Electric bus Market Outlook:

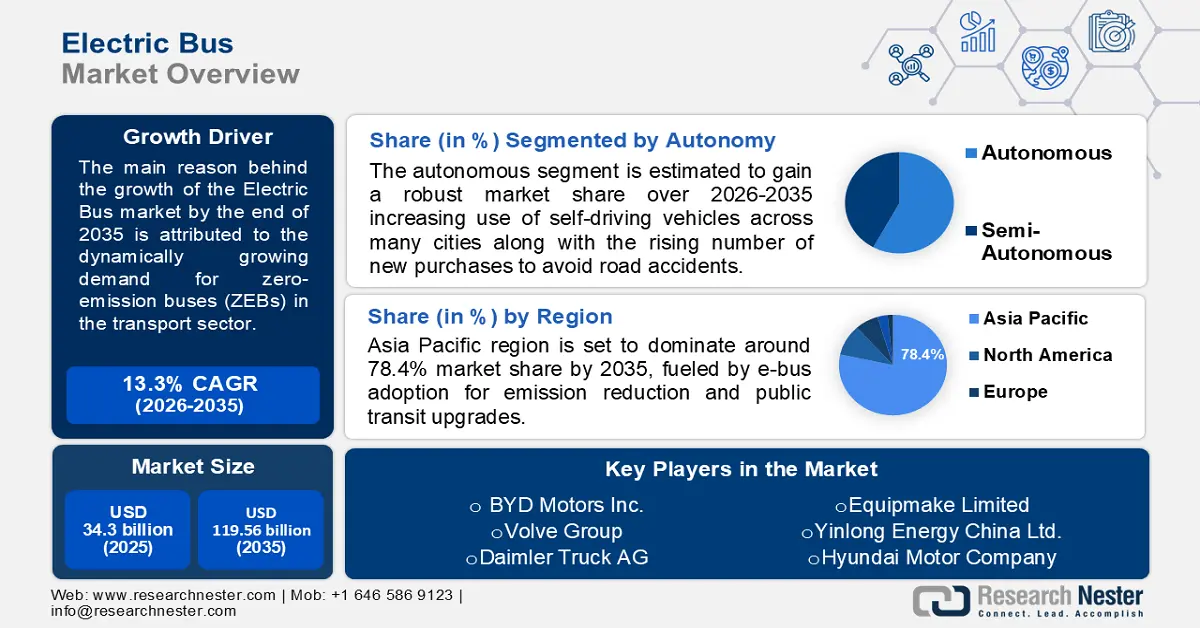

Electric bus Market size was over USD 34.3 billion in 2025 and is anticipated to cross USD 119.56 billion by 2035, witnessing more than 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric bus is assessed at USD 38.41 billion.

The surge in demand for hydrogen fuel cells for their integration in e-buses is a major factor fostering the growth of the market. According to Research Nester, the hydrogen fuel cell industry is predicted to recod significant revenue during the forecast period. These cells act as alternatives to battery electric vehicles, as they are capable of offering faster refueling times, which makes them suitable for long-haul trucking and heavy-duty vehicles. These developments are opening new opportunities for the electric bus industry.

Organizations are taking crucial steps to protect the environment and are forming strategic alliances to curb carbon emissions by coming out with new eco-friendly passenger vehicles. For instance, in March 2025, EKA Mobility partnered with KPIT Technologies and Bharat Petroleum Corporation Limited to deploy a new 9-meter hydrogen fuel-based bus at Cochin International Airport in Kerala. The vehicle comes with a capacity to carry 30 passengers and a three-year operational life. Such initiatives by companies are catering to a clean mobility ecosystem, further propelling the market expansion.

Key Electric Bus Market Insights Summary:

Regional Highlights:

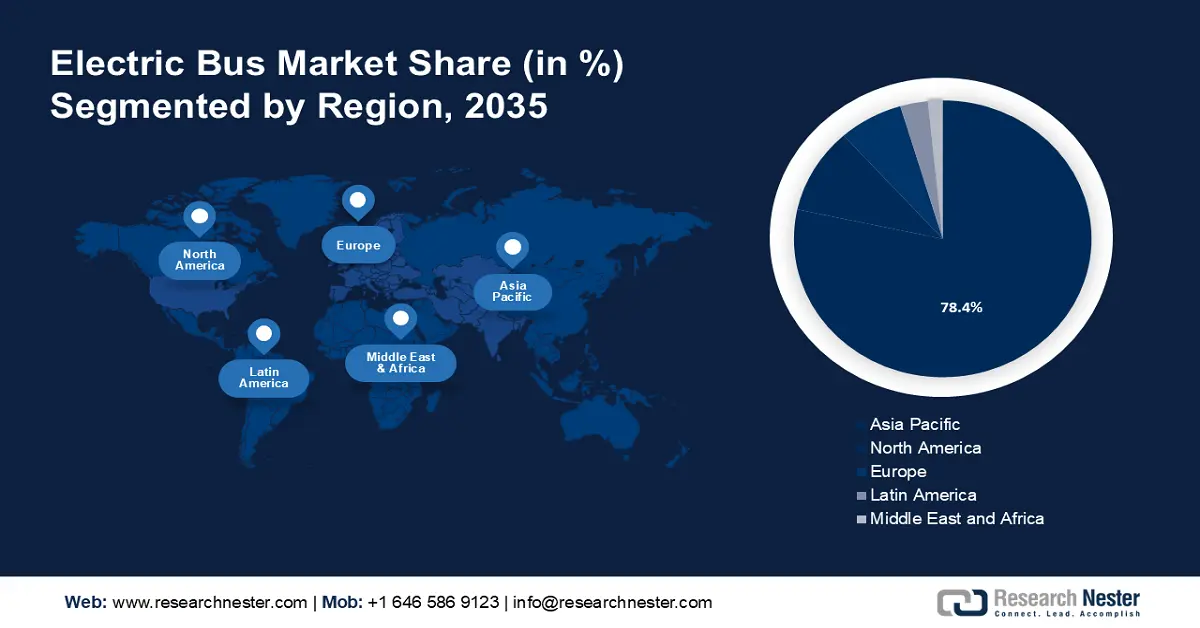

- Asia Pacific electric bus market will dominate more than 78.4% share by 2035, driven by e-bus adoption for emission reduction and public transit upgrades.

- North America electric bus market will experience significant growth during the forecast timeline, driven by environmental regulations and charging infrastructure expansion.

Segment Insights:

- The battery electric vehicle segment in the electric bus market is projected to experience significant growth over 2026-2035, driven by government incentives and green infrastructure initiatives.

- The autonomous segment in the electric bus market will command the largest share, propelled by integration into smart city initiatives, forecast period 2026-2035.

Key Growth Trends:

- Fleet modernization plans

- Private sector investment and innovation

Major Challenges:

- Battery performance limitations

Key Players: BYD Motors Inc., Volve Group, Daimler Truck AG, Equipmake Limited, Yinlong Energy China Ltd., Hyundai Motor Company, Yutong Bus Co., Ltd., NFI Group Inc., Proterra Inc., Nissan Motor Corporation.

Global Electric Bus Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.3 billion

- 2026 Market Size: USD 38.41 billion

- Projected Market Size: USD 119.56 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (78.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, United Kingdom

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 10 September, 2025

Electric bus Market Growth Drivers and Challenges:

Growth Drivers

-

Fleet modernization plans: Globally, transit organizations are developing advanced electric vehicles, with an effort to reduce carbon emissions. In October 2024, Ashok Leyland announced that its subsidiary OHM Global Mobility received an order of 500 12-meter ultra-low-floor e-buses from the Metropolitan Transport Corporation (MTC), Chennai. In addition, Switch Mobility, the EV arm of Ashok Leyland, is expected to supply Switch EiV12 models to OHM and is likely to manage and operate them for around 12 years. The vehicles are likely to cover distances of more than 200 kilometers per charge, and are ideal for long city routes. This highlights a significant shift toward sustainable public transportation, therefore accelerating the market growth.

-

Private sector investment and innovation: Various key players are increasingly investing in research and development to launch more cost-effective, efficient, and reliable electric bus models. For instance, in February 2024, BYD Company Limited expanded its R&D wing to over 90,000 engineers and filed more than 48,000 patents around the globe. On the other hand, Volvo, in March 2024, introduced the BZR electric bus chassis, catering to city and intercity services, featuring a modular design and advanced battery technology. These advancements are portraying the role of the private sector in supporting the global transition to sustainable public transportation.

Challenges

-

Battery performance limitations: The overall performance of the battery is posing a major challenge to the growth of the e-bus market. In extreme temperatures, battery efficiency can drop, causing range anxiety. This results in shorter ranges of driving and replacement requirements due to the degradation of batteries. Such factors are reducing the practicality of the electric buses, hindering the market growth.

Electric bus Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 34.3 billion |

|

Forecast Year Market Size (2035) |

USD 119.56 billion |

|

Regional Scope |

|

Electric bus Market Segmentation:

Autonomy Segment Analysis

The autonomous segment is anticipated to garner the largest revenue by the end of 2035, backed by the integration of autonomous e-buses into smart city initiatives. Various cities worldwide are exploring self-driving technology to enhance public transportation systems. For instance, in August 2023, San Francisco launched the Loop, a free autonomous shuttle service on Treasure Island, aimed at improving local connectivity. Operated by Beep, the all-electric shuttles run every 20 minutes between 9 a.m. and 6 p.m., with an onboard attendant for safety. These initiatives are encouraging other cities to adopt autonomous e-vehicles as well as align with their urban mobility strategies.

Propulsion Type Segment Analysis

Government incentives and policies are playing a major role in supporting the growth of the battery electric vehicle to garner significant growth in the forthcoming years. Many countries are emphasizing cleaner alternatives and phasing out fossil fuel-powered vehicles. Additionally, the governments are investing in e-buses through subsidies and green infrastructure initiatives. Various companies are gradually advancing their BEV offerings to address rising market needs. For instance, Alexander Dennis, in November 2023, unveiled the Enviro100EV, a midibus equipped with an in-house electric drivetrain, targeting smaller operators and rural routes. Such developments and strategic product diversification are accelerating the segmental growth. Such developments and strategic product diversification are accelerating the segmental growth.

Our in-depth analysis of the global electric bus market includes the following segments:

|

|

|

Autonomy

|

|

|

Propulsion Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric bus Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is set to dominate around 78.4% market share by 2035, fueled by e-bus adoption for emission reduction and public transit upgrades. According to the World Bank (report from December 2023), the region accounts for 39% of the greenhouse gas emissions in the world. The e-buses are eliminating this problem by increasing their efficiency of the vehicles, which is accelerating the market growth.

Furthermore, there has been a growing introduction and deployment of the electric vehicles in public transportation, as it is cheaper to travel daily for work, school, or college compared to other conventional methods. For instance, in December 2024, Tata Motors started electric bus services for the workforce transportation at its plant in Uttarakhand. Such initiatives by organizations are creating immense avenues for the market.

The China electric bus market is dominating the global industry, owing to the presence of a robust EV manufacturing sector. Major organizations are significantly investing in research and development to enhance the range of e-buses and to make them more cost-effective. The strong shift towards zero emissions is enabling the production of these vehicles at competitive prices. As per the report from the International Council on Clean Transportation, the sales of electric buses and trucks reached more than 2,30,000 units in 2024, in China. The sales are ensuring the development of necessary infrastructure, including charging stations, and fostering market growth.

North America Market Insights

The electric bus market in North America is set to experience significant growth during the forecast period, driven by strict environmental regulations. Governments in Canada and the U.S. are setting tighter air quality standards, which are driving public green vehicles to adopt cleaner means of transportation. Also, there is an increasing establishment of charging networks for the streamlined integration of electric transport facilities into daily operations. According to the Federal Highway Administration in August 2024, currently, there are more than 192,000 charging ports in the U.S., with the addition of nearly 1,000 new public chargers every week. This expansion of charging infrastructure is improving the feasibility of operating electric buses and is providing long-term confidence for private as well as public sector investments in electric mobility.

The market in the U.S. is projected to grow significantly, with the expansion of e-buses by major transit agencies. Several cities in the country are electrifying their public transportation systems for an eco-friendly ecosystem, and these transitions are being supported by governmental investments. There is an increased demand for more charging stations, with more adoption of electric buses by the transit authorities, which is further fueling the electric bus ecosystem. Another factor driving the market growth is the surge in demand for cleaner air and a healthier environment.

Electric bus Market Players:

-

The electric bus market is highly competitive, with the presence of established players and new entrants. Leading manufacturers, including Proterra, BYD, and Daimler, are at the forefront, offering a range of electric buses tailored to various urban transport needs. As governments push for stricter environmental regulations and increased subsidies, competition among manufacturers is intensifying, driving innovation and the expansion of electric transportation worldwide. Here are some key players operating in the global market:

- BYD Motors Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Volve Group

- Daimler Truck AG

- Equipmake Limited

- Yinlong Energy China Ltd.

- Hyundai Motor Company

- Yutong Bus Co., Ltd.

- NFI Group Inc.

- Proterra Inc.

- Nissan Motor Corporation

Recent Developments

- In August 2024, Alexander Dennis rolled out a restyled version of the Enviro400EV, featuring a new Voith driveline and options for 472 kWh or 354 kWh batteries.

- In May 2024, Mercedes-Benz introduced the eCitaro K, a shorter 10.63-meter version of its electric bus, featuring a 491 kWh battery and a range of 300 km.

- Report ID: 4579

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Bus Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.