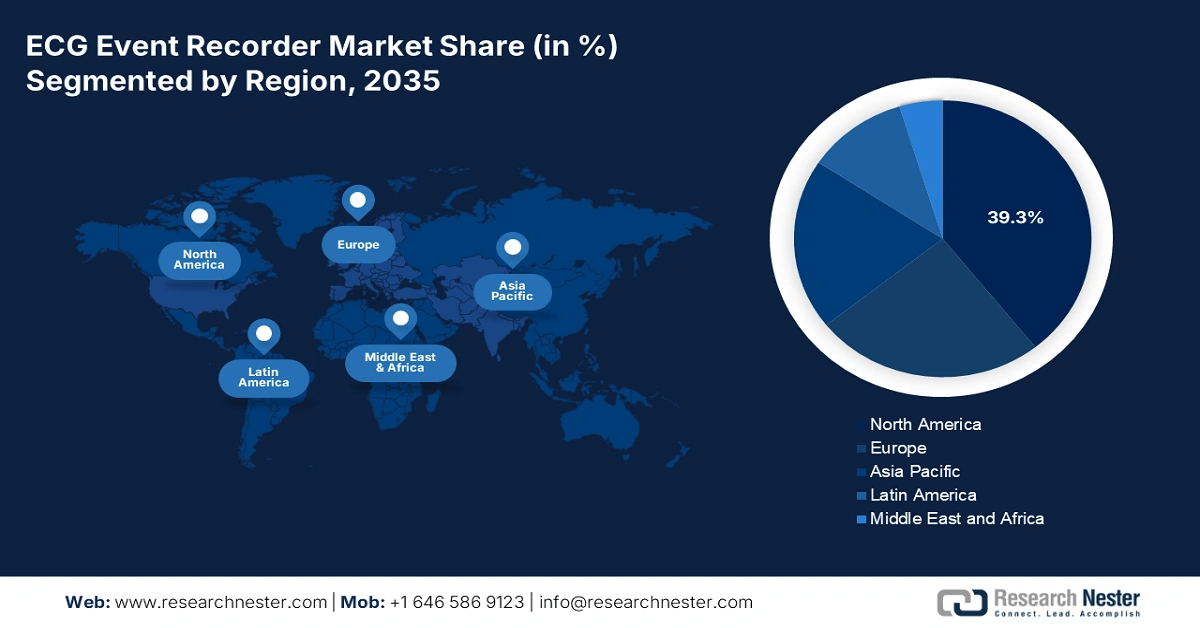

ECG Event Recorder Market - Regional Analysis

North America Market Insights

The North America ECG event recorder market is anticipated to account for the largest share of 39.3% by the end of 2035. The region’s leadership in this sector is attributed to the increased federal funding and broader insurance coverage, where a notable proportion of the national healthcare budget was earmarked for cardiac monitoring technologies. These allocations are a direct response to the rising demand for non-invasive and remote diagnostic options. Besides, the growing patient population across the region also contributes to the continuous expansion of this sector.

The U.S. market follows a positive pace of growth on account of its substantial consumer base, which is fueled by the rising incidence of CVD-related deaths and risk factors. In this regard, a 2024 NLM report unveiled that AFib alone causes 599,790 emergency department visits, 453,060 hospitalizations, and 21,712 deaths nationwide every year. It also mentioned that the annual cost of hospital admissions totaled USD 4 billion in the U.S., underscoring the urgent need for heart monitoring technologies deployment. For the same utility, more than 21% of adults living across the country wear a smartwatch or wearable fitness tracker.

APAC Market Insights

Asia Pacific is poised to exhibit the fastest pace of growth in the global ECG event recorder market during the analyzed timeframe. The rising healthcare awareness, increasing CVD mortality, and expanding access to advanced medical technologies are collectively fostering a lucrative business environment for both domestic and foreign pioneers in this field. On the other hand, robust urbanization, aging, and government initiatives are accelerating the region’s progress in this sector by creating a surge in portable and remote cardiac monitoring solutions.

China holds a leading position in the Asia Pacific market, backed by its large patient population and strong emphasis on medical device manufacturing. Testifying to the demography, a 2022 NLM study revealed that 2 out of every 5 deaths in the country were caused by CVD. In addition, the mortality rate of CVDs accounts for 46.7%-44.2% of all deaths in rural and urban areas, as per the 2024 clinical findings. Thus, the country is pushing the pace and scale of healthcare digitization under its ambitious goals of Healthy China 2030, which are boosting demand for advanced diagnostic technologies, including ECG monitoring devices.

Public Provinces to Support Adoption

|

Country |

Program/Initiative |

Key Notes |

Timeline |

|

India |

National Health Mission (NHM) |

USD 4.4 billion allocation nationwide NCD screening (including CVD prevention/intervention) |

2025-2026 |

|

China |

National Health Commission |

Raised its per capita government subsidies for basic public health services to USD 12.4 |

2023 |

|

Australia |

Cardiovascular Health Mission |

Invested USD 220 million to transform heart and vascular health and stroke |

2022-2025 |

Source: PRS, NMPA, and Government of Australia

Europe Market Insights

Europe is estimated to hold a prominent position in the global ECG event recorder market over the timeline between 2026 and 2035. The region’s consistent propagation in this sector is largely propelled by the rise in geriatric populations, the increased rates of CVD incidence and mortality, and the rapid deployment of digital health infrastructure. According to the NLM, CVDs made up over 36% of all fatalities in Europe till 2023, while impacting the health and quality of life severely for more than 60 million people. Such alarming figures are strengthening the region-wide efforts on deploying early detection tools, such as ECG event recorders.

High utilization rates in outpatient monitoring programs are the major growth factors for the UK ECG event recorder market. Reimbursement reforms by the National Health Service (NHS) are also playing a crucial role in boosting adoption in this category. Moreover, the rise of public-private partnerships (PPPs) is improving access to innovative wearable ECG devices, cultivating an attractive landscape of revenue generation for innovators. This can be evidenced by funding from the Association of Medical Research Charities (AMRC) till 2022, which contributed to the spin-out of over 61 new companies and the production of more than 550 medical products, including medical devices and diagnostic tools.

Country-wise Potential Consumer Bases

|

Country |

Key Notes |

Timelines |

|

UK |

Age-standardized CVD incidence was as high as 527 per 100,000 population |

2021 |

|

Germany |

56.6% and 60.5% of men and women were living with raised cholesterol |

2022 |

|

Italy |

65.3% and 51.5% of male and female populations were overweight |

2022 |

|

France |

Crude CVD mortality accounted for 230 per 100,000 population |

2021 |

|

Ireland |

Age-standardized CVD incidence stood at 511 per 100,000 population |

2021 |

Source: World Heart Observatory