Eddy-current Testing Market Outlook:

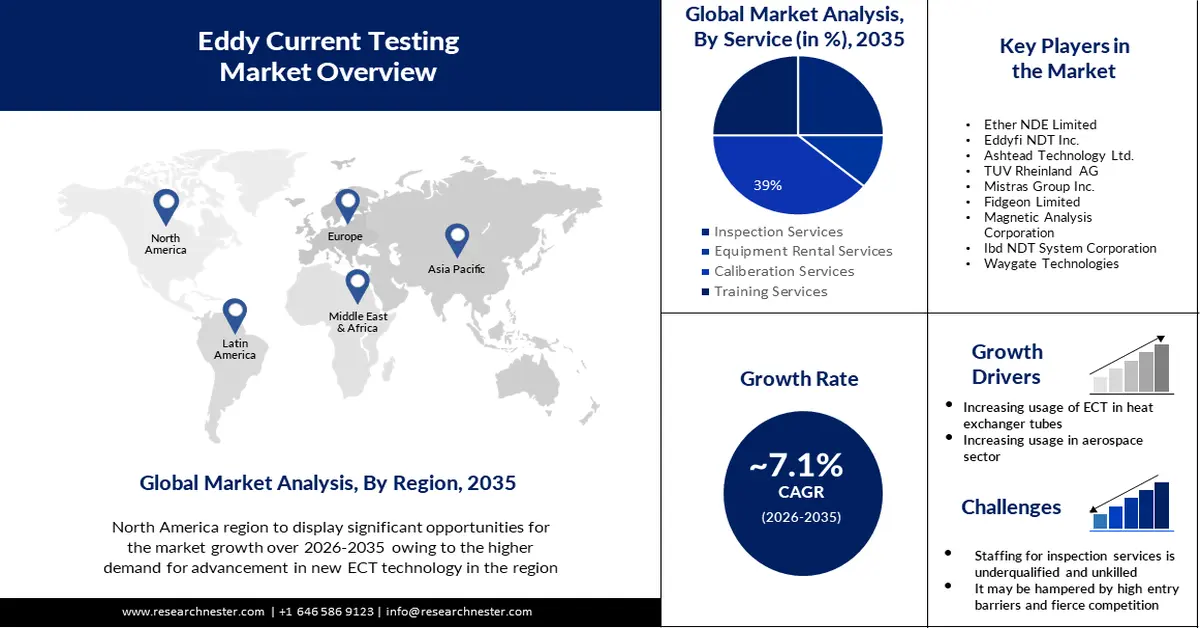

Eddy-current Testing Market size was over USD 1.27 billion in 2025 and is poised to exceed USD 2.52 billion by 2035, witnessing over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of eddy-current testing is estimated at USD 1.35 billion.

The industrial possibilities in BRICS and rising infrastructure development in emerging economies are anticipated to offer attractive potential for the growth of the eddy-current testing market. India has already made significant progress towards building national highways that connect all points for travelers, commerce, and freight. In 2014–15, India has a total of 97,830 km of national highways. By March 2023, that number would increase to 145,155 km. According to government figures, the country would see a 28.6 km increase in daily road construction from 12.1 km in 2014–15 to 12.6 km in 2021–22.

Additionally, the market of eddy-current testing industry is being driven by the rising demand for electronic equipment and durable consumer items. In India, the market for electrical equipment was estimated to be worth USD 50 billion in 2021. By 2025, it was predicted that this would increase to USD 72 billion, a rise over prior years.

Key Eddy Current Testing Market Insights Summary:

Regional Highlights:

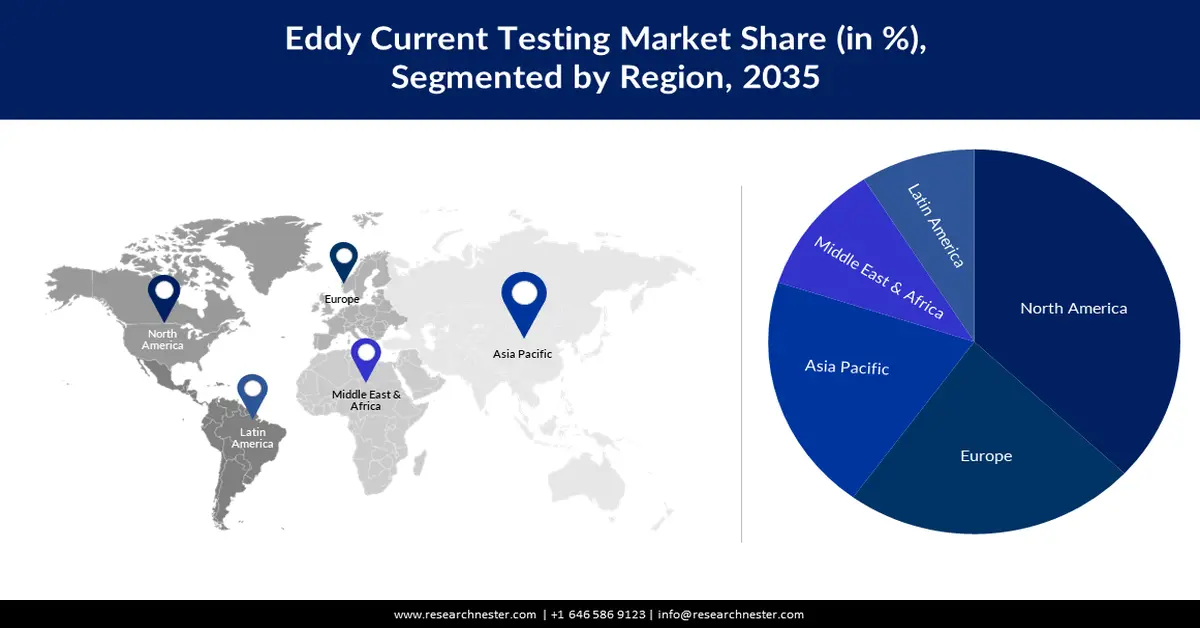

- North America eddy-current testing market is anticipated to achieve a 37% share by 2035, driven by frequent use in the oil and gas business for safety inspections and to find flaws on surfaces and tubes.

- Europe market is forecasted to experience significant CAGR during 2026-2035, driven by wide use for the detection of defects in nuclear power plants subject to stringent public safety requirements.

Segment Insights:

- The conventional eddy-current testing segment in the eddy-current testing market is anticipated to secure a 42% share by 2035, driven by its sensitivity in pit detection in nuclear reactors and petrochemical sectors.

- The calibration services segment in the eddy-current testing market is expected to experience substantial growth through 2035, fueled by its ability to detect discrepancies and flaws in measurement tools.

Key Growth Trends:

- Eddy-current Testing is Becoming More and More Popular in the Aerospace Sector

- Increasing Use of Eddy-current Testing in the Power Generation Technologies Sector

Major Challenges:

- Staffing for Inspection Services is Underqualified and Unskilled

- High Entry Barriers and Fierce Competition in Eddy-current Testing

Key Players: General Electric Company, Ether NDE Limited, Eddyfi NDT Inc., Ashtead Technology Ltd., TUV Rheinland AG, Mistras Group Inc., Fidgeon Limited, Magnetic Analysis Corporation, Ibd NDT System Corporation, Waygate Technologies.

Global Eddy Current Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.27 billion

- 2026 Market Size: USD 1.35 billion

- Projected Market Size: USD 2.52 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Eddy-current Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Eddy-current Testing is Becoming More and More Popular in the Aerospace Sector- The aircraft business demands the greatest requirements for material, structure, and strength. The phrases non-destructive evaluation (NDE), non-destructive inspection (NDI), and non-destructive examination all refer to the same technique. Failures in surface, strength, and cracks can lead to a variety of fatal incidents and serious injuries. A study found that globally significant passenger aircraft fatal disasters happened at a rate of 0.18 per million flights in 2019 and 0.30 per million flights in 2018. Before assembly, ECT is a frequently used testing technique for evaluating aircraft parts and components. Fatigue cracks in aviation parts are frequent and may deepen over time.

-

Increasing Use of Eddy-current Testing in the Power Generation Technologies Sector- This method is frequently used in numerous applications, including fuel inspection. IAEA studies indicate that 1-3 failed fuel rods out of every 100,000 operating fuel rods worldwide, or a fuel failure rate of about 10-5. The failure rate is dropping as a result of the use of eddy-current testing.

-

Eddy-current Testing is Used in Heat Exchanger Tubes- Under ideal circumstances, eddy-current testing can find flaws in pipes with a diameter of just 0.5 millimeters. When performed by a skilled expert using the proper tools, conductive materials, and equipment, this test is very accurate at detecting even the smallest defects.

Challenges

-

The Staffing for Inspection Services is Underqualified and Unskilled- There are many residential, industrial, and commercial applications for non-destructive testing. Numerous end-use sectors worldwide benefit from the enhanced evaluation output. A skilled technician interprets the signals to look for tube flaws or wall loss. Baseline eddy-current testing is frequently carried out on a new heat exchanger so that the outcomes can be collected for later in-service tests to determine whether any changes have taken place. A quick, precise, and economical method of locating weakened or broken tubes before they fail and result in an expensive shutdown is Eddy's current testing.

-

The Market for Eddy-current Testing is Facing Difficulties as a Result of the Drop-In Oil and Gas Prices.

-

High Entry Barriers and Fierce Competition in Eddy-current Testing

Eddy-current Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 1.27 billion |

|

Forecast Year Market Size (2035) |

USD 2.52 billion |

|

Regional Scope |

|

Eddy-current Testing Market Segmentation:

Service Segment Analysis

The calibration segment in the eddy-current testing market is anticipated to grow with about 39% revenue share, considering that it can detect any discrepancies and flaws in measurement tools and dimensional standards. During calibration, data that deviates from "normal" are found. The measurement device or method is then used to bring tolerances to acceptable limits.

Technique Segment Analysis

The conventional eddy-current testing market attracted the biggest revenue share of approximately 42%.Steam generator tubes in nuclear reactors and heat exchanger tubing in the power and petrochemical sectors are inspected using conventional ECT. The method is quite sensitive to pit detection and size. Although sizing is imprecise, wall loss or corrosion can be detected. There were 436 nuclear reactors in use as of May 2023, spread across 32 different nations. At the time, the United States led the world with 93 operational nuclear power reactors. Those nuclear reactors that are wired into the grid are operational.

Our in-depth analysis of the global market includes the following segments:

|

Technique |

|

|

Service |

|

|

Industry Verticals |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Eddy-current Testing Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 37% by 2035. In the oil and gas business, eddy-current testing is frequently used for safety inspections and to find flaws on surfaces and tubes in the region. Thus, the demand for eddy-current testing will increase as oil production increases regionally. With a daily production of 23.0 million barrels in 2021, North America will be a big oil producer globally. The average daily production of oil in 2020 was 23.5 million barrels.

European Market Insights

Europe region is attributed to grow at a significant CAGR till 2035. Since nuclear power plants are subject to stringent public safety requirements, eddy-current testing is widely used for the detection of defects in the region. Demand in the United Kingdom is anticipated to rise as eddy-current testing becomes more prevalent in nuclear power facilities. Around nine nuclear reactors are now in operation in the UK, while two more are being built. An important share of the nation's energy needs is met by nuclear energy.

Eddy-current Testing Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ether NDE Limited

- Eddyfi NDT Inc.

- Ashtead Technology Ltd.

- TUV Rheinland AG

- Mistras Group Inc.

- Fidgeon Limited

- Magnetic Analysis Corporation

- Ibd NDT System Corporation

- Waygate Technologies

Recent Developments

- In June 2021: Ether NDE announced the launch of ETi-300n. It was developed to improve the end-to-end workflow of inspection. It is an eddy-current equipment that was developed to inspect the non-ferrous tubing from an inner diameter and deliver accurate inspection results.

- May 2022: Waygate Technologies Robotics came into a partnership with PETRONAS Technology Ventures, PETRONAS’ technology commercialization arm. Together, the companies aimed to market jointly designed robotic examination equipment and escalate employment in the gas and oil businesses. Additionally, BIKE robotic system, enhance data inspection and management of restricted or hard-to-reach places in oil and gas areas including onshore and offshore. Moreover, the improved technology includes a cleaning device along with additional eddy-current and ultrasonic examination abilities.

- Report ID: 5265

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Eddy Current Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.