Electric Passenger Cars Market Outlook:

Electric Passenger Cars Market size was valued at USD 429.91 billion in 2025 and is set to exceed USD 7.17 trillion by 2035, expanding at over 32.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric passenger cars is estimated at USD 555.66 billion.

The strict regulations on carbon emissions and favorable government policies on eco-friendly vehicle adoption are expected to boost the sales of electric passenger cars in the coming years. The Paris Agreement, for instance, focuses on limiting greenhouse gas emissions by 43% by 2030. As electric vehicles effectively help to mitigate carbon emissions, manufacturers are continuously focused on advancing their EV performance and design.

As per the International Energy Agency (IEA), if EV sales increase substantially in the coming years, the CO2 emission by cars can be reduced effectively aligning with the Net Zero Emissions by 2050 initiative. Furthermore, it is estimated that Europe, China, and the U.S. are set to experience high sales of electric vehicles including battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), and fuel cell electric vehicles in the foreseeable future.

Key Electric Passenger Cars Market Insights Summary:

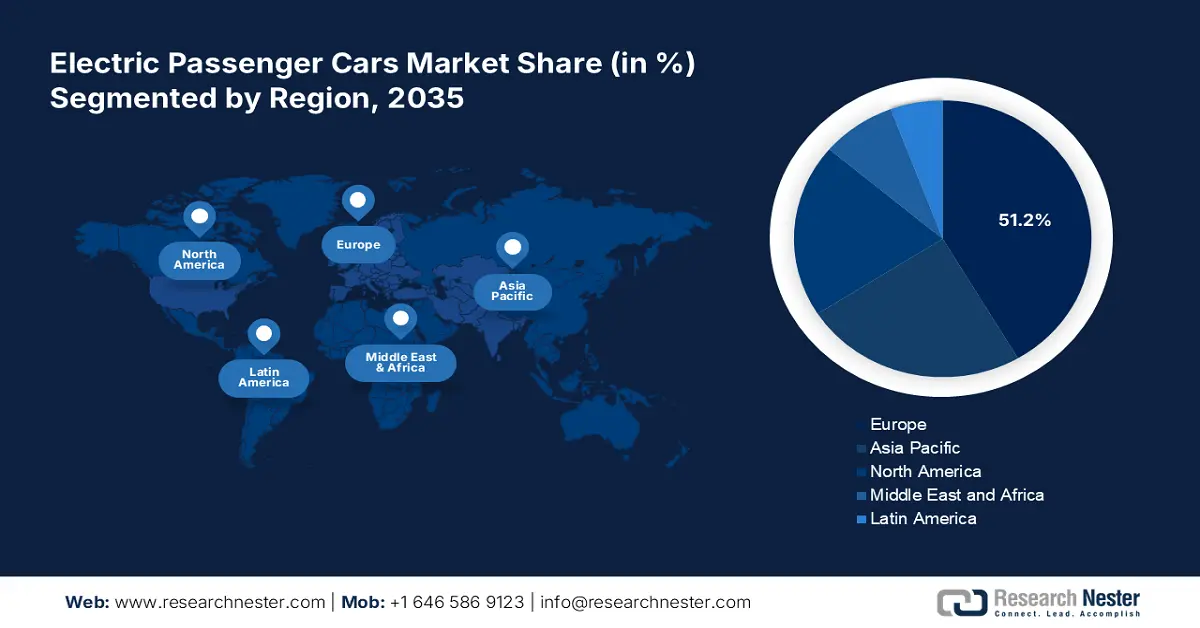

Regional Highlights:

- Europe’s 51.2% share in the electric passenger cars market is propelled by strict carbon emission regulations, driving growth through 2026–2035.

- The Electric Passenger Cars Market in Asia Pacific is forecasted to experience lucrative growth through 2026–2035, driven by strong EV manufacturer presence, rising ownership, and government support.

Segment Insights:

- The Battery Electric Vehicles segment is forecasted to secure more than 65.5% share by 2035, driven by subsidies on eco-friendly cars and lower maintenance and ownership costs.

- The Compact SUVs segment of the Electric Passenger Cars Market is anticipated to secure a significant share by 2035, driven by strong demand due to population growth, limited parking, and poor infrastructure.

Key Growth Trends:

- Innovations in battery technology

- Development of public charging stations

Major Challenges:

- Low availability of public EV chargers in poor economies

- Limited expansion of advanced EV batteries

- Key Players: Volkswagen AG, Dr. Ing. h.c. F. Porsche AG, Tesla, Inc., Mercedes-Benz Group AG, General Motors, Hyundai Motor Company, and Renault Group.

Global Electric Passenger Cars Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 429.91 billion

- 2026 Market Size: USD 555.66 billion

- Projected Market Size: USD 7.17 trillion by 2035

- Growth Forecasts: 32.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (51.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Germany, United States, Japan, France

- Emerging Countries: China, Japan, South Korea, India, Norway

Last updated on : 14 August, 2025

Electric Passenger Cars Market Growth Drivers and Challenges:

Growth Drivers

- Innovations in battery technology: The ongoing innovations in electric car battery technology is one of the significant trends anticipated to augment electric passenger car sales in the coming years. Manufacturers are investing heavily in R&D to advance the features of EV batteries such as longer life, performance, and quick charging time, and also to mitigate the overall production costs. For instance, Sila Nanotechnologies and Group 14 Technologies the two start-ups are focused on developing silicon-based electrodes that can replace graphite in battery anodes. They are set to manufacture their innovative anode material for around 200,000 EVs in their Moses Lake facility. Furthermore, Sila Technologies has elevated over USD 900 million from Siemens, Mercedes, and ATL as a corporate investment.

- Development of public charging stations: To boost EV sales, governments worldwide are investing more in expanding public electric vehicle charging infrastructure. The easy accessibility of public chargers can significantly appeal to drivers to adopt or shift towards battery electric vehicles or plug-in hybrid electric vehicles. For instance, according to the IEA study, there were around 1.8 million EV charging points worldwide in 2021. Globally, China has a large number of publicly accessible chargers, with 85% of the total accounts for fast chargers. Currently, there are around 50,000 active charging stations in the U.S.

Challenges

- Low availability of public EV chargers in poor economies: The low availability of public EV charging stations in poor and developing countries is one of the major factors hampering the adoption of alternate fuel vehicles such as BEVs and PHEVs. Private chargers are not affordable by all and the lack of knowledge regarding their use can also limit the sales of electric passenger cars.

- Limited expansion of advanced EV batteries: Even though manufacturers are investing more in battery technology advancements, most of these are in the production stages, and others that are introduced are limited to certain areas. The majority of drivers across the world are using EV batteries with low life and slow charging, hindering the overall electric passenger cars market growth.

Electric Passenger Cars Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

32.5% |

|

Base Year Market Size (2025) |

USD 429.91 billion |

|

Forecast Year Market Size (2035) |

USD 7.17 trillion |

|

Regional Scope |

|

Electric Passenger Cars Market Segmentation:

Product (Battery Electric Vehicles (BEV), Plug-In Hybrid Electric Vehicles (PHEV))

Battery electric vehicles (BEV) segment is projected to account for electric passenger cars market share of more than 65.5% by the end of 2035. The increasing subsidies on eco-friendly car use, fuel efficiency, and low maintenance requirements are some of the key factors driving the sales of battery electric vehicles. The cost of ownership for BEVs is comparatively lower than for gasoline-based counterparts, as fuel charges have a drastic influence due to several factors such as environmental, geopolitical, or supply chain disruption. For instance, as per the IEA analysis, in Germany, the cumulative costs of medium-sized battery electric car ownership after 5 years were 10% to 20% cheaper than the ICE equivalent.

In December 2020, Toyota Motor Corporation announced the launch of a C+pod ultra-compact battery electric vehicle, especially for local governments, corporate users, and organizations that are keen on exploring new options for BEVs.

Vehicle Type (Hatchbacks, Sedan, Compact SUVs, SUVs)

The compact SUVs segment is expected to account for a significant electric passenger cars market share through 2035 owing to its powerful motor technology. The rapidly increasing population, limited parking spaces, and poor road infrastructure in some regions are boosting the demand for compact electric SUVs. Considering the above factors, several manufacturers are targeting high-potential economies to launch electric passenger cars such as compact SUVs. For instance, in March 2024, BYD Auto Co., Ltd launched the BYD Dolphin Mini compact electric care model in Brazil and Mexico. The compact hatchback design effectively aligns with sustainability trends and is suitable and comfortable for city living.

Our in-depth analysis of the global market includes the following segments:

|

Product

|

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Passenger Cars Market Regional Analysis:

Europe Market Forecast

Europe electric passenger cars market is set to account for revenue share of around 51.2% by 2035. The strict regulation on carbon emissions and advancing charging infrastructure in the region are mainly fuelling the sales of electric passenger cars. For instance, the IEA estimates that electric car ownership in Europe increased by 20% in 2023.

Norway leads the sales of electric passenger cars in Europe and accounted for a share of 93% in 2023. The reintroduction of electric vehicle sales taxes, supportive incentives, and the Net Zero Emission goal are some key factors contributing to Norway market growth.

In Germany, the low cost of medium-sized EVs compared to ICE counterparts is majorly influencing the market growth. The price of best-selling Dacia Spring, MG, and Renault Megane ranges from USD 23883 to USD 37996 lower than 3 front runner ICEs above 45,000.

Asia Pacific Market Statistics

Asia Pacific electric passenger cars market is expected to observe substantial growth between 2026 and 2035. The strong presence of EV manufacturers, an increasing number of vehicle ownerships, and supportive policies on EV use are pushing the sales of electric passenger cars in the region. India and China are high-earning marketplaces owing to the rapid public investments in infrastructure development including, EV charging stations and continuous development of innovative models due to low labor costs. The existence of the world’s top automobile manufacturers such as Toyota Motor Corporation and Hyundai Motor Company is significantly influencing the sales of electric passenger cars in Japan and South Korea.

China captured around 60% of the new electric vehicle registrations in 2023 due to the country’s new energy vehicle industry development plan (2021 to 2035). The continuous innovations in EV technology and the expansion of public EV charging stations are further contributing to the China electric passenger cars market growth. For instance, according to an IEA report, in 2021 there were around 470 thousand publicly accessible fast chargers in the country.

In India, the cost-effective availability of labor and manufacturing base cuts the operational costs by 10% to 25% compared to Europe and Latin America. The rising environmental concerns and supportive government policies are promoting the adoption of electric passenger cars. For instance, the Government of India allotted around a USD 60.18 billion budget under the Electric Mobility Promotion Scheme to drive green mobility and expand electric vehicle production.

Key Electric Passenger Cars Market Players:

- BYD Company Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tesla, Inc.

- Mercedes-Benz Group AG

- Lucid Group, Inc.

- General Motors

- Volkswagen AG

- Audi AG

- Škoda Auto a.s.

- Dr. Ing. h.c. F. Porsche AG

- Rivian

- Karma Automotive

- Fisker Inc.

- Hyundai Motor Company

- Renault Group

- Ford Motor Company

- BMW Group

- SAIC Motor Corporation Limited

Key players in the electric passenger cars industry are employing several market strategies such as technological advancements, strategic collaborations, mergers & acquisitions, and regional expansions to earn high profits. Strategic partnerships with other players and tech firms are helping them to develop an innovative electric car model that can appeal to a larger consumer base. They are also entering emerging economies to tap new growth opportunities and maximize their market presence. Some of the key players include:

Recent Developments

- In September 2024, BMW Group and Toyota Motor Corporation entered into a strategic partnership to produce fuel-cell electric vehicle options for passenger cars. This collaboration plans to launch its fuel-cell electric passenger vehicle by 2028.

- In March 2024, Fisker Inc. revealed that it received iF Design Award for Best Electric SUV Fisker Ocean. The Fisker Ocean electric SUV excelled in jury assessment owing to its sustainable features and engaging design.How big is the electric passenger cars market?

- Report ID: 6578

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Passenger Cars Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.