Zero Motorcycles to Co-Develop Electric Vehicles as a foundation for rEV'd up. Furthermore, a 10-year exclusive partnership agreement in off-road vehicles and snowmobiles has been signed between Polaris and Zero Motorcycles to combine Zero's proven electric powertrain technology and Polaris' industry leadership.

The market in Canada is evolving at a steady pace as it embraces the support from well-established key players in the market to flourish. For instance, in April 2024, Honda Motor Co., Ltd. announced that it intends to construct a comprehensive EV value chain in Canada with an estimated investment of USD 10.8 million, including investment from joint venture partners. In Alliston, Ontario, Honda has started assessing the conditions necessary to construct a cutting-edge and ecologically conscious Honda EV plant as well as a standalone Honda EV battery plant.

Asia Pacific Market Statistics

Asia Pacific is expected to witness substantial growth in the electric power sports market during the forecast timeline from 2025 to 2035. The growth is stimulated by the rapid pace of urbanization, increasing disposable incomes, and environmental awareness. The growth drivers are being pushed by government initiatives on electric mobility through various subsidies and charging infrastructure developments. Furthermore, well-established manufacturers complemented by a growing innovation ecosystem of startups, make Asia-Pacific critically important to the global future of market.

Consumers in India favor electric two-wheelers owing to their availability of varied product options, dependable technological features, changing purchasing patterns, and adaptable ownership arrangements. For instance, in September 2023, it was published in McKinsey & Company that by 2030, the sales of electric two-wheeler vehicles are expected to surge to 60-70%. The increased use of electric two-wheelers will support India’s alignment with global climate policies, such as faster adoption and manufacturing of electric vehicles, aimed at reducing air pollution and improving traffic conditions.

China focuses on moving strategically with the growth of the market to expand its reach and widen its consumer base through collaborations. For instance, in May 2024, Leapmotor, a Chinese EV manufacturer, planned to join forces with Stellantis to enter India. Two electric vehicles (EVs) will be introduced by the company to its international markets, the D-segment sports utility vehicle (SUV) C10 and a small electric city car known as the T03. Leapmotor will utilize Stellantis’s manufacturing networks and facilities for the regions that will face high tariffs.

Key Electric Power Sports Market Players:

- Alke

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Damon Motors Inc.

- Energica Motor Company S.p.A

- Greenworks Commercial

- Harley-Davidson, Inc.

- Intimidator UTV

- Polaris, Inc.

- TACITA S.r.l

- Taiga Motors Inc.

- Zero Motorcycle

The competitive landscape is driven by a growing focus on innovation in performance enhancement, widened range availability, and concerns over sustainability. For instance, in November 2023, at the EICMA 2023 show in Milan, Bosch demonstrated its dedication to influencing the direction of the motorcycle industry. It is revolutionizing the two-wheeler industry with its cutting-edge powertrain systems, a creative software solution with an inclination towards electrification. Moreover, manufacturer cooperation with technology companies to bring together sophisticated features, including connectivity and autonomous features, would make electric power sports more futuristic.

Here’s the list of some key players:

Recent Developments

- In August 2024, an electric vehicle start-up company, River Mobility Pvt Ltd. funded by investors such as Yamaha Motor Corp. and Mitsui & Company Ltd., aimed to open 100 showrooms by March 2026.

- In November 2021, Austin decided to expand its portfolio with Volcon, a powersports electric vehicle startup. It offered electric off-road vehicles with two or four wheels, including utility terrain vehicles and motorcycles.

- Report ID: 6787

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Power Sports Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.