Edge Banding Materials Market Outlook:

Edge Banding Materials Market size was valued at USD 1.6 billion in 2025 and is set to exceed USD 3.45 billion by 2035, expanding at over 8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of edge banding materials is estimated at USD 1.72 billion.

The edge banding materials market is experiencing tremendous growth due to increased investments in both commercial and residential construction, primarily driven by the rising housing demands associated with a growing population. According to the UN-Habitat Organization, 3 billion people, or around 40% of the world's population, will require access to decent housing by 2030. This means there is a daily need for 96,000 new units of accessible and affordable housing. Furthermore, a deliberate effort has been made to improve public infrastructure, including roads, bridges, airports, and rail systems, to promote economic development. These construction activities necessitate using various materials such as wood, particle boards, plywood, and other wood panel components, consequently elevating the demand for edge banding supplies.

As developers continue to construct a greater number of homes, apartments, and gated communities, there is a substantial increase in the demand for interior and exterior wood trimmings, borders, edgings, and finishes. Edge banding not only protects the raw edges of wood panels, boards, and furniture components but also enhances their aesthetic appeal. A diverse range of edge banding strips, made from materials such as wood, plastic, and laminates, is extensively employed across various applications, including windows, wooden flooring, building joinery, doors, and other fixtures.

Furthermore, with the expansion of global wood product exports, manufacturers and suppliers of edge banding materials are scaling up production to meet the diverse needs of various regions, thus fueling the market’s growth.

|

Country |

Export value of Wood Products (USD billion) |

Country |

Import Value of Wood Products (USD billion) |

|

China |

20.4 |

U.S. |

35.3 |

|

Canada |

20.1 |

China |

18.1 |

|

Germany |

13 |

Germany |

11.9 |

|

U.S. |

10.6 |

Japan |

11.8 |

|

Russia |

8.21 |

UK |

8.99 |

Source: OEC

According to the Observatory of Economic Complexity with a total trade of USD 188 billion in 2022, wood products ranked as the 18th most traded product globally. Wood product trade accounts for 0.8% of global trade. According to the Product Complexity Index (PCI), Wood Products is ranked 15th.

Key Edge Banding Materials Market Insights Summary:

Regional Highlights:

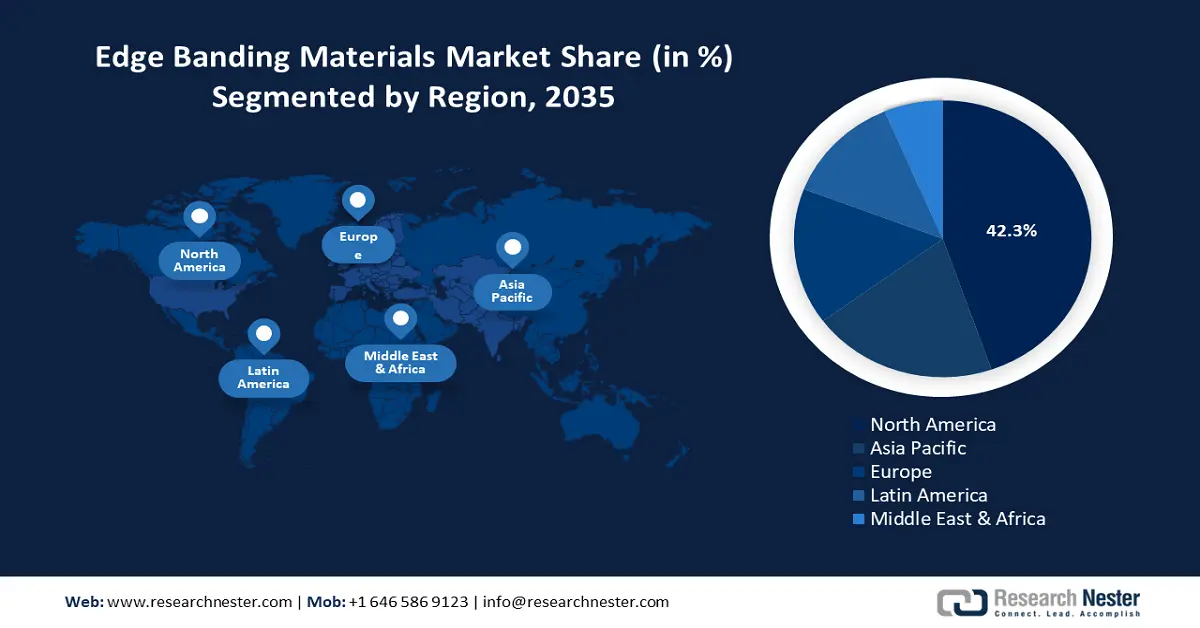

- North America dominates the Edge Banding Materials Market with a 42.30% share, driven by a high number of furniture manufacturers and automated edge banding technology, ensuring strong growth by 2035.

- Asia Pacific’s edge banding materials market is expected to see significant growth by 2035, driven by rapid urbanization, disposable incomes, and low production costs.

Segment Insights:

- The PVC segment is forecasted to hold a significant market share by 2035, driven by its cost-effectiveness, versatility, and resilience in the furniture industry.

- The Furniture segment of the Edge Banding Materials Market is forecasted to achieve a 40.2% share by 2035, propelled by increased furniture production and the protective and cosmetic benefits of edge banding.

Key Growth Trends:

- Expanding furniture industry

- Recent advances in edge banding materials

Major Challenges:

- Fluctuating raw material prices

- Environmental concerns and stringent laws

- Key Players: Veena Polymers, IMA Schelling Group, Vaibhav Industries, Aeroplastics Inc., REHAU India, Blzic Robni Trakovi, Coskunuzer Mobilya Ltd. St., Unipegasus Profiles Pvt. Ltd., HOMAG Group, SURTECO GmbH.

Global Edge Banding Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.72 billion

- Projected Market Size: USD 3.45 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Edge Banding Materials Market Growth Drivers and Challenges:

Growth Drivers

- Expanding furniture industry: Rising disposable incomes, shifting lifestyles, and the increasing affordability of high-quality furniture items have all contributed to the rapid evolution of the global furniture sector in recent decades. Numerous countries are becoming important export destinations for various types of furniture that serve both residential and commercial sectors. Furniture is now a crucial component of interior design projects for offices and homes due to the continuous introduction of new materials, design trends, and technology. Meanwhile, high furniture sales worldwide are driven by variables including nuclear families, dual-income households, and the demand for periodic updating.

Edge-banded wood boards and panels are a major component of furniture manufacturing businesses' products. The majority of furniture, including office tables, bookcases, sofa sets, beds, kitchen cabinets, and wardrobes, will have their edges polished and covered with wood or plastic edge banding strips. This principle applies to all categories of furniture, ranging from budget-friendly options to premium selections. Additionally, the furniture industry, which historically relied on physical storefronts, is currently undergoing a significant digital transformation. E-commerce is fundamentally altering how consumers discover, research, and purchase furniture, presenting substantial opportunities for furniture companies and driving market expansion. The rise in online furniture sales is contributing to the accelerated growth of the edge banding materials market.

|

Year |

Global E-commerce Furniture Industry Size (in USD billion) |

Increase in Percentage |

|

2017 |

158.4 |

|

|

2018 |

172.4 |

8.8% |

|

2019 |

186.8 |

8.4% |

|

2020 |

235.7 |

26.2% |

|

2021 |

269.7 |

14.4% |

|

2022 |

258.1 |

4.3% |

|

2023 |

256.4 |

0.7% |

|

2024 |

283.3 |

10.5% |

|

2025 |

318.5 |

12.4% |

|

2026 |

356.3 |

11.9% |

|

2027 |

393.9 |

10.6% |

|

2028 |

418.0 |

6.1% |

|

2029 |

436.0 |

4.3% |

- Recent advances in edge banding materials: Recent advancements have facilitated the development of a diverse range of edge banding materials that exhibit exceptional performance characteristics. Among these, polyvinyl chloride (PVC) stands out due to its superior resistance to impact, moisture, and ultraviolet radiation. Designers can thus ensure a seamless integration within the overall design concept. Also, the emergence of innovative edge-binding technologies has enabled the production of edge-banding materials that seamlessly blend with various surfaces, imparting a clean and robust aesthetic. The application of polyurethane (PUR) adhesive, along with techniques such as hot air and laser edging, enhances and extends the durability of the bond.

Moreover, in light of increasing consumer awareness regarding working conditions in design, there is a growing demand for sustainable edge-binding solutions. Consequently, manufacturers are responding by developing environmentally responsible materials and production methodologies. Therefore, these advances are proliferating the edge banding materials market.

Challenges

- Fluctuating raw material prices: Wood, plastic, melamine, and other raw materials are major components of edge banding materials. Nonetheless, the costs of these basic materials can change based on variables like availability and demand. Manufacturers of edge banding materials face significant challenges in maintaining constant manufacturing costs due to unpredictable price fluctuations. They find it challenging to maintain quoted prices over extended periods. Players' profit margins and profitability are also impacted by the swings. Manufacturers are frequently compelled to raise product pricing to offset growing raw material costs, which can impact their ability to compete in the edge banding materials market.

- Environmental concerns and stringent laws: Sustainability concerns arise since many edge banding materials, including PVC, are made from non-renewable resources and are not biodegradable. To comply with increasingly strict environmental standards, especially in North America and Europe, firms can modify their production methods or create environmentally friendly substitutes. Complying with these rules can be expensive and resource-intensive, particularly for smaller enterprises that lack the funds to invest in R&D or greener technologies. For businesses seeking profit from sustainable trends, this will restrict edge banding materials market expansion.

Edge Banding Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.45 billion |

|

Regional Scope |

|

Edge Banding Materials Market Segmentation:

Application (Furniture, Cabinetry, Flooring)

Furniture segment is projected to dominate edge banding materials market share of around 40.2% by the end of 2035. The segment growth can be attributed to the increased furniture production in response to the surging demand from residential and commercial sectors. Also, larger furniture companies use edge banding on assembly lines to maximize efficiencies of scale, while smaller custom furniture makers continue to rely on edge banding for its protective and cosmetic benefits. Edge banding extends the lifespan of furniture by protecting wood, laminate, or other vulnerable materials along high-contact edges, improving lifespan in high-traffic areas of furniture such as table tops, armrests, or footboards that see wear over time.

All furniture needs some form of edge banding to finish and protect raw edges. Global population growth and the rise of the middle class have increased the demand for new furniture in both the residential and business markets. According to the United Nations Organization, from an estimated 2.5 billion in 1950, the world's population grew to 8.0 billion in mid-November 2022, with an additional 1 billion people since 2010 and 2 billion since 1998.

Material Type (PVC (Polyvinyl Chloride), ABS (Acrylonitrile Butadiene Styrene), Melamine, Wood Veneer)

The PVC segment in edge banding materials market will garner a significant share during the assessed period. Polyvinyl chloride (PVC) is widely regarded as the most commonly utilized material for edge banding due to its straightforward shaping and production processes. Depending on the required thickness or desired form, PVC can be either cold-formed or thermoformed. Beyond its versatile formability, PVC edge bands are also cost-effective when compared to alternative materials. The raw material for PVC is relatively inexpensive, and the production methods for PVC edge tape are both uncomplicated and economically viable, especially when contrasted with materials such as metal or wood.

Consequently, customers benefit from lower production costs, resulting in reasonably priced finished products. Moreover, PVC edge bands exhibit remarkable resilience against impacts, moisture, and general wear and tear. The material's rigidity enhances the structural integrity of edges while allowing sufficient flexibility to conform to curves and corners without risk of breakage. This balance of rigidity and flexibility contributes to the extended longevity of PVC edge banding, particularly in high-traffic areas. The aesthetic appeal of PVC also plays a significant role in its popularity. It can be engineered to aesthetically complement a variety of flooring, cabinets, furniture, and other materials to which it is applied. PVC edge bands can be tinted, printed, or textured to achieve the desired appearance, enabling them to either blend seamlessly into their surroundings or make a distinctive visual statement, depending on design objectives.

Our in-depth analysis of the global edge banding materials market includes the following segments:

|

Material Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Edge Banding Materials Market Regional Analysis:

North American Market Statistics

North America in edge banding materials market is expected to hold over 42.3% revenue share by the end of 2035. The region's need for edge banding materials has been driven by the large number of furniture manufacturing businesses that serve both commercial and residential markets. This has made it possible for a large range of edge banding materials to be supplied smoothly. Furthermore, the product's rate of adoption has increased due to the availability of sophisticated technology for automated edge banding procedures.

In the U.S., the growth of residential construction is driving demand for edge banding materials, which are essential for finishing furniture, cabinetry, and other wood-based interior elements. The Census Bureau reported that in December, the number of privately-owned housing units authorized by building permits reached a seasonally adjusted annual rate of 1,483,000. This figure represents a 0.7% decline from the revised November rate of 1,493,000 and is 3.1% lower than the December 2023 rate of 1,530,000. Meanwhile, authorizations for single-family homes in December stood at a rate of 992,000, which marks a 1.6% increase compared to the revised November figure of 976,000.

Post-pandemic renovation and remodeling activities in both residential and commercial spaces have further boosted the edge banding materials market. Additionally, the aesthetic and protective benefits of edge banding, such as providing a smooth finish and shielding furniture from moisture and damage, make it a preferred choice in modern furniture manufacturing.

In Canada, consumers are increasingly favoring wood-based edge banding for its aesthetic and natural finish, enhancing the visual appeal of furniture. Also, the shift towards a luxurious lifestyle and higher income levels have led to increased spending on high-quality furniture, further propelling the demand for edge banding materials.

APAC Market Analysis

Asia Pacific edge banding materials market is expected to grow at a significant rate during the projected period. Rapid urbanization, rising disposable incomes, and shifting lifestyles in densely populated nations like China and India are significantly increasing furniture demand in the region. As a result, many foreign companies have been drawn to set up their manufacturing base in these nations. Additionally, the demand for the product has increased due to the strong presence of domestic furniture brands that serve both domestic and foreign markets. Additionally, several North American and European firms have been enticed to outsource their production activities to Asia Pacific due to the region's competitive raw material prices and moderate production expenses.

Moreover, there’s an increase in demand for aesthetically pleasing and durable furniture in China which has fueled the need for high-quality edge banding solutions to improve product appearance and longevity. Additionally, the growth of e-commerce platforms has made furniture and related materials more accessible, boosting sales. The International Trade Administration reported that China accounts for about half of worldwide e-commerce transactions, making it the world's largest e-commerce market. China surpassed the United States as the top e-commerce market in 2021, with USD 1.5 trillion in revenue. Therefore, the expanding e-commerce industry is consequently accelerating the edge banding materials market in the country. Also, the government’s push towards sustainable and eco-friendly manufacturing practices has spurred innovation in edge banding materials such as PVC, ABS, and wood veneer, further escalating the edge banding materials market.

In India, with the expansion of the real estate and construction industries, there is a surge in residential and commercial projects requiring modular furniture and interior solutions. India Brand Equity Foundation revealed that the realtors' association CREDAI has hailed the new framework for Small and Medium Real Estate Investment Trusts (SM REITs), to improve the flow of capital into the Indian real estate industry. Around USD 3.1 billion is invested in Indian real estate annually by foreign investors, with a 37% YoY growth in the first half of 2024. Therefore, these initiatives are expanding the real estate industry in the nation. Additionally, the growth of the organized furniture sector, driven by e-commerce platforms and global furniture brands entering the Indian edge banding materials market, is boosting the demand for high-quality edge banding materials.

Key Edge Banding Materials Market Players:

- Veena Polymers

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IMA Schelling Group

- Vaibhav Industries

- Aeroplastics Inc.

- REHAU India

- Blzic Robni Trakovi

- Coskunuzer Mobilya Ltd. St.

- Unipegasus Profiles Pvt. Ltd.

- HOMAG Group

- SURTECO GmbH

The potential for international edge banding materials market expansion is significant, especially in developing economies where the demand for furniture is driven by urbanization and modernization. Companies are investing in the development of innovative materials that meet environmental standards and demand lighter, durable, and versatile products. They are also adopting digital and automated solutions in production process optimization to enhance competitiveness in the edge banding materials market.

Recent Developments

- In March 2024, Together, HOMAG's most recent EDGETEQ S-500 edge banders and LOOPTEQ automated workpiece return systems offer increased versatility and state-of-the-art technology for reliable, quick, and efficient production.

- In June 2023, IMA Schelling created a novel, extremely efficient method for automated edge handling that may be utilized on single machines up to batch size 1 manufacturing.

- Report ID: 7091

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Edge Banding Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.