Electric Motor Market Outlook:

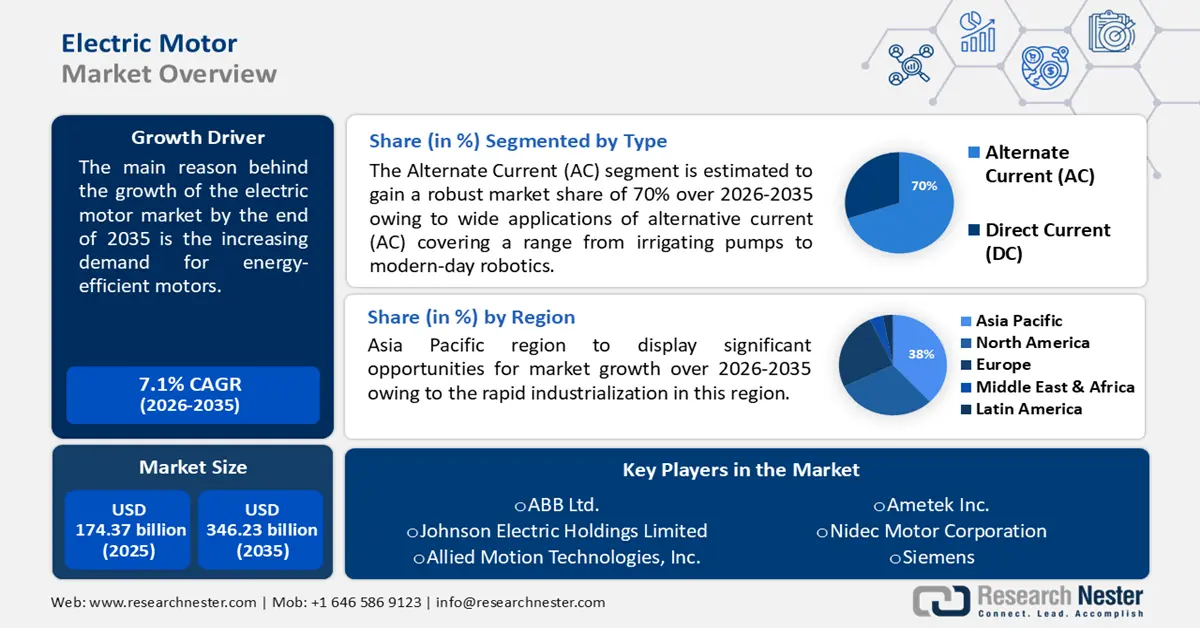

Electric Motor Market size was over USD 174.37 billion in 2025 and is projected to reach USD 346.23 billion by 2035, growing at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric motor is evaluated at USD 185.51 billion.

The reason behind the growth is the increasing demand for energy-efficient motors. According to the International Energy Association (IEA) published in the year 2023, the primary cause of the decreased global energy intensity improvement rate is the 1.7% increase in energy demand in 2023, as opposed to the 1.3% increase in the previous year.

Key Electric Motor Market Insights Summary:

Regional Highlights:

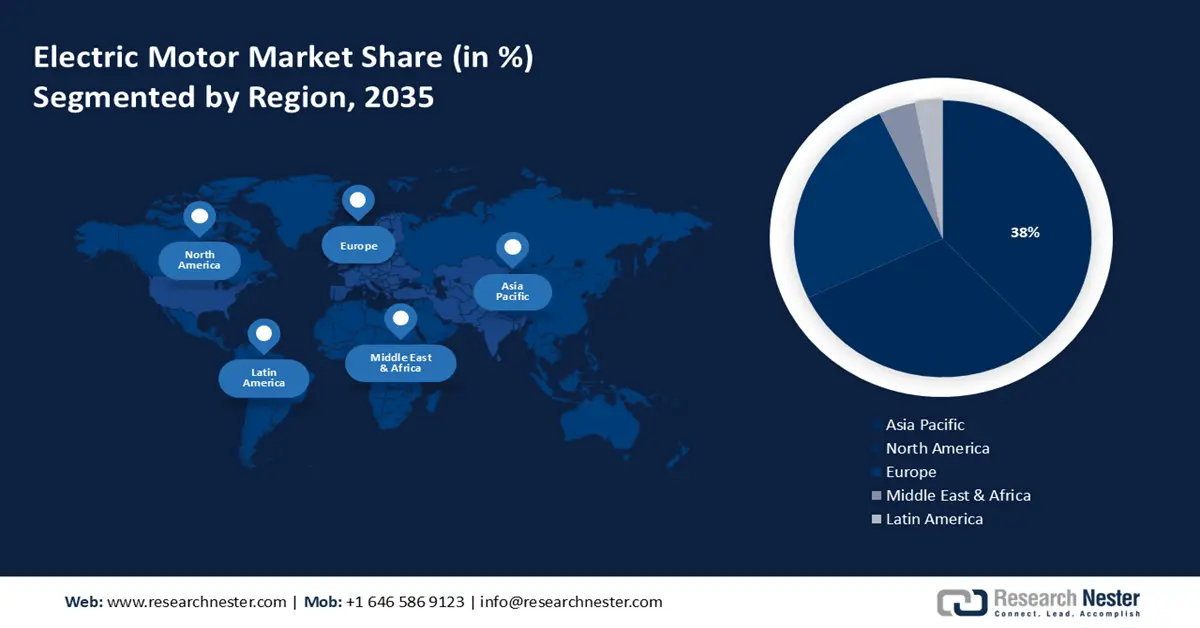

- Asia Pacific electric motor market is anticipated to capture 38% share by 2035, driven by rapid industrialization and increasing demand for electric motors in HVAC systems.

Segment Insights:

- The alternate current (ac) segment in the electric motor market is forecasted to witness robust growth till 2035, attributed to the wide application of AC motors in irrigation and robotics.

- The low voltage electric motors segment in the electric motor market is anticipated to secure a 46% share by 2035, driven by the demand for low-voltage motors in daily-use devices.

Key Growth Trends:

- Budding robotics technology will raise demand for electric motors

- Increase in the demand for new vehicles

Major Challenges:

- High maintenance cost of electric motors

- Shortage as well as high cost of raw materials of electric motors

Key Players: ABB Ltd., Johnson Electric Holdings Limited, Allied Motion Technologies, Inc., Ametek Inc., Nidec Motor Corporation, Siemens, Franklin Electric Co., Inc., Schneider Electric, Regal Rexnord Corporation, ORIENTAL MOTOR USA CORP., Mitsubishi Electric Corporation, Hitachi, Ltd., Fuji Electric Co., Ltd., Terra Motors Corporation, Toyota Motor Corporation.

Global Electric Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 174.37 billion

- 2026 Market Size: USD 185.51 billion

- Projected Market Size: USD 346.23 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 17 September, 2025

Electric Motor Market Growth Drivers and Challenges:

Growth Drivers

-

Budding robotics technology will raise demand for electric motors - Since the industrial revolution, machines have made the perfect companion because they can handle some of the most tedious jobs, freeing up human labor for more engaging and worthwhile endeavors.

According to China’s Industrial and Military Robotics Development published in October 2021, China's authorities have designated AI research as a national priority because they see the area as a means of increasing the country's technological prowess and ability to compete on a global scale in commercial output. These AI-generated robots require electric motors to work properly. - The communication between the motor’s magnetic field and electric current - When a motor is supplied with electric current, a magnetic field is created that interacts with the motor's parts to generate motion. The majority of motors operate on the basis of electromagnetism, namely the relationship that exists between an electric current and a magnetic field. Moreover, the use of electrically run vehicles is becoming quite common globally.

As per the National Library of Medicine's recent predictions published in February 2022, there will be a huge advancement worldwide in the automobile sector as public transportation use rises. - Increase in the demand for new vehicles - A number of variables, including the growing need for new cars, electric vehicles, household appliances, industrial machinery, and any other product that heavily relies on electric motors, are the main drivers of the electric motor sector.

As stated in the International Electric Association (IEA) study released in 2022, sales of electric vehicles around the globe increased by 3.5 million in 2023 compared to 2022, a 35% annual rise. Compared to 2018, which was only five years ago, this is more than six times greater.

Challenges

-

High maintenance cost of electric motors - In contrast to regenerative brakes, which prolong the life of braking components at least three to four times, an internal combustion engine and gearbox require routine maintenance, including oil, coolant, and air filters and fluids.

For instance, a just 20% decrease in fan speed might result in a roughly 50% reduction in energy usage. In actuality, a fan's operating horsepower is reduced by a factor of eight when its speed is halved. - Shortage as well as high cost of raw materials of electric motors - A variety of materials, including steel, copper, aluminum, and rare earths, are needed for EV motors. Over the previous two years, the price of these materials has increased significantly, which has an effect on the margin that a motor manufacturer may get. This can further impede the market of electric motors by the end of 2035.

Electric Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 174.37 billion |

|

Forecast Year Market Size (2035) |

USD 346.23 billion |

|

Regional Scope |

|

Electric Motor Market Segmentation:

Type Segment Analysis

In electric motor market, alternative current (AC) segment is projected to hold revenue share of over 70% by the end of 2035. This high market share will be attributed to wide applications of alternative current (AC) covering a range from irrigating pumps to modern-day robotics.

For instance, according to the National Library of Medicine published in May 2023, the yearly energy available to run the WPS is 23502 kWh, while the annual PV array virtual energy at MPP of the planned photovoltaic system is 33342 kWh. Ohmic wiring losses and module array mismatch are 298.83 kWh and 374.16 kWh, respectively. The alternate current (AC) motor is used in photovoltaic irrigation.

Application Segment Analysis

By 2035, industrial machinery segment is set to hold electric motor market share of more than 39% and will notice constant growth. The increasing automation and progression in the industrial sector will be the primary reason behind the exponential growth of this segment.

As per the World Economic Forum published in April 2021, the 2020 launch of SpaceX represented a significant advancement in automation as it made it possible for people to securely dock onto the International Space Station with zero effort. Electric motors are an integral part of these recent developments in industrial automation as these industrial types of machinery are solely dependent on electric motors.

Voltage Segment Analysis

Low-voltage electric motors segment is expected to dominate electric motor market share of around 46% by the end of 2035. The expansion of this segment will be noticed by the need for low-voltage motors for the majority of electrical equipment and gadgets used in daily life, including tiny machines, pumps, fans, and appliances.

Nearly 70% of industrial power demand and 60% of industrial electricity consumption worldwide are attributed to electric motor systems as found in the survey of Research Nester in 2023. Electric motors power auxiliary systems including compressed air generation, ventilation, and water pumping in addition to central industrial operations like presses and rolls.

Our in-depth analysis of the global electric motor market includes the following segments:

|

Type |

|

|

Output Power |

|

|

Rotor Type |

|

|

End-User |

|

|

Application |

|

|

Voltage |

|

|

Rated Power |

|

|

Magnet Type |

|

|

Weight |

|

|

Speed |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Motor Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 38% by 2035, Moreover, the electric motor industry will increase immensely from 2023 to 2035 and will reach around USD 137 billion.

Rapid industrialization will drive the market expansion of electric motors. Taking into consideration the survey done in October 2020 by East Asia’s Paths to Industrialization and Prosperity: Lessons for India and Other Late Comers in South Asia; the Asia Pacific’s global GDP along with Japan has increased from 10% to 20% in the last decade. Developing Asia's share of the global GDP increased significantly between 1960 and 2018, rising from 4.1% to 24.0%.

Electric motors are especially in actual demand in China, driven by the increasing demand for HVAC systems. International Energy Association published in 2019 stated that over the last 20 years, China has had the highest rise in the world in terms of energy demand for space cooling in buildings. Since 2000, the country's electricity consumption has increased by 13% annually, reaching approximately 400 terawatt-hours (TWh) in 2017.

In Japan, electric motors will encounter massive growth because of the advancement in the agricultural sector. As stated in the survey made in December 2020 by the United States Department of Agriculture (USDA) for the eighth year in a row, Japan set a record with its combined yearly exports of food, forestry, and fishery goods totaling JP¥ 912.1 billion (USD 8.79 billion).

The electric motors sector will have a significant expansion in South Korea due to the massive investment in industrialization in this country. As noticed in the survey of the Federal Reserve Bank of St. Louis done in 2018, the advancement in businesses and policies of incentivizing investment in the latest innovation is driving the expansion of industrialization in South Korea.

North American Market Insights

The North America region will encounter massive growth in the sector of the electric motor market during the anticipated period. This rapid growth in the electric motor market will be noticed due to the rising government initiatives to reduce carbon emissions. As stated in the study by the United States Environmental Protection Agency in the year 2021, in terms of carbon dioxide equivalents, North American greenhouse gas emissions came to 6,340 million metric tons (14.0 trillion pounds).

The electric motors market has expanded in the U.S. as a result of the presence of some prominent automobile companies in this country. For instance, in April 2024 Tesla, Inc. launched the New Model 3 Performance the newest generation of performance drive units, which increases torque, power, and efficiency.

The Canadian electric motor sector will grow mainly due to the rising demand of electric vehicles in this country. As stated in the Electric Vehicles and the Demand for Electricity published in the year 2024 the EV sales are increasing, but they still make up a small portion of the car market overall. From less than 1% of sales in 2017 to 9.1% in the last quarter of 2022, this is despite continued legislative measures.

Electric Motor Market Players:

- Cabot Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- Johnson Electric Holdings Limited

- Allied Motion Technologies, Inc.

- Ametek Inc.

- Nidec Motor Corporation

- Siemens

- Franklin Electric Co., Inc.

- Schneider Electric

- Regal Rexnord Corporation

Prominent industry participants are making significant R&D investments to broaden their product offerings, hence contributing to the further expansion of the electric motor market. Some major participants in the industry are:

Recent Developments

- ABB Ltd. Robotics introduced OmniCoreTM, a quicker, more accurate, and more sustainable intelligent automation platform, in 2024 to empower, improve, and future-proof enterprises.

- Johnson Electric received the Silver Medal from EcoVadis on January 25, 2024, putting us in the top 15% of over 100,000 enterprises from 175 countries in terms of sustainability. Four major criteria are used by EcoVadis, a worldwide renowned assessment platform, to rank the sustainability of businesses: environmental effects, labor and human rights, ethics, and procurement procedures.

- Report ID: 6228

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.