Electric Kick Scooter Market Outlook:

Electric Kick Scooter Market size was over USD 4.98 billion in 2025 and is projected to reach USD 13.15 billion by 2035, witnessing around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric kick scooter is evaluated at USD 5.44 billion.

Electric kick scooters have become a popular alternative to the conventional means of urban mobility. They are supported by technological advancements, environmentalism, and shifting consumer preferences. With the increase in vehicle density in urban cities, electric scooters provide riders with a nimble alternative wherein they can pass through congested streets and sidewalks while avoiding traffic jams. For instance, in November 2024, Radboards unveiled its eco-friendly, foldable e-kick scooter at the 27th Bengaluru Tech Summit. The scooter allows to commute short distances while avoiding traffic and is handy to lift.

From an environmental perspective, in the electric kick scooter market, the scooters are charged using rechargeable batteries, hence reducing their reliance on fossil fuels. The new wave of electric scooters falls in line with the global sustainability objective since cities seek to reduce their carbon footprint and adopt greener transport modes. For instance, in March 2024, Motovolt Mobility Pvt Ltd set new standards with the launch of the Motovolt M7, India's first Multi-Utility e-scooter (MUSe) powered by German technology. M7 marks Motovolt's entry into the high-speed electric scooter category, promising to redefine urban commuting on safety, quality, comfort, and sustainability lines.

The adoption rate for electric kick scooters is rising as economic benefits abound them. In addition, electric kick scooters have an added impetus in the scooter-sharing schemes that allow scooters to be available to many people. Users can, on demand, borrow scooters without necessarily owning a scooter, hence contributing to the sharing economy. As cities continue with their development by adapting ever-increasing needs of populations, the electric kick scooter market promises a significant role in facing future urban transportation toward making general improvements in the quality of life in the city.

Key Electric Kick Scooter Market Insights Summary:

Regional Highlights:

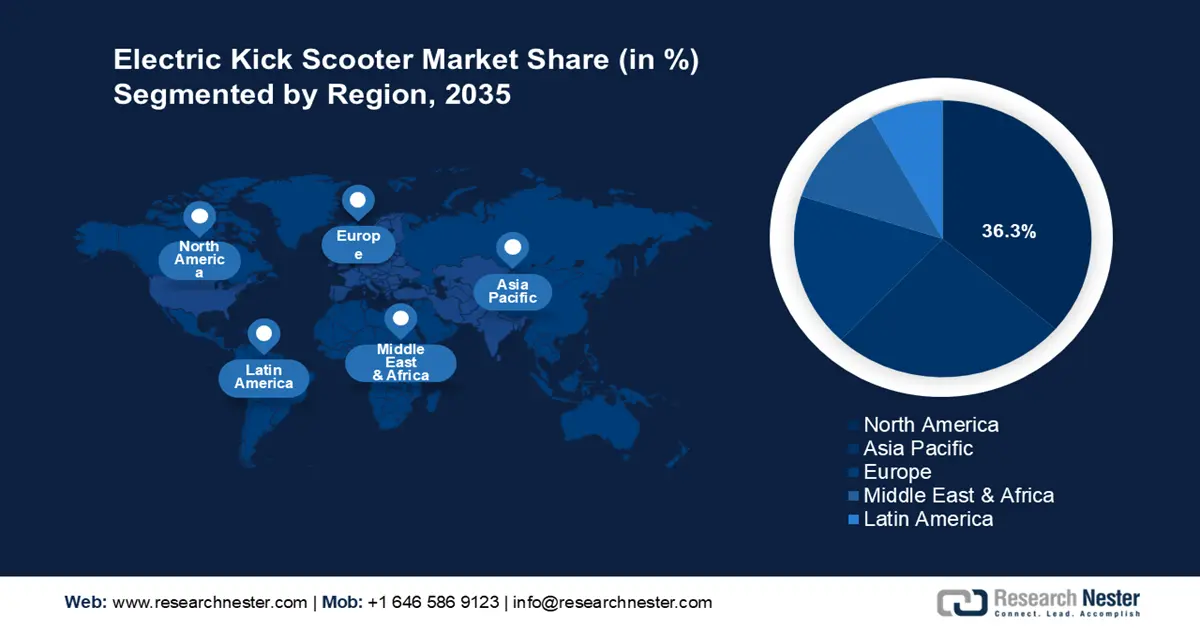

- North America leads the electric kick scooter market with a 36.3% share, driven by the high uptake of micro-mobility services among major cities, supporting strong growth prospects through 2035.

Segment Insights:

- The All-Terrain Kick Scooters segment is projected to hold a significant share by 2035, fueled by the popularity of outdoor recreational activities and demand for durable scooters.

- The Personal segment is projected to capture a 64.7% share by 2035, driven by consumer preference for convenient short-distance transport solutions.

Key Growth Trends:

- Technological advancements

- Rise of shared mobility services

Major Challenges:

- Market saturation and competition

- Maintenance and durability

- Key Players: Apollo Scooters, GOTRAX, iconBIT, Inokim Inc., Joyor, and more.

Global Electric Kick Scooter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.98 billion

- 2026 Market Size: USD 5.44 billion

- Projected Market Size: USD 13.15 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Electric Kick Scooter Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements: An important growth promoter in the electric kick scooter market, is ongoing technological development. The ability to integrate into GPS tracking, mobile app capability, and real-time analytics has greatly transformed the riding experience. For instance, in October 2024, Segway-Ninebot introduced its brand-new ZT series of electric scooters in Australia with the ZT3 Pro. The new Segway ZT3 Pro combines smart technology such as an AirLock System with the Segway-Ninebot app and all-terrain performance with the brand's signature style. As consumers increasingly seek seamless and efficient transport solutions, smart technology in the electric kick scooter market would further boost their adoption.

-

Rise of shared mobility services: Scooter-sharing programs allow users to access electric scooters without bearing the burdens of ownership, such as maintenance and storage, making them an attractive choice for last-mile connectivity. For instance, in September 2024, EMotorad partnered with Booz Mobility to supply electric kick scooters for fleet operations. The collaboration was witnessed to boast Booz Mobility's fleet in gated communities, aiming to provide sustainable micro-mobility solutions for short-distance commuting across metro areas by 2025. As cities continue to embrace shared mobility solutions, the proliferation of the electric kick scooter market will be faster and further enhance market presence and appeal.

Challenges

-

Market saturation and competition: The electric kick scooter market has become very challenging, mainly due to several new companies entering the fray. Saturation leads to intense competition and price wars, which lowers profit margins and leads to restricting service quality and innovation. As companies look to compete, they are forced to slash prices that harm the sustainability of operations. Moreover, the existence of substitute products makes it hard for other brands to have any distinct identity and customer loyalty. Therefore, company efforts are hampered, thus they fail to invest in innovation, marketing, and customer interaction and thus can’t sustain in the long run.

-

Maintenance and durability: The concern in the electric kick scooter market rises with scooter-sharing service providers whose business model requires high utilization rates. Scooters, if not maintained are susceptible to mechanical failure, reduced battery capacity, and deterioration. These lead to shabby user experiences and consequently high operating costs for companies. There is a high requirement for frequent service in resource and logistics-intensive sectors mainly in cities with wide dispersal geographies. Moreover, companies find it complex to employ robust maintenance procedures and invest in a design that is durable enough to support the longevity of their fleets, enabling reliability and user satisfaction while managing operational expenses.

Electric Kick Scooter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 4.98 billion |

|

Forecast Year Market Size (2035) |

USD 13.15 billion |

|

Regional Scope |

|

Electric Kick Scooter Market Segmentation:

End use (Personal, Commercial)

The personal segment is estimated to account for electric kick scooter market share of more than 64.7% by the end of 2035. The primary is increased consumer preference for convenient and flexible solutions for short-distance transport. For instance, in September 2023, the New Honda Motocompacto e-Scooter redefines personal urban mobility as sleek, simple, and uniquely foldable. The zero-emissions Motocompacto is designed for the modern realities of urban mobility, providing riders with an easy and fun-to-ride alternative transport that greatly reduces their carbon footprint while offering great convenience. As urban dwellers look for alternatives to public transport and personal vehicles, personal electric scooters provide a simple solution to navigate congested city roads and park in compact spaces.

Type (Foldable Kick Scooters, Off-Road Kick Scooters, All-Terrain Kick Scooters, Three-Wheel Kick Scooters, Others)

The all-terrain kick scooters segment continues to hold a significant share of the electric kick scooter market due to the increasing popularity of outdoor recreational activities and versatile mobility solutions. With more consumers seeking scooters that can travel on various surfaces such as gravel, dirt trails, and uneven terrains, the all-terrain models give out higher durability and performance. For instance, in February 2022, Razor Scooter launched its new electric scooter in partnership with Auburn Hills' Stellantis-owned Jeep brand. This electric scooter boasts a wide-standing platform and riser-style handlebars for an even more comfortable ride. All-terrain kick scooters are preferred for individuals who cater to their active lives, enabling smooth transitions between urban settings and off-road environments.

Our in-depth analysis of the global electric kick scooter market includes the following segments:

|

End use |

|

|

Type |

|

|

Battery |

|

|

Power |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Kick Scooter Market Regional Analysis:

North America Market Statistics

In electric kick scooter market, North America region is expected to hold over 36.3% revenue share by the end of 2035 attributable to the high uptake of micro-mobility services among major cities. The proliferation of scooter-sharing programs, supported by high investments from both private companies and municipal governments, has set up a robust infrastructure for electric scooters to be broadly accessible to consumers. Thus, North America has emerged as a market leader for electric kick scooters, characterized by a strong demand for eco-friendly mobility options that cater to the needs of urban populations.

The U.S. landscape in the electric kick scooter market is fueled due to its strong entrepreneurial ecosystem and the presence of numerous innovative startups that have pioneered scooter-sharing services. Companies have exploded their operations within major cities, creating competition that encourages better service offerings and technology in a continuous mode. The entrepreneurial spirit has spurred the growth of applications that are friendly to the user and have also efficiently supported fleet management. For instance, in August 2021, Brightway Intelligent Technology Co., Ltd, launched an innovative electric kick scooter, NAVEE N65. It utilizes advanced technologies to bring more convenience in operation and comfortability in riding for the customers.

Canada takes the lead as it offers a sustainable route mainly in the electric kick scooter market with the emphasis it has towards sustainable and ecologically friendly urban mobility solutions. The Canadian government has introduced a series of policies and incentives that aim to reduce the emission of greenhouse gases and increase the use of alternative transport modes, such as electric scooters. For instance, in June 2024, Bird Canada announced a new mode of transport for residents and visitors in the city of Cranbrook, BC. This mission aimed to combat congestion and create sustainable yet efficient ways to move across the city.

Asia Pacific Market Analysis

The Asia Pacific electric kick scooter market is growing rapidly primarily because of its urbanizing population and the corresponding demand for efficient transportation solutions in densely populated cities. The region is embracing the culture of technology and innovation and has also promoted the idea of scooter-sharing platforms to increase accessibility and, therefore, encourage wide acceptance. For this reason, urbanization, combined with technological advancement, sets Asia Pacific in a favorable position to lead the market for electric kick scooters.

India in the electric kick scooter market is witnessing substantial growth owing to the shift in demographics. This growth promoter in conjunction with rising concerns for air pollution and traffic congestion, urges consumers to look for green alternatives. Government policies and schemes in favor of electric mobility further fuel the market growth, making electric kick scooters an attractive option for urban commuters. For instance, in September 2023, it was published by the India Brand Equity Foundation that the government of India has set a target of having sales penetration of 80% of electric two and three-wheelers by 2030. This target is aimed to achieve the target of net zero emissions by 2070.

China has turned into a world leader in the electric vehicle manufacturing sector by achieving economies of scale, the most advanced technology, and an adequately developed infrastructure for battery production. This allows China manufacturers to produce high-quality electric kick scooters at a price that makes them available to consumers across a vast range of market segments. Furthermore, the support that electric mobility initiatives get from a strong government further increases the share of China in the market.

Key Electric Kick Scooter Market Players:

- Apollo Scooters

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GOTRAX

- iconBIT

- Inokim Inc

- Joyor

- Kaabo Scooter

- Micro Mobility Systems AG

- Razor USA LLC

- Niu International

- SWAGTRON

- ZHEJIANG DUALTRON ESCOOTER CO LTD

The companies present in the electric kick scooter market vary from large, well-established automotive companies to startups. One factor shaping the landscape is the trend to make electric scooters smarter with advanced technology and smart features. For instance, in November 2024, Nextbrain Electric unveiled the first glimpse of its revolutionary electric scooter. The scooter boasts characteristics such as striking LED headlights, crafted aesthetically with a focus on performance for its excellent ride, and has an eco-friendly powertrain. This emphasis on innovation is propelling brand loyalty and creating a technology-loving consumer group, thereby furthering the growth and development of the electric kick scooter industry.

Here's the list of some key players:

Recent Developments

- In January 2024, Gogoro Inc. unveiled its new model, the Gogoro Pulse. This electric scooter not only embodies the company's swappable battery standard but also represents a technological leap, making it Gogoro's most high-performance scooter ever.

- In August 2023, eWAKA, to improve the region's economic prospects, deepened its footprint by partnering with Rwanda's AC Mobility. This partnership aimed to bring electric kick scooters and cargo e-bicycles to the Land of a Thousand Hills.

- Report ID: 6860

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Kick Scooter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.